Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry encounters a major obstacle regarding cost efficiency that may limit widespread expansion. The high cost associated with consumables, specifically proprietary inks and printheads, frequently renders digital printing less economically feasible compared to traditional analog techniques for high-volume orders. Consequently, while digital methods offer flexibility, the financial implications of large-scale production remain a significant barrier to replacing conventional workflows entirely.

Market Drivers

Advancements in digital press speed and substrate versatility are greatly enlarging the market for digital packaging by narrowing the productivity difference with analog techniques. While previously limited to short runs, modern digital presses now provide throughput capable of making medium-run production economically sound, thus fostering wider industrial usage. For example, Labels & Labeling reported in December 2025 that the HP Indigo V12 digital press achieved production speeds up to 117.5 meters per minute, enabling converters to shift larger volumes from flexographic methods to digital workflows. This maturity is highlighted by the installed base; WhatTheyThink noted in May 2025 that HP Indigo achieved a milestone by installing its 400th flexible packaging press globally.A growing focus on sustainable and waste-reducing manufacturing processes serves as a second primary catalyst transforming the industry. As brand owners increasingly prioritize environmental, social, and governance (ESG) objectives, the ability of digital printing to eliminate prepress consumables like plates and minimize substrate waste through on-demand production offers a crucial competitive edge. This environmental advantage is both substantial and measurable, giving brands the metrics needed to verify sustainability efforts. According to HP's '2024 Sustainable Impact Report' released in July 2025, using the HP Indigo 25K digital press can lower the global warming impact of packaging production by up to 65 percent relative to traditional analog technologies, directly answering regulatory and consumer demands for greener supply chains.

Market Challenges

The Global Digital Printing Packaging Market encounters significant hurdles related to cost efficiency, particularly due to the high operational expenses linked to consumables such as proprietary inks and printheads. In contrast to traditional analog methods where unit costs drop significantly as volume increases, digital printing maintains a consistently high variable cost per unit. This cost structure makes the technology economically impractical for high-volume production runs, which represent the bulk of the packaging sector's output. As a result, converters are forced to limit digital applications to short-run or promotional tasks, hindering the technology from replacing analog methods in the core mass-production market.This economic limitation is exacerbated by wider financial strains within the industry, where maintaining profit margins is critical. The high cost of digital inputs complicates the justification for moving standard long-run jobs to digital platforms. According to the PRINTING United Alliance, the industry experienced an average operating cost inflation of 2.9% in 2025, a financial pressure that outstripped the capacity to increase prices. In such a margin-sensitive climate, the substantial ongoing costs associated with digital consumables serve as a deterrent to broader adoption, effectively limiting the market's potential for expansion.

Market Trends

The adoption of AI-driven workflow automation and inspection is transforming the production landscape by improving quality control and operational efficiency. Beyond simply increasing print speeds, AI algorithms now facilitate predictive maintenance and real-time defect detection, which drastically reduces production errors and material waste. This technological evolution is a key strategic focus for converters seeking to streamline complex manufacturing processes and decrease dependence on manual supervision. According to Esko's 'Packaging Trends 2025 Survey' from March 2025, 73 percent of industry respondents identified automation, artificial intelligence, and machine learning as the factors likely to have the most significant impact on the packaging sector in the upcoming year.Concurrently, the integration of smart packaging and connected technologies is converting passive containers into digital data carriers, providing brands with new opportunities for supply chain visibility and consumer interaction. This trend entails embedding technologies like RFID and NFC directly into packaging to enable product traceability and interactive digital experiences that go beyond the retail shelf. Commercial adoption of these intelligent solutions is gaining speed, especially in high-volume consumer markets. For instance, Avery Dennison reported in its 'Fourth Quarter and Full Year 2024 Results' in January 2025 that total sales rose by 4.7 percent to $8.8 billion, a performance bolstered by robust demand for Intelligent Labels in the apparel and general retail sectors.

Key Players Profiled in the Digital Printing Packaging Market

- CCL Industries, Inc.

- Quad/Graphics Inc.

- DS Smith PLC

- Smurfit Kappa Group PLC

- Printpack, Inc.

- Thimm The Highpack Group

- Krones AG

- ePac Holdings, LLC

- Nosco Inc.

- Quantum Print & Packaging Ltd.

Report Scope

In this report, the Global Digital Printing Packaging Market has been segmented into the following categories:Digital Printing Packaging Market, by Printing Ink:

- Solvent-Based

- UV-based

- Aqueous

- Others

Digital Printing Packaging Market, by Printing Technology:

- Thermal Transfer Printing

- Inkjet Printing

- Electrophotography & Electrostatic Printing

- Others

Digital Printing Packaging Market, by Format:

- Fill Color Printing

- Variable Data Printing

- Large Format Printing

- Others

Digital Printing Packaging Market, by Packaging Type:

- Corrugated

- Folding Cartons

- Flexible Packaging

- Others

Digital Printing Packaging Market, by End User Industry:

- Food & Beverage

- Pharmaceutical & Healthcare

- Household & Cosmetic Products

- Others

Digital Printing Packaging Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Printing Packaging Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Digital Printing Packaging market report include:- CCL Industries, Inc.

- Quad/Graphics Inc.

- DS Smith PLC

- Smurfit Kappa Group PLC

- Printpack, Inc.

- Thimm The Highpack Group

- Krones AG

- ePac Holdings, LLC

- Nosco Inc.

- Quantum Print & Packaging Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

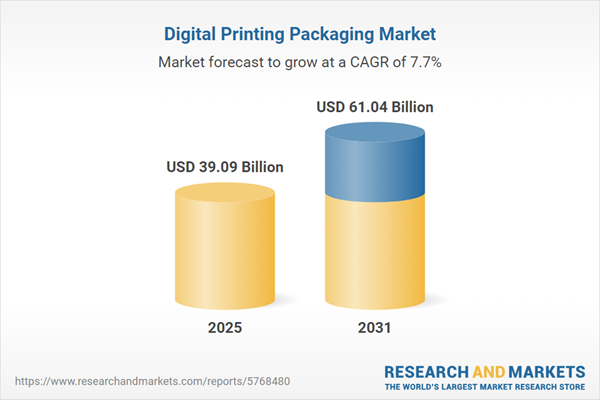

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 39.09 Billion |

| Forecasted Market Value ( USD | $ 61.04 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |