The key drivers in the automotive filters market are increased vehicle production and demand for better engine efficiency, fuel economy and reduced emissions. According to the report published by the India Brand Equity Foundation, in September 2024, India produced 2,773,039 vehicles showcasing strong demand. The passenger car market is projected to grow from $32.70 billion in 2021 to $54.84 billion by 2027. The global EV market valued at $250 billion is expected to reach $1.31 trillion by 2028. Stringent environmental regulations push for advanced filtration technologies to meet emission standards. Consumer preference for longer-lasting filters and rising awareness about vehicle maintenance also contribute to automotive filters market growth. The adoption of electric vehicles and hybrid vehicles along with technological advancements in filtration materials further drive the demand for automotive filters.

The primary drivers of the United States automotive filters market include stringent environmental regulations demanding better emission control and improved fuel efficiency thereby increasing demand for advanced filtration systems. For instance, in March 2024, the Biden-Harris Administration announced final pollution standards for passenger cars and light-duty trucks for model years 2027-2032 aiming to cut over 7 billion tons of carbon emissions. The rules expect $100 billion in annual benefits including $13 billion in public health gains and $6,000 savings per driver. An increasing focus on vehicle maintenance, longer filter life and a rising consumer awareness of engine performance further propel growth. Increasing numbers of electric and hybrid vehicles also demand more specialized filters. The market is further being supported by increasing aftermarket industry size and higher rates of vehicle production.

Automotive Filters Market Trends:

Growth in Aftermarket Sales

The rising number of vehicles on the road is propelling the market. According to recent estimates in 2024, there are 1.475 billion vehicles worldwide, encompassing cars, trucks, and SUVs, excluding motorcycles. Consumers are becoming more aware of the importance of regular maintenance, which is strengthening the market. Moreover, the increasing popularity of e-commerce platforms is also acting as another significant growth-inducing factor. For instance, in June 2024, UNO Minda introduced a new line of cabin air filters in the Indian aftermarket. They are also commonly available at leading offline and online retail stores, including UnoMinda Kart, Amazon, and Flipkart. This is escalating the automotive filters market demand.Strict Emission Regulations

The implementation of stringent rules by regulatory authorities to combat climate change and reduce air pollution is fueling the market. They mandate the usage of high-efficiency filters in vehicles to minimize the release of harmful pollutants, such as nitrogen oxides and particulate matter. Consequently, leading manufacturers are developing emission control filters, which is positively influencing the market outlook. For example, in February 2024, Amazon Filters introduced sustainable polypropylene versions of its melt-blown filter media manufactured from sustainable resources.Rising Technological Innovations

Continuous advancements, including electrostatic filtration, nanofiber technology, and advanced synthetic media that capture smaller particles, allow for better filtration performance, extend the lifespan of filters, etc., are providing a positive impact on the automotive filters market outlook. For example, in March 2024, Intangles Lab Pvt. Ltd. unveiled its diesel particulate filter (DPF) solution across the commercial vehicle segment to boost fuel efficiency and improve engine performance.Automotive Filters Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with the automotive filters market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the media type, filter type, distribution channel, and vehicle type.Analysis by Media Type:

- Cellulose

- Fiberglass

- Others

Fiberglass-based automotive filters offer superior filtration efficiency particularly for capturing finer particles. Made from glass fibers they are commonly used in air and fuel filtration systems providing better durability and performance under high temperatures. Fiberglass filters are more resistant to clogging and tend to have a longer lifespan than cellulose filters. As the demand for improved engine performance and stricter emission standards increases fiberglass filters are becoming increasingly popular especially in high-performance vehicles and modern engines that require precise filtration.

Analysis by Filter Type:

- Air Filters

- Fuel Filters

- Hydraulic Filters

- Oil Filters

- Steering Filters

- Coolant Filters

- Others

Analysis by Distribution Channel:

- OEM

- Aftermarket

Analysis by Vehicle Type:

- Commercial Vehicles

- Passenger Vehicles

- Others

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

North America Automotive Filters Market Analysis

The North American automotive filters market is experiencing strong growth driven by a stable demand for vehicle components as the automotive sector remains robust. With a large number of vehicles on the road the need for regular maintenance and filter replacements such as air, oil, cabin and fuel filters is significant. The region’s strict environmental regulations are pushing automakers to adopt advanced filtration technologies that contribute to reducing emissions and improving fuel efficiency. The rising adoption of electric vehicles further fuels the demand for specialized filters particularly for battery systems and cabin air quality. As consumer awareness regarding vehicle maintenance grows the aftermarket segment sees increasing opportunities for filter replacements. A diversified vehicle fleet and an ongoing pursuit of sustainability and energy efficiency will ensure North America's leadership in the global automotive filters market which is expected to grow further.United States Automotive Filters Market Analysis

In 2024, the United States captured 90.00% of revenue in the North American market. According to industry reports, 2023 sales of light vehicle units are around 15.5 million, indicating good demand for all automotive parts and components, such as filters. Along with the increase in the number of vehicles on the road, demand for maintenance and filter replacement-because of air, oil, cabin, and fuel filters-increases. Moreover, in order to control emission and enhance fuel efficiency, the government keeps raising stringency standards, further influencing automakers to include more advanced technologies for filters, which increases the demand for high-quality filters. Increased penetration of electric vehicles is also fuelling market growth, as EVs require filtration solutions for specialized battery systems and cabin air quality. The significant and heterogeneous fleet of vehicles in the United States, combined with increasing awareness on vehicle maintenance, is expected to fuel further growth in demand for automotive filters over the next five years.Europe Automotive Filters Market Analysis

The Europe automotive filters market has grown at a very vigorous rate due to the recovery and expansion of the automotive sector. New van sales in the European Union gained 12.6% growth during the first quarter of 2024, with nearly 400,000 units sold, as per the European Automobile Manufacturers' Association (ACEA). Such strong performance in all key markets results in this significant surge and testifies to increasing demand for commercial vehicles, for which effective filtration systems are significantly important to their optimal operation as well as achieving the stringent regulations on emissions.The rising levels of environmental constraints across the region are making higher adoption of the advanced automotive air filters, oil, fuel, and cabin filters. These filters significantly contribute to reduced emissions, better fuel efficiency, and improved air quality inside a vehicle. Additionally, a transition towards electric and hybrid vehicles is increasing demand for specific types of filters that are used in battery systems and climate control systems in the automobile. The growth of vehicle manufacturing and sales bodes well for the European Automotive Filter Market to continue upward momentum going forward.

Latin America Automotive Filters Market Analysis

Latin America is a large market for automotive filters, driven by the rapidly growing automotive industry in the region. In 2023, the Latin American automotive industry marked a milestone by selling 4.8 million vehicle units. This is testimony to the high demand of the consumers and market resilience. As per industry reports, the sector is expected to grow by 8.2% in 2024, which will continue to fuel the demand for efficient automotive filters for rising production and aftersales requirements.With increased vehicle ownership, the rising trend of urbanization and infrastructure development in Latin America are driving up passenger and commercial vehicle demand. All this creates an imperative for efficient high-performance filters that improve the efficiency of the engine, better fuel economy, and adherence to strict emission regulations. Furthermore, the growing shift toward electric and hybrid vehicles in the region opens up avenues for innovative filtration solutions designed specifically for new drivetrain technologies. With favorable market conditions and rising consumer preference for cleaner and more efficient vehicles, the Latin America automotive filters market is poised to sustain growth.

Middle East and Africa Automotive Filters Market Analysis

The Middle East and Africa automotive filters market is growing rapidly. Automotive sales across the region have been on the rise. According to industry reports, in 2023, ten key countries in the Middle East saw a growth of 9.3% in automobile sales compared to the previous year, reaching 2,818,169 units. This is due to robust growth in demand for passenger and commercial vehicles, supported by economic recovery, urbanization, and infrastructure development in the region.The uptick in vehicle sales is boosting demand for high quality automotive filters to enhance engine performance, ensure compliance with strict emission regulation, and improve in-car air quality. In addition, the increasing use of electric and hybrid vehicles within the UAE and Saudi Arabia is creating opportunities for advanced filtration technologies that can cater to new drivetrain requirements. The focus of the governments on sustainable transportation and vehicle fleet modernization further boosts demand for efficient and durable automotive filters. This growth path makes the Middle East and Africa an attractive market for solutions in automotive filtration.

Competitive Landscape:

The automotive filters market is highly competitive with key players focusing on product innovation, quality enhancement and expanding distribution channels to maintain their market position. Companies are investing in research and development to create advanced filtration solutions that meet stricter environmental regulations and improve fuel efficiency. With the increasing shift toward electric and hybrid vehicles manufacturers are also diversifying their product offerings to cater to new drivetrain technologies and specialized filtration needs for battery systems and climate control. Strategic collaborations, acquisitions and partnerships are common in this market to strengthen supply chains and enhance market reach. The rising trend of aftermarket sales and growing consumer awareness regarding vehicle maintenance contribute to intensifying competition among market participants striving to capture a larger share of the growing demand for automotive filters.The report provides a comprehensive analysis of the competitive landscape in the automotive filters market with detailed profiles of all major companies, including:

- Cummins Inc.

- DENSO Corporation

- Donaldson Company Inc.

- General Motors Company

- Hengst SE

- Hollingsworth & Vose Company

- K & N Engineering Inc.

- Lydall Inc.

- MAHLE GmbH

- MANN+HUMMEL GmbH

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- Sogefi SpA

Key Questions Answered in This Report

1. How big is the automotive filters market?2. What is the future outlook of automotive filters market?

3. What are the key factors driving the automotive filters market?

4. Which region accounts for the largest automotive filters market share?

5. Which are the leading companies in the global automotive filters market?

Table of Contents

Companies Mentioned

- Cummins Inc.

- DENSO Corporation

- Donaldson Company Inc.

- General Motors Company

- Hengst SE

- Hollingsworth & Vose Company

- K & N Engineering Inc.

- Lydall Inc.

- MAHLE GmbH

- MANN+HUMMEL GmbH

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- Sogefi SpA

Table Information

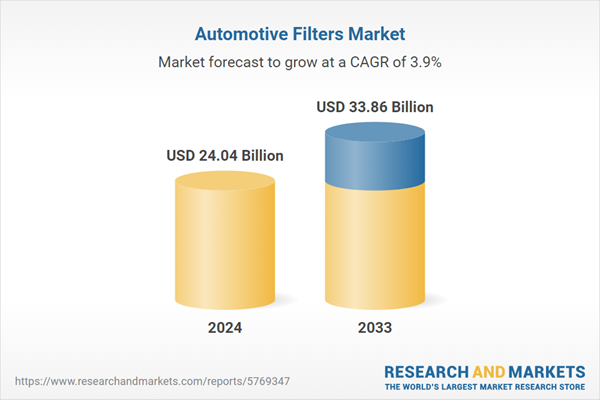

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 24.04 Billion |

| Forecasted Market Value ( USD | $ 33.86 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |