The global cigarette market is experiencing ongoing growth, with innovative cigarette products like e-cigarettes and flavoured cigarettes gaining increasing popularity among consumers seeking alternatives to conventional smoking. Marketing and advertising campaigns continue to be major factors in promoting these products. Additionally, the social and cultural influence on smoking habits is crucial, as evolving attitudes towards tobacco consumption, driven by health concerns and lifestyle choices, significantly impact market trends.

Cigarette Market Analysis

Market Growth and Size

The global cigarette market is experiencing steady growth, with shifting smoking habits influenced by stress and anxiety. As consumers seek ways to cope, the market growth is driven by evolving preferences, impacting the demand for traditional and alternative smoking products.Major Market Drivers

Cultural acceptance of smoking continues to shape the global cigarette market, with flavored cigarettes and value-added products driving growth. These factors act as key market drivers, responding to consumer demand for enhanced smoking experiences and influencing overall market dynamics.Key Market Trends

The cigarette market is evolving with the rise of alternative nicotine delivery systems like e-cigarettes and vaping products. Health consciousness and regulatory pressures are influencing consumer choices, as nicotine consumption increasingly shifts towards these alternatives, impacting traditional cigarette sales.Geographical Trends

The global cigarette market is witnessing diverse trends across regions, with Asia-Pacific and North America showing varying smoking cultures. In Asia-Pacific, traditional smoking habits remain prevalent, while North America sees a rise in vapes and vaping. These shifting smoking habits are influencing the market, as consumers seek alternatives to traditional cigarettes, shaping the future of the industry.Competitive Landscape

The global cigarette market's competitive landscape is evolving, driven by innovative startups and strategic partnerships. Companies are expanding their product portfolios with new tobacco formulations, aiming to capture changing consumer preferences. These developments are reshaping the tobacco industry, creating opportunities for both established players and emerging brands.Challenges and Opportunities

Government regulations and health awareness are influencing the global cigarette market, with anti-smoking campaigns promoting reduced-risk products. Emerging markets are seeing growth despite stricter regulatory landscapes. As consumer preferences shift, companies adapt their strategies to meet demand for healthier alternatives in these evolving markets.Key Trends and Developments

The rise of reduced-harm products, sustainability, and environmental concerns, premiumisation of cigarette brands, and technological advancements in production are the major trends enhancing the cigarette industry growth rate.May 4, 2024

Reliance Retail and Code Effort collaborated to launch jeans made from 600 discarded cigarette butts per pair for Lee Cooper's Eco Collection, set to debut in July-August 2024.February 23, 2024

Japan Tobacco International shipped 531 billion combustible cigarettes in 2023, standing out as the only top-three Big Tobacco firm to increase volumes. Winston and Camel brands contributed to a 2.3% rise in 2023.February 14, 2024

Consumers are willing to pay more for premium cigarette brands, which offer higher-quality tobacco, sophisticated packaging, and exclusive marketing. This helps companies maintain KT&G reported Esse, their ultra-slim cigarette brand, sold over 900 billion cigarettes in 2023. It gained popularity in South Korea for its slim, low-tar design, unique amid high-tar cigarettes initially dominating the market.June 5, 2023

The Coimbatore-based Dr Kalam Foundation launched ‘Green Buds’, an initiative aimed at recycling cigarette butts to create various products such as pillows, toys, and mattresses using cellulose acetate filters.Rise of Reduced-Harm Products

Consumers increasingly prefer reduced-harm products like heated tobacco and nicotine pouches, viewed as safer than traditional cigarettes. Companies invest in developing these to attract health-conscious customers.Sustainability and Environmental Concerns

The cigarette industry trends are shaped by environmental sustainability by adopting eco-friendly practices, reducing plastic waste, and promoting biodegradable alternatives. Consumer and regulatory pressure drives companies towards sustainable production and packaging.Premiumisation of Cigarette Brands

Consumers are willing to pay more for premium cigarette brands, which offer higher-quality tobacco, sophisticated packaging, and exclusive marketing. This helps companies maintain profitability by focusing on high-margin products.Technological Advancements in Production

Advancements in cigarette production technology improve manufacturing efficiency and product quality. Automation, advanced filtration, and precision agriculture techniques help reduce costs and meet strict quality standards.Cigarette Market Trends/Drivers

The Rising Impact of Social and Cultural Factors

The global cigarette market is significantly shaped by social and cultural influences, which impact smoking behaviours across different regions. Peer influence plays a crucial role in shaping smoking habits, particularly among younger demographics, who are often exposed to cigarette advertisements. These advertisements, once predominantly in traditional media, have now found a place on social media platforms and online communities, amplifying their reach. While the cigarette market continues to experience growth, this is counterbalanced by increasing awareness around the health risks of smoking. Despite this, advertisements still attempt to create aspirational imagery, driving smoking demand. According to Office of National Statistics, in 2023, 6.0 million adults (11.9%) in the UK smoked cigarettes, with the highest proportion (14.0%) in the 25-34 age group. Additionally, 5.1 million adults (9.8%) in Great Britain used e-cigarettes, either daily or occasionally. The cigarette market growth is partly fueled by shifting social trends, where smoking can be seen as a status symbol in some cultures. However, anti-smoking campaigns are gaining momentum, challenging the market outlook and the influence of peer pressure. As societal perceptions evolve, future growth in the cigarette market will largely depend on changing consumer attitudes towards smoking.A Range of Impactful Marketing and Advertising Campaigns

Tobacco companies have long relied on strategic marketing and advertising techniques to drive market growth. These companies focus heavily on brand awareness and loyalty to retain existing smokers while attracting new smokers and potential smokers. Their campaigns often utilise various advertisements, including product placement in movies, television shows, and music videos, to influence popular culture. Social media platforms and online advertising have become increasingly important tools, with tobacco companies leveraging influencer marketing to reach younger audiences. These modern advertising techniques enable companies to maintain a strong presence in the market, despite growing health concerns. KT&G revealed that its ultra-slim cigarette brand, Esse, sold over 900 billion cigarettes in 2023. It became popular in South Korea due to its slim, low-tar design, standing out in a market previously dominated by high-tar cigarettes. The cigarette market continues to face regulatory pressures, but tobacco companies continue to adapt their strategies to ensure sustained market growth. As smoking habits of smokers evolve, these companies adjust their advertising methods, focusing on reaching potential smokers through digital channels. Overall, the market outlook for the cigarette market will depend on how well companies manage the changing landscape of advertising and smoking trends.The Launch of Innovative Cigarette Products

Tobacco companies are diversifying their product offerings to cater to evolving consumer preferences, driving market growth. This includes flavored cigarettes, with various tobacco flavours appealing to different smoker segments. In response to increasing demand for reduced-risk tobacco products, tobacco companies are also introducing heat-not-burn devices and e-cigarettes, which aim to reduce tar and combustion by-products. As smoking habits shift, smokers are exploring alternatives to traditional cigarettes for harm reduction and smoking cessation. However, regulatory landscapes continue to evolve, impacting market strategies. In 2024, Bratislava's waste management company, Odvoz a Likvidácia Odpadu (OLO), launched specially designed containers for cigarette waste at public events. This initiative aims to recycle the discarded materials into asphalt for use in road construction. The market growth of these innovative products depends on how effectively tobacco companies navigate changing regulations while meeting the demands of both existing and potential smokers seeking healthier alternatives.Cigarette Industry Segmentation

The global cigarette market is segmented by type, distribution channel, and region. Light cigarettes dominate due to their low-tar and nicotine content, appealing to health-conscious smokers. Tobacco shops play a key role in distribution, fostering customer loyalty. Regionally, Asia-Pacific leads the market, followed by other regions with varying consumer preferences.Breakup by Type

- Light

- Medium

- Others

Light Cigarettes are the Most Preferred Type

Market analysis of the global cigarette market reveals that light cigarettes hold a significant market share. These products have become increasingly popular due to their lower tar and nicotine levels, with consumer preferences shifting towards them. The market breakup highlights light cigarettes as the dominant segment in the industry.Light cigarettes have seen significant market growth, with smokers increasingly opting for low-tar and low-nicotine options. These cigarettes, known for their reduced tar and nicotine content, appeal to health-conscious smokers looking to lower their exposure to harmful substances. As awareness of the risks associated with smoking grows, the demand for light cigarettes continues to rise. The shift towards lower tar and nicotine products reflects changing consumer preferences, contributing to the overall market growth in the global cigarette industry. This trend is expected to continue as more smokers seek healthier alternatives.

Light cigarettes have gained popularity as smokers increasingly seek alternatives to traditional smoking. These light products, with lower tar and nicotine levels, are often seen as less harmful. As awareness of smoking-related health risks grows, market growth in this segment continues. Cigarette manufacturers are adapting to this demand, introducing more low-tar and low-nicotine options. However, regulatory initiatives aimed at reducing smoking rates may influence future market dynamics. Despite this, the preference for light cigarettes remains strong among smokers, pushing manufacturers to innovate and expand their product offerings.

Breakup by Distribution Channel

- Tobacco Shops

- Supermarkets and Hypermarketz

- Convenience Stores

- Online Stores

- Others

Cigarettes are extensively sold through tobacco shops

Tobacco shops play a vital role in the distribution channel for cigarettes, capturing a significant cigarette market share. These specialised outlets offer a broad selection of tobacco products, appealing to smokers seeking variety and quality. Their expertise and focused product range ensure that tobacco shops remain a dominant and essential part of the global cigarette distribution network.Tobacco shops are essential in the global cigarette market, offering a wide variety of tobacco products to cater to smokers needs. These specialised outlets, including specialty tobacco retailers and tobacconists, provide exclusive brands, cigarettes, and smoking accessories. As per the Japan Tobacco Inc., in 2022, Japan Tobacco Inc. reportedly invested USD 51 million in 522 communities across 65 countries as part of its global outreach initiatives. The market growth is driven by increasing demand for unique tobacco blends and high-quality products. These shops remain key to meeting consumer preferences, supporting both brand loyalty and product diversification in the ever-evolving cigarette market.

Tobacco shops offer a unique shopping experience, with knowledgeable staff providing expert advice on tobacco blends and smoking techniques. Their personalized approach enhances customer loyalty, offering exclusive deals and limited-edition products. These shops attract smokers seeking high-quality tobacco and specialty products, with tobacco manufacturers benefiting from strong relationships with these retail channels. By creating a tailored shopping experience, tobacco shops foster a connection with customers, further cementing their position in the market. The specialised service and exclusive offerings in tobacco shops continue to drive consumer preference, ensuring ongoing market growth.

Breakup by Region

- North America

- United States of America

- Canada

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Asia-Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

- Latin America

- Brazil

- Argentina

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Asia-Pacific (Excluding Australia) Demonstrates a Strong Dominance in the Market

Asia-Pacific (excluding Australia) holds a dominant position in global cigarette markets, with significant market share. Regional markets, including Eastern Europe, Western Europe, the Middle East and Africa, North America, and Latin America, contribute to overall market dynamics. Australia, while smaller in comparison, also plays a role. The growth in these regions influences global trends and the overall market share of the cigarette industry.The global cigarette market is influenced by factors such as a growing population and rapid urbanization. A diverse smoking culture exists, with tobacco-consuming countries being some of the largest consumers of cigarettes. Smoking prevalence varies across regions, shaped by cultural factors and social acceptance. Longstanding traditions associated with smoking contribute to entrenched smoking habits. Tobacco is a highly valuable crop worldwide, praised for its drought tolerance and adaptability to poor soils. In India, it occupies 0.27% of the total cultivated land, producing around 750 million kilograms of tobacco leaf each year, supporting the cigarette market. Rising product demand, alongside marketing efforts, strengthens market presence. The cigarette market demand is driven by innovative product variations catering to diverse consumer preferences. These trends highlight the significant role of cultural influences in entrenched smoking habits and the overall market growth.

The North America market is witnessing significant growth driven by reduced-risk tobacco products like e-cigarettes and heat-not-burn devices. These innovations support harm reduction and smoking cessation initiatives. Product innovation and targeted marketing efforts are contributing to market growth, with consumers seeking alternatives to traditional smoking, further expanding the reach of these reduced-risk options.

Competitive Landscape

Key players in the global cigarette market are focusing on product portfolios that cater to evolving consumer preferences. Brands are innovating with new flavors and product variants, enhanced by attractive packaging designs. Reduced-risk tobacco products, including e-cigarettes and heat-not-burn devices, are gaining traction, supported by research and development (R&D) efforts to enhance smoking experiences. As per Philip Morris International's 2023 annual report, the company saw a 5.5% growth in organic net revenue, largely driven by an 8.9% rise in pricing. In 2023, Marlboro, the top international cigarette brand, accounted for approximately 39% of total cigarette shipment volume. Product innovation, including filter technology and tobacco blends, strengthens market presence, especially in emerging economies and consumer markets. As competition intensifies, key players aim for a competitive edge through strategic market expansions, driving global demand and increasing cigarette market revenue.Philip Morris International

Established in 1847 and based in New York City, Philip Morris International is a major player in the tobacco industry, renowned for its global presence and popular brands like Marlboro.British American Tobacco

Founded in 1902 and located in London, British American Tobacco is a significant multinational tobacco corporation, operating worldwide with well-known brands such as Dunhill and Lucky Strike.Japan Tobacco Inc.

Founded in 1985 and headquartered in Tokyo, Japan Tobacco Inc. stands as one of the largest tobacco companies globally, distinguished for its brands including Winston and Camel.

Imperial Brands PLC

Founded in 1901 and headquartered in Bristol, UK, Imperial Brands PLC is a multinational company recognized for its extensive portfolio, which includes renowned cigarette brands like Davidoff and Gauloises.The report provides a thorough analysis of the competitive landscape, offering detailed profiles of major companies. Key players in the cigarette market include prominent industry leaders and well-established brands:

- China National Tobacco Corporation

- Philip Morris International

- British American Tobacco

- Japan Tobacco Inc.

- Imperial Brands PLC

Recent Developments

- May 2024, Reliance Retail and Code Effort collaborated to create the world’s first jeans made from discarded cigarette butts, launched as part of the Lee Cooper Eco Collection. This initiative addresses the environmental challenge posed by the billions of cigarette butts discarded annually.

- February 2024, Japan Tobacco International increased its cigarette shipments in 2023, producing over 531 billion combustible cigarettes. It was the only major tobacco company among the top three to boost its volumes, standing out in an otherwise declining market.

- February 2024, KT&G, South Korea's leading cigarette maker, announced that its ultra-slim Esse brand exceeded 900 billion cumulative sales in 2023, with 405.1 billion sold abroad. Launched in 1996, Esse's slim design and low-tar appeal helped boost KT&G’s record overseas sales of 61.4 billion cigarettes.

- June 2023, The Dr. Kalam Foundation, based in Coimbatore, launched the 'Green Buds' initiative on World Environment Day. This project aimed to recycle cigarette butts, made of cellulose acetate, into products such as pillows, stuffed toys, and mattresses.

Table of Contents

Companies Mentioned

The key companies featured in this Cigarette market report include:- China National Tobacco Corporation

- Philip Morris International

- British American Tobacco

- Japan Tobacco Inc.

- Imperial Brands PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | August 2025 |

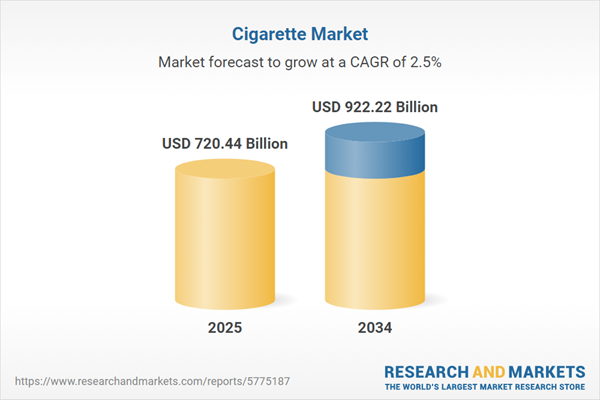

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 720.44 Billion |

| Forecasted Market Value ( USD | $ 922.22 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |