Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Due to high tinctorial strength and brightness properties, basic dyes offer different shades to fibres when exposed or dipped in dye. Apart from these, the basic dye has exceptional light fastness properties because of its resistance to the harmful effect of ultraviolet radiation in sunlight. Hence, there is growing demand from end-user industries for applications like textile, industrial, and medical applications. Basic dyes are the best product for dyeing plastics like acrylic, dyeing paints, coatings & stains, dyeing paper products, dyeing hair, and other applications due to their chemical properties known as Paper Dyes Market. Owing to the numerous advantages of basic dyes, the requirement for basic dyes from end-users is going to rise and propel the growth of the basic dyes market in the anticipated period.

Key Market Drivers

Rapid Growth of Global Textile and Paper Processing Drives Basic-Dye Demand

One of the primary commercial drivers of the global basic dyes market is the sheer scale and growth of industrial sectors that require strong, fast colouring - especially textiles (particularly synthetic fibres), leather finishing, and some paper/board applications. Basic (cationic) dyes are prized because of their bright shades and strong tinctorial strength on certain fibre classes (e.g., acrylics, paper, some leathers).Global textile production and the associated finishing and dyeing operations remain massive consumers of colorants: textile dyeing and finishing account for a very large share of the sector’s water and chemical use, and growth in textile volumes - driven by population, rising per-capita clothing consumption in developing markets, and e-commerce - directly translates into higher dye throughput at dyehouses.

Public sources highlight the large environmental footprint of textile production: for example, the European Parliament (summarizing UN and industry data) notes that the textile sector is responsible for an estimated ~20% of global industrial water pollution from dyeing and finishing, underscoring the scale of dye usage worldwide. Similarly, the UN Alliance for Sustainable Fashion / World Bank have quantified the enormous water consumption of the fashion/textile system (hundreds of trillions of liters annually), which implies continued demand for dyeing inputs as textile volumes grow. In addition to textiles, other large-volume applications - paper and board coloration, leather finishing, and specialty industrial inks - use basic or cationic dyes where their optical properties are required.

Key Market Challenges

Environmental Persistence, Toxicity and Effluent Removal of Cationic/Basic Dyes

An enduring and widely documented challenge for basic dyes is their environmental persistence and the difficulty of removing cationic colorants from wastewater. Basic dyes (cationic dyes) often show strong adsorption to substrates and can be resistant to conventional biological wastewater treatment; when discharged they increase chemical oxygen demand (COD), impair light penetration in receiving waters, and may contain components that are toxic to aquatic organisms or form hazardous degradation products. Peer-reviewed reviews of textile wastewater note that dye effluents are complex and that certain dye classes (including cationic/basic dyes) require advanced physico-chemical or oxidative treatment to meet discharge standards. This technical reality imposes real costs on dye users (textile mills, paper finishers): capital for advanced treatment (ozonation, advanced oxidation, adsorption, membrane systems), ongoing reagent and energy costs, and more complex sludge or concentrate disposal.Key Market Trends

Process-Level Shifts: Water-Saving and Low-Impact Dyeing Methods Reduce Overall Dye Loads but Raise Premium Demand for High-Performance Basic Dyes and Auxiliaries

A major industry trend is the increasing adoption of water-saving and low-impact dyeing technologies - e.g., pad-dyeing, foam dyeing, dope-dyeing (dope or mass coloration), and digital textile printing - driven by both regulation and brand sustainability commitments. These process shifts reduce the total water and chemical footprint per unit of fabric but change dyestuff demand in important ways: they often require dyes with tailored solubility, fixation behavior, and compatibility with low-liquor ratios or non-aqueous/foam media. For basic dyes, this trend means that while aggregate dye mass used per fabric unit may fall (because of better dye uptake and less rinsing), the value and specification demand on the dye itself increase - customers pay a premium for dyes engineered for fast fixation, low bleed, and low residuals in modern dyeing processes.Key Market Players

- GFS Chemicals, Inc.

- Sigma-Aldrich Corporation

- DuPont de Nemours Inc.

- Clariant AG

- BASF SE

- Bayer AG

- Archroma US Inc

- CHT Group

- Abbey Color Inc.

- Ambuja Intermediates Limited

Report Scope:

In this report, Global Basic Dyes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Basic Dyes Market, By Type:

- Liquid

- Powder

Basic Dyes Market, By Sales Channel:

- Direct

- Indirect

Basic Dyes Market, By Application:

- Textile

- Non-Textile

Basic Dyes Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Basic Dyes Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GFS Chemicals, Inc.

- Sigma-Aldrich Corporation

- DuPont de Nemours Inc.

- Clariant AG

- BASF SE

- Bayer AG

- Archroma US Inc

- CHT Group

- Abbey Color Inc.

- Ambuja Intermediates Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

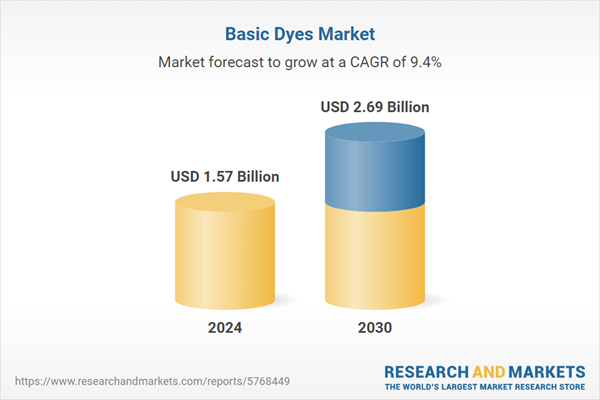

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.57 Billion |

| Forecasted Market Value ( USD | $ 2.69 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |