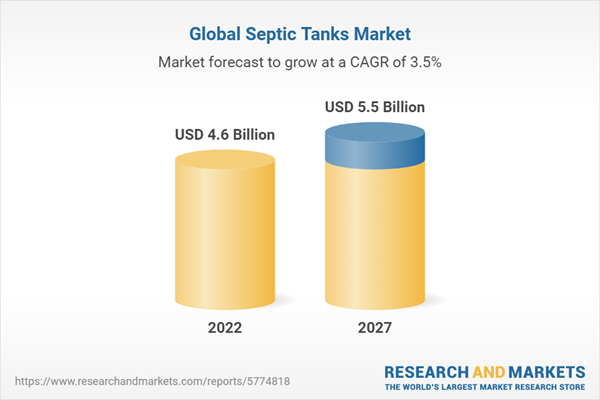

The Septic tanks market is projected to grow from USD 4.6 billion in 2022 to USD 5.5 billion by 2027, at a CAGR of 3.5% from 2022 to 2027. Increasing commercial and residential construction, as well as the expanding use of septic systems in rural regions, and developing countries provide growth opportunities and smart solutions for the septic tanks market.

By raw material, the precast concrete segment is estimated to be the fastest-growing segment of the Septic tanks market from 2022 to 2027

Based on raw-material, Septic tanks made of precast concrete are regarded as one of the greatest solutions for on-site wastewater treatment systems because of its resilience, lifespan, water tightness, adaptability, and sustainability. Their lengthy lifespan of 30 to 40 years or more is due to the fact that they are made to withstand adverse weather conditions, soil pressure, and seismic activity.

By application, commercial is estimated to be the fastest-growing segment of the Septic tanks market from 2022 to 2027

Based on application, the Commercial is estimated to be the fastest-growing segment during the forecast period. Septic tanks for commercial use are an important part of wastewater treatment for businesses, public buildings, and other non-residential establishments. Commercial septic tank systems are an efficient and cost-effective way to handle wastewater in these buildings.

The Septic tanks market in the Asia Pacific region is projected to witness the highest CAGR during the forecast period

Asia Pacific region is projected to register the highest CAGR in the Septic tanks market from 2022 to 2027. Asia Pacific is one of the key markets for septic tanks. The region has high demand for septic tanks due to rising demand from various applications such as residential, commercial, and Industrial.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: Asia Pacific - 30%, North America - 40%, Europe - 20%, Middle East & Africa - 5%, and South America - 5%

The septic tanks market report is dominated by players, such as Kingspan Group (Ireland), Advanced Drainage Systems (US), Synder Industries (US), GRAF(Germany), Orenco Systems(US), and Norwesco, Inc (US), CHEM-TAINER INDUSTRIES(US), Wieser Concrete(US), SIMOP(France), Oldcastle Infrastructure, Inc.(USA) and others

Research Coverage:

The report defines, segments, and projects the size of the Septic tanks market based on type, size, raw material, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as partnerships, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the Septic tanks market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Growth in the adoption of septic systems in rural areas, growing adoption of septic systems in rural areas), restraints (High cost of concrete septic tanks), opportunities (Developing countries provide growth opportunities for the septic systems market and smart solutions for septic systems), and challenges (Environmental rules & regulations for installation and operations and high prices of Raw materials for septic systems.) influencing the growth of the Septic tanks market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the Septic tanks market.

- Market Development: Comprehensive information about septic tanks markets - the report analyses the Septic tanks market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Septic tanks market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Kingspan Group (Ireland), Advanced Drainage systems (US), Synder Industries (US), GRAF(Germany), Orenco Systems(US, Ltd. among others in the Septic tanks market.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Septic Tanks Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

Figure 2 Key Industry Insights

2.1.2.2 Breakdown of Primaries

Figure 3 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Data Triangulation

Figure 4 Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

2.3.2 Top-Down Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

2.3.3 Demand-Side Analysis

Figure 7 Demand-Side Calculation

Figure 8 Metrics Considered for Analyzing and Assessing Demand for Septic Tanks

2.3.3.1 Research Assumptions

2.3.4 Forecast Determination

3 Executive Summary

Table 1 Septic Tanks Market: Snapshot

Figure 9 North America to Lead Market in 2022

Figure 10 Conventional Systems to Account for Largest Share During Forecast Period

Figure 11 Residential Application to Account for Largest Share During Forecast Period

Figure 12 Polymer Septic Tanks to Account for Largest Share Through 2027

Figure 13 1,000-5,000-Liter Tanks to Account for Largest Share by 2027

4 Premium Insights

4.1 Attractive Opportunities for Players in Septic Tanks Market

Figure 14 Higher Demand for Storage Tanks due to Water Shortage to Drive Market During Forecast Period

4.2 Septic Tanks Market: Regional Analysis

Figure 15 Asia-Pacific to Grow at Highest CAGR During Forecast Period

4.3 Septic Tanks Market, by Type

Figure 16 Conventional Septic Systems to Account for Largest Share by 2027

4.4 Septic Tanks Market, by Application

Figure 17 Residential Applications Accounted for Largest Share in 2021

4.5 Septic Tanks Market, by Size

Figure 18 1,000-5,000-Liter Size Accounted for Largest Share in 2022

4.6 Asia-Pacific: Septic Tanks Market, by Application and Country

Figure 19 Residential and China Accounted for Significant Shares in 2022

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 20 Drivers, Restraints, Opportunities, and Challenges: Septic Tanks Market

5.2.1 Drivers

5.2.1.1 Increase in Commercial and Residential Construction

5.2.1.2 Growth in Adoption of Septic Systems in Rural Areas

5.2.2 Restraints

5.2.2.1 High Cost of Precast Concrete Septic Tanks

5.2.3 Opportunities

5.2.3.1 Need for Safe Disposal of Wastewater in Emerging Economies

5.2.3.2 Smart Solutions for Septic Systems

5.2.4 Challenges

5.2.4.1 Environmental Rules & Regulations for Installation and Operations

Table 2 Examples of Varied Regulations

5.2.4.2 High Prices of Raw Materials for Septic Systems

5.3 Porter's Five Forces Analysis

Table 3 Septic Tanks: Porter's Five Forces Analysis

Figure 21 Porter's Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threats of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Industry Trends

6.1 COVID-19 Impact

6.2 Average Price Analysis, by Region

Table 4 Septic Tanks: Average Price Trends, by Region (USD Per Unit)

6.3 Value Chain Analysis

Figure 22 Value Chain for Septic Tanks

6.3.1 Raw Material and Component Suppliers

6.3.2 Suppliers of Other Components

6.3.2.1 Gravel

6.3.2.2 Sand

6.3.2.3 Septic Tank Risers

6.3.2.4 Drainfield Fabrics

6.3.2.5 Pvc Piping

6.3.2.6 Pump Systems

6.3.3 Polymer/Precast Concrete Manufacturers

6.3.4 Tank Manufacturers

6.3.5 Distributors

6.3.6 End-users

6.4 Macroeconomic Indicators

6.4.1 Gdp Trends and Forecasts of Major Economies

Table 5 Gdp Trends and Forecasts, by Key Country, 2019-2027

6.5 Septic Tanks Market Regulations

6.5.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 6 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 7 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 8 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

6.6 Trade Analysis

6.6.1 Export Scenario

Table 9 Export Scenario for Hs Code: 392510, by Key Country, 2021 (USD Million)

6.6.2 Import Scenario

Table 10 Import Scenario for Hs Code: 392510, by Key Country, 2021 (USD Million)

6.7 Trends/Disruptions Impacting Customers’ Businesses

Figure 23 Revenue Shift of Septic Tank Providers

6.8 Key Stakeholders and Buying Criteria

6.8.1 Key Stakeholders in Buying Process

Figure 24 Influence of Stakeholders on Buying Process for Septic Tanks

Table 11 Influence of Institutional Buyers on Buying Process for Septic Tanks

6.8.2 Buying Criteria

Figure 25 Key Buying Criteria for Septic Tanks

Table 12 Key Buying Criteria for Three Applications

7 Septic Tanks Market, by Material

7.1 Introduction

Figure 26 Polymer Tanks to Account for Largest Market Share During Forecast Period

Table 13 Septic Tanks Market, by Material, 2018-2021 (USD Million)

Table 14 Septic Tanks Market, by Material, 2022-2027 (USD Million)

7.1.1 Polymer

7.1.1.1 Polymer to be Largest Material Segment

7.1.2 Precast Concrete

7.1.2.1 Precast Precast Concrete Septic Tanks Commonly Used in Commercial Industry

7.1.3 Fiberglass

7.1.3.1 Fiberglass Septic Tanks Mainly Used in Industrial Application Segment

8 Septic Tanks Market, by Size

8.1 Introduction

Figure 27 1,000-5,000 Liter Tank Size to Account for Largest Market Share During Forecast Period

Table 15 Septic Tanks Market, by Size, 2018-2021 (USD Million)

Table 16 Septic Tanks Market, by Size, 2022-2027 (USD Million)

8.2 <1,000 Liters

8.2.1 Market Alignment with Wastewater Management

8.3 1,000-5,000 Liters

8.3.1 Growth of Small-Scale Industries

8.4 5,000-10,000 Liters

8.4.1 Growth of Commercial Sector in Emerging Economies

8.5 >10,000 Liters

8.5.1 Consumer Preference Shift Toward More Water Storage due to Water Scarcity in Middle East

9 Septic Tanks Market, by Type

9.1 Introduction

Figure 28 Conventional Septic Tanks to Account for Largest Market Share During Forecast Period

Table 17 Septic Tanks Market, by Type, 2018-2021 (USD Million)

Table 18 Septic Tanks Market, by Type, 2022-2027 (USD Million)

9.2 Biodigester/Conventional Septic Tank

9.2.1 Increase in Wastewater Treatment in Emerging Countries

9.3 Chamber Septic Tanks

9.3.1 Used in Various Soil Types; Ideal for Diverse Geography of Asia-Pacific

9.4 Drip Distribution Septic Tanks

9.4.1 Effective Approach to Meet Stringent North American Environmental Standards with Wastewater Treatment

9.5 Other Types

9.5.1 Mound Septic Tanks

9.5.2 Sand Filter Septic Tanks

9.5.3 Evapotranspiration Septic Tanks

9.5.4 Built Wetland Septic Tanks

10 Septic Tanks Market, by Application

10.1 Introduction

Figure 29 Commercial Applications to be Largest During Forecast Period

Table 19 Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 20 Septic Tanks Market, by Application, 2022-2027 (USD Million)

10.2 Residential

10.2.1 Urbanization and Restricted Access to Centralized Sewage Systems in Residential Sector

10.3 Commercial

10.3.1 Rise in Demand for Wastewater Treatment and Tightening Environmental Restrictions

10.4 Industrial

10.4.1 Large Volumes of Wastewater Generated by Agrochemical, Chemical & Health, and Pharmaceutical Industries

11 Septic Tanks Market, by Region

11.1 Introduction

Figure 30 Asia-Pacific to be Fastest-Growing Market During Forecast Period

Table 21 Septic Tanks Market, by Region, 2018-2021 (USD Million)

Table 22 Septic Tanks Market, by Region, 2022-2027 (USD Million)

11.2 Asia-Pacific

11.2.1 Recession Impact

Figure 31 Asia-Pacific: Septic Tanks Market Snapshot

Table 23 Asia-Pacific: Septic Tanks Market, by Country, 2018-2021 (USD Million)

Table 24 Asia-Pacific: Septic Tanks Market, by Country, 2022-2027 (USD Million)

Table 25 Asia-Pacific: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 26 Asia-Pacific: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.2.1.1 China

11.2.1.1.1 Financial Support by Government Induces Mechanization and Industrialization

Table 27 China: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 28 China: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.2.1.2 Japan

11.2.1.2.1 Technological Advancements and Strict Environmental Regulations

Table 29 Japan: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 30 Japan: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.2.1.3 India

11.2.1.3.1 Growing Population and Government Initiatives

Table 31 India: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 32 India: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.2.1.4 South Korea

11.2.1.4.1 Government Initiatives Toward Environment Protection

Table 33 South Korea: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 34 South Korea: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.2.1.5 Rest of Asia-Pacific

Table 35 Rest of Asia-Pacific: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 36 Rest of Asia-Pacific: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.3 North America

11.3.1 Recession Impact

Figure 32 North America: Septic Tanks Market Snapshot

Table 37 North America: Septic Tanks Market, by Country, 2018-2021 (USD Million)

Table 38 North America: Septic Tanks Market, by Country, 2022-2027 (USD Million)

Table 39 North America: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 40 North America: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.3.1.1 US

11.3.1.1.1 Advancements in Agriculture and Livestock

Table 41 US: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 42 US: Septic Tanks Market, by Application, 2022-2027 (USD Million)

Table 43 US: Septic Tanks Market, by Region, 2018-2021 (USD Million)

Table 44 US: Septic Tanks Market, by Region, 2022-2027 (USD Million)

11.3.1.2 Canada

11.3.1.2.1 Canada to Register Largest Growth Rate

Table 45 Canada: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 46 Canada: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.3.1.3 Mexico

11.3.1.3.1 Growth in Number of Residential Constructions

Table 47 Mexico: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 48 Mexico: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.4 Middle East & Africa

Table 49 Middle East & Africa: Septic Tanks Market, by Country, 2018-2021 (USD Million)

Table 50 Middle East & Africa: Septic Tanks Market, by Country, 2022-2027 (USD Million)

Table 51 Middle East & Africa: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 52 Middle East & Africa: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.4.1 Recession Impact

11.4.1.1 Saudi Arabia

11.4.1.1.1 Supply-Demand Gap for Water

Table 53 Saudi Arabia: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 54 Saudi Arabia: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.4.1.2 South Africa

11.4.1.2.1 Fastest-Growing Market due to Demand for Clean Water

Table 55 South Africa: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 56 South Africa: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.4.1.3 Rest of Middle East & Africa

Table 57 Rest of Middle East & Africa: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 58 Rest of Middle East & Africa: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5 Europe

11.5.1 Recession Impact

Figure 33 Europe: Septic Tanks Market Snapshot

Table 59 Europe: Septic Tanks Market, by Country, 2018-2021 (USD Million)

Table 60 Europe: Septic Tanks Market, by Country, 2022-2027 (USD Million)

Table 61 Europe: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 62 Europe: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5.1.1 UK

11.5.1.1.1 Growing Wastewater Treatment Industry in UK

Table 63 UK: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 64 UK: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5.1.2 France

11.5.1.2.1 Demand for Centralized Sewage Systems in Rural Areas in France

Table 65 France: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 66 France: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5.1.3 Germany

11.5.1.3.1 Germany to Lead Septic Tanks Market During Forecast Period

Table 67 Germany: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 68 Germany: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5.1.4 Italy

11.5.1.4.1 Uneven Distribution of Water Resources in North and South Italy

Table 69 Italy: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 70 Italy: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5.1.5 Spain

11.5.1.5.1 Spain to Register Highest Growth Rate

Table 71 Spain: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 72 Spain: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.5.1.6 Rest of Europe

Table 73 Rest of Europe: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 74 Rest of Europe: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.6 South America

11.6.1 Recession Impact

Table 75 South America: Septic Tanks Market, by Country, 2018-2021 (USD Million)

Table 76 South America: Septic Tanks Market, by Country, 2022-2027 (USD Million)

Table 77 South America: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 78 South America: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.6.1.1 Brazil

11.6.1.1.1 Brazil to be Leading Market in South America

Table 79 Brazil: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 80 Brazil: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.6.1.2 Peru

11.6.1.2.1 Government Initiatives to Enhance Fundamental Sanitation Services

Table 81 Peru: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 82 Peru: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.6.1.3 Argentina

11.6.1.3.1 Argentina to be Fastest-Growing Market for Septic Tanks in South America

Table 83 Argentina: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 84 Argentina: Septic Tanks Market, by Application, 2022-2027 (USD Million)

11.6.1.4 Rest of South America

Table 85 Rest of South America: Septic Tanks Market, by Application, 2018-2021 (USD Million)

Table 86 Rest of South America: Septic Tanks Market, by Application, 2022-2027 (USD Million)

12 Competitive Landscape

12.1 Overview

Table 87 Review of Strategies Adopted by Key Manufacturers of Septic Tanks

12.2 Market Share Analysis

Figure 34 Market Share Analysis of Top Five Players in Septic Tanks Market, 2021

Figure 35 Market Share Analysis, 2021

Table 88 Septic Tanks Market: Degree of Competition

12.3 Market Evaluation Framework

Table 89 Market Evaluation Framework, 2019-2022

12.4 Recent Developments

12.4.1 Deals

Table 90 Septic Tanks Market: Deals, 2018-2022

12.5 Key Company Evaluation Quadrant

12.5.1 Stars

12.5.2 Emerging Leaders

12.5.3 Pervasive Players

12.5.4 Participants

Figure 36 Evaluation Quadrant for Key Players, 2021

12.6 Startup/Sme Evaluation Quadrant

12.6.1 Progressive Companies

12.6.2 Responsive Companies

12.6.3 Dynamic Companies

12.6.4 Starting Blocks

Figure 37 Evaluation Quadrant for Startups/Smes, 2021

Table 91 Startup/Sme Footprint, by Type

Table 92 Startup/Sme Footprint, by Application

Table 93 Startup/Sme Footprint, by Material

Table 94 Startup/Sme Footprint, by Region

Table 95 Key Company Footprint, by Type

Table 96 Key Company Footprint, by Application

Table 97 Key Company Footprint, by Material

Table 98 Key Company Footprint, by Region

13 Company Profiles

(Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices, Weakness and Competitive Threats)*

13.1 Key Companies

13.1.1 Kingspan Group

Table 99 Kingspan Group: Company Overview

Figure 38 Kingspan Group: Company Snapshot

Table 100 Kingspan Group: Products Offered

Table 101 Kingspan Group: Deals

13.1.2 Snyder Industries

Table 102 Snyder Industries: Company Overview

Table 103 Snyder Industries: Products Offered

Table 104 Snyder Industries: Deals

13.1.3 Advanced Drainage Systems

Table 105 Advanced Drainage Systems: Company Overview

Figure 39 Advanced Drainage Systems: Company Snapshot

Table 106 Advanced Drainage Systems: Products Offered

Table 107 Advanced Drainage Systems: Deals

13.1.4 Graf

Table 108 Graf: Company Overview

Table 109 Graf: Products Offered

Table 110 Graf: Deals

13.1.5 Orenco Systems

Table 111 Orenco Systems: Company Overview

Table 112 Orenco Systems: Products Offered

13.1.6 Norwesco

Table 113 Norwesco: Company Overview

Table 114 Norwesco: Products Offered

13.1.7 Chem-Tainer Industries

Table 115 Chem-Tainer Industries: Company Overview

Table 116 Chem-Tainer Industries: Products Offered

13.1.8 Wieser Precast Concrete Products

Table 117 Wieser Precast Concrete Products: Company Overview

Table 118 Wieser Precast Concrete Products: Products Offered

13.1.9 Simop

Table 119 Simop: Company Overview

Table 120 Simop: Products Offered

13.1.10 Old Castle Precast

Table 121 Old Castle Precast: Company Overview

Table 122 Oldcastle Precast: Products Offered

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices, Weakness and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

13.2 Startups/SMEs

13.2.1 Cultec Inc.

13.2.2 Aplitec

13.2.3 Wiefferink B.V.

13.2.4 Nijhuis Industries

13.2.5 Innovative Water Systems

13.2.6 Biomicrobics Inc.

13.2.7 Aquacell

13.2.8 Polylok

13.2.9 Klaro GmbH

13.2.10 Protank

13.2.11 Bioman

13.2.12 Premier Plastics

13.2.13 Trumbull Manufacturing

13.2.14 Biodisk Ab

13.2.15 Ak Industries

14 Appendix

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledgestore: The Subscription Portal

14.4 Customization Options

Companies Mentioned

- Advanced Drainage Systems

- Ak Industries

- Aplitec

- Aquacell

- Biodisk Ab

- Bioman

- Biomicrobics Inc.

- Chem-Tainer Industries

- Cultec Inc.

- Graf

- Innovative Water Systems

- Kingspan Group

- Klaro GmbH

- Nijhuis Industries

- Norwesco

- Old Castle Precast

- Orenco Systems

- Polylok

- Premier Plastics

- Protank

- Simop

- Snyder Industries

- Trumbull Manufacturing

- Wiefferink B.V.

- Wieser Precast Concrete Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | April 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |