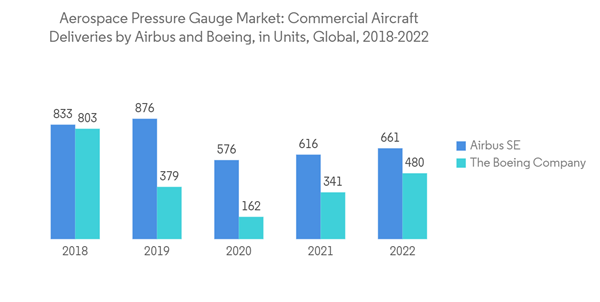

Rising demand for new aircraft due to the growing number of air travelers creates demand for aircraft parts and components, which drives the market's growth. In an aircraft, the number of instruments informs the pilot about the aircraft’s condition and flight situations through measuring pressure. The pressure-sensing instruments are installed in the flight group and the engine group. These components can be either remote sensing or direct reading. These are the most critical instruments on the aircraft and accurately inform the pilot to maintain safe operations.

An increase in demand for new aircraft and growing investment in aircraft modernization programs drive market growth. There are different types of pressure gauges, such as fuel pressure gauges, hydraulic pressure gauges, manifold pressure gauges, oil pressure gauges, and others used in an aircraft. An aircraft fuel pressure gauge is a device that measures and reports the quantity of fuel remaining in a vehicle's tank(s). Thus, the growing expansion of the aviation sector will drive market growth in the coming years. On the other hand, issues related to pointer deviation and fuzzy dial numbers created errors which affects the flight test. Such factors hamper market growth.

Aerospace Pressure Gauge Market Trends

Digital Pressure Gauge Will Showcase Significant Growth During the Forecast Period

The digital pressure gauges segment is estimated to have remarkable growth during the forecast period. These are used to convert the pressure to an electronic signal. The gauge shows the pressure using a digital display, furthermore, the signal can be used to control equipment. Newbow Aerospace provides an innovative range of digital tire pressure checking gauges that are calibrated to an accuracy of +/-0.4% FS. For instance, in November 2022, DLA Aviation issued a solicitation for dial pressure gauges used in the HH-60 aircraft. The NSN 6685-00-074-2288 pressure gauge is made of anodized aluminum with a Beryllium copper element. It has a range of 0 to 20 PSI marked in 5 psi increments. DLA announced that they would procure 37 of these gauges each year for an estimated total of 185 units. The total value of the contract was estimated at USD 800,000. Thus, growing investments in developing such innovative products propel market growth.Furthermore, growing air traffic, rising investment in aircraft systems modernization, and growing spending on research and development in aviation boost the market growth. According to the International Air Transport Association report, the aviation sector witnessed a strong recovery after the pandemic. The overall number of air passengers will reach 4.0 billion by 2024. Hence, rising spending on procurement of new aircraft and growing aircraft modernization programs drive the market growth during the forecast period.

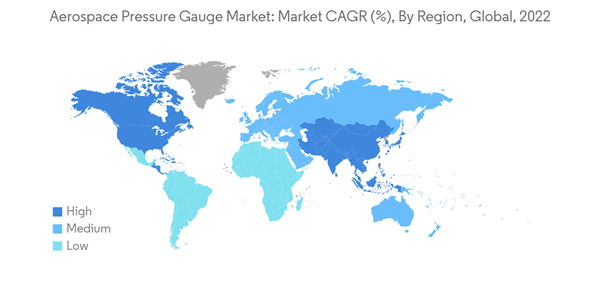

Asia Pacific is Projected to Show Highest Growth During the Forecast Period

Asia-Pacific is projected to show remarkable growth during the forecast period. The growth is due to a rising number of air passengers, a growing number of airports, and increasing expenditure on the aviation sector from emerging economies such as China and India. In Asia-Pacific, major countries like China, India, Japan, and Singapore are planning to construct new airports and expand the existing airports. An increasing number of airports leads to rising demand for aircraft components, thus driving the growth of the market.In February 2020, the Indian government announced that 100 new airports would be built by 2024. This will create demand for various aerospace components such as pressure gauges, temperature gauges, sensors, and other systems. Furthermore, in June 2022, the Union Civil Aviation Minister of India announced that the country will have 33 additional cargo terminals by 2024-2025. Thus, rising disposable income, rapid urbanization, and growing investment in constructing new airports will improve the opportunities to accommodate a higher number of aircraft and consequently lead to a huge demand for aerospace parts and systems, driving the market's growth.

Aerospace Pressure Gauge Industry Overview

The aerospace pressure gauge market is fragmented in nature due to the presence of several suppliers who provide various types of pressure gauges. Some of the prominent players in the aerospace pressure gauge market are UMA, Inc., Ahlers Aerospace, Inc., Davtron Inc., L3Harris Technologies, Inc., and Alcor, Inc. With the growing competition in the industry, the key OEMs are focusing on the development of innovative solutions for the aviation sector. For instance, in October 2022, Meggitt PLC launched a long-range wireless tire pressure gauge for aviation, iPRESS. It would be available for a range of Beechcraft and Cessna products. The new gauge will deliver an enhanced user experience while verifying inflation pressure through the use of a Wireless Tire Pressure Sensor (WTPS) and a new tire pressure status feature. Thus, rising investment in innovative technologies and increased spending on research and development from key players will boost market growth during the forecast period.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- UMA Instruments

- Ahlers Aerospace Inc.

- L3Harris Technologies Inc.

- Davtron Inc.

- Alcor Inc.

- Flybox Avionics

- Howell Instruments Inc.

- Meggitt PLC

- Adams Aviation

- CIRCOR AEROSPACE PRODUCTS GROUP