The outbreak of the COVID-19 pandemic impacted the global healthcare system and the biliary stents market. For instance, an article published in the journal WJCC, in October 2021, reported that endoscopic ERCP and percutaneous PTC procedures were associated with high rates of viral transmission. Thus, initially, the high number of COVID-19 cases led to increased transmission of infections that led to the suspension of non-emergency surgical procedures including ERCP and PTC procedures, imposed by the government restrictions which impacted the growth of the studied market. However, in the upcoming years, it is anticipated that declining COVID-19 infection rates and the resumption of ERCP and other surgical procedures may increase the demand for the biliary stent, and thus the market is expected to witness significant growth over the forecast period.

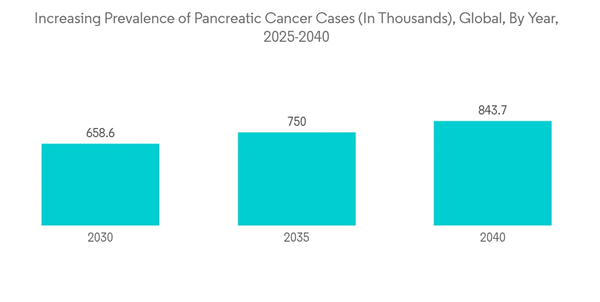

The factors that are driving the growth of this market are an increase in the prevalence of pancreatic cancer and biliary duct diseases, technological advancements in stents and endosonographic, and the increasing popularity of minimally invasive surgery. For instance, according to the Globocan 2020 report, globally 132.5 thousand gallbladder cancer cases will be recorded in 2025, and this number is expected to increase to 150.9 thousand by 2030 and to 190 thousand by 2040. Bile duct cancer can lead to the enlargement of a tumor blocking the bile duct. Hence, the placement of a biliary stent can assist in the optimum drainage of the bile; hence, the rising burden of gallbladder cancer is expected to boost market growth. Similarly, an article published by the journal AHPS, in August 2022, reported that high incidence and mortality rates of gallbladder, extrahepatic bile duct, and pancreatic cancer are steadily increasing in Korea. Thus, a high prevalence of gallbladder cancer is expected to drive the demand for biliary stents, thereby driving the growth of the studied market over the forecast period.

Furthermore, with the introduction of new technologies for gastrointestinal surgeries such as bioabsorbable stents and self-expanding metal stents (SEMS), the use of stents for the treatment of pancreatic and biliary diseases is gaining popularity. For instance, in October 2021, Boston Scientific received the 510 (k) US FDA clearance and CE mark approval to market its Advanix biliary plastic stents. Thus, such product launches are driving the growth of the studied market. Moreover, the increasing popularity of minimally invasive surgery (MIS) due to the low risk associated with it compared to open surgeries is increasing the preference for MIS over normal surgeries and thus, fueling the growth of the studied market.

Therefore, due to the increase in the prevalence of pancreatic cancer and biliary duct diseases, technological advancements in stents and endosonography, and increasing popularity of minimally invasive surgery, the pancreatic and biliary market is anticipated to grow over the forecast period. However, the concerns regarding the high cost associated with procedural complexities, and stringent government regulations may slow down the growth of the studied market over the forecast period.

Pancreatic & Biliary Stents Market Trends

Metal Pancreatic and Biliary Stents is Expected to Witness a Significant Growth Over the Forecast Period.

Metal stents are self-expandable mesh-like tubes of thin wire which are inserted into a lumen or duct in the human body to maintain the passage open in the bile or pancreatic duct. The segment is expected to witness significant growth owing to the wide application of a range of metal stents for the treatment of various pancreatic and biliary-related diseases such as pancreatic cancer, pancreatic and biliary leaks, and other malignant obstructions. Moreover, the increase in the number of prostate cancers worldwide has significantly aided in the growth of metallic stents. For instance, in 2022 ACS, reported a 12.5% increase in prostate cancer cases in the US over the last three years reaching 268.5 thousand prostate cancer cases in 2022. Thus, the high number of prostate cancer cases is driving the demand for metallic stents for its treatment thereby driving the growth of this segment.The increasing research and clinical studies related to applications of metallic stents are also propelling the growth of this segment. For instance, an article published by the journal Scientific Reports, in May 2022, stated that a clinical study reported the successful treatment of benign biliary structures (BBS) using fully covered self-expandable metal stents. Thus, such promising results are leading to the increasing demand for metallic stents thereby driving the growth of the segment.

Furthermore, new products and the development of better technology have bolstered the pancreatic and biliary market. For instance, in May 2021, AMG International GmbH launched the CE mark approval of their second fully biodegradable metal stent UNITY-B, which is a balloon expandable biodegradable biliary stent (BEBS) for endoscopic use. This product launch was aimed at expanding the company’s product offering as well as enhancing its market presence.

Thereby, the sector is anticipated to experience significant expansion, thus driving the market throughout the forecast period, thanks to the widespread application of a variety of metal stents for the treatment of various pancreatic and biliary-related illnesses.

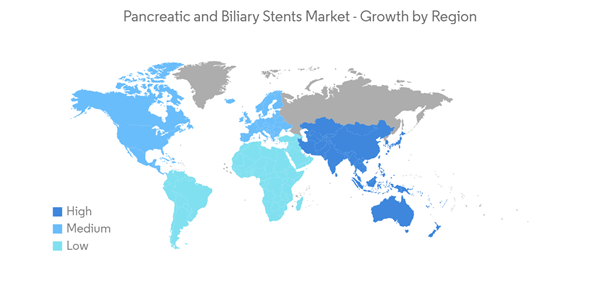

North America Region is Expected to Witness a Significant Growth Over the Forecast Period.

North America is expected to witness significant growth owing to the well-established healthcare industry and the rising prevalence of chronic diseases like prostate cancer, pancreatic cancer, and gall bladder cancer which is increasing the demand for pancreatic and biliary stents. For instance, ACS in 2022, reported 32.9 thousand new pancreatic cancer cases in men compared to 29.2 thousand pancreatic cancer cases in women in the United States. Similarly, CAGS in January 2022, reported the high prevalence of gallbladder cancer in Canada. As a result, the rising prevalence of pancreatic and gallbladder cancers in North American countries is fueling the expansion of the examined market for pancreatic stents.Furthermore, the recent mergers, acquisitions, and partnerships are further driving the growth of this segment. For instance, in May 2021, Cook Medical acquired Cantel Medical to expand its biliary stent and another product portfolio to provide services to customers globally. Thus, such development in the region is likely to boost the demand for pancreatic and biliary stents. Similarly, in July 2022, CDC reported that in 2021, 4.5 million adults were diagnosed with chronic liver disease in the United States alone which contributed to 1.8% of the country’s total adult population diagnosed with the disease. When liver inflammation results in bile duct blockage, a biliary stent must be implanted to relieve the obstruction. This drives up demand for biliary stents and contributes to the growth of the studied market in the region.

Thus, the region is likely to have considerable growth, boosting the market throughout the forecast period, on account of its well-established healthcare industry and the rising prevalence of chronic diseases such as prostate cancer, pancreatic cancer, and gall bladder cancer.

Pancreatic & Biliary Stents Market Competitor Analysis

The global market for pancreatic and biliary stents is moderately competitive, with a number of different market participants. Currently, only a handful of companies hold a sizable percentage of the market share. It is anticipated that several regional players would participate in the pancreatic and biliary stents market throughout the projection period. This is due to the increasing patient awareness levels and high prevalence of diseases.Some of the key players in the market are Boston Scientific Corporation, Cook Medical Inc, CONMED Corporation, Olympus Corporation, Becton, Dickinson and Company, Abbott Laboratories, Medtronic Plc, Stryker Corporation, and Taewoong Medical Co., Ltd., among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Boston Scientific Corporation

- Cook Medical Inc

- CONMED Corporation

- Olympus Corporation

- Becton, Dickinson and Company

- Abbott Laboratories

- Medtronic Plc

- Stryker Corporation

- Taewoong Medical Co., Ltd.

- Endo-Flex GmbH

- B. Braun Melsungen AG

- Cardinal Health