The global logistics market is a backbone of international trade and commerce, facilitating the movement of goods across countries and continents. Its significance lies in enabling supply chain efficiency, reducing delivery times, and lowering operational costs for businesses. As per the data by World Trade Organization (WTO), global merchandise trade volume grew 2.6% in 2024 and is expected to grow 3.3% in 2025. With globalisation and e-commerce growth, logistics has become essential for meeting consumer expectations of fast, reliable, and cost-effective delivery. This sector supports multiple industries, from manufacturing to retail, and directly influences economic development and competitiveness worldwide.

Additionally, investments in roads, railways, aviation, shipping, and inland waterways play a crucial role in boosting the demand of logistics market. In May 2025, in Africa, Ivory Coast's port operator is investing over €60 million to develop inland logistics hubs in regions like Ferkessedougou, Bouaké, and San Pedro. This initiative seeks to decentralize logistics operations, alleviate congestion at the Abidjan port, and strengthen the country's role as a regional transport hub for landlocked nations.

Governments all throughout the world are starting to impose emission limits, carbon taxes, and incentives for the adoption of environmentally friendly technologies. The Carbon Border Adjustment Mechanism (CBAM), which levies a carbon tax on imported commodities based on their carbon intensity, was put into place by the European Union in 2023. Other factors that are predicted to positively influence the logistics market revenue include constant technological advancements, the integration of biometrics, increasing international trade agreements, Bluetooth, driverless vehicle, GPS, and drone delivery.

Key Trends and Recent Developments

February 2024

FedEx has invested USD 350 million in a cutting-edge hub at Dubai World Central Airport in Dubai South, enhancing global logistics and connectivity. The structure complies with the Dubai Municipality Green Standards and has a solar power project as well as a building management system that promotes energy efficiency. FedEx is now using electric ground service vehicles and electric vehicles charging stations for employee and delivery vehicles.February 2024

J.B. Hunt Transport Services Inc. announced a multi-year intermodal service agreement with Walmart. This partnership aims to increase the efficiency and reliability of Walmart's logistics operations by leveraging J.B. Hunt's expertise in intermodal transportation and supply chain management.January 2024

UPS secured a major air cargo contract with the USPS. The expanded partnership will leverage UPS's extensive air network and logistics expertise to improve the speed and reliability of USPS's package delivery services across the United States.March 2023

CEVA Logistics integrated GEFCO into its logistics division. GEFCO is a European leader in automotive logistics and will allow CEVA Logistics to strengthen its range of logistics services, especially in France and the rest of Europe.Adoption of automation and artificial intelligence

Automation and artificial intelligence are supporting the growth of logistics industry by streamlining operations, enhancing efficiency, reducing costs, and meeting the demands of an increasingly complex global supply chain, and boosting the logistics market growth. Companies like Amazon are utilising AI-powered robots in their warehouses, which not only improves operational efficiency but also enhances the overall customer experience through faster and more accurate delivery. By 2025, warehouse automation and robotics will increase productivity by 25% to 70% and reduce operating costs by 20% to 40%. A prime example of AI integration in logistics is UPS's ORION system, which optimises delivery routes for its fleet. The system processes around 250 million address data point every day, optimizing routes and saving the company up to 10 million gallons of fuel annually. This not only cuts costs but also reduces emissions, aligning with sustainability goals.Focus on sustainability and green initiatives

Companies like UPS are investing in electric vehicles and renewable energy sources to reduce their carbon footprint. The adoption of sustainable logistics practices not only contributes to a greener environment but also enhances a company's reputation and competitive edge, thus impacting the logistics demand forecast. One of the most notable examples is Maersk, the world’s largest shipping company, which has committed to achieving net-zero carbon emissions by 2040. As part of this initiative, Maersk ordered 18 carbon-neutral methanol-powered ships in 2023. This initiative alone is expected to reduce 1 million tonnes of CO2 emissions annually. Additionally, the company has committed to using sustainable biofuels and plans to further invest in renewable energy projects.Rise in data-driven decision making

Data analytics is revolutionising logistics management by enabling companies to optimise routes, predict demand, and enhance overall efficiency, thus increase the logistics market share. FedEx uses predictive analytics to forecast package volumes during peak seasons, allowing them to allocate resources effectively. Predictive analytics is used by Amazon, for example, to improve inventory control throughout its extensive worldwide network of fulfillment centers. Amazon uses machine learning algorithms to estimate product demand with great accuracy, allowing for the maintenance of ideal stock levels. With its Prime Now service, which guarantees delivery in less than two hours, Amazon has been able to lower warehouse costs and increase delivery times due to this technique.Last-mile delivery innovations

Last-mile delivery, the final step of a product's journey to the customer, is undergoing significant innovations. As per logistics industry analysis, companies like Nuro and Waymo are pioneering autonomous delivery services, offering contactless delivery for goods. Nuro, for example, has been granted permission by the US Department of Transportation in February 2022 to operate autonomous delivery vehicles, a breakthrough for the logistics market. Urban deliveries are changing because of AI-powered delivery bots, such as those employed by FedEx Roxo and Starship Technologies. These autonomously navigating robots can deliver things to customers' doorsteps around cities. The scalability of this technology was demonstrated in 2023 when Starship's delivery robots achieved a milestone of 5 million autonomous deliveries worldwide.Growing e-commerce platforms

E-commerce growth continues to be a major force driving the logistics market worldwide. As online shopping surges, logistics providers face rising demand for fast, reliable delivery services, especially last-mile delivery, which is often the most complex and costly part of the supply chain. The impact of e-commerce on the logistics market is also evident in the strategies of major players. For instance, Sea Limited, a Singapore-based e-commerce company operating Shopee, has seen its stock rise by over 34% in 2025. The company has invested in its in-house logistics service, SPX Express, to improve delivery efficiency. Nearly 50% of SPX Express orders are now delivered within two days of order placement, reflecting the company's commitment to enhancing its logistics capabilities in response to the growing e-commerce market.Logistics Industry Segmentation

The report titled “Logistics Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Model Type

- 1 PL

- 2 PL

- 3 PL

- Others

Market Breakup by Transportation Mode`

- Roadways

- Seaways

- Railways

- Airways

Market Breakup by End User

- Manufacturing

- Consumer Goods and Retail

- Food and Beverages

- IT Hardware and Telecom

- Healthcare

- Chemicals

- Construction

- Automotive

- Oil and Gas

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Logistics Market Share

3PL providers occupy a significant share in the market

3PL providers have the highest share in logistics market as they offer comprehensive logistics solutions, including transportation, warehousing, and inventory management. For example, DHL Supply Chain and XPO Logistics provide end-to-end supply chain services, allowing businesses to outsource their logistics functions. This model is increasingly popular as companies seek to enhance efficiency and focus on core business activities.2PL involves transportation service providers that do not handle warehousing or inventory management. Companies like FedEx and UPS exemplify this model by offering freight and shipping services for goods. They focus on the transportation aspect, allowing businesses to rely on specialised carriers for efficient delivery without managing the entire supply chain.

Seaways mode driven by expanding trade routes and efficiency

Seaways, characterised by their ability to transport large volumes of goods over long distances, are experiencing notable growth in the logistics market. The expansion of trade routes, such as the Panama Canal, has facilitated faster and more cost-effective transportation of goods between continents. In the fiscal year 2024, the canal facilitated 9,944 transits, handling 423 million tons of cargo. Container ships, chemical tankers, and bulk carriers constituted the majority of these transits, reflecting the canal's capacity to support diverse shipping needs.Meanwhile, while air transportation is costlier than other modes, its ability to reduce transit times significantly makes it indispensable for industries requiring expedited logistics services. DHL Express and FedEx Express leverage air transportation to deliver time-sensitive, high-value, and urgent shipments worldwide within tight deadlines.

Healthcare Industry Dependence on Efficient Logistics

As per logistics market analysis, the healthcare industry relies heavily on efficient logistics for the transportation of pharmaceuticals, medical devices, and equipment. Companies such as UPS Healthcare, DHL Life Sciences, and Kuehne + Nagel specialise in healthcare logistics, providing services like cold chain management and regulatory compliance to ensure the safe and timely delivery of critical medical supplies.In the chemicals sector, logistics providers like CMA CGM, CEVA Logistics, and DHL Chemicals offer expertise in handling hazardous materials, ensuring compliance with international regulations and safety standards. Effective risk management strategies, including proper labeling, packaging, and handling protocols, are essential to mitigate potential hazards and ensure the safe transportation of chemicals.

Logistics Market Regional Analysis

Asia Pacific Logistics Market Accelerates with Infrastructure Growth and E-Commerce Expansion

The Asia Pacific region emerges as a rapidly growing market in the global logistics landscape. China, with its vast manufacturing base and booming e-commerce industry, stands out as a key player in the logistics market in Asia Pacific. The region's focus on enhancing transportation infrastructure, such as high-speed rail networks and modern port facilities, further propels its logistics sector forward. China's logistics industry reached a record-breaking USD 49.42 trillion in 2024, with the establishment of 151 national logistics hubs and over 2,500 overseas warehouses. Markets like Japan, India, and Southeast Asian countries are also witnessing increased trade activities, creating a surge in demand for logistics services.The strict laws and growing consumer demand for sustainability have made Europe a global leader in green logistics and support the logistics market value. By pushing logistics firms to embrace green practices, the European Union's Green Deal seeks to achieve climate neutrality by 2050. In 2023, DHL increased the number of electric delivery cars in its fleet, in line with its commitment to reduce carbon emissions to zero by the year 2050. In 2023, the region demonstrated its commitment to sustainability and lowering emissions from international logistics operations with the adoption of the EU's Carbon Border Adjustment Mechanism (CBAM).

Competitive Landscape

The global logistics market is highly competitive, with leading companies like DHL, UPS, and FedEx continually innovating to maintain their edge. These firms leverage technology, such as automation and AI-driven solutions, to enhance operational efficiency. For instance, FedEx has integrated advanced tracking systems to improve delivery accuracy.Additionally, companies are enhancing sustainability practices by adopting green logistics initiatives, like DHL's commitment to achieving zero emissions by 2050. Expanding global reach is another focus, as seen in partnerships like Evri and JD.com, which aim to facilitate cross-border e-commerce. Investments in data-driven solutions further enable these companies to adapt to evolving customer demands.

CMA CGM Group (CEVA Logistics AG)

CMA CGM Group (CEVA Logistics AG) was founded in 2005 and is based in Cournon-d'Auvergne, France. It offers comprehensive supply chain management, logistics, and freight forwarding services. CEVA is recognised for its expertise in optimising supply chains for businesses across various industries.Deutsche Post AG

Deutsche Post AG was founded in 1995 and has its headquarters in Bonn, Germany. It is a prominent player in the postal services, logistics, and parcel delivery sectors. The company's extensive network and focus on technological advancements have positioned it as a leader in the global logistics industry.Kuehne + Nagel International AG

Kuehne + Nagel International AG was established in 1890 and is headquartered in Switzerland, United Kingdom. Specialising in logistics, supply chain management, and freight forwarding services, company is renowned for its commitment to sustainability and providing customer-specific tailored solutions.FedEx Corporation

FedEx Corporation, founded in 1973 and headquartered in the United States is a global leader in shipping, transportation, and e-commerce services, connects people and possibilities worldwide through its integrated business applications. Renowned for exceptional service, FedEx Express, the world's largest cargo airline, serves over 220 countries with time-definite air-ground services.Other key players in the global logistics market include Evri Limited, Schenker AG, C.H. Robinson Worldwide Inc., Nippon Express Co., Ltd., Kintetsu World Express Inc., TSI Group Inc., XPO, Inc., United Parcel Service, Inc., A.P. Møller - Mærsk A/S, Expeditors International of Washington Inc., GXO Logistics, Inc., and DSV A/S, among others.

Key Features of the Report

- Comprehensive quantitative analysis of the global logistics market and its segments.

- Insight into market dynamics including drivers, restraints, and emerging opportunities.

- Detailed regional analysis covering key markets and growth hotspots.

- Competitive landscape with profiles and strategies of leading logistics providers.

- Examination of technological trends shaping logistics and supply chain management.

- Forecasts through 2025 based on current market and economic conditions.

- Trusted, data-driven insights for informed business decisions.

- Actionable intelligence tailored to procurement and strategic planning needs.

- Experienced analysts delivering thorough and timely market research.

- Continuous updates reflecting evolving global logistics trends.

Table of Contents

Companies Mentioned

The key companies featured in this Logistics market report include:- FedEx Corporation

- United Parcel Service, Inc.

- Schenker AG

- C.H. Robinson Worldwide Inc.

- Deutsche Post AG

- DSV A/S

- CMA CGM Group (CEVA Logistics SA)

- Kuehne + Nagel International AG

- Nippon Express Co., Ltd.

- XPO, Inc.

- Expeditors International of Washington, Inc.

- Kintetsu World Express Inc.

- GXO Logistics, Inc.

- A.P. Møller - Mærsk A/S

- TSI Group Inc.

- Evri Limited

Table Information

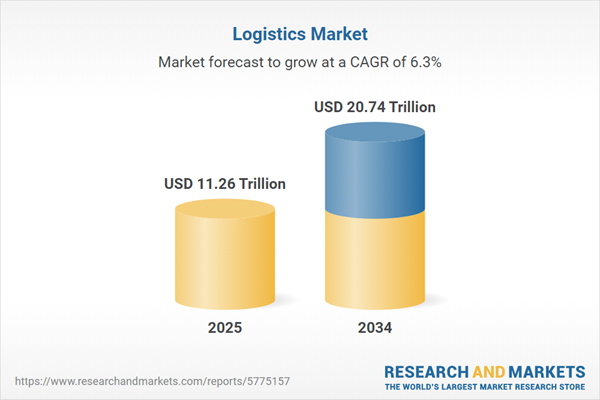

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11.26 Trillion |

| Forecasted Market Value ( USD | $ 20.74 Trillion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |