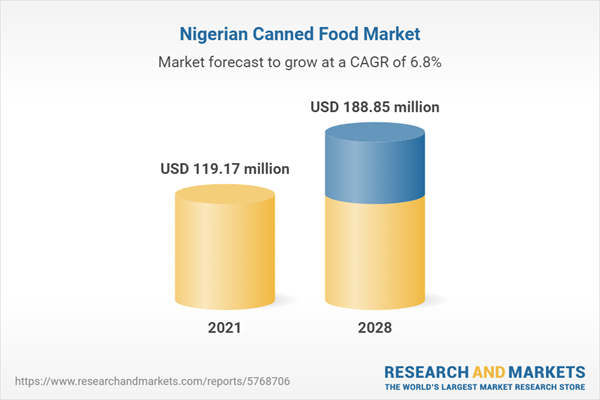

Nigeria canned food market is estimated to grow at a CAGR of 6.80% to reach a market size of US$188.850 million in 2028 from US$119.172 million in 2021.

Canned foods are foods that have been produced and then preserved by closing in an airtight container to increase the shelf life of the product. With a rise in disposable income and a shift in dietary tastes, more consumers are favoring canned goods. Furthermore, canned foods have good nutritional content and need less preparation time which contributes to market expansion. Furthermore, increased engagement in the country by international major players through new products and investments is expected to improve the canned food industry in the future years.One of the primary drivers for canned food in Nigeria is the growing trend of convenience stores in addition to the increasing investments made in the retail e-commerce sector. Furthermore, the increasing online spending of consumers in Nigeria will also contribute to market sales in the upcoming years. According to a Mastercard survey on consumer spending*, more than four out of five (81%) Nigerians are purchasing more online since the COVID-19 epidemic began in 2020. Therefore, such developments in the region will surge the market demand.

Nigeria canned food market is driven by the rise of convenience stores and investments made in the e-commerce sector.

The rise of convenience stores in addition to the developments made by the e-commerce sector will boost the market demand for the canned food market in Nigeria. As a result of expanding retail outlets, the availability of canned food such as canned meat, fish, beans, and others will increase and will have a larger consumer segment as well. Therefore, such initiatives taken by retail companies are anticipated to surge market revenue and profitability. For instance, FoodCo, a leading omnichannel retailer with interests in supermarkets, quick service restaurants, manufacturing, and entertainment, will build a new store in Ikoyi, Lagos, in August 2022. The shop, which is located in the freshly constructed Ikoyi Plaza, takes FoodCo's total store count to 16 throughout Oyo, Lagos, and Ogun States.Moreover, the increasing investments in retail companies will also lead the market to expand. For instance, Alerzo, a well-known B2B e-commerce retail firm located in Ibadan, Nigeria, announced a $10.5 million Series A financing sponsored by Nosara Capital in August 2021. FJ Labs and a number of family offices from the United States, Europe, and Asia. Alerzo has raised more than $20 million in total since its inception. The Baobab Network, a London-based Africa-focused accelerator, and Signal Hill, a Singapore-based fund manager that invested in its $5.5 million seed round last year, are among the early investors. In addition, the firm announced the closure of a $2.5 million working capital facility to better serve its clients.

Key Developments.

- In August 2022, Jumia, an e-commerce platform, announced the introduction of a fast commerce platform in Nigeria called 'Jumia Food Mart' in response to rising consumer demand for quick delivery. Customers will be able to get their online grocery orders in under 20 minutes, which is unprecedented in the industry. Last-mile delivery via neighborhood micro fulfillment centers is a novel approach that will revolutionize Jumia shipping times and make online food delivery faster than ever.

- In November 2021, Retail Supermarkets Nigeria (RSN) Limited launched a new Shoprite shop at Garden City Mall in Port Harcourt, Nigeria. The mall is West Africa's third-largest shopping center. The launch is consistent with the company's aim to extend the retail network in Nigeria, bringing formal retail to more Nigerians while rebuilding the economy. This is the company's 25th location in Nigeria. Shoprite's retail career in Nigeria began in 2005, with the opening of its first shop in Lekki, Lagos. Since then, the retail behemoth has expanded to 24 more stores throughout eleven states, including the Federal Capital Territory (FCT) of Abuja, making it Nigeria's most successful supermarket chain.

Based on type, the Nigeria canned food market is expected to witness positive growth in canned fish/seafood.

Nigeria is regarded to be one of the largest fish consumers in the world and the largest one in Africa. Fish is a vital source of livelihood for the population of Nigeria and not only this but fish provides them with a good source of protein, resulting in an increase in the demand for canned fish/seafood products. These canned fish contains proteins, vitamins, and even minerals which are a few more nutritional components driving the growth of this market. According to WorldFish, fish is considered an important part of the diet in Nigeria and accounts for about 40 percent of Nigeria’s protein intake. The total production of fish in Nigeria per year is estimated to be around 1 million metric tons (313,231 metric tons from aquaculture and 759,828 metric tons from fisheries). According to Food and Agriculture Organization, a total of 94 million hectares is allocated for fishery production. These certain growth factors for the production of fish are expected to drive market growth. Amongst the fishery products, catfishes are regarded to be the most commonly consumed and found products in African events, supermarkets, and even restaurants widely available in cans. The aquaculture and capture production in Nigeria has also witnessed an increase which is further expected to drive market growth.Based on distribution channels, Nigeria canned food market is expected to witness positive growth in the convenience store segment.

Canned food in comparison to frozen food has a higher convenience rate and is affordable owing to which they are widely sold through convenience stores. Furthermore, such stores follow an easy & fast transaction module for such products. Nigeria is experiencing a significant increase in its lower and middle-income earners population which is one of the major users of convenience stores in the country. For instance, according to the World Bank’s data, in 2021, the low and middle-income population in Nigeria stood at 213,401,323 which represented an increase of 2.4% in comparison to 208,327,405 in 2020. Such an increase in the population of low and middle-income earners will boost the demand for more convenience stores establishment to cater to the growing need for affordable food, thereby simultaneously boosting canned food’s availability in such stores.Market Segmentation:

By Type

- Organic

- Inorganic

By Product Type

- Canned Meat

- Canned Fish/Seafood

- Canned Fruits and Vegetables

- Canned Beans and Legumes

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online

Table of Contents

1. INTRODUCTION1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base, and Forecast Years Timeline

2. RESEARCH METHODOLOGY

2.1. Research Data

2.2. Research Design

3. EXECUTIVE SUMMARY

3.1. Research Highlights

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Force Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. NIGERIA CANNED FOOD MARKET, BY TPE

5.1. Introduction

5.2. Organic

5.3. Inorganic

6. NIGERIA CANNED FOOD MARKET, BY PRODUCT TYPE

6.1. Introduction

6.2. Canned Meat

6.3. Canned Fish/Seafood

6.4. Canned Fruits and Vegetables

6.5. Canned Beans and Legumes

6.6. Others

7. NIGERIA CANNED FOOD MARKET, BY DISTRIBUTION CHANNEL

7.1. Introduction

7.2. Supermarket/Hypermarket

7.3. Convenience Stores

7.4. Online

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. COMPANY PROFILES

9.1. Hypergold Limited

9.2. Arjena Food Limited

9.3. Asher Choice Food and Beverages

9.4. Olam Group

9.5. Feco Food Industries Limited

Companies Mentioned

- Hypergold Limited

- Arjena Food Limited

- Asher Choice Food and Beverages

- Olam Group

- Feco Food Industries Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 71 |

| Published | March 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 119.17 million |

| Forecasted Market Value ( USD | $ 188.85 million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Nigeria |

| No. of Companies Mentioned | 5 |