Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

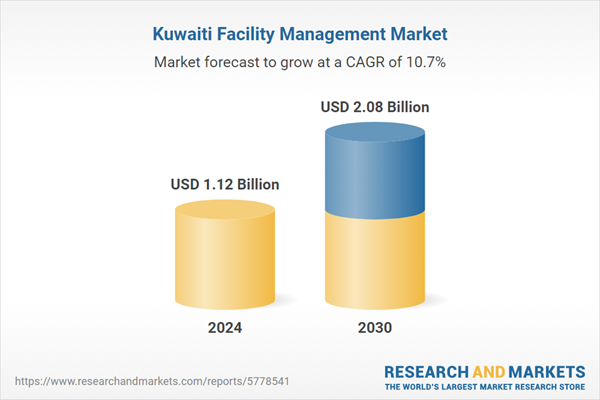

The Kuwait Facility Management (FM) market is undergoing a period of steady growth, supported by widespread infrastructure development, rising commercial construction, and a growing shift from in-house operations to outsourced service models. With increasing investment in sectors such as real estate, healthcare, transport, retail, and hospitality, demand for professional FM services has surged. This demand is being driven not only by the rising number of commercial and residential buildings but also by the need for more efficient and sustainable facility operations. As the country pushes forward with its economic diversification goals, particularly through long-term national development plans, the FM sector is expected to play a crucial role in supporting and maintaining new and existing infrastructure.

Traditionally, facility management in Kuwait was managed internally within organizations, but a significant transformation is now underway. More companies are outsourcing services to specialized FM providers to enhance operational efficiency and reduce long-term costs. This shift is especially prominent in large-scale infrastructure projects, hospitals, malls, airports, and mixed-use developments, where high service quality and advanced technologies are critical. Service providers offering integrated solutions - including both hard services (like mechanical, electrical, HVAC) and soft services (such as cleaning, landscaping, security, and waste management) - are increasingly preferred by clients.

Key Market Drivers

Mega Infrastructure and Housing Expansion

Kuwait is experiencing a construction boom driven by large-scale infrastructure and housing developments, which significantly boost demand for facility management services. Government-backed housing programs aim to build extensive residential cities to accommodate growing population needs. For example, South Al-Mutlaa City is set to provide homes for over 28,000 families, while Sabah Al-Ahmad City is designed to host 100,000+ residents. Nationwide, the Public Authority for Housing and Welfare targets the construction of over 250,000 housing units in the coming decade. These communities require comprehensive FM services - waste management, water systems, HVAC, and security.At the infrastructure level, major projects include a new airport terminal with an annual capacity of 25 million passengers, a national rail network exceeding 500 km, and development of highways spanning over 600 km. The development of the Mubarak Al-Kabeer Port, with a future handling capacity of 2.5 million TEUs, adds complexity to asset and logistics-related FM operations. As these projects move from construction to operational phases, demand for FM services - especially for maintenance, cleaning, and energy management - continues to rise. The FM sector plays a crucial role in ensuring the longevity, safety, and efficiency of these assets in both public and private domains.

Key Market Challenges

Shortage of Skilled and Specialized Workforce

One of the most pressing challenges in the Kuwait FM market is the shortage of trained and skilled personnel, especially in technical domains like HVAC maintenance, electrical systems, plumbing, and energy management. While demand for FM services is growing rapidly across sectors such as healthcare, infrastructure, and hospitality, the local labor pool often lacks the advanced training required to manage modern and complex facility systems.Many service providers depend heavily on expatriate labor, which makes the workforce structure vulnerable to shifting labor regulations, visa policies, and regional geopolitical tensions. Additionally, rising localization targets create pressure on companies to recruit and train Kuwaiti nationals, who often prefer white-collar or government jobs. The result is a limited availability of technicians willing to take up field-level FM roles.

Training and upskilling programs remain underdeveloped in the region, and there are relatively few local institutions offering FM-specific certifications. Companies are thus forced to spend considerable time and resources on in-house training, affecting operational efficiency and scalability. For example, recruiting and preparing a technician for HVAC systems may take several months, reducing the company’s ability to respond quickly to contract needs.

The lack of qualified personnel also affects service quality, response times, and contract retention, particularly in sectors with critical uptime needs like hospitals or airports. Until Kuwait develops a more sustainable pipeline of skilled FM professionals, service providers may continue to face execution challenges and cost burdens tied to labor availability and productivity.

Key Market Trends

Rise of Energy Management and Sustainability-Focused FM Services

As Kuwait aims to diversify its economy and reduce energy consumption, there is a growing emphasis on sustainability and energy-efficient operations within the FM sector. Government mandates and client expectations are aligning to encourage FM providers to integrate energy-saving practices and green technologies.Modern buildings in Kuwait are increasingly designed with sustainable engineering systems, including solar power integration, motion-sensor lighting, and intelligent HVAC systems. As a result, facility managers are tasked with ensuring these systems operate at peak efficiency. FM contracts now commonly include clauses related to energy performance benchmarks, such as reducing power consumption by 10-20% annually through better system control and optimization.

Clients - especially in the healthcare, retail, and public sectors - are demanding carbon footprint reporting and adherence to LEED or other green building certifications. FM providers must now conduct regular energy audits, monitor indoor air quality, and optimize cooling systems in a region where over 60% of energy use is linked to air conditioning alone.

To address these needs, FM companies in Kuwait are investing in energy analytics platforms, IoT-enabled monitoring, and trained energy managers to drive sustainability outcomes. This trend is expected to reshape FM operations from being reactive and routine-based to proactive and performance-based.

The push for sustainability is not only regulatory but also financially driven - energy-efficient buildings have 15-20% lower operating costs, and FM companies that help clients achieve these savings are increasingly preferred.

Key Market Players

- PIMCO Kuwait

- Kharafi National FM

- EcovertFM Kuwait

- Al Mazaya Holding Company KSCP

- ENGIE Services General Contracting for Buildings

- United Facilities Management Company (UFM)

- Alghanim International General Trading & Contracting Co. W.L.L.

- Al Mulla Group Holding Company

- Tanzifco Company W.L.L.

- O&G Engineering W.L.L.

Report Scope:

In this report, the Kuwait Facility Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Kuwait Facility Management Market, By Service:

- Property

- Cleaning

- Security

- Support

- Catering

- Others

Kuwait Facility Management Market, By Type:

- Hard Services

- Soft Services

Kuwait Facility Management Market, By Industry:

- Organized

- Unorganized

Kuwait Facility Management Market, By End User:

- Commercial

- Residential

- Industrial

- Public Sector

Kuwait Facility Management Market, By Region:

- Al Asimah Governorate

- Hawalli Governorate

- Farwaniya Governorate

- Mubarak Al-Kabeer Governorate

- Al Ahmadi Governorate

- Al Jahra Governorate

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Kuwait Facility Management Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PIMCO Kuwait

- Kharafi National FM

- EcovertFM Kuwait

- Al Mazaya Holding Company KSCP

- ENGIE Services General Contracting for Buildings

- United Facilities Management Company (UFM)

- Alghanim International General Trading & Contracting Co. W.L.L.

- Al Mulla Group Holding Company

- Tanzifco Company W.L.L.

- O&G Engineering W.L.L.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.12 Billion |

| Forecasted Market Value ( USD | $ 2.08 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Kuwait |

| No. of Companies Mentioned | 10 |