COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Increasing demand for gas power generation and a rising number of LNG-fueled fleets are expected to drive the India LNG market during the forecast period.

- However, LNG oversupply and trade tension is expected to hamper the market growth during the forecast period.

- A high number of LNG regasification project plans are expected to be proposed in upcoming years, creating several opportunities for the market players, thus, making an emerging LNG market.

India LNG Market Trends

City Gas Distribution segments to Dominate the Market

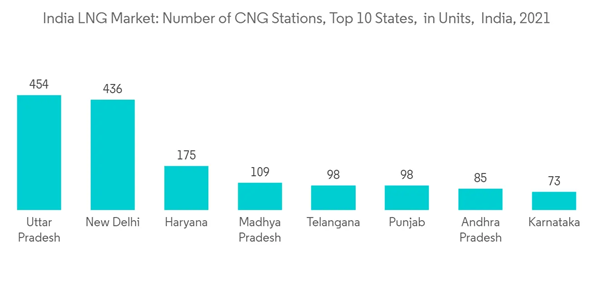

- The City Gas Distribution application includes PNG connections and CNG stations. PNG connections are provided for residential, commercial, and industrial purposes, while CNG stations are installed to access natural gas for transportation purposes.

- 11 CGD bidding rounds were completed till 2021, including natural gas access to 215 districts in 19 states and one union territory. As per data provided by PNGRB, as of December 2020, the total number of domestic PNG connections in India was approximately 72.47 lakh. It is expected to grow during the forecast period. Also, as of January 2022, India had more than 4,500 CNG stations.

- The Petroleum & Natural Gas Regulatory Board in India, under the Natural Gas Infrastructure in India 'Vision 2030,' has announced plans to increase the share of natural gas in the energy mix by 20% in 2025 as compared to 11% in 2010, which may increase the number of PNG connections and CNG stations in the country. Thus, such government initiatives will likely drive the market studied during the forecast period.

- The completion of the 11th CGD bidding round includes 215 districts (212 complete and 3 part) in 19 states and one union territory, which comprises nearly 71% of India's total population.

- The 11th CGD round awarded major contracts to Bharat Petroleum Corporation Limited (BPCL), Megha Enterprises (MEIL), Indian Oil Corporation (IOC), and Adani Total. Additions to the connection in the future are expected to drive the LNG market throughout the forecast period.

- Therefore, based on the factors mentioned above, the City Gas Distribution sector is expected to dominate the India LNG market during the forecast period.

Rise in LNG Bunkering Facilities to Drive the Market

- The reason for the rise in LNG bunkering infrastructure can be attributed to the expected increasing preference for LNG over other fuels by ship makers. Furthermore, several ports in the country are looking to develop an LNG fueling infrastructure.

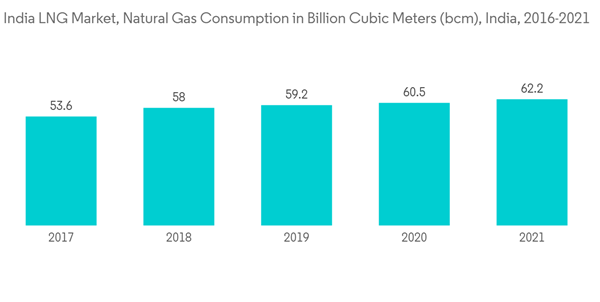

- The rise in demand for natural gas in the country owing to the clean emission is also likely to boost the use of LNG as a marine fuel in the shipping industry. The natural gas consumption was 62.2 billion cubic meters in 2021. The increasing consumption of natural gas is expected to drive the market further.

- The country is expected to be among the regional hot spots for the LNG market in the coming years. India has an operational port in Kochi, where Petronet LNG operates.

- Furthermore, in January 2022, LNG Alliance announced an investment of approximately USD 290 million for developing a major LNG import terminal in Karnataka, which is likely to be India’s first dedicated LNG bunkering facility. The LNG import terminal will likely have a 4 million tonnes per annum (MTPA) capacity. Thus, such upcoming projects are likely to drive the LNG market in India during the forecast period.

- Therefore, based on the factors mentioned above, a rise in LNG is expected to drive the Indian LNG market during the forecast period.

India LNG Market Competitor Analysis

The Indian LNG market is moderately Consolidated. Some of the major players (in no particular order) include JSW Infrastructure, Shell PLC, Adani Total Gas, Petronet LNG Ltd., and GAIL Limited, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Petronet LNG Ltd.

- Adani Total Gas

- JSW Infrastructure

- GAIL Limited

- Shell PLC

- GSPC LNG Limited

- H-Energy Private Limited

- Bharat Petroleum Corporation Limited

- Essar Ports Ltd