Key Highlights

- Growing infrastructure and industrialization are expected to drive the country’s protective coatings market.

- Fluctuations in the prices of raw materials are expected to hamper the market's growth.

- The rising demand for powder coatings is expected to offer various opportunities for market growth during the forecast period.

Japan Protective Coatings Market Trends

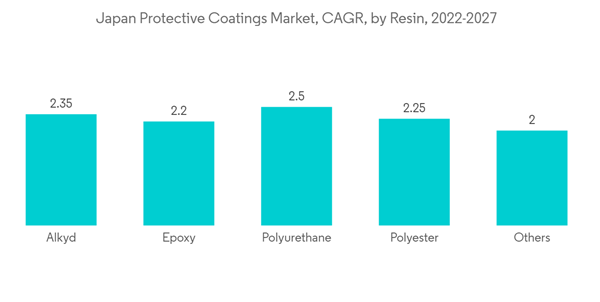

The acrylic resins segment expected to register higher growth rate

- Acrylic resins are used as protective coatings because they are shiny, last a long time outside, don't rust, don't react with chemicals, don't dissolve in solvents, and are hard.

- The application of acrylic protective coatings is primarily found in the construction industry for high-end finishing on roofs, decks, bridges, floors, and other surfaces. Water-based acrylic coatings are in high demand owing to environmental concerns, like the negative impact of VOCs on the air quality in the environment.

- The Japanese government has recently begun construction on the Hokkaido Shinkansen (Shinkansen in the Hokkaido Area) between Shin-Aomori Station in Aomori Prefecture on the island of Honshu and Sapporo Station on the island of Hokkaido (361 kilometers).The project is expected to be completed by 2031.

- The Japanese government also started the Linear Motor Car Maglev Bullet Train Project, which is currently under development and will run between the Shinagawa Station in Tokyo and the Shin-Osaka Station in Osaka (a total distance of 285.6 kilometers).

- Furthermore, price increases in the country's epoxy and polyurethane markets have pushed acrylic coatings in the short term, wherever substitution is possible.

- During the forecast period, all of the above coatings are likely to be made out of resins for acrylic resin-based protective marketing.

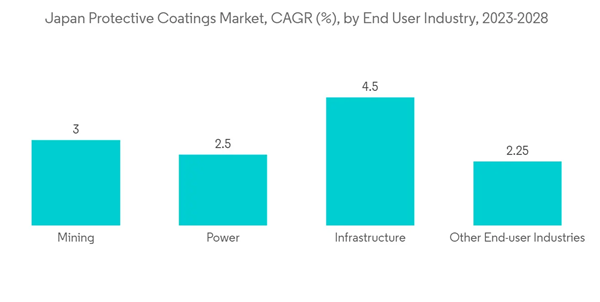

The infrastructure segment to dominate the market

- The backbone of modern cities is the protective coatings that are put on steel, which is often used for public buildings, stadiums, and transportation hubs.Steel bridges need to be protected from corrosion to keep their structural strength and appearance over time. Protective coatings are the most common way to do this.

- Japan is a major country for skyscrapers and high-rise buildings, making it a significant market for consumption. The country hosts various high-rise buildings (nearly 290), with Tokyo being a major hub for such structures. In Japan, there is some growth in the planning and building of these kinds of facilities in the near future.

- Some construction projects include two high-rise towers for Tokyo Station: a 37-story, 230-meter office tower and a 61-story, 390-meter office tower, both due for completion in 2027. One of the most significant redevelopment projects includes the Yaesu redevelopment project for old buildings into new offices, hotels, residences, retail stores, and educational facilities, which is due to be completed by 2023.

- Japan recently announced the USD 463 million Minami Koiwa 6-Chome District Type One Urban Redevelopment Project, which involves the construction of three blocks on 0.9 ha of land in Edogawa-ku, Tokyo, Japan.

Japan Protective Coatings Industry Overview

The Japanese protective coatings market is fragmented in nature. Some of the market's major players (not in any particular order) include Akzo Nobel N.V., PPG Industries, Inc, Sherwin-Williams Company, Kansai Paint Co. Ltd., and Nippon Paint Holdings Co., Ltd.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Infrastructure and Industrialization in Russia

4.1.2 Increasing demand from Japan's Oil and gas industry

4.2 Restraints

4.2.1 The Fluctuations in the prices of raw materials

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Value in USD Million)

5.1 End-user Industry

5.1.1 Oil and Gas

5.1.2 Mining

5.1.3 Power

5.1.4 Infrastructure

5.1.5 Other End-user Industries

5.2 Technology

5.2.1 Waterborne

5.2.2 Solventborne

5.2.3 Powder Coatings

5.2.4 UV-Cured

5.3 Resin Type

5.3.1 Acrylic

5.3.2 Epoxy

5.3.3 Alkyd

5.3.4 Polyurethane

5.3.5 Polyester

5.3.6 Others

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 AGC Cortec Co., Ltd.

6.4.2 Akzo Noble N.V.

6.4.3 Axalta Coatings Systems

6.4.4 BASF SE

6.4.5 Chugoku Marine Paints, Ltd.

6.4.6 DAI NIPPON TORYO CO.,LTD.

6.4.7 H.B. Fuller Company

6.4.8 Jotun

6.4.9 Kansai Paint Co. Ltd

6.4.10 NIPPON PAINT HOLDINGS CO.,LTD.

6.4.11 PPG Industries, Inc.

6.4.12 RPM International Inc.

6.4.13 Sika AG

6.4.14 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 The rising demand for Powder Coatings in Protective coatings end user industries.

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGC Cortec Co., Ltd.

- Akzo Noble N.V.

- Axalta Coatings Systems

- BASF SE

- Chugoku Marine Paints, Ltd.

- DAI NIPPON TORYO CO.,LTD.

- H.B. Fuller Company

- Jotun

- Kansai Paint Co. Ltd

- NIPPON PAINT HOLDINGS CO.,LTD.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company