The COVID-19 pandemic has had a slight adverse impact on assistive technologies for the visually impaired market initially. With the outbreak of COVID-19, the market for assistive technologies for the visually impaired experienced a slight fall in growth. It was primarily due to the imposition of lockdown and the prioritization of COVID-related and only critical condition treatment. During the pandemic, the risk of COVID-19 infections reduced the number of regular visits by visually impaired patients or students to blind schools, hospitals, etc. This put a halt to their consultation and visual assistance. Although the pandemic was widespread, teleconsultation and virtual classes for visually impaired patients and students helped manage their situations and needs. The study conducted by the American Action Fund for Blind Children and Adults in 2020 and 2021 stated that blind and low-vision students across the United States and Canada shifted from their in-person education mode to the virtual education mode amid the pandemic. However, it was found that in some cases, blind or low-vision students had no access to education due to the lockdown after the COVID-19 outbreak. A study published in the journal Research in Developmental Disabilities in 2021 highlighted the use and efficacy of online interventions for visually impaired children. It was observed that the parents felt reassured by the uninterrupted online treatment of their children. In the post-pandemic era, global unlocking, the availability of vaccines, and control cases of COVID-19 allowed visually impaired patients to get back to their treatment regime and access assistance. For instance, in January 2022, the Ontario Provincial Schools for the Deaf and Blind reopened. In February 2022, the White House administration of the United States announced the guidelines for people with disabilities and older adults in response to and recovery from COVID-19. The guidelines highlighted using appropriate resources and equipment to support in-person learning for children with disabilities. Thus, the COVID-19 outbreak had a slightly adverse impact on the market's growth in its preliminary phase. Moreover, the market is expected to grow further at a stable pace with the reopening of blind schools and the regular visits of visually impaired patients to blind schools, hospitals, and clinics globally.

Further, the high prevalence of visual impairment and blindness globally is boosting the growth of the market. According to the WHO, in October 2022, there will be over 2.2 billion people worldwide living with near or distant vision impairment. In addition, the expanding geriatric population globally will propel market growth. The condition of aging is accompanied by several vision-related disorders and even loss of vision. According to the National Institute on Aging, aging is associated with dry eyes, age-related macular degeneration, diabetic retinopathy, cataracts, and glaucoma. According to a study published in JAMA Ophthalmology in 2022, over 1.49 million people aged 40 years and older are living with late-stage age-related macular degeneration. According to the WHO, people aged 60 and above were recorded at 1 billion, and the number is expected to increase to 1.4 billion in 2030. The market players have launched innovative solutions for visually impaired assistive devices. In August 2021, OrCam launched its latest software, Version 9.10, for its two products, the wearable OrCam MyEye, which is intended for blind and visually impaired individuals, and the handheld OrCam Read, intended for individuals with reading challenges. The latest software would offer an improved experience and better accessibility for the hands-free voice command functions.

Therefore, owing to the high prevalence of visual impairment and blindness and the expanding geriatric population, the studied market is anticipated to witness growth over the analysis period. However, the high cost of electronic visual assistance products is likely to impede market growth.

Assistive Technologies for Visually Impaired Market Trends

The Braille Computers/Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

Braille Computers/Systems are specially designed computers that consist of a refreshable braille display device connected to a standard computer. The refreshable braille display is made of electronically driven pins that display braille pop-ups after translating the display output into braille. Braille computers are highly utilized for teaching and working purposes by visually impaired or blind individuals. These systems consist of specialized software (such as screen readers, JAWS) to assist visually impaired or blind individuals in reading and writing with these computers. The use of braille computers is being promoted and emphasized by social groups, schools, etc. For instance, in February 2022, Hadley, a United States-based non-profit organization and the leader in remote learning for visually impaired adults in the United States, launched a series of interactive workshops, Braille for Everyday Use.Further, in September 2022, the Royal National Institute of Blind People (RNIB) launched its refreshable braille display, Orbit Reader 20, in the United Kingdom. The braille display consists of 20 refreshable eight-dot braille cells and offers to assist in book reading with simple notetaking, USB and Bluetooth connectivity, and an SD card.

Therefore, the braille computers/systems segment is expected to witness significant growth over the forecast period due to its active use in education and work. Also, the recent launches of software and educational workshops are expected to bolster the growth of the segment further.

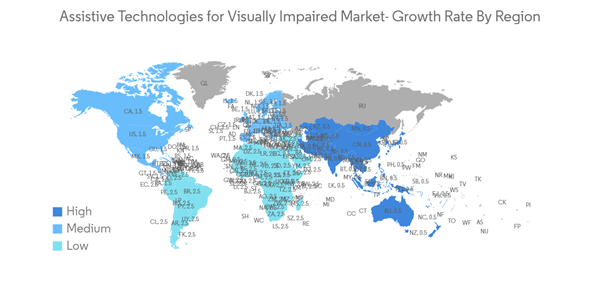

North America is Expected to Dominate the Assistive Technologies for Visually Impaired Market

North America is expected to dominate the market owing to factors such as the large population of visually impaired or blind people, the vast geriatric population, the advanced healthcare and education infrastructure, and the growing expenditure for the visually impaired.There are several grants which offer financial assistance to the visually impaired or blind individuals, which aid in buying the needful devices and training. Some of the grants available for visually impaired or blind individuals, such as the Quality of Life Grant and the Ed Cossart Immediate Needs Grant, offer USD 5,000 and USD 1,500 per person every year, respectively. Some scholarship grants are provided by the American Council of the Blind (ACB), the Association for Education and Rehabilitation of the Blind and Visually Impaired (AER), the Blinded Veterans Association (BVA), and many more. In September 2022, NewHaptics, an innovative display technology company, was awarded a Phase II Small Business Innovation Research (SBIR) grant of USD 1.7 million by the National Eye Institute of the NIH. The grant would help the company assist individuals with vision loss and improve their quality of life through their vision research. The grant would help the company further develop its novel tactile display technology at a low cost and offer a multiline refreshable braille display for the visually impaired or blind.

The presence of leading players is also driving the growth of assistive technologies for the visually impaired market. Several leading players have undertaken key developments in the region. For instance, in September 2022, American Thermoform Corp. acquired the blind assistive products manufacturer Zychem Technologies Ltd. The acquisition would strengthen the visually impaired assistive product portfolio of American Thermoform Corp. Further, in April 2022, Vispero partnered with McDonald’s to offer McDonald’s customers the chance to experience Vispero’s JAWS Kiosk. The self-order kiosk interface would assist visually impaired or blind customers in accessing the food menu. Further, these continuous developments in the region are anticipated to drive the growth of the market in the region.

Therefore, owing to the vast population of visually impaired and blind people, advanced education and healthcare expenditure, and recent developments, the studied market is anticipated to grow further in the North American region.

Assistive Technologies for Visually Impaired Market Competitor Analysis

The assistive technology for the visually impaired market is moderately consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of some international as well as local companies that hold market shares and are well known, including INDEX BRAILLE, American Thermoform Corp., Amedia Networks, Inc., Vispero, Dolphin Computer Access Ltd., Access Ingenuity, LVI Low Vision International, ViewPlus, HumanWare, Freedom Scientific, Inc., HIMS, Inc., OrCam, and Orbit Research, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- INDEX BRAILLE

- American Thermoform Corp.

- Amedia Networks, Inc.

- Vispero

- Dolphin Computer Access Ltd.

- Access Ingenuity

- LVI Low Vision International

- ViewPlus

- HumanWare

- Freedom Scientific, Inc.

- HIMS, Inc.

- OrCam

- Orbit Research