Key Highlights

- The Polish mobile market is steadily expanding, with a total of 54 million mobile subscriptions. Strong 4G/LTE-A technology coverage ranges between 85% and 90% across carriers. The Office of Electronic Communication (UKE) stated that telecommunications investments amounted to PLN 8.9 billion (USD 1.96 billion) last year. 66.6% of fixed-line Internet users were already using connections with a minimum data rate of 100 Mbps. In addition, more people are using mobile connectivity with 4G technology. According to predictions, 81% of users with dedicated mobile Internet connections will reportedly be using 5G technology in 2026.

- According to Dataxis, the Polish pay TV market is very active and has well-established, bitter rivals vying for market share in the over-the-top (OTT) space. Operators are resorting to interactive TV to keep subscribers as the number of homes with cable and satellite access to TV is expected to decline in the coming years. Due to the plethora of local and foreign streaming services, the telecom industry is transitioning toward aggregation strategies. Although its user share of all TV services dropped to 49.5%, satellite access is still the most popular way to receive services.

- However, traditional fixed-line telephony is continuously declining in popularity. Last year, there were just a little more than 2.7 million customers. However, traditional fixed-line telephony is continuously declining in popularity. There were only slightly more than 2.7 million customers the previous year. VoIP is displacing traditional telephone services, and in terms of subscribers, it made up over 49% of all voice services provided on fixed networks last year. The increasing trend has continued in the mobile telecommunications sector, where there are currently over 56 million SIM cards in use and M2M card usage has increased.

- According to UKE, there has been a noticeable increase in the number (by around 30.000 during the previous year) of installed own telecommunications network nodes . In the previous year, the development of the telecom industry and the effectiveness of investments made with public money also contributed to the 4% increase in optical networks. At the end of the previous year, the Polish optical network had a total length of 421,000 km. The extension of the infrastructure would also increase the coverage and reach of the NGA networks. Over 80% of residences in Los Angeles will have fixed-line Internet with a speed of at least 30 Mbps.

- The need for quick mobile connections in Poland increased because of COVID-19. Following the pandemic, dedicated access utilising modems, cards, and keys increased significantly compared to 2019. When considering all available mobile access methods, Poland saw a significant increase in the number of people using mobile internet services per 100 people. Telecom providers' activities have expanded due to a rise in data traffic. Since the pandemic spread, the e-payment industry has experienced a major increase in activity. Teleconferencing and e-health have increased the demand for smartphones and digital services across the country.

Poland Telecom Market Trends

Rising OTT & Pay TV Market

- Over the coming years, a significant increase in over-the-top deployments is anticipated in Poland. The Polish PayTv and OTT markets are extremely active, with strong competitors. The digitalization of information - and subsequently audio-visual content - and the delivery of digitized media via the Internet are transforming Poland's society and the audio-visual industry. These important changes in the audio-visual marketplace were not brought about by the Internet or digitalization alone.

- Instead, the market altered the supply and demand for audio-visual services nationwide. According to Wirtualne Media, Netflix has reportedly been Poland's most popular OTT and VOD service since the second half of 2019 and experienced incredibly rapid growth in the final few months of the previous year. Nearly half of all Internet users in Poland currently use Netflix. Netflix had more than 1.7 million paying streaming members in the second quarter of last year, bringing in USD 60.8 million in income in Poland. During this time, the average monthly income per paying member was USD 11.66.

- According to Dataxis, the Polish pay TV industry is also highly vigorous and has established strong competitors battling in the OTT space. According to Dataxis, Poland is an important market for telecom operators and streaming providers in Central and Eastern Europe for telecom operators and streaming providers, with 14 million TV homes and an 80% pay-TV penetration rate. Operators are resorting to interactive TV to keep subscribers as the number of homes with cable and satellite access to TV is expected to decline in the coming years. The proliferation of domestic and international streaming services, however, is forcing the telecom sector to adopt aggregation strategies.

- As per the report published by Digital TV Research, subscription video on demand (SVOD) revenues in Eastern Europe are expected to reach USD 2.95 billion by 2027, up from USD 1.6 billion in 2021. Notably, Poland is anticipated to be the only nation in the area to generate more than USD 1 billion in income. Also, the research forecasts that by 2027, there will be 38 million SVOD subscribers in Eastern Europe, up from 22 million at the end of 2021. There will be ipportunity for growth beyond the forecast period as only 16% of the region’s TV households will subscribe to at least one SVOD platform by 2027.Poland's SVOD penetration would be at 44% by the end of 2027.

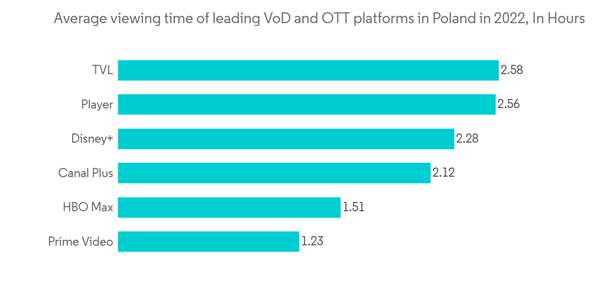

- Netflix had the most viewers of any VoD platform in October 2022, with users in Poland spending an average of 5.5 hours watching. Netflix was followed by TVP, Payer, and Disney+, with average watching times of 2.58 hours, 2.56 hours, and 2.28 hours, respectively. According to Filmweb, Heartstopper was the best-rated Netflix Originals program, with a 7.74/10 among Polish viewers as of May this year.

Digital Transformation Initiatives

- Although no harmonized radio spectrum has yet to be given to Poland to implement 5G, the legislation still needs to be finished, and the government agreed to change a few parts of the cybersecurity laws connected to the development of 5G. Moreover, a proposal to create a Strategic Communications Operator, a state-owned organization that would offer telecommunications services to the public administration, and to establish a wholesale operator in the 700 MHz band, which might become available in 2022, would be considered by the government.

- Poland has been seeking help from European Commission requesting Ukraine's improved digital integration in the telecoms industry. While telecom companies have provided arriving Ukrainians with Polish SIM cards, most Ukrainians link their current sims to European telecom networks to keep in touch with their loved ones. For migrants who are also arriving in other EU nations, high roaming rates may make it difficult for them to stay connected. Accordingly, to reduce roaming fees, European operators must come to an understanding with their Ukrainian counterparts.

- For the past few years, coupled with the growth of smartphone usage, the nation has significantly applied cloud computing in various application software. By 2030, the widespread adoption of cloud computing by Polish businesses and government organizations could produce a value of 4% of Poland's annual GDP. Furthermore, over seven out of ten businesses claimed to have moved or planned to migrate data or apps to the cloud. Nearly 60% of those surveyed had switched to remote work or plan to do so. Additionally, 8% aim to use AI and ML solutions in 2021 or have already done so.

- Earlier this year, there were 32.86 million internet users in Poland, and 87.0% of people had access to the internet. According to Kepios data, the number of internet users in Poland rose by 15,000 (+0.05%) between last and current year. Encouragingly, Poland would likely have 26.33 million smartphone users this year. The number of monthly active users is anticipated to increase by around six million, to an estimated 32.32 million, during the forecasted years. All persons, regardless of age, who use a device at least once each month are included in the statistics.

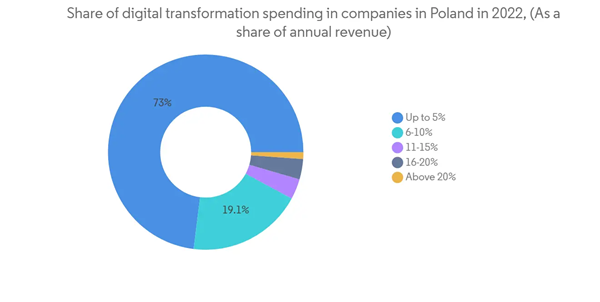

- The cloud accelerates digital transformation in the telecom business. It has a history of aiding in disrupting and reshaping contemporary economies. According to KPMG Poland research, nearly two-thirds of Polish businesses stated that they would invest 5% of yearly sales on digital transformation this year.

Poland Telecom Market Competitor Analysis

The Poland telecom market is fragmented in nature. Some major players in the market studied include Orange Polska, Play Communications S.A, T‑Mobile Polska, Polkomtel (Plus), and Spectrum. The market also hosts other Internet service providers (ISPs), MVNOs, and fixed-line service providers. Some of the Poland telecommunication companies are very competitive internationally and hold strong ground in the global telecom space.In July 2022, Orange Polska (Orange) announced the extension of its partnership with Nokia for another 10 years. According to the agreement, Nokia would improvise all current networks, including the hardware facilitating the decommissioning of Orange's 3G network and the infrastructure solutions enabling the reallocation of frequencies to increase Orange's 4G capacity and coverage. The network will continue to be updated through 2025.

In May 2022, Vectra, one of the leading Polish telecom companies, unveiled the launch of its first 10Gbps services via XGS-PON 10G technology. The first nine cities to offer access to the high-speed service include Warsaw, Gdynia, Gdansk, Wroclaw, and Olsztyn.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Orange Polska

- Play Communications S.A

- T‑Mobile Polska

- Polkomtel (Plus)

- Spectrup Poland

- Netia

- Effortel SA

- Multimedia Polska SA

- Platforma Canal+

- Vectra S.A.