The COVID-19 pandemic negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increasing demand for renewable energy sources, the rise in demand for sustainable energy sources, and the high efficiency of wind energy are driving the market's growth.

- However, the high cost of the offshore wind power system due to the movement of heavy and oversized equipment to the offshore location is a significant factor that will restrain the market growth during the forecast period.

- Nevertheless, in an effort to fine-tune wind turbines for maximum efficiency, the integration of sophisticated software that monitors wind and weather patterns, sea level, tides, and load patterns on the electrical grid is under process. Furthermore, incorporating big data and the Internet of Things (IoT) will also create an excellent opportunity for the offshore energy market during the forecast period.

- The United Kingdom is expected to be the largest market during the forecast period. This projection is based on increased offshore wind and tidal energy activities and new pipeline projects that will drive the demand for offshore energy in the coming years.

Europe Offshore Energy Market Trends

Wind Energy Segment to Dominate the Market

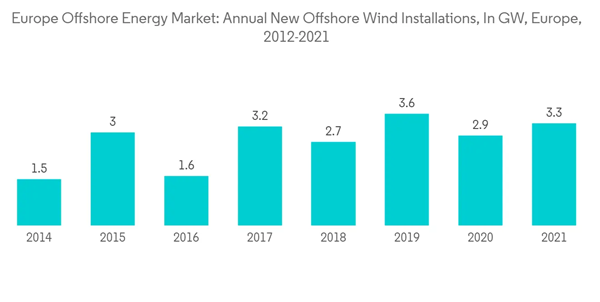

- As per WindEurope's statistics, in 2021, Europe installed 17.4 GW of new wind power capacity, establishing an 18% increase from 2020. 11 GW of the new installations were in the EU-27. With 14 GW, onshore wind installations accounted for 81% of the new installations, while offshore wind installations contributed to 3.4 GW. Over the next five years, 27.9 GW of offshore wind installations are expected, doubling the annual installation rate from 3 GW to 5.6 GW.

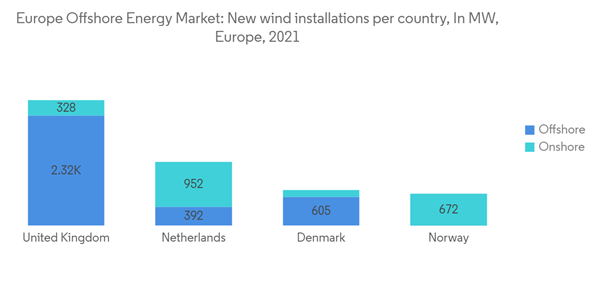

- In 2021, Denmark installed 754 MW primarily from offshore wind, with Kriegers Flak, the world's first hybrid offshore wind project (connected to Denmark and Germany), contributing 0.6 GW.

- In May 2022, the Government of Norway launched an investment plan to allocate sea areas for offshore wind development by 2040, targeting 30 GW of capacity.

- In Europe, floating offshore wind offers unique opportunities. Compared to bottom-fixed turbines, floating turbines can produce electricity further offshore and in deeper waters. Their technology opens up offshore wind to countries that do not have shallow water, as the offshore wind can be developed in deep sea basins, such as the Mediterranean or Atlantic.

- A growing number of floating offshore wind farms are being built in Europe. Currently, 113 MW of floating wind turbines are in operation. By 2024, Europe is expected to have 330 MW of floating wind power. Norway is building the world's largest floating wind farm, Hywind Tampen (88 MW), while France is anticipated join in. Earlier this year, France had four small projects of 30 MW each, expected to run within two years.

- In 2022, the Norwegian government announced holding its first offshore wind auction in the summer of 2023. The auction is expected to have a total capacity of 1.5 GW.

- Following the Renewable Energy Act (EEG), Germany plans to boost offshore wind energy. As part of the Coalition Agreement, Germany has stated that by 2030, it would increase its offshore wind target to 30 GW.

- Because of these factors, the ongoing investments and developments in offshore wind in European countries are expected to dominate the market during the forecast period.

United Kingdom to Dominate the Market

- The United Kingdom has the highest offshore wind installation rate of 28.9%, as per the UK Wind Energy Database. According to the National Grid statistics, in 2021, wind energy generated 21.4% of electricity in the United Kingdom, including onshore and offshore wind.

- According to WindEurope, in 2021, the United Kingdom had the most significant wind installed capacity with 2,645 MW. Moreover, offshore wind contributed more to the capacity, with a share of 87.5%.

- With offshore wind, once relatively expensive compared to onshore wind or solar, capital costs fell sharply in 2020, around 65% lower than the five-year-old UK project. Significant factors that reduced prices were the usage of more giant turbines and technological advances, including lithium-ion batteries, which are essential to ensuring continuity of supply from weather-dependent sources.

- With more than 8 GW of offshore wind capacity installed and 7 GW under construction, the United Kingdom has the largest offshore wind capacity in the world. Its current installed base can power 7 million homes.

- In late 2020, the UK government published The Ten Point Plan for a Green Industrial Revolution, which articulated its commitment to supporting renewable energy. It pledged to mobilize USD 15 billion for the green industrial revolution. This plan aims to quadruple offshore wind production to 40GW by 2030. Advancing offshore wind is the first tenet of this plan. More than 30 wind farms and related projects have already been planned or developed to reach these ambitious goals.

- To significantly increase the country's affordable energy supply while reducing carbon emissions, the UK government has developed a long-term strategy to deliver at least one-third of its electricity from offshore wind, as part of a Sector Deal between the offshore wind industry and the government. A report by the UK's Committee on Climate Change indicates the country could become the first large economy to legislate a 'net zero' emissions target for 2050.

- In May 2022, the Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) announced providing the UK government with GBP 160 million (USD 0.19 billion) to boost floating offshore wind capability in Scotland, Wales, and elsewhere. By supporting manufacturers and providing private investors with the confidence to invest in this emerging sector, which is expected to overgrow in the future, the government will provide funding for these projects.

- With GBP 20 million (USD 0.02 billion) per year invested in Tidal Stream electricity, as part of its flagship renewable energy auction scheme announced in November 2021, the UK government is set to write a new chapter for the tidal industry and create more job opportunities. The announcement established the potential for a thriving UK tidal power sector, with the cash boost supporting marine technologies that could benefit the country.

- Based on the above factors, the United Kingdom is expected to dominate the offshore energy market during the forecast period.

Europe Offshore Energy Market Competitor Analysis

The European offshore energy market is moderately fragmented. Some of the major players (in no particular order) include Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, Hydroquest, Ørsted AS, and E.ON SE, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Service Providers

- Operators