Increasing Demand for High CIS Polybutadiene to Augment the Growth of the Global Polybutadiene Market

Based on product, the high CIS polybutadiene segment is predicted to hold a substantial market share in the polybutadiene market. This growth can be attributed to the high green strength and cut growth resistance properties exhibited by high cis polybutadiene. In addition, the heightened application of high cis polybutadiene in tyre manufacturing is also expected to positively impact the market growth. Moreover, the low vinyl content makes the high cis polybutadiene material ideal for golf ball cores manufacturing.Key Trends and Developments

Growing demand for tyres; increasing application of acrylonitrile-butadiene-styrene resin (ABS); surging infrastructural development activities; and rising emphasis on sustainability are favouring the polybutadiene market expansion.May 2023

ARLANXEO announced the planned construction of a world-class rubber facility in Jubail, Saudi Arabia, to produce Ultra High cis Polybutadiene (NdBR) and Lithium Butadiene Rubber (LiBR). Through this, the company reinforces its dominant position in the high-performance rubber market.February 2023

ARLANXEO announced the opening of a new 65-kiloton-per-annum polybutadiene (BR) production line in Brazil to meet the growing customer demand for locally produced and reliable polybutadiene in Latin America.July 2022

Evonik’s Coating & Adhesive Resins business line launched POLYVEST® eCO, its new range of sustainable liquid polybutadienes, hence reducing the use of fossil raw materials by up to 99.9%. Through the launch, the company aims to meet the rising demand for environmentally friendly products and support the transition to a circular economy.March 2022

Indian Oil Corporation Ltd (IOCL) announced its decision to build INR 1459 crore Poly-Butadiene Rubber (PBR) plant at IndianOil's Naphtha Cracker Complex at Panipat, Haryana. Through the plant, the company aims to produce 60,000 tonnes of polybutadiene per annum.Rising demand for tyres

Polybutadiene is widely used in treads and sidewalls of tyres due to its low rolling resistance and excellent wear and abrasion resistance. Hence, rising sales of vehicles in both developing and developed countries are driving the polybutadiene market expansion.Growing applications of acrylonitrile-butadiene-styrene resin (ABS)

In acrylonitrile-butadiene-styrene resin (ABS), polybutadiene finds wide usage as an impact modifier due to its toughness, impact resistance, flexibility, durability, and weatherability. The extensive use of ABS resin in musical instruments, gardening tools, medical implants, automotive parts, pipes and fittings, and electronic appliances is aiding the market.Increasing investments in infrastructural development

Liquid polybutadiene plays a crucial role in improving the durability and performance of construction materials such as coatings, paints, and sealants. Thus, the increasing demand for paints, coatings, and sealants in construction and infrastructural development activities is driving the market.Growing emphasis on sustainability

With the increasing focus on sustainability, key players in the market are attempting to produce bio-based polybutadiene from renewable sources such as corn, sugarcane, and other plant-based materials. They are also focusing on optimising manufacturing processes and efficiently using raw materials to reduce their carbon footprint.The Asia-Pacific to Account for a Significant Market Share in the Global Polybutadiene Market

The Asia-Pacific is estimated to possess a significant share of the polybutadiene market in the forecast period. This increase can be attributed to the rising population growth in the region, which is catalysing the trends of urbanisation, thus, propelling the demand for automobiles. As tyre manufacturing is one of the significant applications of the product, the growing automobiles market in the region is expected to enhance the demand for polybutadiene. Other factors contributing to the growing demand for automobiles include rising disposable incomes, a huge consumer base, and increased availability of raw materials. Moreover, the heightened utilisation of polybutadiene in the polymer modification process is also predicted to catalyse the market growth in the region.Polybutadiene: Market Segmentation

Polybutadiene is a synthetic elastomer or rubber made from chemically linking multiple butadiene molecules to form giant molecules or polymers, also known as polymerisation. It is one of the most cost-effective and largest-volume synthetic general-purpose elastomer, which is also used as a substitute for natural rubber. In addition, polybutadiene, by virtue of having high resistance to wearing out, is used especially in the manufacture of tyres, which takes up over 70% of the production. Moreover, it is utilised as an additive to enhance the toughness of plastics such as polystyrene and acrylonitrile butadiene styrene (ABS). It also finds application in the manufacturing of golf ball cores, elastic objects, and also to encapsulate electronic assemblies, providing high electrical resistivity.Based on product, the market is divided into:

- High CIS Polybutadiene

- Low CIS Polybutadiene

- High Trans Polybutadiene

- High Vinyl Polybutadiene

On the basis of application, the market can be segmented into:

- Tyre Manufacturing

- Polymer Modification

- Industrial Rubber Manufacturing

The regional markets for the product include:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The rising global population and the resultant increase in urbanisation and industrialisation are driving the market demand for automobiles. In this regard, the demand for high-performance tyres is also increasing to ensure a safe driving experience. For instance, in August 2021, Bridgestone Americas announced the release of the Bridgestone Potenza Sport and Bridgestone Potenza RE980AS+ as part of the expansion of the company's bestselling ultra-high performance tyre line.

Environmental concerns and sustainability initiatives are posing a threat to the polybutadiene market. The rising air pollution level and its drastic impact on the environment and living beings due to butadiene production are an increasing concern, as a result of which, leading manufacturers are now looking for ways to produce bio-based butadiene to counter the negative consequences of petroleum-based products.

Competitive Landscape

Key polybutadiene market players are increasingly investing in expanding their production capacities to meet the growing demand for the material in diverse applications such as rubber, tyres, paints, and coatings, among others. Polybutadiene companies are also adopting advanced technologies and new production methods to enhance the efficiency of polybutadiene manufacturing.ENEOS Corporation

ENEOS Corporation, headquartered in Tokyo, Japan, and established in 1888, is an energy company. The company creates advanced fully-synthetic and synthetic lubricants that protect the environment throughout the lifecycle of a car by lowering carbon emissions, reducing wear on critical components, and optimising fuel efficiency.ARLANXEO Holding B.V.

ARLANXEO Holding B.V., headquartered in The Hague, Netherlands, and established in 2016, is one of the world's largest synthetic rubber producers. The company is a wholly owned subsidiary of Saudi Aramco and develops, markets, and manufactures high-performance rubbers with 10 production sites in 8 countries and 2 innovation centres.

UBE Corporation

UBE Corporation, established in 1942 and headquartered in Tokyo, Japan, is a global chemical company. As of March 2024, the company boasted a capital of JPY 58.4 billion and employed 7,882 consolidated employees. The company actively invests in R&D activities to contribute to sustainable growth.Reliance Industries Limited

Reliance Industries Limited, established in 1958 and headquartered in Maharashtra, India, is one of the largest private sector companies in India. In FY 2024, the company generated a consolidated revenue of USD 119.9 billion. Its activities span petroleum refining and marketing, hydrocarbon exploration and production, advanced materials and composites, and renewables, among others.Other key players in the polybutadiene market are Versalis SpA, among others.

Table of Contents

Companies Mentioned

The key companies featured in this Polybutadiene market report include:- ENEOS Corporation

- ARLANXEO Holding B.V.

- UBE Corporation

- Reliance Industries Limited

- Versalis SpA

Table Information

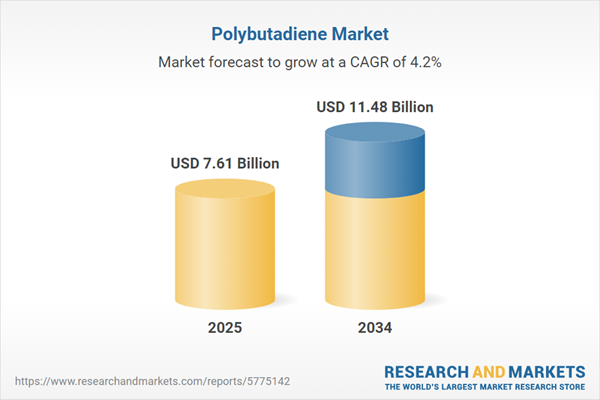

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 7.61 Billion |

| Forecasted Market Value ( USD | $ 11.48 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |