During the COVID-19 pandemic outbreak, the market was severely hit because of the imposed lockdowns worldwide to curb the spread of the virus. People across Thailand avoided visiting places and reduced gatherings at public places. It reduced the ride-hailing demand across the country. Although, 2021 showcased a significant recovery post-pandemic which portrayed high demand for ride-hailing services across the country.

Recently, passenger preferences for ride-hailing services across Thailand have increased. It helped the companies to enhance the options and expand their operations to be provided in mobile applications, to retain their respective market shares in a highly competitive market.

Ride-hailing companies are working to eliminate overall vehicle carbon emissions across Thailand by converting the gasoline fleet to electric. Fleet conversion includes various direct environmental and indirect benefits for other markets. It can support the public charging infrastructure and increase individual consumer exposure to EVs. Thus, considering these factors and changing consumer preferences towards ride-hailing positively impacted the market dynamics.

Thailand Ride Hailing Market Trends

Online Booking to Gain Traction

Online ride-hailing bookings are gaining momentum in the country due to the rising usage of smartphones and the growth in the number of users preferring online channels. Thailand is the epi-center for the tourist spots that millions of tourists visit each. These online booking platforms help them maintain the accessibility of the fleet and improve connectivity across all the offered vehicle types under one roof for renting.With the growing trend in technology, renting a vehicle through online booking has become the most preferred choice for customers over the past few years. Moreover, it provides additional facilities to monitor a rental vehicle's operation, performance, and maintenance in real-time. Such features are tremendous assets for drivers and fleet managers, enabling them to better and more efficiently identify risks and implement timely improvements to their rental services.

Most renters prefer renting cars online during peak seasons. As the ride-hailing market experiences an increase in demand during peak holiday seasons, people tend to book cars, bikes, and scooters in advance. Only a handful of vehicles are booked through rental stores, as the rest get pre-booked during the off-season. Online booking services include booking vehicles via internet sites and mobile applications, among which booking-via-sites is the most common method opted for by renters.

Although, the government provided strict guidelines for online customers to keep the ride-hailing process seamless.

- In July 2021, Thailand's Transport Ministry issued rules regarding private car rentals in Thailand using online applications. Consumers can only book ride-hailing services online for passenger vehicles with a maximum capacity of 7 passengers. In addition, individuals can only book a single ride at a time using its registration. The government also imposed unusual traffic congestion fees worth TBH 3 (USD 0.087) and TBH 10 (USD 0.29) for small and large vehicles.

Further, considering these factors and the government's stance in promoting a healthy ride-hailing culture for online services provided traction to the segment. It is anticipated to register an improved sales bar during the forecast period.

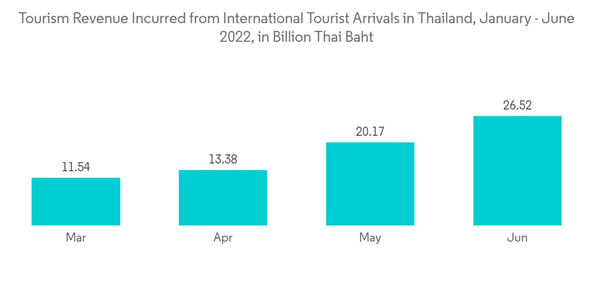

Tourism to Attract Ride Hailing Demand

Thailand is a critical hotspot for travel destinations and tourism over the decades. Families are attracted by this place and enjoy their holidays visiting different locations across the country.Places including Gren blue beaches, coral islands, mountains, shopping markets, Hindu temples, and monasteries are much-attracted destinations for those that look forward to a fantastic holiday destination. It improved the demand for ride-hailing across the country. People coming to Thailand often look for self-driving rental cars to visit Thailand with their families.

Ride-hailing companies are expanding their business potential to offer better and more reliable services to end customers. For instance:

- In November 2022, Airasia ride expanded its ride-hailing services in Thailand under its AirAsia Super App. The company is looking forward to setting competitive fees to attract passengers, mainly tourists. The company expects 15% lower fares for its ride-hailing service than its key competitors.

- In September 2022, Robinhood, a food delivery company, announced the expansion of its car-hailing services in Thailand. The company already took approval from the transport department for its Thai app, which will provide ride-hailing services to customers in the market.

After considering these factors and demand, ride-hailing demand in Thailand is anticipated to hold high growth potential attributed to expanding tourism sector in Indonesia.

Thailand Ride Hailing Market Competitor Analysis

The market is moderately fragmented as the regional players have a high market share and are consistently seeking ways to increase growth potential. Companies including Grab Holdings Inc. and Bolt remained the key players occupying high revenue share. Further, in 2021, Gojek, among the critical ride-hailing service providers, sold its business to Airasia, which entered the country.Moreover, other companies, including Gobike and AllThaiTaxi, hold a prominent share in the business and consistently look forward to expanding their respective business potential in the market.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Grab Holdings Inc.

- Bolt

- Airasia

- GoBike

- AllThaiTaxi

- NaviGo

- Robinhood