Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Ethyl chloride, which is commonly known as Chloroethane, is a chemical compound which is a flammable gas at normal temperature & pressure conditions. It has a slightly pungent odor and is an irritating gas. Earlier the main application of ethyl chloride was to produce Tetra Ethyl Lead (TEL), which is an anti-knock additive for gasoline. However, as people are getting more concerned about harmful air pollutants in the environment, TEL has been or is being gradually phased out resulting in demand declination for ethyl chloride across various countries. Like any other chlorinated hydrocarbons, ethyl chloride is mostly used as a refrigerant, an aerosol spray propellant, and a blowing agent, etc. for a wide range of applications. Foam plastics comprise of ethyl chloride which acts as a major raw material. Trends in sales volumes over the past few years for foam plastic packaging have been favorable and are likely to bolster foam plastic packaging market which would drive the demand for ethyl chloride, thereby providing a boost to Global Ethyl Chloride Market.

Key Market Drivers

Medical & Outpatient Procedure Demand

Ethyl chloride (chloroethane) is widely used as a fast-acting topical vapocoolant (cold spray) for brief, low-pain outpatient procedures such as lancing, minor excisions, IV starts, and sports-medicine care. Health systems globally have been shifting an increasing share of minor surgical and procedural volume from inpatient hospitals to ambulatory and urgent-care settings to lower costs and improve throughput; this structural change expands the occasions where fast, needle-free topical anesthetics are useful. The Lancet Commission on Global Surgery estimated ~313 million surgical procedures are performed worldwide annually - a large clinical base that includes many minor procedures where vapocoolants are appropriate.Hospitals, clinics and field medical teams value ethyl chloride for immediate onset, minimal equipment needs, and portability compared with injectable local anesthetics for very short interventions. In the U.S., ethyl-chloride vapocoolants are commercially cleared by FDA 510(k) pathways (multiple K-numbers exist), demonstrating an established regulatory route for medical spray products and continuing availability for clinical channels. Those clearances and the enduring procedural volume in ambulatory care sustain a steady baseline demand for medical-grade ethyl-chloride sprays and single-use dispensers. As outpatient care volumes and sports/EMS first-aid provisioning grow, the medical usage channel remains a reliable, policy-aligned market driver for ethyl chloride supply.

Key Market Challenges

Flammability & Occupational-Health Constraints

Ethyl chloride is extremely flammable and carries inhalation hazards that trigger detailed occupational-safety rules and facility requirements. U.S. OSHA/NIOSH guidance and EU classification (ECHA) set out exposure limits, hazard statements, and handling controls: OSHA’s annotated PEL table and NIOSH pocket guide list exposure recommendations; ECHA classifies chloroethane as an extremely flammable gas with hazard considerations. These regulatory controls drive higher capital and operating costs for manufacturers, distributors and large end-users because plants need explosion-proof storage, ventilation, continuous leak detection, specialized packaging for transportation (UN 1037 class 2.1), and trained EHS staff.In practice, smaller clinics and ambulatory centers that lack sophisticated EHS infrastructure often face tighter inventories, stricter storage rules, or procurement barriers - which can dampen demand in low-resource settings. Transport rules for hazardous goods (49 CFR / international ADR/IMDG/IATA provisions) add complexity and cost to cross-border logistics, increasing lead times in strained supply chains. Combined, flammability plus inhalation hazards create a persistent regulatory and cost headwind that affects supply continuity and price.

Key Market Trends

Outpatient Care & Sports Medicine Integration

Healthcare delivery is evolving toward ambulatory, field-side, and decentralized care models (urgent care, sports clinics, mobile medical units), and ethyl chloride’s attributes - rapid cooling analgesia, portability, and immediate effect - align closely with these settings. Regulatory records (FDA 510(k) listings for vapocoolant devices) and clinical practice guidance reflect continuing acceptance of vapocoolants for short procedures. Sports medicine teams, EMS responders, and occupational first-aid kits increasingly standardize vapocoolants in procedural packs because they reduce time to analgesia and require minimal training for correct application.This trend is magnified where surgical backlogs or outpatient throughput targets exist: a quick topical anesthetic can lower procedure time and patient discomfort while avoiding injectable analgesics for very brief interventions. Expect formulation and delivery innovation (unit-dose cans, refined spray geometry, tamper-evident packaging, clearer IFUs), plus inclusion in pre-packaged procedural kits and medical supply catalogs oriented to ambulatory and field medicine. Public procurement for school sports programs, emergency response kits, and community health outreach often references standardized consumables lists, further institutionalizing vapocoolant usage.

Key Market Players

- The Linde Group

- MESA International Technologies, Inc.

- The Dow Chemical Company

- BASF SE

- Seidler Chemical Company

- Tokyo Chemical Industry (TCI) Company Limited

- Puyer (Nantong) Biopharma Co., Ltd.

- Saudi Basic Industries Corporation (SABIC)

- Westlake Chemical Corporation and Occidental Petroleum Corporation (OXY)

- Hebei Jianxin Chemical

Report Scope:

In this report, Global Ethyl Chloride Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Ethyl Chloride Market, By Product:

- Ethylene chloride

- Ethylene dichloride

Ethyl Chloride Market, By Application:

- Pesticides

- Dyes

- Foam Plastics

- Pharmaceuticals

- Others

Ethyl Chloride Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ethyl Chloride Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- The Linde Group

- MESA International Technologies, Inc.

- The Dow Chemical Company

- BASF SE

- Seidler Chemical Company

- Tokyo Chemical Industry (TCI) Company Limited

- Puyer (Nantong) Biopharma Co., Ltd.

- Saudi Basic Industries Corporation (SABIC)

- Westlake Chemical Corporation and Occidental Petroleum Corporation (OXY)

- Hebei Jianxin Chemical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

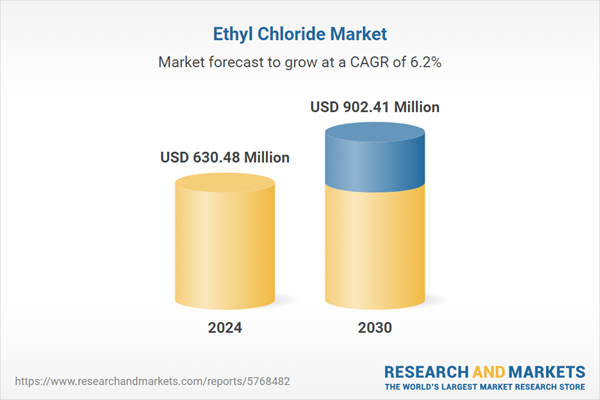

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 630.48 Million |

| Forecasted Market Value ( USD | $ 902.41 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |