The Asia-Pacific to Witness the Fastest Growth During the Forecast Period

Regionally, North America holds the dominant position in the global market for tape storage due to the presence of numerous large enterprises. The Asia-Pacific region is projected to register the highest CAGR during the forecast period owing to the emerging growth in demand from enterprises and consumers and because of expanding market players in the region. Among the various industry verticals, the IT and telecom industry accounted for the highest demand for tape storage and is likely to secure the leading position during the forecast period.Moreover, daily worldwide production of data is witnessed to be skyrocketing, owing to the advent of HD 4K/8K videos, IoT, and AI-based big-data analysis. To fulfil this demand, the emergence of high-capacity tape storage is likely to aid the market growth positively.

Tape Storage: Market Segmentation

Tape storage, also known as magnetic tape data storage, is a system that uses magnetic tape as a recording media for the purpose of offline, archival data storage. Despite the competition it faces from contemporary advanced storage devices, tape storage remains popular among organisations and consumers for its long archival stability.The market is divided on the basis of capacity into:

- Less Than 1 TB

- 1 TB to 200 TB

- 201 TB to 999 TB

- 1 PB to 100 PB

- More Than 100 PB

The major components of tape storage are:

- Tape Cartridges

- Tape Vault

By technology, the market can be divided into:

- LTO-1 to LTO-4

- LTO-5 to LTO-6

- LTO-7 to LTO-9

- Others

On the basis of use case, the segments are:

- Archiving

- Backup

Based on end-use, the industry is segmented into:

- Cloud Providers

- Data Centres

- Enterprise

The market can be broadly categorised on the basis of its industry vertical segments into:

- IT and Telecom

- BFSI

- Media and Entertainment

- Healthcare

- Manufacturing

- Oil and Gas

- Government and Defence

- Others

The market can be broadly categorised on the basis of type into:

- Hardware

- Software

Market Breakup by Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Archival Stability and High Storage Capacity Likely to Bolster the Tape Storage Industry Growth

The global market for tape storage is primarily driven by the growing demand for archival stability and cyber security in large enterprises and business organisations. Organisations and enterprises require static storage units for a large amount of data, which is fulfilled by tape storage, which is comparatively less portable than other storage alternatives, and have diverse and huge capacity options. Additionally, industrialisation is estimated to aid the tape storage industry growth. Apart from the digitised solutions, the popularity of tape storage for offline backup during system failure pushes the product demand further. Meanwhile, the high cost of tape storage, and the emergence of cloud storage, compact and portable alternatives might prove to be hurdles for the growth. However, advanced technologies and applications are projected to offer profitable opportunities for the growth of the market during the forecast period.Key Industry Players in the Global Tape Storage Market

The report presents a detailed analysis of the following key players in the global tape storage market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- DELL Technologies Inc.

- Hewlett Packard Enterprise Company

- International Business Machines Corporation (IBM)

- Overland Tandberg

- Oracle Corporation

- Others

Tape Storage Market Report Snapshots

Tape Storage Companies

Table of Contents

Companies Mentioned

The key companies featured in this Tape Storage market report include:- DELL Technologies Inc.

- Hewlett Packard Enterprise Company

- International Business Machines Corporation (IBM)

- Overland Tandberg

- Oracle Corporation

Table Information

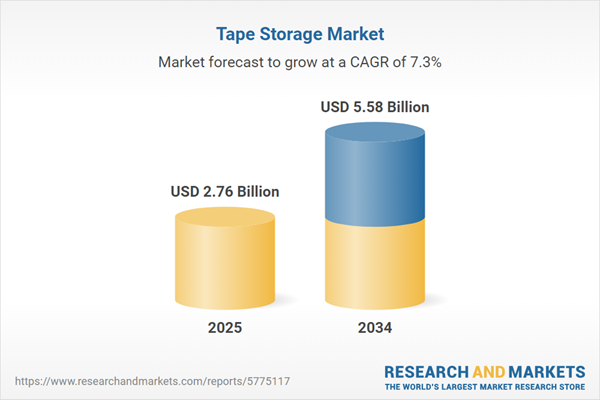

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.76 Billion |

| Forecasted Market Value ( USD | $ 5.58 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |