The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing investments in natural gas production are expected to drive the growth of the market studied.

- On the other hand, highly volatile prices and a growing emphasis on clean energy sources are expected to hamper the growth of the Asia-Pacific natural gas market during the forecast period.

- Countries such as India, Indonesia, Singapore, and Malaysia are the fast-growing economies in the Asia-Pacific region. Thus, the demand for natural gas is expected to rise. This increase is expected to provide an opportunity for growth after the forecast period.

- China dominates the market. It is also expected to register the highest CAGR during the forecast period. This growth is attributed to increasing domestic production and consumption.

APAC Natural Gas Market Trends

Increasing Investments in Natural Gas Production to Drive the Market

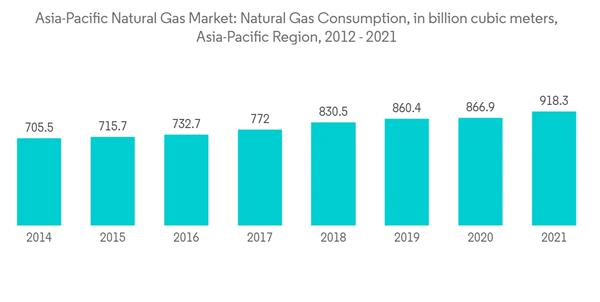

The Asia-Pacific region is one of the major consumers of natural gas in the world. The natural gas consumption in the region was around 918 billion cubic meters in 2021, a 5.9% growth compared with the previous year, which was approximately 867 billion cubic meters. The natural gas consumption was around 575.2 billion cubic meters in 2010, which rose to 918.3 billion cubic meters in 2021, totaling a 22.7% share of global natural gas consumption.Therefore, natural gas companies are investing heavily in the oil and gas industry to cater to the increased demand. For instance, in April 2022, GAIL announced that its joint venture company Bengal Gas Co and Hindustan Petroleum Corporation Ltd aims to invest more than INR 17,000 in various CNG projects in West Bengal over the next five years.

In September 2021, the Indonesian government announced an investment of USD 20.3 million from the auction of two oil and gas blocks in South CPP Block and Liman Block. PT Energi Mega Persada Tbk and Husky Energy International won the auction. In July 2021, the Indian government approved an order allowing 100% foreign direct investments in oil and gas public sector units. Furthermore, the government has allowed 100% Foreign Direct Investment in upstream and private sector refining projects.

In March 2022, China Petroleum & Chemical Corporation announced plans to invest about CNY 81.5 billion in upstream exploitation, especially the crude oil bases in Shunbei and Tahe fields and natural gas fields in Sichuan province and the Inner Mongolia region. The fields plan to produce 281.2 million barrels of crude oil and 12,567 billion cubic feet of natural gas in 2022.

Therefore, based on the above-mentioned factors, the increasing investments in natural gas production are expected to drive the Asia-Pacific natural gas market during the forecast period.

China to Dominate the Market

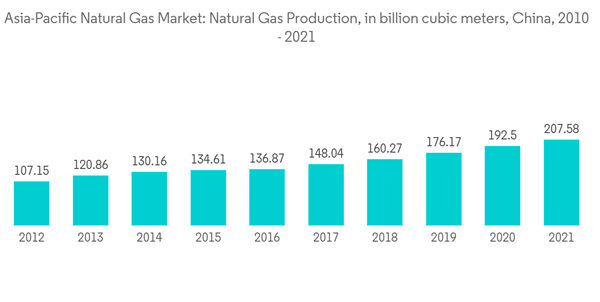

China is the leading producer of natural gas in the Asia-Pacific region. In 2010, natural gas production was 96.5 billion cubic meters. It reached 207.5 billion cubic meters in 2021. In terms of global natural gas production, China contributed around 5.2% in 2021. This was an increase of over 15 billion cubic meters compared to the previous year.In 2021, China had total proven natural gas reserves of 8.4 trillion cubic meters, which is 4.5% of global natural gas reserves. Furthermore, according to the OPEC, in 2030, China's primary energy demand for gas is expected to be around 8.1 mboe/d. Further, the demand for gas is likely to grow by about 10.1 mboe/d by 2035. To full fill this increased demand, the Chinese government is taking various initiatives to increase investment in the oil and gas industry, such as FDI policy reforms, financial benefits, subsidies, and other policy reforms.

In March 2022, China's biggest state-owned oil and gas company PetroChina announced plans to increase natural gas production to 55% of its total oil and gas output by 2025. It also aims to produce 4,625.1 Bcf, or 130.97 Bcm, of marketable natural gas in 2022, up 4.6% Year-on-Year. It is estimated to account for 46.2% of its total oil and gas production target of 1,669.7 million barrels. In May 2022, the China National Offshore Oil Company (CNOOC) awarded CNY 16 billion (USD2.42 billion) contracts for building 12 liquefied natural gas tankers. The 12 vessels will be constructed by Hudong Zhonghua Shipbuilding Co., a China State Shipbuilding Corporation (CSSC). Each tanker can carry about 174,000 cubic meters of LNG, equivalent to 108 million cubic meters when re-gasified. The vessels are slated for commissioning between 2024 and 2027.

Hence, the above factors are expected to drive the Chinese natural gas market during the forecast period.

APAC Natural Gas Market Competitor Analysis

The Asia-Pacific Natural Gas Market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include China National Petroleum Corporation, China Petroleum & Chemical Corporation, Oil and Natural Gas Corporation, Chevron Corporation, and GAIL Limited.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Oil and Natural Gas Corporation

- Chevron Corporation

- GAIL Limited

- Korea Gas Corporation

- Mitsubishi Corporation

- Tokyo Gas Co. Ltd

- Bharat Petroleum Corporation Limited

- ENN Energy Holdings Limited