Biscuits are baked, flour-based snacks or treats that are typically crisp and dry. They consist of ingredients such as flour, sugar, butter or vegetable oil, eggs, leavening agents like baking powder or baking soda, and flavorings. The dough or batter is formed into shapes and then baked until they become crispy or firm. Biscuits are popular as a snack, dessert, or accompaniment to tea or coffee. They are made in various shapes, sizes, and flavors and can be found in a wide range of varieties, including plain, cream-filled, sandwiched, wafer-style, shortbread, digestive, and many more.

The market is primarily driven by the growing snacking culture due to changing eating habits and preferences. Biscuits are often consumed as snacks between meals, providing a quick energy boost. The convenience and portability of biscuits make them a popular choice for snacking, contributing to market growth. In addition, the globalization of food markets and increased international trade have facilitated the expansion of biscuit brands into new markets. Hence, the availability of diverse biscuit products from different regions and the cross-cultural exchange of culinary preferences represents another major growth-inducing factor. The expansion of organized retail, including supermarkets, hypermarkets, and convenience stores, provides increased shelf space and visibility for biscuit products. This facilitates easy access to biscuits, enhancing consumer convenience and contributing to market growth.

Biscuits Market Trends/Drivers:

The rising preference toward convenient snacking options

As consumers' lifestyles become busier and time-constrained, there is a growing demand for convenient snacking options that can be consumed on-the-go or during quick breaks. Biscuits fulfill this need as they are portable, pre-packaged, and require no additional preparation. The convenience factor drives the demand for biscuits as an easy and accessible snack. Moreover, consumers are increasingly opting for frequent snacking throughout the day instead of having full meals. Biscuits serve as a convenient and quick snacking option, fitting into these new consumption patterns. Besides, many biscuit brands offer individually wrapped or portion-controlled packages, making them convenient for on-the-go consumption. These single-serve packages cater to consumers' desire for portion control, allowing them to enjoy a snack without the need for portioning or storage concerns, thus contributing to market growth.The introduction of innovative products

Consumers are often drawn to new and novel offerings that provide a fresh and unique experience. The introduction of innovative flavors, ingredient combinations, or product formats is generating consumer engagement, leading to increased sales and brand loyalty. In addition, manufacturers are tapping into new and untapped market segments by introducing innovative biscuit products. For example, the advent of gluten-free, vegan, or organic biscuit options caters to the growing demand for specialty diets and lifestyles. This, coupled with the launch of premium and gourmet biscuits, featuring unique ingredients, artisanal craftsmanship, or luxury packaging is positively influencing the market growth.The easy product availability on online platforms

Online platforms provide consumers convenient access to a wide range of biscuit products from various brands and manufacturers. Customers can browse different options, compare prices, read reviews, and make purchases from the comfort of their homes or on-the-go. This increased accessibility expands the reach of biscuit products to consumers who may not have easy access to physical stores or a diverse selection of biscuits locally. Moreover, online platforms enable smaller and niche biscuit brands to reach a wider consumer audience. These platforms provide a space for specialty biscuit products, such as organic, gluten-free, vegan, or international varieties, which may have limited availability in local stores. This is also providing a positive thrust to market growth.Biscuits Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global biscuits market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, ingredient, packaging type and distribution channel.Breakup by Product Type:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-coated Biscuits

- Others

Sweet biscuits dominate the market

The report has provided a detailed breakup and analysis of the biscuits market based on the product type. This includes crackers and savory biscuits (plain crackers, and flavored crackers) and sweet biscuits (plain biscuits, cookies, sandwich biscuits, chocolate-coated biscuits, and others. According to the report, sweet biscuits represented the largest segment.Sweet biscuits have long been a popular choice among consumers worldwide. The sweet flavor profile appeals to a broad range of tastes and preferences, making them a go-to option for indulgence and enjoyment. Moreover, these biscuits come in a wide range of flavors, textures, and forms such as classic butter cookies, chocolate chip cookies, cream-filled sandwich biscuits, wafer biscuits, and more that offer a diverse selection to consumers. This versatility and variety contribute to the dominance of sweet biscuits in the market. Besides, sweet biscuits are often perceived as snacks or desserts that provide a satisfying treat or a quick energy boost. They are enjoyed on their own, paired with beverages like tea or coffee, or used as ingredients in desserts and recipes. This snack and dessert appeal of sweet biscuits makes them a popular choice among consumers looking for a quick and enjoyable indulgence.

Breakup by Ingredient:

- Wheat

- Oats

- Millets

- Others

Wheat holds the largest share in the biscuits industry

A detailed breakup and analysis of the biscuits market based on the ingredient has also been provided in the report. This includes wheat, oats, millets, and others. According to the report, wheat accounted for the largest market share.Wheat is a staple grain that is widely recognized for its nutritional value. It is a rich source of carbohydrates, dietary fiber, and various essential nutrients such as vitamins and minerals. Wheat-based biscuits can provide a substantial amount of energy, making them a satisfying and nourishing snack option. Moreover, consumers are familiar with the taste, texture, and aroma of wheat-based biscuits, which contributes to their preference and widespread acceptance. In addition, wheat flour possesses desirable functional properties for biscuit production as it contributes to the dough structure, provides texture and volume, and assists in the browning and flavor development during baking, thus accelerating its adoption in production of biscuits.

Nowadays, as consumers increasingly prioritize health and wellness, there is a growing demand for healthier biscuit options made with grains like oats and millets. In addition, they are naturally gluten-free, making them suitable for individuals with gluten intolerance or celiac disease, thus increasing their market share.

Breakup by Packaging Type:

- Pouches/Packets

- Jars

- Boxes

- Others

Pouches/Packets represent the leading market segment

A detailed breakup and analysis of the biscuits market based on the packaging type has also been provided in the report. This includes pouches/packets, jars, boxes, and others. According to the report, pouches/packets accounted for the largest market share.Pouches or packets offer convenience to consumers as individually wrapped or portion-controlled biscuit packets are easy to carry, store, and can be consumed on-the-go. They eliminate the need for additional packaging or storage containers, making them suitable for busy lifestyles and snacking occasions. In addition, pouches or packets often provide better protection against moisture, air, and light, preserving the freshness and quality of biscuits. This extends the shelf life of the products, ensuring that consumers can enjoy biscuits for longer periods without compromising taste or texture. Moreover, pouches or packets can be designed with eye-catching graphics, colors, and branding elements, enhancing their on-shelf visibility. The attractive packaging helps draw consumer attention and facilitates brand recognition and differentiation in a competitive market, thus strengthening the dominance of packets in the market.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

Biscuits are majorly distributed through supermarkets and hypermarkets

A detailed breakup and analysis of the biscuits market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, independent bakery, online stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.Supermarkets and hypermarkets offer a wide range of products, including various biscuit brands, flavors, and types. These retail outlets provide ample shelf space to accommodate a diverse selection of biscuits, catering to different consumer preferences and demands. The extensive product range available in supermarkets and hypermarkets ensures that consumers have a variety of options. Moreover, these stores provide ample space for displaying different packaging formats, including convenient pouches, boxes, and multipacks. The packaging formats are designed to enhance product visibility and consumer appeal, making it easier for shoppers to locate and select their desired biscuit products.

Online platforms offer convenience and time-saving benefits to consumers. They can easily search for specific biscuit products, filter results based on their preferences, and have the products delivered to their doorstep. This eliminates the need for physical store visits, saving time and effort. This convenience factor contributes to the growing preference for purchasing biscuits online.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest biscuits market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.Asia Pacific is home to a significant portion of the global population, including highly populous countries such as China and India. The large consumer base in the region drives the demand for biscuits, resulting in a substantial market size. Moreover, the region is experiencing rapid urbanization and changing lifestyles, which is escalating the demand for packaged and easily accessible food options, including biscuits. The expansion of organized retail, such as supermarkets, hypermarkets, and convenience stores, has played a crucial role in the growth of the biscuits market in Asia Pacific. These modern retail formats provide better shelf space, visibility, and distribution networks for biscuit products, making them easily accessible to consumers.

Europe is also witnessing significant growth in recent years due to the increasing number of players entering the market and the rising demand for convenient snacking options among individuals.

Competitive Landscape:

The competitive landscape of the biscuit market is characterized by the presence of numerous players, ranging from multinational corporations to regional and local manufacturers. The market is highly competitive, with companies striving to differentiate their products, expand their market reach, and capture consumer demand. Presently, companies are investing in research and development (R&D) activities to introduce new flavors, textures, packaging formats, and healthier variants of biscuits. They are also developing gluten-free, organic and natural ingredient-based, and functional biscuits with added nutritional benefits to expand their consumer base. Moreover, various key players are investing in aggressive marketing strategies to strengthen their foothold in the market. They are also engaging in mergers, acquisitions (M&As), strategic alliances and partnerships with other brands to gain access to new markets, technologies, or distribution channels.The report has provided a comprehensive analysis of the competitive landscape in the global biscuits market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bahlsen GmbH & Co. KG

- Britannia Industries Limited

- Burton's Biscuit Company

- ITC Limited

- Kellogg Company

- Lotus Bakeries Corporate

- Mondelez International Inc.

- Nestlé S.A.

- Parle Products Private Limited

- Pladis Global

- Walker's Shortbread

Notable Developments:

Mondelez International acquired Chipita Global SA, one of the European leaders in croissants and baked snacks such as bagel chips, cake bars, and biscuits, to expand its current product portfolio.Kellogg Company introduced two thinner and crispier crackers under the Club and Town House brands. The company introduced these crackers in sea salt, ranch flavor, sea salt, and black pepper.

Britannia Industries Limited has expanded its product portfolio to include healthier and premium biscuit options. They have launched products like NutriChoice and Marie Gold Heavens that cater to health-conscious consumers.

Key Questions Answered in This Report

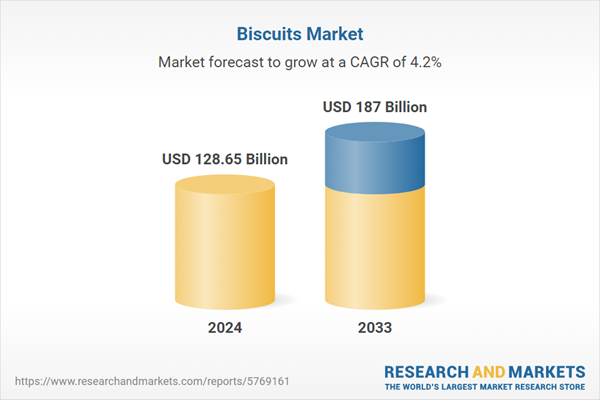

1. How big is the biscuits market?2. What is the future outlook of biscuits market?

3. What are the key factors driving the biscuits market?

4. Which region accounts for the largest biscuits market share?

5. Which are the leading companies in the global biscuits market?

Table of Contents

Companies Mentioned

- Bahlsen GmbH & Co. KG

- Britannia Industries Limited

- Burton's Biscuit Company

- ITC Limited

- Kellogg Company

- Lotus Bakeries Corporate

- Mondelez International Inc.

- Nestlé S.A.

- Parle Products Private Limited

- Pladis Global and Walker's Shortbread.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 128.65 Billion |

| Forecasted Market Value ( USD | $ 187 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |