Growth in the market is largely driven by sustainable mobility mandates and smarter public transportation systems. Governments worldwide are setting emission goals and actively funding public transport revamps. For instance, India’s PM-eBus Sewa scheme, announced in 2023, allocated INR 57,613 crore to deploy 10,000 electric buses across on PPP model, which indicates a clear shift from policy drafts to implementation. In addition, The EU-funded ZeEUS project has been pivotal in testing electric buses in urban spaces, now influencing national policies. Colombia leads the Latin American market with over 1,500 electric buses operating as of late 2023.

B2B buyers, including fleet operators, city transit authorities, and private transport contractors, are targeting modular, AI-integrated, and ultra-low emission buses, accelerating the overall bus market development. The industry also observes that smart bus solutions are beginning to take precedence over traditional physical fleets. These solutions include onboard diagnostics, dynamic route optimization, and predictive maintenance.

In addition, rising fuel prices are making public transport, especially buses, more appealing to the cost-conscious passengers. As the prices of fuel escalate, the cost of running one’s vehicle also increases, which gives people a reason to look for cheaper means of transport. This leads to increased demand for buses as they offer a cheaper means of transport and reduce the cost incurred individually when travelling. More bus passengers surge the demand for development and procurement of more bus fittings and facilities, hence driving industry growth.

Key Trends and Recent Developments

May 2025

The North Bengal State Transport Corporation (NBSTC) announced plans to introduce a new Volvo AC bus service that will go from Raiganj to Digha via Kolkata. By removing the need for break trips, this project seeks to give travellers a smooth ride from North Dinajpur to the seaside town of Digha. The launch of a long-distance AC Volvo route in India reflects growing demand for seamless intercity bus services, pushing OEMs to offer premium, comfort-focused models.March 2025

The first electric articulated and bi-articulated bus produced in Mexico, the Volvo 7800 Electric, was introduced by Volvo Buses. The new electric bus, which is based on Volvo Buses' global electromobility Volvo BZR platform, will improve Mexico's Bus Rapid Transit systems and make the country's people-transporting infrastructure more sustainable and effective. Volvo’s debut of articulated EV buses in Mexico enhances the credibility of electric Bus Rapid Transit (BRT) models globally, signalling scalability of high-capacity clean mobility solutions.January 2025

At the Bharat Mobility Global Expo 2025, BM Electric Vehicles debuted four new electric buses, including the Luxury Coach Galaxy. In addition, JBM Electric, a division of the JBM Group, has expanded its role in green mobility with the introduction of the Intercity Bus Xpress, the low Floor Electric Medical Mobile Unit e-MediLife, and India's first-ever 9 Metre Electric Tarmac Coach e-SkyLife. New electric offerings, including medical and intercity variants, from Indian manufacturers show rising diversification in e-bus portfolios to cater to B2B use-cases like airports and health fleets.December 2024

Tata Motors introduced the 7-meter EV bus at Prawaas, a ground-breaking product in India with 21 seats for a comfortable and safe ride. In line with the government's sustainability pledges, this launch marks a major advancement toward the company’s objective of reaching net-zero emissions. Tata's compact EV bus targets urban and last-mile routes, aligning with global trends of downsized, zero-emission fleets optimised for smart city applications.Government Electrification Programs Driving Demand

Governments all over the world are laying the groundwork for mass electric bus adoption. The United States Federal Transit Administration committed over USD 1.7 billion in 2023 under the Low or No Emission Grant Program to fund zero-emission buses and infrastructure. Similarly, China continues to dominate electric bus deployment, with over 420,000 electric buses on the roads, driven by subsidies and local manufacturing incentives. B2B fleet operators are finding easier entry into electrification owing to government-facilitated charging infrastructure and subsidy schemes, making adoption economically viable.Shift Towards Smart and Connected Public Transport

Companies like Volvo and Scania are integrating AI and IoT for predictive maintenance, fuel optimisation, and route efficiency, reshaping the overall bus market dynamics. In Sweden, the “Drive Sweden” initiative includes autonomous electric shuttles in city centres, laying groundwork for broader technology deployment in regular buses. B2B operators gain from these enhancements by reducing downtime and achieving considerable operational savings.Demand for Modular and Customisable Bus Platforms

An emerging trend in the bus market is the preference for modular bus chassis that allow easy retrofitting and hybrid powertrain integration. Companies like Switch Mobility (Ashok Leyland’s EV arm) are building platforms adaptable to electric, CNG, or diesel configurations. These chassis systems also streamline production cycles and lower engineering costs. Modular designs enable faster scaling of fleets, reduce the need for separate production lines, and simplify training for maintenance staff. This is especially useful in regions where diverse operating conditions demand multiple fuels and feature combinations within the same fleet.Public-Private Collaborations Fuel Market Entry

Emerging markets like Southeast Asia are witnessing public-private partnerships flourish, boosting the bus market development. In the Philippines, the “PUV Modernisation Program” enabled private fleets to upgrade to modern, eco-friendly buses, with considerable co-financing from government banks. This model has encouraged brands like Foton and BYD to enter with scalable leasing models for private operators. These schemes de-risk large capital investments, opening new doors for B2B fleet management firms.Green Financing and ESG Pressure

Environmental, Social, and Governance (ESG) goals are pushing corporates and governments to opt for greener transport solutions. For instance, World Bank’s Green Urban Mobility Partnership with Bangladesh aims to introduce 400 electric buses in Dhaka. Meanwhile, cities like Paris are issuing green bonds specifically tied to public transport upgrades. B2B procurement officers are now including ESG compliance as a core metric in supplier evaluations, pushing OEMs toward sustainable innovation.Global Bus Industry Segmentation

The report titled “Global Bus Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Single Deck

- Double Deck

Market Breakup by Application

- Transit Bus

- Intercity/Coaches

- Others

Market Breakup by Fuel Type

- Diesel

- Electric and Hybrid

- Others

Market Breakup by Seat Capacity

- 15-30 Seats

- 31-50 Seats

- More than 50 Seats

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Europe

Global Bus Market Share

By Type, Single Deck Buses Account for the Largest Share of the Market

Single deck buses dominate the global market due to their cost efficiency, ease of maintenance, and adaptability in urban settings. Recent models like NFI’s Xcelsior CHARGE NG offer lightweight aluminium bodies and 160kWh battery packs, ideal for short, repetitive urban routes. Municipal fleets prefer these due to higher manoeuvrability and lower upfront cost. In Europe, the e-bus registrations saw a 53% growth. The category’s dominance stems from their compact, smart-enabled single deck designs with upgraded passenger comfort and real-time tracking integration.The category of the double deck buses is witnessing growth in the bus market, especially in megacities where commuter load is high. For instance, Hong Kong introduced electric double decker buses with AI-powered driver alert systems. These buses can carry up to 130 passengers while maintaining a minimal footprint. With urban vertical expansion, B2B operators are targeting double decker buses as a space-maximising solution. Innovations like lighter carbon fibre frames and hybrid propulsion systems make them ideal for intercity and suburban deployment without compromising energy efficiency.

By Application, Transit Bus Secure the Bigger Share of the Market Revenue

Transit buses continue to be dominant in the market as urban transport systems. Governments are investing heavily to renew outdated fleets. For instance, Indonesia, through its National Urban Mobility Programme, allocated funds for low-emission city buses. Innovations like onboard energy recovery systems and real-time passenger counting are improving operational efficiency. Transit authorities, from New York’s MTA to Manila’s LTFRB, are integrating these technology-enabled buses to boost capacity and lower emissions.Long-distance buses or inter-city coaches are accelerating the overall bus market revenue, driven by the booming domestic tourism sector and improved highway infrastructure. OEMs like Mercedes-Benz and Yutong are launching luxury electric coaches with features like cabin-level climate control, autonomous driving aids, and regenerative braking systems. Additionally, governments are stabilising this application’s growth pace with several initiatives. For example, India’s Parivahan Sewa is enabling state-run intercity operators to upgrade 38,000 buses to electric by 2027. B2B fleet companies are capitalising on this growing commuter demand with premium services, such as Wi-Fi, entertainment, and ergonomic seating.

By Fuel Type, Diesel Clock in the Largest Share of the Market

Despite the EV surge, diesel has continued to dominate the industry. The fuel’s continued dominance stems from robust infrastructure and the ability to cover long distances without recharging delays. In markets like Africa and Southeast Asia, diesel buses remain dominant in public transport. The fuel consumption is also boosted by innovations. For instance, Bosch’s new generation of low-NOx diesel engines reduces emissions without compromising power.Electric and hybrid buses are witnessing surging demand, especially in policy-heavy markets. According to global bus market analysis, electric buses are expected to comprise 39% of new bus sales worldwide. On the other hand, in 2017, Shenzhen became the first city to operate an entirely electric bus fleet, with over 16,000 units. In March 2025, Volvo launched its 7800 electric buses in Mexican cities, marking the first electric articulated and bi-articulated buses manufactured in Mexico. Built on Volvo's global BZR platform, these buses aim to enhance bus rapid transit systems across the country.

By Seat Capacity, 31-50 Seats Occupy a Substantial Market Share

The range of 31-50 seats occupies a substantial share of the market. OEMs are optimising this range with lightweight materials and energy-efficient air-conditioning units. For instance, Ashok Leyland’s “Cheetah” model offers dual-fuel capabilities including CNG and battery. Transit authorities in Eastern Europe and Southeast Asia are bulk ordering these due to their balance of passenger volume and fuel efficiency.As per the bus market analysis, buses with 15-30 seats are the fastest-growing seat capacity category. These offer flexibility for smaller groups and short-distance travel, making them ideal for urban shuttle services, schools, and private hire. Moreover, such compact vehicles are more fuel-efficient, easier to navigate through tight spaces, and require lower maintenance costs than larger buses. Their size allows for quicker boarding and disembarking, improving overall service efficiency. Additionally, these buses contribute to reducing road congestion while still offering a comfortable and cost-effective transport solution for both operators and passengers.

Global Bus Market Regional Analysis

By Region, Asia Pacific Register the Leading Position of the Bus Market

Growth in the Asia Pacific market is majorly driven by large populations and strong government support. China alone accounts for more than 60% of the world’s electric buses. On the other hand, India’s FAME-II schemes and Japan’s Smart City initiatives are boosting adoption of electric and AI-integrated buses. B2B buyers in this region enjoy strong financial incentives, large procurement tenders, and growing public-private ecosystems, making it the high-priority zone for OEM innovation and partnership deals.North America witnesses significant bus market growth, driven by increased urbanisation and a shift towards sustainable transportation solutions. Governments and public transport authorities are investing in electric and hybrid buses to reduce carbon emissions and improve air quality. The rise in environmental consciousness, coupled with government incentives, has made electric buses an attractive option for fleet operators. In December 2024, Solaris entered the United States market by signing its first contract for electric buses with King County Metro. This contract marked a significant step in Solaris’ North American expansion, providing zero-emission buses in the United States.

Competitive Landscape

The bus market players are focusing on three strategic zones, including electrification, AI-powered fleet analytics, and modular platforms. Most companies specialise in producing a wide range of commercial vehicles, including trucks and buses, designed for applications across various industries. They are actively advancing in electric and autonomous vehicle technologies, aiming to create sustainable transport solutions. Startups like Arrival are being acquired for their smart battery technology. Major OEMs are launching in-house digital platforms to offer predictive maintenance, route planning, and driver behaviour monitoring. Strategic partnerships with governments and local operators are also rising. In India, Daimler partnered with local governments for EV bus trials with their BharatBenz platform. Bus companies can find lucrative opportunities in mid-life bus conversion, aftermarket telematics, and subscription-based procurement models. Electrification, smart fleet management, modular designs, public-private partnerships, and ESG-driven procurement are some of the key trends that they can focus on to gain an edge in this competitive market in the coming years.Anhui Ankai Automobile Company

Established in 1997 and headquartered in Hefei, China, Ankai is a leading manufacturer of electric and luxury coaches. The company has built a strong export presence across the Middle East and Southeast Asia, often partnering with governments under bilateral trade agreements.Daimler Truck Holding AG

Founded in 2019, headquartered in Germany, Daimler Truck focuses on zero-emission buses via its Mercedes-Benz and BharatBenz sub-brands. Their eCitaro model is already in use across several European cities. The company is heavily invested in hydrogen-fuelled buses, with pilot fleets operating in Hamburg.NFI Group Inc.

Based in Winnipeg, Canada and established in 2015, NFI is a global innovator with brands like New Flyer and Alexander Dennis under its belt. The company’s Xcelsior line features battery-electric and fuel cell electric buses with onboard telematics.

AB Volvo

Founded in 1927, headquartered in Sweden, AB Volvo is a pioneer in integrating connectivity and automation into buses. Its ElectriCity project in Gothenburg tests semi-autonomous buses with passenger behaviour analytics.Other key players in the market are Solaris Bus & Coach sp. z o.o., among others.

Key Highlights of the Global Bus Market Report:

- Historical performance and accurate forecasts through 2034.

- Insights into transformative trends such as electric drivetrain integrations and next-gen autonomous bus trials in urban corridors.

- In-depth competitive landscape profiling global OEMs like Daimler, Volvo, and Ashok Leyland, alongside agile regional players.

- Regional analysis highlighting low-emission zone rollouts in Europe and rising intercity connectivity in Southeast Asia and Latin America.

- Investment-focused outlook supported by OEM capex strategies and data-backed transition pathways to EV and hydrogen-powered fleets.

- Proven expertise from mobility, transport infrastructure, and public fleet analysts.

- Insight-led intelligence designed to align with OEM, Tier-1 supplier, and regulatory perspectives.

- Rigorous methodology including primary stakeholder consultations and verified trade association data.

- Strategic insights enhanced by forecasting models that decode macroeconomic, policy, and lifecycle cost variables.

Table of Contents

Companies Mentioned

The key companies featured in this Bus market report include:- Anhui Ankai Automobile Company

- Daimler Truck Holding AG

- NFI Group Inc.

- AB Volvo

- Solaris Bus & Coach sp. z o.o.

Table Information

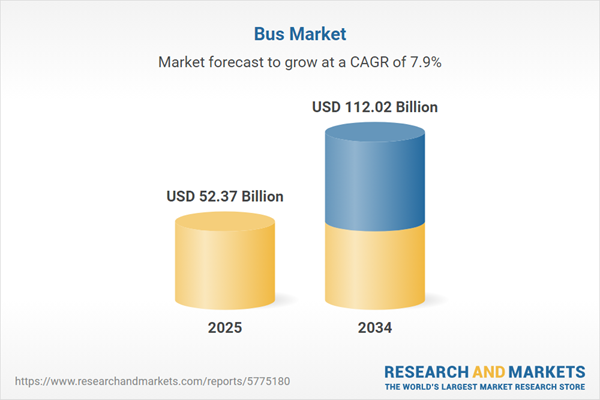

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 52.37 Billion |

| Forecasted Market Value ( USD | $ 112.02 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |