Government cloud refers to a specialized cloud computing infrastructure and services designed exclusively for government agencies and organizations. It ensures that sensitive government data, applications, and services are hosted and managed in a secure, compliant, and reliable environment. Government clouds adhere to strict security standards and regulations, such as FedRAMP in the United States, to safeguard data and protect against cyber threats. These cloud solutions offer scalability, cost-efficiency, and agility to government entities, allowing them to streamline operations, improve data accessibility, and enhance collaboration while maintaining the highest levels of data security and compliance with government-specific requirements.

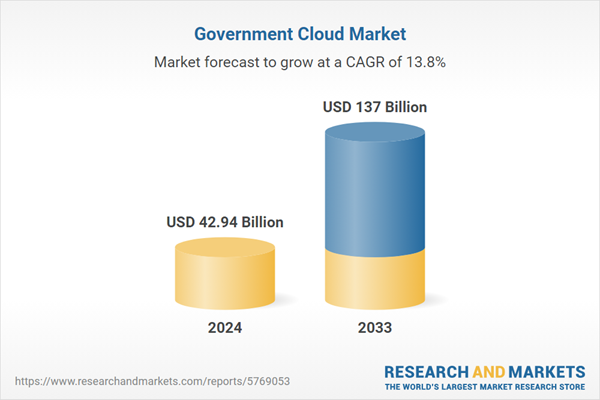

The global government cloud market is experiencing substantial growth driven by the increasing demand for secure and compliant data storage and management solutions in government agencies. In line with this, as cyber threats continue to evolve, governments recognize the need for government clouds equipped with robust cybersecurity measures, creating a positive outlook for market expansion. Moreover, the COVID-19 pandemic accelerated the shift toward digital government services, prompting governments worldwide to invest in cloud infrastructure to support remote work, digital citizen engagement, and online service delivery, contributing to the market’s growth. In addition to this, the cost-efficiency and scalability of cloud solutions are enticing governments looking to optimize their IT budgets while ensuring reliable and accessible services, aiding in market expansion. Furthermore, the availability of specialized government cloud offerings, tailored to meet the unique compliance and security requirements of the public sector, is bolstering the market’s growth.

Government Cloud Market Trends/Drivers:

Increasing demand for secure data management

Governments worldwide handle vast amounts of sensitive data, ranging from citizen records to national security information. This necessitates robust security measures to protect against cyber threats and ensure data integrity, fueling the demand for government cloud. Concurrent with this, government clouds also offer advanced security features and compliance certifications tailored to meet the stringent requirements of public sector entities. These features include encryption, identity and access management, regular security audits, and adherence to industry standards such as FedRAMP in the United States. As cyberattacks become more sophisticated, the heightened security provided by government clouds becomes a compelling reason for their adoption.Digital transformation and remote work trends

The COVID-19 pandemic accelerated the digital transformation efforts of governments globally, creating a positive outlook for the market’s growth. Moreover, with remote work becoming the norm, governments needed agile and scalable IT infrastructure to support their operations. Government clouds offer the flexibility to scale resources up or down as needed, ensuring that government agencies can provide uninterrupted services even during crises. This adaptability allows governments to rapidly deploy digital solutions for citizen engagement, online service delivery, and data analytics. As governments continue to invest in modernization, the demand for government cloud services remains robust.Cost efficiency and resource optimization

Governments often face budget constraints and pressure to do more with less. Traditional information technology (IT) infrastructure can be costly to maintain and may lack the agility required for modern governance. Government clouds provide cost-efficiency through a pay-as-you-go model, eliminating the need for significant upfront capital investments. Additionally, shared infrastructure and resource pooling result in reduced operational costs. Governments can allocate resources more efficiently, optimizing their IT budgets while still benefiting from the latest technology and services. This cost-effectiveness has been a driving force behind the adoption of government cloud solutions, enabling public sector organizations to achieve greater operational efficiency.Government Cloud Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global government cloud market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment model, service model, and application.Breakup by Component:

- Solutions

- Services

The growing demand for government cloud solutions and services is propelled by the need for disaster recovery and business continuity planning. Governments recognize the importance of maintaining critical operations during unforeseen events, such as natural disasters or cyberattacks. Government clouds offer robust disaster recovery capabilities, ensuring that essential services can swiftly recover and operate with minimal disruption. This assurance of business continuity enhances the resilience of government agencies, bolstering their ability to serve citizens and maintain essential functions even in challenging circumstances. Consequently, the pursuit of disaster recovery and continuity measures is a driving force behind the growing adoption of government cloud solutions worldwide.

Breakup by Deployment Model:

- Hybrid Cloud

- Private Cloud

- Public Cloud

The expanding need for flexibility and tailored IT environments represents one of the key factors driving the demand for hybrid, private, and public government cloud solutions. Governments seek to optimize their IT infrastructure to suit diverse needs, ranging from sensitive data storage to scalable public-facing services. Hybrid cloud configurations allow governments to seamlessly integrate on-premises systems with public and private cloud resources, offering agility and control, thereby strengthening the market demand. Moreover, the increasing demand for private clouds, catering to agencies with stringent data security requirements, and ensuring data remains within government-controlled environments are supporting the market growth. Public cloud adoption enables cost-effective scalability and rapid deployment of citizen services. This diverse mix of cloud models enables governments to align their IT strategies precisely with their unique operational demands, fueling the demand for hybrid, private, and public government cloud solutions.

Breakup by Service Model:

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

Software as a service dominates the market

The report has provided a detailed breakup and analysis of the market based on the service model. This includes infrastructure as a service, platform as a service, and software as a service. According to the report, software as a service represented the largest segment.The surging need for streamlined access to cutting-edge software applications while minimizing infrastructure overhead is impelling the demand for government cloud software as a service (SaaS) solutions. In addition to this, a growing number of governments across the world are increasingly turning to SaaS offerings to efficiently manage software deployment and updates, strengthening the market’s growth. Furthermore, SaaS provides the advantage of automatic software updates, reducing the burden on IT teams and ensuring that government agencies consistently use the latest, secure software versions, positively impacting the market growth. Apart from this, SaaS solutions facilitate remote access, allowing government employees to work from anywhere, which has become crucial in the wake of remote work trends and emergency situations. This accessibility and cost-effectiveness are driving the adoption of government cloud SaaS solutions across various public sector functions.

Breakup by Application:

- Server and Storage

- Disaster Recovery/Data Backup

- Security and Compliance

- Analytics

- Content Management

- Others

The demand for government cloud solutions in server and storage, disaster recovery/data backup, security and compliance, analytics, and content management applications is driven by the need for specialized, purpose-built infrastructure and services in these critical domains. Moreover, governments require reliable, scalable, and secure server and storage solutions to manage the vast volumes of data they handle. Disaster recovery and data backup capabilities are essential to ensure data resilience in the face of unforeseen disruptions. Besides this, robust security and compliance features address the unique regulatory and security requirements of government agencies. Analytics empower governments to derive actionable insights from their data, enhancing decision-making, while content management streamlines information sharing and accessibility. The demand for government cloud solutions in these specific applications arises from the necessity of tailoring technology to meet the distinct challenges and responsibilities faced by public sector organizations.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest government cloud market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North America government cloud market is experiencing robust growth, primarily driven by the region's relentless focus on data security, technological innovation, and the need for agile government services. Additionally, North American governments, particularly in the United States and Canada, place a premium on safeguarding sensitive information, driving the adoption of secure government cloud solutions to meet stringent compliance standards such as FedRAMP and FISMA. In confluence with this, the rapid pace of technological advancement and digital transformation initiatives in North America necessitate scalable and resilient cloud infrastructure. Moreover, as citizens increasingly expect online access to government services, public sector entities are turning to cloud technology to provide seamless and user-friendly digital experiences, bolstering the market growth. Furthermore, the region's commitment to modernization, coupled with its recognition of the cloud's efficiency and cost-effectiveness, continues to propel the North America government cloud market as it addresses the evolving needs of government agencies and citizens alike.

Competitive Landscape:

The competitive landscape of the global government cloud market is characterized by a dynamic interplay of established tech giants, specialized cloud providers, and regional players vying for market share. Leading players dominate the market due to their extensive infrastructure, comprehensive service offerings, and robust security measures, making them preferred choices for governments with diverse needs. Specialized government cloud providers cater specifically to the public sector, emphasizing compliance, security, and tailored solutions to meet government agencies' unique requirements. Regional providers, on the other hand, focus on specific geographic markets and offer localized expertise and support. The market is characterized by ongoing innovation, with providers constantly enhancing their offerings to address the evolving needs of governments.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amazon Web Services Inc.

- CGI Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- NetApp Inc.

- Oracle Corporation

- Salesforce.com Inc.

- Verizon Communications Inc.

- VMware Inc.

Key Questions Answered in This Report

1. How big is the government cloud market?2. What is the future outlook of government cloud market?

3. What are the key factors driving the government cloud market?

4. Which region accounts for the largest government cloud market share?

5.

Table of Contents

Companies Mentioned

- Amazon Web Services Inc.

- CGI Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- NetApp Inc.

- Oracle Corporation

- Salesforce.com Inc.

- Verizon Communications Inc.

- VMware Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 42.94 Billion |

| Forecasted Market Value ( USD | $ 137 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |