Intelligent Power Module (IPM) Market Trends:

Technological Advancements

Technological advancements, including the development of advanced Insulated Gate Bipolar Transistors (IGBTs), Silicon Carbide (SiC), and Gallium Nitride (GaN) technologies, are significantly enhancing the performance and efficiency of Intelligent Power Modules (IPMs). The innovations offer superior switching speeds, higher thermal conductivity, and reduced power losses, making IPMs more effective for high-performance applications. These technological advancements are expected to positively influence the intelligent power module market outlook in the coming future. For instance, in June 2024, Texas Instruments introduced the industry's first 650V three-phase GaN Integrated Power Module (IPM), named DRV7308, for 250W motor drive applications. This module offers over 99% inverter efficiency, improved acoustic performance, reduced solution size, and lower system costs. It incorporates GaN technology to meet global efficiency standards and reduce power losses by 50%. The compact 12mm-by-12mm footprint makes it suitable for a range of applications. Consequently, industries such as automotive, renewable energy, and industrial automation are increasingly adopting IPMs, driven by the need for reliable, efficient, and compact power solutions. Such significant intelligent power module market trends highlight the IPM market's critical role in advancing technology across various sectors.Rising Adoption in Electric Vehicles (EVs)

The rising adoption of electric vehicles (EVs) is driving the demand for efficient Intelligent Power Modules (IPMs). According to a report published by International Energy Agency (IEA), in 2023, electric car sales reached nearly 14 million globally, with 95% sold in China, Europe, and the United States. The total number of electric cars on the roads was 40 million, making up approximately 18% of all car sales in 2023, a significant increase from previous years. These modules are essential for managing high power loads and enhancing overall battery performance. As EVs require efficient power conversion and management to maximize battery life and ensure reliable operation, IPMs provide the necessary high efficiency, compact size, and thermal management capabilities. Additionally, IPMs contribute to faster charging times and improved power density, which are crucial for the performance and appeal of EVs. The automotive industry's shift toward sustainable and energy-efficient solutions further accelerates the integration of IPMs in EV applications. The intelligent power module market forecast projects a surge in the demand as people increasingly adopt electric vehicles, driven by environmental concerns and advancements in automotive technology, thereby solidifying IPMs' role as a pivotal component in the future of sustainable transportation.

Widespread Product Adoption in Industrial Automation

The growing trend of industrial automation is significantly boosting the demand for intelligent power modules (IPMs). In April 2024, Nvidia's expanded collaboration with industrial automation technology suppliers was emphasized at the March 2024 GTC event. The company's advancements in AI, digital twins, and robotics are revolutionizing the manufacturing industry. Significant partnerships with Rockwell Automation, Siemens, and Schneider Electric showcase the extensive integration of Nvidia technology, with a focus on accelerating digital twin development and enhancing factory analysis. These modules are essential for motor drives, robotics, and control systems, providing the necessary power management and efficiency required for automated processes. IPMs enhance precision, reliability, and energy efficiency in automated manufacturing, leading to improved productivity and reduced operational costs.Intelligent Power Module Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on voltage rating, current rating, circuit configuration, power device and application.Breakup by Voltage Rating:

- Upto 600V

- 601V-1200V

- More than 1200V

Upto 600V accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the voltage rating. This includes upto 600V, 601V-1200V and more than 1200V. According to the report, upto 600V represented the largest segment.The Upto 600V segment holds the majority of the intelligent power module market share, driven by its extensive use in consumer electronics, industrial automation, and renewable energy applications. These modules offer a balanced combination of efficiency, reliability, and cost-effectiveness, making them ideal for medium-power applications. Their prevalent use in motor drives, HVAC systems, and home appliances underlines their importance. Additionally, the growing demand for energy-efficient devices and the transition toward renewable energy sources further propel this segment's dominance. Technological advancements and the increasing adoption of electric vehicles also contribute significantly to the growth of the Upto 600V IPM market.

Breakup by Current Rating:

- Upto 100A

- 101A-600A

- Above 600A

Upto 100 A holds the largest share of the industry

A detailed breakup and analysis of the market based on the current rating have also been provided in the report. This includes upto 100A, 101A-600A and above 600A. According to the report, upto 100A accounted for the largest market share.The upto 100 A segment holds the largest share of the intelligent power module industry, driven by its suitability for a wide range of applications requiring moderate current levels. According to the intelligent power module market overview, the up to 100 A segment is gaining traction due to its versatility and efficiency, making it a preferred choice for various industrial, consumer electronics, and automotive applications. As industries nowadays seek more energy-efficient and compact solutions, the demand for Upto 100 A IPMs is on the rise. These IPMs are extensively used in industrial machinery, consumer electronics, and automotive systems, offering an optimal balance of performance and efficiency. Their popularity in motor control, inverters, and power supplies highlights their versatility. The increasing adoption of electric vehicles and renewable energy systems further boosts this segment's prominence.

Breakup by Circuit Configuration:

- 6-PAC

- 7-PAC

- Others

The 6-PAC (Six-Pack) configuration is a prominent segment in the intelligent power module (IPM) market, primarily used in three-phase motor drives and inverters. It comprises six IGBTs and diodes, offering a compact and efficient solution for controlling three-phase motors in industrial applications. This configuration is highly valued for its ability to enhance energy efficiency, reduce system size, and lower costs. With the growing demand for energy-efficient motor control systems in industrial automation, HVAC, and renewable energy sectors, the 6-PAC configuration continues to hold a significant share in the market.

The 7-PAC configuration in the intelligent power module (IPM) market includes an additional IGBT and diode as compared to the 6-PAC, providing enhanced control and efficiency for high-performance applications. This configuration is especially beneficial in applications requiring precise control and higher power density, such as advanced industrial drives and electric vehicles. The 7-PAC configuration's ability to handle higher power levels and its improved thermal management capabilities make it a preferred choice for demanding applications. As industries push for higher efficiency and performance, the 7-PAC segment is expected to see significant growth in the IPM market. The intelligent power module market value is expected to rise in tandem with the rising need for advanced power management solutions in automated systems, the push for greater energy efficiency, and the rapid adoption of automation technologies across various industries, thus ensuring sustained market expansion.

Breakup by Power Device:

- IGBT

- MOSFET

IGBT exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the power device have also been provided in the report. This includes IGBT AND MOSFET. According to the report, IGBT accounted for the largest market share.IGBT (Insulated Gate Bipolar Transistor) exhibits clear dominance in the intelligent power module market due to its superior efficiency, fast switching capabilities, and high thermal stability. These attributes make IGBTs ideal for applications in industrial automation, electric vehicles, renewable energy systems, and consumer electronics. Their ability to handle high voltages and currents while minimizing energy loss is crucial in enhancing system performance and reducing operational costs. As the demand for energy-efficient and high-performance power solutions grows, IGBT-based IPMs continue to lead the market, securing a significant portion of the market share. For instance, in February 2024, Onsemi unveiled its 1200V SPM31 Intelligent Power Modules featuring the latest Field Stop 7 (FS7) IGBT technology. These modules promise higher efficiency, reduced power losses, and increased power density for three-phase inverter drive applications, such as heat pumps and HVAC systems. With a focus on energy efficiency and reduced emissions, these modules offer a compelling solution for the transition to electrification.

Breakup by Application:

- Consumer Electronics

- Servo Drives

- Transportation

- Renewable Energy

- Others

Consumer Electronics dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, servo drives, transportation, renewable energy and others. According to the report, consumer electronics represented the largest segment.According to intelligent power module market research report, consumer electronics dominate the market due to the high demand for efficient, compact, and reliable power solutions in devices such as smartphones, laptops, and home appliances. IPMs enhance energy efficiency, performance, and durability in these applications, making them indispensable. The rapid advancement and proliferation of smart devices, coupled with increasing consumer expectations for longer battery life and better performance, drive the adoption of IPMs in the consumer electronics sector, ensuring its leading position in the market.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest intelligent power module (IPM) market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for intelligent power module (IPM).According to intelligent power module market report, Asia Pacific holds the largest share mainly driven by the region's robust industrial base, rapid urbanization, and increasing adoption of advanced technologies. Countries like China, Japan, and South Korea are at the forefront due to their strong electronics manufacturing sectors and significant investments in renewable energy projects. The growing demand for energy-efficient solutions in industrial automation, consumer electronics, and electric vehicles further propels the market. Additionally, favorable government policies and initiatives supporting technological innovation and energy efficiency contribute to Asia Pacific's dominant position in the IPM market. For instance, in April 2024, the Japanese company Sharp announced their plans to invest $3-5 billion to establish a semiconductor display fab factory in India, which will be larger than its current unit in Japan. The company is currently in discussions with state governments in Telangana, Gujarat, and Maharashtra to identify potential locations. With a proposed 1,000-acre facility, Sharp aims to serve both domestic and global markets.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the intelligent power module (IPM) industry include Fuji Electric Co. Ltd., Future Electronics Inc., Infineon Technologies AG, Mitsubishi Electric Corporation, ON Semiconductor Corporation, ROHM Co. Ltd, Sanken Electric Co. Ltd, SEMIKRON Elektronik GmbH & Co. KG, STMicroelectronics N.V., Texas Instruments Incorporated.

- The market is highly competitive, characterized by the presence of prominent players such as Mitsubishi Electric, Infineon Technologies, and ON Semiconductor. These intelligent power module companies are dominating due to their extensive R&D investments, advanced technological capabilities, and broad product portfolios. The market is driven by increasing demand for energy-efficient solutions in industrial automation, renewable energy, and electric vehicles. New entrants face significant barriers due to the high capital requirements and the need for advanced technological expertise. Continuous innovation and strategic partnerships are essential for maintaining competitive advantage in this rapidly evolving market. The competition encourages ongoing innovation to improve product performance, cut costs, and meet evolving industry needs which in turn is expected to drive, intelligent power module market revenue in the coming future.

Key Questions Answered in This Report

1. How big is the global Intelligent Power Module (IPM) market?2. What is the expected growth rate of the global Intelligent Power Module (IPM) market during 2025-2033?

3. What are the key factors driving the global Intelligent Power Module (IPM) market?

4. What has been the impact of COVID-19 on the global Intelligent Power Module (IPM) market?

5. What is the breakup of the global Intelligent Power Module (IPM) market based on the voltage rating?

6. What is the breakup of the global Intelligent Power Module (IPM) market based on the current rating?

7. What is the breakup of the global Intelligent Power Module (IPM) market based on the power device?

8. What is the breakup of the global Intelligent Power Module (IPM) market based on the application?

9. What are the key regions in the global Intelligent Power Module (IPM) market?

10. Who are the key players/companies in the global Intelligent Power Module (IPM) market?

Table of Contents

Companies Mentioned

- Fuji Electric Co. Ltd.

- Future Electronics Inc.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- ON Semiconductor Corporation

- ROHM Co. Ltd

- Sanken Electric Co. Ltd

- SEMIKRON Elektronik GmbH & Co. KG

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Table Information

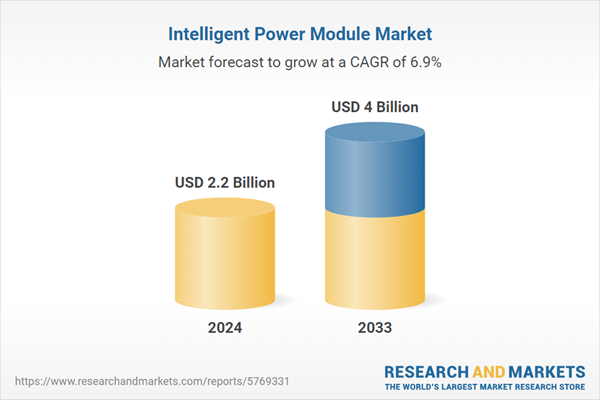

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |