The Agriculture logistics market is expected to witness a CAGR of more than 5% through the forecast period.

Corn seed in the U.S. is grown from May through November. When harvested, a portion of the yield is used for human and animal consumption while another portion is stored or exported. Stored seeds will be kept for planting in the next viable season in the U.S., while a certain amount is exported to other parts of the world to be planted, so the supply of agricultural seeds is perpetuated. When winter season comes in the U.S., corn is planted in the southern hemisphere, where the season is summer. Just as the U.S. handles corn seeds, countries in the southern hemisphere will dedicate a part for consumption and another part for planting in the next viable season or export it back to the U.S. to be planted.

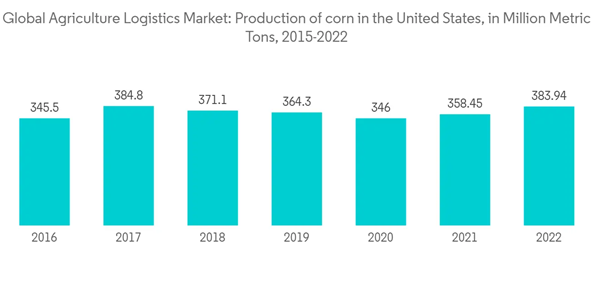

Effective logistics management is essential for corn production since the crop is one of the major contributors to feeding livestock and manufacturing industrial products, food, beverages, etc. Corn also plays a significant role in combating the rising price of petroleum since it is a major component of ethanol, a viable alternative to petroleum. Corn was America’s largest grown crop in 2019, with the U.S. farmers planting 91.7 million acres of corn.

This product will be delivered within 2 business days.

Key Highlights

- As the global demand for the agricultural industry is rising consistently, logistics management in the agricultural industry becomes even more vital in ensuring the agricultural production and food supply chain runs smoothly to prevent shortages across the world.

- The COVID-19 pandemic severely impacted the growth of the global agriculture logistics market with supply chain disruptions in the agriculture sector caused as a result of labor shortage, inefficient cold chain facilities, transport restrictions, fluctuations in costs, and lack of collectors. In the post-pandemic period, firms are predicted to focus on end-to-end stock visibility, complex supplier monitoring, and process automation. This will boost the global market trends.

- The decline in agriculture can be seen on developed nations as well, for instance, in US the logistics for agricultural produce which are rural roads remains inefficient due to pending receivables for infrastructure, lack of revenue for maintenance, as per US transportation research group (TRIP), 13% of major rural roads are not under operational condition, with 21% under mediocre, 66% in good condition. Low on workforce bandwidth have made the situation for the agriculture sector worse. There was limited outflow of agricultural produce from California which supplies over third of country's fruits, and vegetables as the number of COVID-19 positive cases piled up.

- Companies such as Ag Growth International (AGI) based out of Canada has suspended its global operations in Italy, India, France, and Brazil as mandated by the government. The effect on the agriculture would be aggravated by decline in the global growth as US GDP has been reduced by USD 1.5 trillion in terms of economic output. This has led to contagion effects by casting reduction in global trade as the Chinese economy suffers the hardest. The relations were on decline since the US-China trade war which also have contributed on to the decline in the agricultural trade.

Agriculture Logistics Market Trends

Increasing Importance of Logistics Management in the U.S.’s Largest Crop Production

Corn, the most widely produced crop in the U.S., relies heavily on logistics management to ensure farmers receive the necessary resources to feed the world. But due to various planting seasons, corn is grown in different parts of the world, with a portion of the harvest stored or exported to other countries.Corn seed in the U.S. is grown from May through November. When harvested, a portion of the yield is used for human and animal consumption while another portion is stored or exported. Stored seeds will be kept for planting in the next viable season in the U.S., while a certain amount is exported to other parts of the world to be planted, so the supply of agricultural seeds is perpetuated. When winter season comes in the U.S., corn is planted in the southern hemisphere, where the season is summer. Just as the U.S. handles corn seeds, countries in the southern hemisphere will dedicate a part for consumption and another part for planting in the next viable season or export it back to the U.S. to be planted.

Effective logistics management is essential for corn production since the crop is one of the major contributors to feeding livestock and manufacturing industrial products, food, beverages, etc. Corn also plays a significant role in combating the rising price of petroleum since it is a major component of ethanol, a viable alternative to petroleum. Corn was America’s largest grown crop in 2019, with the U.S. farmers planting 91.7 million acres of corn.

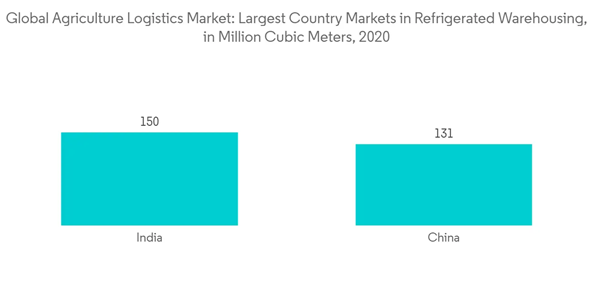

Growing Cold Storage and Refrigerated Warehouses Market Worldwide for Agriculture Sector

With increasing Fast-Moving Consumer Goods (FMCG) and Agro sales in the current scenario, the need for cold storage warehouses has been rapidly increasing. Several warehouses comprising cold chain systems are usually designed to ensure the ideal storage and transportation conditions for temperature-sensitive products. The global cold chain logistics market was worth almost 160 billion U.S. dollars in 2018 and is expected to exceed USD 500 billion by 2025. Cold chain logistics involves the transportation of temperature-controlled products along a supply chain using refrigerated packaging solutions to preserve the quality of products such as fresh agricultural goods, seafood, frozen food, or pharmaceutical products. Multiple export industries are dependent on the vital links that cold chain solutions provider. Businesses invest millions of dollars in their cold chain operations to create effective, efficient, and reliable processes, as end-to-end cold chain security is the weak link in the system. A single breakdown in the cold chain logistics chain can lead to catastrophic losses of products and capital. Globally, the number of refrigerated warehouses is increasing owing to a surge in demand for agriculture and pharmaceutical products, which in turn is boosting the Asia-Pacific cold chain logistics statistics. The total capacity of refrigerated warehouses worldwide amounted to 616 million cubic meters in that year and has grown since. In 2020, the United States had the largest capacity of refrigerated warehousing in the world, with 156 million cubic meters. The total capacity of refrigerated warehouses worldwide amounted to 719 million cubic meters in that year.Agriculture Logistics Industry Overview

The Global Agriculture logistics market is fragmented in nature, with a mix of global and regional players. The market is expected to grow during the forecast period due to several factors such as e-commerce, technology integration, and growing economies. The major companies in the country have adopted various modern technologies, such as warehousing management systems, automation, drone delivery, and the transportation management system, which has enabled better planning and tracking facilities, resulting in increased productivity and increased value proposition. Some of the major Players Include DHL, Kuehne+Nagel AG, Fed Ex, CEVA Logistics, and United Parcel Services are among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET INSIGHTS

5 MARKET DYNAMICS

6 MARKET SEGMENTATION

7 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- DHL

- Kuehne + Nagel International AG

- Bollore Logistics

- Blue Yonder

- Nippon Express Co., Ltd.

- The Maersk Group

- C.H. Robinson

- CEVA Logistics

- FedEx Corp.

- United Parcel Service

Methodology

LOADING...