COVID-19 had a substantial influence on the cardiac resynchronization therapy market growth as cardiac consultations and treatments got delayed due to the lockdown. For instance, according to the research study published in May 2021 in PubMed, during the COVID-19 pandemic, cardiac procedural activity in England decreased dramatically, with a deficit of about 45,000 procedures, with no increase in the risk of mortality for most cardiac procedures conducted during the pandemic. This study showed the disrupting impact of COVID-19 on cardiology services. However, the market is predicted to expand in the coming years due to the extensive post-pandemic cardiac problems coupled with other cardiovascular complications that demand cardiac resynchronization therapy.

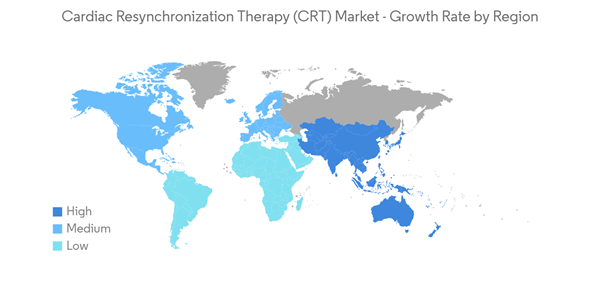

The major factors for the growth of the cardiac resynchronization therapy (CRT) market include the rising burden of heart failure and cardiac disorders and an increase in the geriatric population and a rising sedentary lifestyle among the population. The global population is aging rapidly, owing to reduced birth rates and increasing life expectancy. According to a report by the United Nation Economic and Social Commission for Asia and the Pacific (ESCAP), the geriatric population in the Asia-Pacific region was around 671.1 million in 2021, accounting for more than half of the world’s total elderly population. It is estimated that, by 2050, Asia-Pacific is likely to account for almost two-thirds of the world’s geriatric population. The rise in the geriatric population is one of the major reasons behind the increase in the cases of cardiovascular and heart failure. As the geriatric population rises, the demand for cardiac resynchronization therapy increases and thereby boosting the market growth over the forecast period.

Furthermore, as per the Centers for Disease Control and Prevention article titled published in July 2022 stated that coronary heart disease is the most common type of heart disease, and around 20.1 million adults aged 20 and older have coronary artery disease (approximately 7.2%). Thus, the high burden of coronary artery disease is driving the growth of the market. Furthermore, according to the World Heart Federation update published in 2022, stated that cardiovascular disease, including heart disease and stroke, is the most common non-communicable disease globally. Diabetes, overweight or obesity, an unhealthy diet, physical inactivity, and excessive alcohol use were the main causes of heart disease. As a result of the increasing frequency of heart illnesses worldwide, people who are affected by them are increasingly adopting cardiac resynchronization therapy worldwide.

Moreover, strategic acquisitions, collaborations, and funding are anticipated to drive market growth. For instance, in October 2022, Virginia Commonwealth University’s School of Medicine received funding worth USD 31 million, for a multi-institutional study focused on evaluating a new method for pacing the heart in people with heart failure and conduction system disease. The funding was awarded by the Patient-Centered Outcomes Research Institute.

Thus, due to the rise in the burden of heart failure and cardiac disorders and an increase in the geriatric population, and a rising sedentary lifestyle among the population, the studied market is anticipated to witness significant growth over the forecast period. However, stringent regulatory frameworks restrain the market growth.

Cardiac Resynchronization Therapy Market Trends

CRT - Defibrillators Segment is Expected to Hold a Significant Share Over the Forecast Period

The CRT - Defibrillators (CRT-D) are special devices for heart failure patients who are also at high risk for sudden cardiac death. While functioning like a normal pacemaker to treat slow heart rhythms, a CRT-D device also delivers small electrical impulses to the left and right ventricles to help them contract at the same time. CRT Defibrillators (CRT-D) segment is anticipated to hold a significant share of the market due to the rise in cardiac complications, the increase in the geriatric population, and technological advancements in CRT Defibrillators. For instance, according to the Government of the UK, Office of Health Improvement & Disparities, in 2020-21 the admission rate for chronic heart disease in NHS Barking and Dagenham CCG was 427.9 for every 100,000 people in the population (580 admissions). This is significantly higher than the England rate (368 per 100,000). Thus, the rise in cardiovascular complications increases the demand for CRT - Defibrillators thereby driving the market growth over the forecast period.Arrhythmias, which are excessively quick heartbeats that might cause a cardiac arrest, can also be treated with a CRT-D device. If the device senses heartbeats that are dangerously fast, it delivers a shock to the heart. This shock (defibrillation) stops the abnormal rhythm. Without this life-saving therapy, the dangerously rapid rhythm could lead to death in just minutes. At the same time, launches and developments of products are further propelling the market growth. For instance, as per the article published in March 2022 in ScienceDirect, placement of a CRT defibrillator (CRT-D) with an implantable cardioverter defibrillator (ICD) was associated with significantly reduced mortality compared with CRT pacemaker placement.

Furthermore, an increase in clinical studies to assess the efficiency of CRT defibrillators is anticipated to boost the demand for the segment over the forecast period. For instance, in September 2022, Bayer sponsored a clinical trial to evaluate how safe BAY2413555 is compared to a placebo in participants with chronic heart failure and implanted cardiac defibrillator, or cardiac resynchronization devices (ICD/CRT). Thus, CRT defibrillator-related studies demonstrate the efficiency of the device compared to others and increase the demand over the study period.

Thus, due to the increase in heart failure and cardiac disorders and an increase in the geriatric population, and a rise in research in CRT Defibrillators (CRT-D, the studied segment is anticipated to witness significant growth over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America is anticipated to hold a significant share of the studied market owing to the increase in cardiovascular diseases, and favorable government policies. For instance, as per the Spotlight on Heart Failure 2022 report, more than 100,000 Canadians are diagnosed with heart failure each year. Similarly, as per the American Heart Association 2021 journal, it is estimated that by the year 2035, more than 130 million adults in the United States will have some type of heart disease. Thus, an increase in the prevalence of cardiovascular diseases is likely to drive the demand for CRT and promote market growth.New product approvals, clinical studies, and launches by the prominent players operating in the market are anticipated to further boost the market's growth in the region. For instance, in April 2022, the Heart Rhythm Society (HRS) released the findings of three clinical trials demonstrating positive outcomes of conduction system pacing (CSP) for patients in need of cardiac resynchronization therapy (CRT). The studies were presented as late-breaking clinical science during Heart Rhythm 2022. Hence, due to the rise in cardiovascular diseases and the increase in cardiac implant product launches, North America is expected to witness significant growth in the market over the forecast period. Furthermore, in October 2021, Boston Scientific Corporation consented to purchase Baylis Medical Company, Inc. This acquisition esteemed at USD 1.76 billion, extended its primary heart and electrophysiology portfolios. Moreover, in April 2021, a researcher from Geisinger Clinic initiated a clinical study to evaluate the overall rate of successful His-Purkinje conduction system pacing Optimized Trial of Cardiac Resynchronization Therapy (HOT-CRT) versus biventricular pacing using coronary sinus lead (BVP) to compare acute and mid-term outcomes. Thus, such developments demonstrating the advantages of CRT therapy are expected to drive the market growth over the forecast period.

Hence, due to the increase in cardiac disorders and the rise in advancements of CRT, North America is anticipated to witness growth in the market over the forecast period.

Cardiac Resynchronization Therapy Market Competitive Analysis

The market studied is a consolidated market owing to the presence of few major market players. Some of the market players are Abbott Laboratories, BIOTRONIK, Boston Scientific Corporation, Lepu Medical Technology Co., Ltd., MEDICO S.p.A., Medtronic Plc, Microport Scientific Corporation, and Shree Pacetronix Ltd.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- BIOTRONIK

- Boston Scientific Corporation

- Lepu Medical Technology Co., Ltd.

- MEDICO S.p.A.

- Medtronic Plc

- Lombard Medical (Microport Scientific Corporation)

- Shree Pacetronix Ltd.

- Integer Holdings Corporation (OSCOR Inc)

- OSYPKA MEDICAL