This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

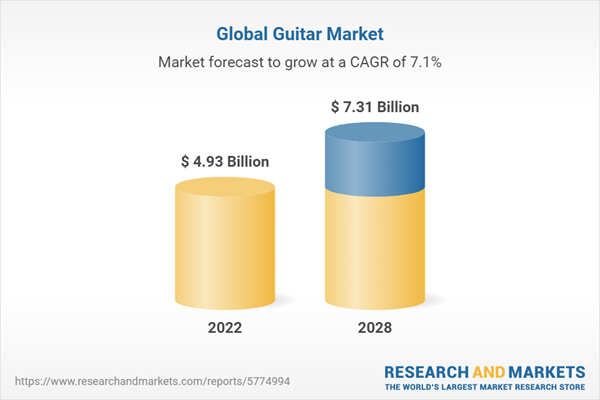

According to the research report, “Global Guitar Market Outlook, 2028”, published by Bonafide research the market is anticipated to reach USD 7.31 Billion by 2028 with a CAGR of 7.06% from USD 4.93 Billion in 2022. Around the world, both the quantity of live music performances and the number of people who attend them are rising quickly. This further inspires, stimulates, and encourages people to pursue music as a career and to learn how to play various guitars. As a result, it is anticipated that the global popularity of music-related leisure activities will support the expansion of the guitar market. Throughout the projection period, the extended replacement cycle will pose a significant challenge to the guitar market. The expansion of musical events and the continuous popularity of rock and metal music represent the biggest prospects.

The popularity of leisure pursuits like music, travel, and sports is rising globally as they provide a break from people's busy and repetitive lives. One of the most popular pastimes across the globe is learning to play an instrument. Due to people having more discretionary income, music lessons are growing in popularity all around the world. Also, the number of individuals attending live music performances is increasing quickly. Additionally, it encourages/inspires people to learn how to play various guitar styles and to pursue careers as musicians. Because of this, the global appeal of music-related leisure activities is projected to boost the growth of the global guitar market.

Due to the presence of manufacturers in areas like the USA, the region's fastest-growing and most populous country, North America is predicted to experience the greatest increase in terms of the worldwide market. The large population of those with musical interests and the presence of some of the most well-known and revolutionary music figures are expected to be the main drivers of the rising revenue. According to Sound charts, the American music industry is one of the most lucrative, with devoted fans of music all over the world and a current market worth of USD 43 billion. Throughout the projection period, Asia Pacific is anticipated to develop at a substantial CAGR of 8.07%. Due to a significant consumer influence and rapidly shifting consumer preferences brought on by rising per capita disposable income levels, the region's guitar industry has been growing. The market is also expected to expand as a result of the increasing popularity of music, the ability to spend money on leisure activities, the increase in the number of musical groups hosting concerts and festivals, and the increase in the number of musical groups performing at concerts and festivals. China hosts one of the major international trade fairs for musical instruments. These significant trade events enable the production of electric guitars. These factors are increasing the demand for electric guitars.

As per Product Type, the segment for electric guitars is anticipated to grow at the quickest CAGR of 8.86% during the course of the projected period. Rock and metal music are played on electric guitars. The electronics business is mostly driven by the extreme popularity of these genres. Lifestyle modifications, increasing disposable income, high standards of living, and a rise in the number of music bands worldwide are all factors pushing consumers to participate in more leisure activities. During the anticipated term, these elements are anticipated to fuel category expansion. In terms of market share, the acoustic sector held the majority with 53.38% in 2022. Acoustic guitar is used in a variety of musical genres. Folk, country, and blues are a few of the most well-liked genres. Jazz and popular music both make extensive use of the acoustic guitar. Despite the fact that acoustic guitar is frequently linked to mellower musical styles, it has many other applications. An acoustic guitar can be used for many different things and can be performed solo or in a band. As a result, it receives a lot of use globally and brought in a lot of money in 2022.

In terms of market share, the offline sector held onto a sizable market with 58.15% in 2022. The retail establishment sells a selection of guitars from different brands. Guitar sales through offline outlets rose as the lockdowns were progressively lifted in numerous nations around the world. For instance, according to a blog post by Guitar.com, the famous Guitar Centre store on Sunset Boulevard in Hollywood, California, saw a triple-digit increase in sales in August 2020 (compared to August 2019), which the company attributed to an increase in podcasters and amateur musicians purchasing equipment to use while under lockdown for COVID-19. Thus, a sizable portion of revenue in 2022 came from the offline category. However the quickest CAGR of 8.78% is predicted for the online category during the projection period. Guitar sales in traditional stores have been surpassed by e-commerce. Consumers prefer making purchases from online channels due to rising internet usage and advantages like convenient access and payment alternatives. Any guitar sold online has a different selling price from the market price. This is typically a result of the deals and discounts that may be found on business websites or any other internet resource. Throughout the projected period, these variables will continue to be favourable for the segment.

The Use of a guitar is linked to a Number of Problems the market's expansion is anticipated to be impeded by the stringent laws and regulations controlling the acquisition of rosewood. In addition, guitars are losing ground to music production software, which could further impede the expansion of the guitar market. For instance, the United States' implementation of the Lacey Act and the Convention on International Trade in Endangered Species (CITES) restricts the use of rosewood and other endangered wood species in musical instruments.

Recent Development:

- In July 2022, Yamaha Music Square introduces a brand-new line-up of Revstar electric guitars launched recently by Yamaha Music Worldwide

- In January 2022, Samsung divulged a smart and new electric guitar named the ZamString to ease and simplify the learning process for learners. It is a part of ZamStar which is a combination of the app and guitar.

- In September 2021, Fender Musical Instruments Corporation (FMIC) announced the launch of the all-new Player plus Series. As a new generation of guitar players continues to emerge, Player Plus puts the power of guitar squarely in their hands with new versions of Fender's most iconic models

- In July 2021, Gibson Brands, Inc. announced a partnership with Kirk Hammett, a popular guitarist from the well-known heavy metal band Metallica. With this partnership, the company aims to introduce a signature line of guitars

- In 2021, Fender Musical Instruments collaborated with the company for the launch of Kyser’s electric guitar capos. This newly launched electric guitar capos are available at Fender and Kysermusical.

- In September 2020, Harley Benton, a leading guitar creator, demoed three new double guitar effects pedals as additions to its double pedal range

Covid-19 Impact:

Due to the covid-19 pandemic, there was a significant increase in demand for fitness products, and the guitar industry grew in 2020 as a result. Many had started to take up new hobbies with the extra time that Covid-19 had given those who could afford it, with playing the guitar being one of the most obvious options. According to Music Strive, guitar sales rose by 15.0% between 2019 and 2020. One of the biggest American guitar makers, Fender, reported that during the pandemic, their sales of guitars surged by 17. 0% as housebound consumers looked for new pastimes.Companies Mentioned in this Report:

Fender Musical Instruments Corporation, Gibson Brands, Inc., Karl Höfner GmbH & Co. KG , Yamaha Corporation, Cort Guitars, Paul Reed Smith Guitar, G&L Musical Instruments, Godin Guitars, Samick Musical, Instrument Co., Ltd, Schecter Guitar Research, Taylor Guitars, Rickenbacker International Corporation , C.F. Martin & Co. Inc, Armadillo Enterprises, Inc., Hoshino Gakki, Kiesel Guitars, Roland Corporation, B.C. Rich Guitars, The ESP Guitar Company, Casimi.Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Guitar market with its value and forecast along with its segments

- Region-wise Guitar market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- SAMEA (Brazil, Saudi Arabia)

By Product Type:

- Acoustic Guitar

- Electric Guitar

By Distribution Chanel:

- Offline

- Online

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third party sources such as press releases, annual report of companies, analysing the government generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this the publisher has started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once the publisher has primary data with us the publisher has started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to Guitar industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

1. Executive Summary2. Market Dynamics

2.1. Market Drivers

2.2. Challenges

2.3. Opportunity

2.4. Restraints

2.5. Market Trends

2.6. Covid-19 Effect

2.7. Supply chain Analysis

2.8. Policy & Regulatory Framework

2.9. Industry Experts Views

3. Research Methodology

3.1. Secondary Research

3.2. Primary Data Collection

3.3. Market Formation & Validation

3.4. Report Writing, Quality Check & Delivery

4. Market Structure

4.1. Market Considerate

4.2. Assumptions

4.3. Limitations

4.4. Abbreviations

4.5. Sources

4.6. Definitions

5. Economic /Demographic Snapshot

6. Competitive Landscape

6.1. Competitive Dashboard

6.2. Business Strategies Adopted by Key Players

6.3. Key Players Market Share Insights and Analysis, 2022

6.4. Key Players Market Positioning Matrix

6.5. Consolidated SWOT Analysis of Key Players

6.6. Porter's Five Forces

7. Global Guitar Market Outlook

7.1. Market Size By Value

7.2. Market Size and Forecast, By Geography

7.3. Market Size and Forecast, By Product Type

7.4. Market Size and Forecast, By Distribution Channel

8. North America Guitar Market Outlook

8.1. Market Size By Value

8.2. Market Share By Country

8.3. Market Size and Forecast By Product Type

8.4. Market Size and Forecast By Distribution Channel

8.5. US Guitar Market Outlook

8.5.1. Market Size By Value

8.5.2. Market Size and Forecast By Product Type

8.5.3. Market Size and Forecast By Distribution Channel

8.6. Canada Guitar Market Outlook

8.6.1. Market Size By Value

8.6.2. Market Size and Forecast By Product Type

8.6.3. Market Size and Forecast By Distribution Channel

8.7. Mexico Guitar Market Outlook

8.7.1. Market Size By Value

8.7.2. Market Size and Forecast By Product Type

8.7.3. Market Size and Forecast By Distribution Channel

9. Europe Guitar Market Outlook

9.1. Market Size By Value

9.2. Market Share By Country

9.3. Market Size and Forecast By Product Type

9.4. Market Size and Forecast By Distribution Channel

9.5. Germany Guitar Market Outlook

9.5.1. Market Size By Value

9.5.2. Market Size and Forecast By Product Type

9.5.3. Market Size and Forecast By Distribution Channel

9.6. UK Guitar Market Outlook

9.6.1. Market Size By Value

9.6.2. Market Size and Forecast By Product Type

9.6.3. Market Size and Forecast By Distribution Channel

9.7. France Guitar Market Outlook

9.7.1. Market Size By Value

9.7.2. Market Size and Forecast By Product Type

9.7.3. Market Size and Forecast By Distribution Channel

9.8. Italy Guitar Market Outlook

9.8.1. Market Size By Value

9.8.2. Market Size and Forecast By Product Type

9.8.3. Market Size and Forecast By Distribution Channel

9.9. Spain Guitar Market Outlook

9.9.1. Market Size By Value

9.9.2. Market Size and Forecast By Product Type

9.9.3. Market Size and Forecast By Distribution Channel

9.10. Russia Guitar Market Outlook

9.10.1. Market Size By Value

9.10.2. Market Size and Forecast By Product Type

9.10.3. Market Size and Forecast By Distribution Channel

10. Asia-Pacific Guitar Market Outlook

10.1. Market Size By Value

10.2. Market Share By Country

10.3. Market Size and Forecast By Product Type

10.4. Market Size and Forecast By Distribution Channel

10.5. China Guitar Market Outlook

10.5.1. Market Size By Value

10.5.2. Market Size and Forecast By Product Type

10.5.3. Market Size and Forecast By Distribution Channel

10.6. Japan Guitar Market Outlook

10.6.1. Market Size By Value

10.6.2. Market Size and Forecast By Product Type

10.6.3. Market Size and Forecast By Distribution Channel

10.7. India Guitar Market Outlook

10.7.1. Market Size By Value

10.7.2. Market Size and Forecast By Product Type

10.7.3. Market Size and Forecast By Distribution Channel

10.8. Australia Guitar Market Outlook

10.8.1. Market Size By Value

10.8.2. Market Size and Forecast By Product Type

10.8.3. Market Size and Forecast By Distribution Channel

10.9. South Korea Guitar Market Outlook

10.9.1. Market Size By Value

10.9.2. Market Size and Forecast By Product Type

10.9.3. Market Size and Forecast By Distribution Channel

11. South America, Middle East & Africa Guitar Market Outlook

11.1. Market Size By Value

11.2. Market Share By Country

11.3. Market Size and Forecast By Product Type

11.4. Market Size and Forecast By Distribution Channel

11.5. Brazil Guitar Market Outlook

11.5.1. Market Size By Value

11.5.2. Market Size and Forecast By Product Type

11.5.3. Market Size and Forecast By Distribution Channel

11.6. Saudi Arabia Guitar Market Outlook

11.6.1. Market Size By Value

11.6.2. Market Size and Forecast By Product Type

11.6.3. Market Size and Forecast By Distribution Channel

12. Company Profile

12.1. Fender Musical Instruments Corporation

12.1.1. Company Snapshot

12.1.2. Company Overview

12.1.3. Financial Highlights

12.1.4. Geographic Insights

12.1.5. Business Segment & Performance

12.1.6. Product Portfolio

12.1.7. Key Executives

12.1.8. Strategic Moves & Developments

12.2. Gibson Brands, Inc.

12.3. Karl Höfner GmbH & Co. KG

12.4. Yamaha Corporation

12.5. Cort Guitars

12.6. Paul Reed Smith Guitar

12.7. G&L Musical Instruments

12.8. Godin Guitars

12.9. Samick Musical Instrument Co., Ltd

12.10. Schecter Guitar Research

12.11. Taylor Guitars

12.12. Rickenbacker International Corporation

12.13. C.F. Martin & Co. Inc

12.14. Armadillo Enterprises, Inc.

12.15. Hoshino Gakki

12.16. Kiesel Guitars

12.17. Roland Corporation

12.18. B.C. Rich Guitars

12.19. The ESP Guitar Company

12.20. Casimi

13. Strategic Recommendations

14. Annexure

14.1. FAQ`s

14.2. Notes

14.3. Related Reports

15. Disclaimer

List of Figures

Figure 1: Global Guitar Market Size (USD Billion) By Region, 2022 & 2028

Figure 2: Market attractiveness Index, By Region 2028

Figure 3: Market attractiveness Index, By Segment 2028

Figure 4: Competitive Dashboard of top 5 players, 2022

Figure 5: Market Share insights of key players, 2022

Figure 6: Porter's Five Forces of Global Guitar Market

Figure 7: Global Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 8: Global Guitar Market Share By Region (2022)

Figure 9: North America Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 10: North America Guitar Market Share By Country (2022)

Figure 11: US Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 12: Canada Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 13: Mexico Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 14: Europe Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 15: Europe Guitar Market Share By Country (2022)

Figure 16: Germany Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 17: UK Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 18: France Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 19: Italy Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 20: Spain Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 21: Russia Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 22: Asia-Pacific Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 23: Asia-Pacific Guitar Market Share By Country (2022)

Figure 24: China Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 25: Japan Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 26: India Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 27: Australia Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 28: South Korea Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 29: South America, Middle East & Africa Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 30: South America, Middle East & Africa Guitar Market Share By Country (2022)

Figure 31: Brazil Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 32: Saudi Arabia Guitar Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

List of Table

Table 1 : Global Guitar Market Snapshot, By Segmentation (2022 & 2028) (in USD Billion)

Table 2 : Influencing Factors for Global Guitar Market, 2022

Table 3: Top 10 Counties Economic Snapshot 2020

Table 4: Economic Snapshot of Other Prominent Countries 2020

Table 5: Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars

Table 6: Global Guitar Market Size and Forecast, By Geography (2017 to 2028F) (In USD Billion)

Table 7 : Global Guitar Market Size and Forecast, By Product Type (2017 to 2028F) (In USD Billion)

Table 8 : Global Guitar Market Size and Forecast, By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 9 : North America Guitar Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 10 : North America Guitar Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 11 : US Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 12 : US Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 13 : Canada Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 14 : Canada Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 15 : Mexico Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 16 : Mexico Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 17 : Europe Guitar Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 18 : Europe Guitar Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 19 : Germany Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 20 : Germany Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 21 : UK Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 22 : UK Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 23 : France Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 24 : France Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 25 : Italy Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 26 : Italy Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 27 : Spain Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 28 : Spain Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 29 : Russia Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 30 : Russia Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 31 : Asia-Pacific Guitar Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 32 : Asia-Pacific Guitar Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 33 : China Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 34 : China Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 35 : Japan Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 36 : Japan Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 37 : India Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 38 : India Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 39 : Australia Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 40 : Australia Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 41 : South Korea Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 42 : South Korea Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 43 : South America, Middle East & Africa Guitar Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 44 : South America, Middle East & Africa Guitar Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 45 : Brazil Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 46 : Brazil Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 47 : Saudi Arabia Guitar Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 48 : Saudi Arabia Guitar Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | March 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( $ | $ 4.93 Billion |

| Forecasted Market Value ( $ | $ 7.31 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |