Speak directly to the analyst to clarify any post sales queries you may have.

OUTDOOR POWER EQUIPMENT MARKET TRENDS & DRIVERS

Technological Advancements

Advancements in technology and the development of new products are important market driver that helps manufacturers to cater to the growing customers' demand. For instance, in 2024, Robot Mowers, a dealer for FJ Dynamic, released RM21, which is a fully autonomous robotic mower with five hours of run time and can maintain areas up to 90,000 square feet in size. This equipment is suitable for commercial applications such as turf farms, sporting facilities, parks, golf courses, and solar farms, among others, as well as large residential properties. This shift enhances user convenience and efficiency and creates new opportunities for vendors to differentiate their products, expand their customer base, and strengthen their presence in the market.Advances In Lithium-Ion Batteries

The development of lithium-ion batteries has further accelerated the market demand for outdoor power equipment. In 2024, Stanley improved its battery technology by introducing a 20V lithium-ion V20 battery pack, which is compatible with all the power tools and outdoor products in its V20 range. Moreover, in 2023, EVE Energy and the Malaysian Investment Development Authority (MIDA) announced a new manufacturing site in Kedah, Malaysia, which is dedicated to producing cylindrical lithium-ion batteries to support the manufacturing of power tools throughout Southeast Asia. Hence, such factors and investments in battery technology create strong growth opportunities for outdoor power equipment manufacturers, supporting the industry’s shift toward cordless and sustainable solutions.Urbanization & Housing Expansion

With the rising urbanization and housing, the outdoor power equipment market demand is significantly surging across the world. According to the data by the United Nations, around 55% of the world's population lives in urban areas and is expected to rise to around 68% by 2050. These urban areas need to maintain residential and commercial spaces to enhance aesthetic appeal and functionality, which drives the homeowners and property managers to invest in efficient outdoor power tools for maintenance. Additionally, the development of the residential sector across emerging countries like India is further supporting the demand for outdoor power equipment. For instance, Goodrej Riverine Project is an upcoming luxury residential project in Noida, Delhi, expected to be completed by 2030, which features apartments, a clubhouse, swimming pool, spa, gymnasium, and various other amenities along with social infrastructure.OUTDOOR POWER EQUIPMENT MARKET SEGMENTATION INSIGHTS

INSIGHTS BY EQUIPMENT TYPE

The global outdoor power equipment market by equipment type can be segregated into lawn mowers, chainsaws, snow blowers, tillers, trimmers, leaf blowers, and others. The lawn mowers segment accounted for the most significant market share. The segment is experiencing a dynamic evolution, driven by the rise of smart and autonomous mowing solutions with GPS, sensors, and AI capabilities that are gaining traction among homeowners seeking convenience and precision as these machines map lawn boundaries, avoid obstacles, and operate with minimal human intervention, significantly reducing maintenance time. With manufacturers focusing on developing products that align with these expectations to gain a competitive edge in the industry, this further supports the market demand.INSIGHTS BY CATEGORY

The global outdoor power equipment market by category is segmented into mass and premium. In 2024, the mass segment is expected to witness an incremental growth of USD 7.61 billion during the forecast period. Mass outdoor power equipment remains the most accessible and widely purchased category globally, even as it is primarily designed for the maintenance of moderate-sized homes, lawns, and yards, making it the preferred choice for residential users and DIY enthusiasts. This category is expected to continue dominating the global outdoor power equipment market by share, driven by strong consumer demand and affordability.Moreover, in emerging regions like APAC, particularly in countries like India and China, mass outdoor equipment is favored because of its price sensitivity, with strong interest in basic and entry-level tools for household gardening.

INSIGHTS BY POWER SOURCE

Based on the power source in 2024, the ICE segment has the largest global outdoor power equipment market share. ICE-powered equipment continues to be the backbone of the industry because of its high-power output, reliability, and capability to perform demanding tasks. The strength of the ICE category lies in its ability to provide consistent runtime, and superior torque makes it the preferred choice for large-area maintenance and professional landscaping contracts. However, the market is getting impacted negatively owing to regulatory compliance and bans across various regions because of its loud sound output and carbon emissions produced by using gasoline as fuel. Furthermore, the cordless segment is growing at a high CAGR rate because of the rising awareness about energy-efficient tools, as they do not emit direct carbon and produce less noise.INSIGHTS BY END-USER

Based on end-user, the residential segment has the highest revenue share in the global outdoor power equipment market. The segment is dominating due to the rising popularity of home gardening, landscaping, and DIY lawn maintenance. Homeowners increasingly invest in tools that allow them to maintain small to medium-sized lawns and gardens efficiently, without relying on professional services. Products like walk-behind mowers, corded trimmers, leaf blowers, and entry-level chainsaws are widely used in residential applications due to their affordability, ease of use, and low maintenance requirements.The demand for garden parties, backyard gatherings, and cookouts has grown significantly in 2024, driving the residential sector’s interest in backyard beautification and landscaping. Homeowners are increasingly investing in well-maintained lawns, flower beds, and outdoor spaces, which has boosted the demand for outdoor power equipment such as walk-behind mowers, robotic mowers, cordless trimmers, and leaf blowers.

INSIGHTS BY DISTRIBUTION CHANNEL

The offline sales channel is traditionally the backbone of the global outdoor power equipment market and has a crucial role in the global distribution landscape. In 2024, the offline distribution channel dominated the market with the largest share. The offline channel refers to the traditional sales model where products are sold through physical retail outlets such as specialty stores, supermarkets, hypermarkets, and dealer networks. It enables customers to physically evaluate product quality, compare options, and receive face-to-face assistance, which is especially important in the outdoor power equipment market due to the technical nature and higher cost of these machines.Popularity in areas that lack connectivity and high consumer trust associated with personally experiencing the quality of products is driving the growth of this segment. Customers value the ability to personally inspect product quality, seek demonstrations, and receive guidance from sales staff, which continues to make offline channels the preferred choice for both residential and commercial buyers.

OUTDOOR POWER EQUIPMENT MARKET GEOGRAPHICAL ANALYSIS

The North America region is dominating the global outdoor power equipment market in 2024. The regional market’s growth is attributed to North America’s larger geographical area compared to its population, which leads to more gardens and lawns in the region. Furthermore, rising investment by the government in infrastructure is also expected to drive the region’s growth. Furthermore, the region's established infrastructure and preference for premium outdoor tools further fueled the outdoor power equipment market expansion in the region. Moreover, the presence of major multinational brands and their extensive distribution networks has created a strong market for innovative outdoor power equipment products.The Europe region is growing at a rate of around 4.75% during the forecast period. The European outdoor power equipment market is increasingly transformed by automation and smart technologies, with strong adoption of IoT-enabled and robotic solutions. Furthermore, stringent EU carbon reduction policies are accelerating the transition toward battery-powered and electric OPE. Thus, the adoption of robotic lawnmowers is high across Germany as the country has over 500 national parks and around 550 botanical gardens.

The APAC outdoor power equipment market is expected to grow at a strong pace during the forecast period, supported by rising disposable incomes and changing lifestyles in countries such as India and China. Growing interest in gardening, landscaping, and home improvement is boosting demand across residential users. In addition, large-scale sporting events like the Indian Premier League (IPL), Asian Games, and other tournaments are increasing the need for modern equipment to maintain stadiums and sports fields. Thus, the above-mentioned factors are expected to increase the demand for outdoor power equipment during the forecast period.

OUTDOOR POWER EQUIPMENT MARKET VENDOR LANDSCAPE

The global outdoor power equipment market is moderately fragmented, with the presence of international manufacturers and numerous regional players competing across different segments. This fragmentation reflects the diversity of consumer needs worldwide, ranging from household gardening and lawn maintenance to large-scale commercial landscaping and lawn care. Despite its fragmented nature, the market is increasingly dominated by global players such as Deere & Co., Husqvarna, HONDA, Stanley Black & Decker, and The Toro Group that continue to strengthen their foothold through technological innovation, wide distribution networks, and strong brand value.Outdoor Power Equipment Market News & New Product Innovations

- In 2025, Greenworks Commercial introduced the 2025 OPTIMUS series, which is a fully electric line of commercial-grade outdoor equipment. It includes zero-turn mowers and utility vehicles integrating advanced battery systems and smart fleet management technology to support zero-emission landscaping activities.

- In 2024, ECHO Incorporated announced the launch of its nine new products to its portfolio during its annual media event, Power-On-Athon 2024.

- In 2023, The Toro Company and Lowe's Companies, Inc. revealed a strategic retail collaboration, and as part of this partnership, Lowe's will stock Toro zero-turn riding mowers, walk mowers, portable power equipment, and snow blowers.

Key Company Profile

- Husqvarna Group

- Deere & Company

- Honda Motor Co., Ltd.

- Toro Company

- Stanley Black & Decker, Inc.

- Robert Bosch GmbH

Other Prominent Company Profiles

- AriensCo

- STIGA Group

- Makita Corporation

- STIHL

- Techtronic Industries Company Limited (TTI)

- Einhell Germany AG

- Masport

- Greenworks Tools

- Emak Group S.p.A.

- Generac Power Systems

- Briggs & Stratton Corporation

- SUMEC Hardware & Tools Co., Ltd.

- WEN

- Yambiko Group

- Sun Joe

- BISON

- Positec Group

- Zucchetti Centro Sistemi (ZCS)

- Mammotion

- LuckNow Products

- Hustler Turf

- Bad Boy Mowers

- Chervon Group

- Kubota Corporation

- AGCO Corporation

- Ningbo Daye Garden Machinery Co., Ltd

- Altoz

- Doosan Corporation

- Cobra Garden

- FutureGen Robotics

- Grey Technology Ltd (Gtech)

- The Grasshopper Company

- Alfred Karcher SE & Co. KG

- Zhejiang Titan Machinery Co., Ltd.

- PRORUN

- Westinghouse Outdoor Power Equipment

Segmentation by Equipment Type

- Lawn Mowers

- Chainsaws

- Snow Blowers

- Tillers

- Trimmers

- Leaf Blowers

- Others

Segmentation by Category

- Mass

- Premium

Segmentation by Power Source

- ICE

- Cordless

- Corded

Segmentation by End-User

- Residential

- Commercial

Segmentation by Distribution Channel

- Offline

- Online

Segmentation by Geography

- North America

- The U.S.

- Canada

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Sweden

- Netherlands

- Belgium

- Poland

- Switzerland

- Finland

- Austria

- APAC

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- UAE

- South Africa

- Saudi Arabia

- Egypt

KEY QUESTIONS ANSWERED

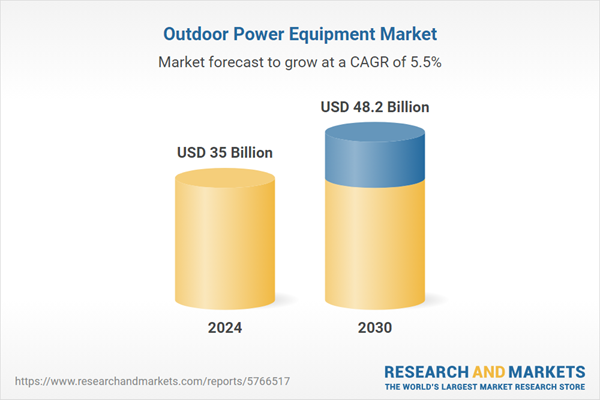

- How big is the global outdoor power equipment market?

- Who are the major players in the global outdoor power equipment market?

- What is the growth rate of the global outdoor power equipment market?

- Which region dominates the global outdoor power equipment market?

- What are the key trends in the global outdoor power equipment market?

Table of Contents

Companies Mentioned

- Husqvarna Group

- Deere & Company

- Honda Motor Co., Ltd.

- Toro Company

- Stanley Black & Decker, Inc.

- Robert Bosch GmbH

- AriensCo

- STIGA Group

- Makita Corporation

- STIHL

- Techtronic Industries Company Limited (TTI)

- Einhell Germany AG

- Masport

- Greenworks Tools

- Emak Group S.p.A.

- Generac Power Systems

- Briggs & Stratton Corporation

- SUMEC Hardware & Tools Co., Ltd.

- WEN

- Yambiko Group

- Sun Joe

- BISON

- Positec Group

- Zucchetti Centro Sistemi (ZCS)

- Mammotion

- LuckNow Products

- Hustler Turf

- Bad Boy Mowers

- Chervon Group

- Kubota Corporation

- AGCO Corporation

- Ningbo Daye Garden Machinery Co., Ltd

- Altoz

- Doosan Corporation

- Cobra Garden

- FutureGen Robotics

- Grey Technology Ltd (Gtech)

- The Grasshopper Company

- Alfred Karcher SE & Co. KG

- Zhejiang Titan Machinery Co., Ltd.

- PRORUN

- Westinghouse Outdoor Power Equipment

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 332 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35 Billion |

| Forecasted Market Value ( USD | $ 48.2 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 42 |