Key Highlights

- The COVID-19 pandemic wreaked havoc on the economy, resulting in construction being halted and impacting labor-intensive sectors. The outbreak of the pandemic caused market turbulence and uncertainty across Europe. Furthermore, stock market volatility hurt manufacturer stock prices and trade volumes. As a result, new residential and non-residential development had declined significantly, reducing the demand for modular construction.

- The modular construction market is expected to grow because of the rising demand for permanent modular construction. This is because modular construction saves time and money compared to traditional construction.

- However, the higher initial funding required for setting up production on a huge scale and the high risk of project failure while shipping the finished construction model to the preferred site might pose a hindrance to the market's growth. Moreover, the impact of the recession could further weaken demand for modular construction across the European region.

- On the other hand, the growing need for higher-quality, eco-friendly homes all over the continent could be a chance for the modular construction market to grow.

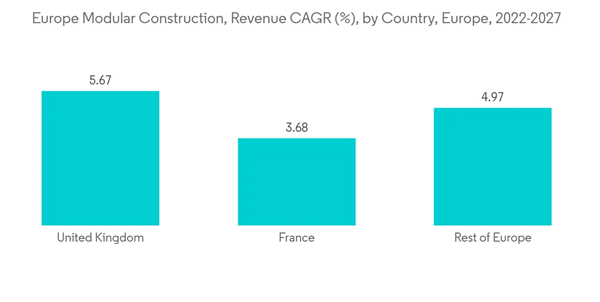

- Germany is expected to lead the market for modular construction over the next few years because it has the biggest construction industry in Europe.

Europe Modular Construction Market Trends

Commercial Sector Expected to Dominate the Market

- Commercial buildings are constructed using the modular construction process in accordance with the International Building Code (IBC) or a version of a code modeled after the IBC and state regulations.

- The European modular market is very strong for commercial buildings. The most common examples are modular office buildings being used as extensions of existing buildings when companies need more space for their workers or as temporary offices while traditional buildings are being renovated.

- In Europe, according to the Europe Hotel Construction Pipeline Trend Report, at the close of the third quarter of 2021, Europe’s hotel construction pipeline stood at 1,814 projects and 295,719 rooms and remained largely unchanged year-over-year.

- Moreover, the commercial sector did benefit from the COVID-19 scenario too. In Europe, various manufacturers found an increase in demand for storage space and distribution hubs as a result of the pandemic, with e-commerce replacing regular commerce and more groceries being delivered rather than bought in-store.

All the aforementioned factors are expected to drive the modular construction market in the commercial segment.

Germany Set to Dominate Growth in the European Region

- The German economy is the largest in Europe and the fifth-largest globally. According to the International Monetary Fund (IMF), GDP was estimated to rise to 2.8% in 2021, subject to the post-pandemic global economic recovery. The GDP is forecast to register a growth rate of 2.1% in 2022.

- Germany has the largest construction industry in Europe. The prefabricated building industry in Germany is booming, with high growth in the residential sector. Along with the general boom in residential construction in the country, the share of prefabricated housing solutions in residential construction is increasing, reaching more than 20%. Additionally, the high demand for turnkey solutions is increasing the demand for prefabricated houses, thus fueling the market's growth.

- The Federal Statistical Office says that in May 2021, 32,384 homes were allowed to be built in Germany. This is 8.7% more than in April 2021.In October 2021, the construction of 29,597 dwellings was permitted in Germany. The total number of building permits from January to October 2021 increased by 4.2% compared with the same period a year earlier.

- Moreover, millions of immigrants are projected to arrive in Germany in the coming few years and may require thousands of new dwellings. In 2021, the German government plans to build approximately 1.5 million new apartments.All such growth in the construction industry is likely to propel the country's market demand for modular buildings.

- Overall, based on the above factors, it is expected that the demand for modular constructions in Germany will continue and grow during the forecast period.

Europe Modular Construction Market Competitor Analysis

The European modular construction market is highly fragmented, with no player holding a significant share to influence the market. Some of the key players in European modular construction include Skanska, Modulaire Group, DFH Group, Daiwa House Modular Europe Ltd. (Jan Snel), and Elements Europe, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Demand for Modular Construction in Commercial Segment

4.1.2 Rising Demand for Higher-quality, Eco-friendly Homes

4.2 Restraints

4.2.1 Requirement of Substantial Initial Financing owing to Size and Scale of Production

4.2.2 Impact of Recession

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Type

5.1.1 Permanent

5.1.2 Relocatable

5.2 Material

5.2.1 Steel

5.2.2 Concrete

5.2.3 Wood

5.2.4 Plastic

5.3 End-user Industry

5.3.1 Commercial

5.3.2 Industrial/Institutional

5.3.3 Residential

5.4 Geography

5.4.1 Germany

5.4.2 United Kingdom

5.4.3 France

5.4.4 Italy

5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Berkeley Group

6.4.2 Bouygues Batiment International

6.4.3 Daiwa House Modular Europe Ltd. (Jan Snel)

6.4.4 DFH Haus GmbH

6.4.5 Elements Europe

6.4.6 Karmod Prefabricated Technologies

6.4.7 Laing O'Rourke Corpt Ltd.

6.4.8 Modulaire Group

6.4.9 Modubuild

6.4.10 Moelven Industrier ASA

6.4.11 Skanska AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Healthcare Sector Embracing Modular Construction

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Berkeley Group

- Bouygues Batiment International

- Daiwa House Modular Europe Ltd. (Jan Snel)

- DFH Haus GmbH

- Elements Europe

- Karmod Prefabricated Technologies

- Laing O'Rourke Corpt Ltd.

- Modulaire Group

- Modubuild

- Moelven Industrier ASA

- Skanska AB