Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Government Initiatives to Promote Family Planning and Reproductive Health

One of the primary drivers of growth in the global hormonal contraceptives market is the significant investment by governments and international health organizations in reproductive health and family planning programs. Hormonal contraceptives - including oral pills, patches, injections, implants, and vaginal rings - form the cornerstone of modern contraception. Their widespread availability and integration into public health systems are largely supported by government policies that aim to reduce unintended pregnancies, maternal mortality, and child morbidity.The World Health Organization (WHO) states that around 257 million women globally who want to avoid pregnancy are not using safe or modern contraceptive methods. To address this unmet need, numerous governments have scaled up access to hormonal contraceptives through national programs. For instance, the U.S. federal Title X Family Planning Program supports clinics in offering affordable or free birth control to low-income individuals. According to the Office of Population Affairs (OPA), Title X clinics served 1.5 million individuals in 2022 alone, and over 99% of those clients received contraceptive services.

In developing countries, such as India, the Ministry of Health and Family Welfare operates the National Family Planning Program, which provides subsidized contraceptives through public health centers. As of 2023, the Indian government distributed over 20 million cycles of oral contraceptive pills under its Mission Parivar Vikas scheme. These expansive efforts ensure continuous market demand for hormonal contraceptives and stimulate innovation and supply chain efficiency. In effect, public health policies aimed at increasing contraceptive prevalence are driving hormonal contraceptive market growth across regions.

Key Market Challenges

Health Risks and Side Effects Associated with Hormonal Contraceptives

Despite their widespread use and effectiveness, hormonal contraceptives are associated with various health risks and side effects, which pose a significant challenge to market growth. Hormonal contraceptives function by altering a woman's hormone levels to prevent ovulation, and this hormonal interference can lead to adverse effects such as mood swings, weight gain, nausea, headaches, and menstrual irregularities. More serious risks include an increased likelihood of blood clots, cardiovascular complications, and, in rare cases, certain types of cancer. A study by the National Cancer Institute (NCI) reported a slight increase in the risk of breast and cervical cancer among long-term users of hormonal contraceptives, although they may reduce the risk of ovarian and endometrial cancers.In 2019, the U.S. Food and Drug Administration (FDA) updated warnings on combined hormonal contraceptives (CHCs) about the risk of venous thromboembolism (VTE), especially for products containing drospirenone. Similarly, regulatory agencies in Europe, such as the European Medicines Agency (EMA), have recommended stronger warnings and educational efforts to ensure informed use.

Concerns about side effects can lead to discontinuation or switching to non-hormonal methods, particularly in high-risk populations such as smokers over 35, obese individuals, and those with hypertension or a family history of thrombotic disorders. These health considerations reduce user confidence and affect market penetration, especially among new adopters. As awareness of potential adverse effects grows, particularly through social media and health advocacy platforms, it may hinder widespread adoption unless offset by education, personalized medical guidance, and the development of safer formulations.

Key Market Trends

Increasing Preference for Long-Acting Reversible Contraceptives (LARCs)

A prominent trend reshaping the hormonal contraceptives landscape is the growing preference for Long-Acting Reversible Contraceptives (LARCs) such as hormonal intrauterine devices (IUDs) and subdermal implants. These methods offer extended protection ranging from three to ten years, minimal maintenance, and high efficacy - qualities that are increasingly appealing to women globally, particularly those seeking convenience and long-term reproductive autonomy. According to the U.S. Centers for Disease Control and Prevention (CDC), LARCs have the lowest failure rates among contraceptive methods - less than 1% - compared to 7% for oral contraceptive pills. This reliability, combined with a low requirement for user adherence, has fueled rapid adoption, especially in developed countries with well-established healthcare systems.Government programs are also promoting LARCs as part of comprehensive reproductive healthcare. For instance, the UK's National Health Service (NHS) includes hormonal IUDs in its publicly funded contraceptive offerings. In the U.S., state-level Medicaid expansion has been linked to increased access and uptake of LARCs, particularly in underserved populations. A report from the Kaiser Family Foundation found that the use of LARCs among U.S. women aged 15-44 increased from 8.5% in 2009 to 14% in 2020. In low- and middle-income countries, international bodies like UNFPA and USAID have rolled out LARC-focused initiatives to reduce unmet contraceptive needs. These global efforts, combined with innovations in hormonal implant technologies, are likely to sustain the rising demand for LARCs over the coming decade.

Key Market Players

- Abbvie, Inc.

- Afaxys, Inc.

- Teva Pharmaceuticals Industries Ltd.

- Bayer AG

- Merck KGaA

- Organon Group of Companies

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Lupin Pharmaceuticals, Inc.

- Pregna International Ltd.

Report Scope:

In this report, the Global Hormonal Contraceptives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Hormonal Contraceptives Market, By Method:

- Pill

- Intrauterine Device

- Injectable

- Vaginal Ring

- Implant

- Others

Hormonal Contraceptives Market, By Hormone:

- Combination Hormonal Contraceptives

- Progestin Only

Hormonal Contraceptives Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hormonal Contraceptives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Abbvie, Inc.

- Afaxys, Inc.

- Teva Pharmaceuticals Industries Ltd.

- Bayer AG

- Merck KGaA

- Organon Group of Companies

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Lupin Pharmaceuticals, Inc.

- Pregna International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

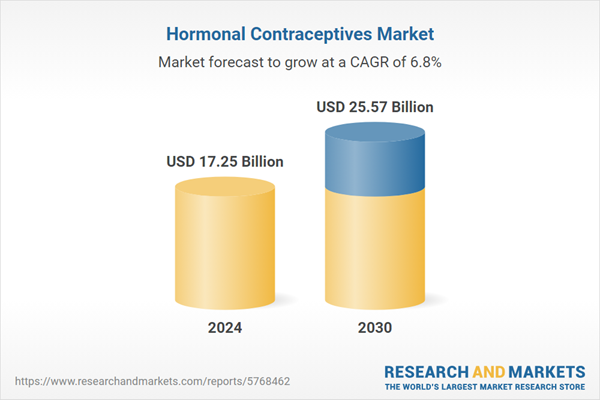

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.25 Billion |

| Forecasted Market Value ( USD | $ 25.57 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |