Type 1 diabetes was more likely to occur after being diagnosed with COVID-19. Young pediatric patients and older adult patients with COVID-19 had the highest risk. Patients with type 1 diabetes were more likely to contract the virus and experience life-threatening consequences such as diabetic ketoacidosis. The patients' access to diabetes services and receipt of effective clinical care, including diabetes screening, education, and monitoring of control and complications, was therefore crucial.

An insulin hormone signals the liver, muscle, and fat cells to take up glucose to regulate blood sugar levels. It facilitates cells' uptake of glucose for cellular energy utilization. When the pancreas fails to produce enough insulin to meet the body's needs, type 1 diabetes develops. The management of type 1 diabetes is intricate and extremely customized. Synthetic insulin is required to regulate blood sugar levels in people with Type 1 diabetes every day or several times during the day.

The New Zealand PHARMAC staff is aware of the need for healthcare providers to receive education to use these treatments. The New Zealand Society for the Study of Diabetes (NZSSD) and the Ministry of Health are actively updating the type 2 diabetes recommendations, and PHARMAC staff is aware of this. These revisions will help provide clear guidance on when these medications should be used in therapy. PHARMAC has already started providing the tools and resources that it has been working to develop to support the use of this and other medications for type 2 diabetes. The main goal of these resources will be to support equitable access to these and other treatments.

New Zealand Diabetes Drugs Market Trends

Rising diabetes prevalence

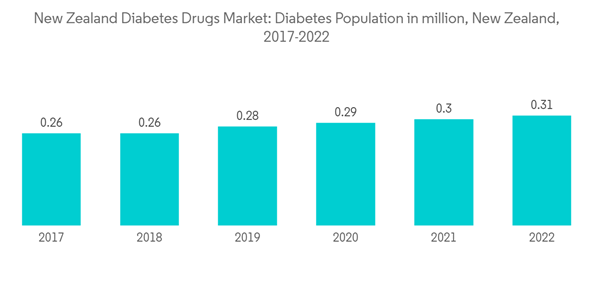

Individuals with the condition have difficulty controlling their blood sugar levels, either due to their bodies not producing enough insulin or their cells developing a resistance to insulin, a hormone produced by the pancreas that aids in the body's processing of sugars. If a person with diabetes does not manage their blood sugar levels, it can be fatal and also result in other health problems, such as kidney failure, heart disease, strokes, and blindness. The Ministry of Health estimates that approximately 250,000 New Zealanders (mainly type 2), more likely to be Mori, Pacific Islanders, and South Asians, have been diagnosed with diabetes. Also, the prevalence of the illness is rising.Diabetes drugs aid the body's production of more insulin. They have also been in use for a time, much like metformin. Sulfonylureas are somewhat more likely to cause hypoglycemic episodes than metformin. As the treatment first begins, some patients also put on weight. Sulfonylureas may cause allergic responses in certain people.

Owing to the rising prevalence of diabetes and the factors above, it is likely that the market will continue to grow.

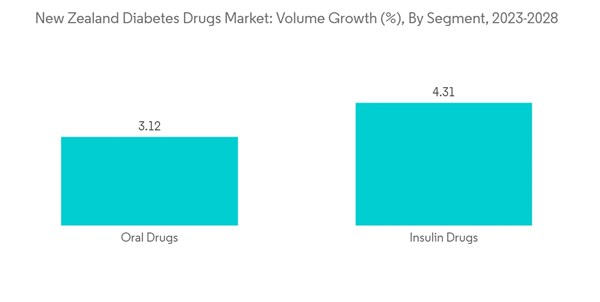

Insulin Drugs segment Expected to Witness Highest Growth Rate Over the Forecast Period

Insulin Drugs are expected to grow with a CAGR of more than 4% in the market during the forecast period.The New Zealand Society for the Study of Diabetes (NZSSD), with support from the Ministry of Health, recently released type 2 diabetes management guidelines, which state that while the Special Authority criteria for empagliflozin and dulaglutide ensure access for those at high risk of cardiovascular and renal disease, the funding restriction is not entirely consistent with best practice. Departments within public hospitals provide free care for any complications or issues related to diabetes (for citizens and residents of New Zealand). The available therapeutic options are on par with those in other developed nations besides New Zealand.

There is a government organization in New Zealand called Pharmac that controls the kinds of diabetic drugs that are sold there. As a result, several medications that are sold abroad are unavailable in New Zealand. Yet, a drug that is nearly identical to it is frequently on the market. In New Zealand, you can get insulin and almost all diabetes medications. The two major insulin manufacturers, Novo Nordisk and Eli Lilly offer a sizable selection of their products in New Zealand. Eli Lilly Humalog and Novo Nordisk NovoRapid are two very short-acting insulin analogs that are commonly accessible. The price of medications is the same throughout New Zealand. If you live in New Zealand, each prescription item will cost you $5.00.

The roll-out of many new products, increasing international research collaborations in technology advancement, and increasing awareness about diabetes among people are expected to boost the market.

New Zealand Diabetes Drugs Industry Overview

The New Zealand Diabetes Drugs Market is moderately consolidated with few significant and generic players. The major players are working on innovations in insulin drugs and devices which is evident from the companies spending on research and developments to strengthen their market presence.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Takeda

- Novo Nordisk

- Pfizer

- Eli Lilly

- Janssen Pharmaceuticals

- Astellas

- Boehringer Ingelheim

- Merck And Co.

- AstraZeneca

- Bristol Myers Squibb

- Novartis

- Sanofi