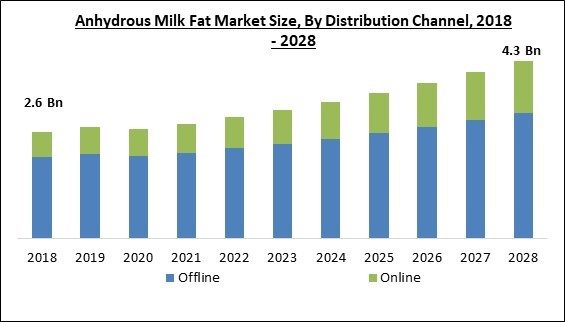

The Global Anhydrous Milk Fat Market size is expected to reach $4.3 billion by 2028, rising at a market growth of 6.6% CAGR during the forecast period.

Triacylglycerols, or glycerol readily converted to three fatty acids, are a range of compounds that make up anhydrous milk fat, each with a distinct physical property. Anhydrous milk fat, for instance, melts at a range of temperatures and has a high melting point. Anhydrous milk fat has a normal melting point higher than 40 °C. The anhydrous milk now changes into a transparent liquid with a little yellow color due to the presence of carotene.

When chilled, anhydrous milk fat crystallizes and transforms into a soft, somewhat gritty, and pale white-yellow solid. Due to its longer shelf life and low moisture content, anhydrous milk fat is frequently stored for several months at room temperature and then easily shipped throughout the globe. Also, it has a varied range of applications in the fast food sector, which is predicted to expand significantly over the coming few years. Anhydrous milk fat will become highly in demand worldwide as a result.

The way that consumers select healthier products is changing. Rather than concentrating only on functional ingredients, they are emphasizing more natural products and avoiding those that contain many additives, preservatives, and stabilizers. Anhydrous milk fats have become increasingly common because they have constant flavor, texture, mouthfeel, structure, and anti-bloom qualities. Also, customers are prioritizing their health and refusing to compromise on taste, driving up demand for goods with buttery flavors.

Demand in the market has been significantly influenced by how easily anhydrous milk can be preserved. As a result, the use of preservatives in producing several dairy and pastry goods, including packaged yogurt, cakes, and chocolates, has increased. In addition, the rise of the world market for anhydrous milk fat has also been boosted by the popularity of milk-flavored drinks and confections.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Royal VIVBuisman (The Van Ballegooijen), Interfood Holding BV, Eurial Services (Agrial Group), Polmlek Group, Asha Ram & Sons Pvt. Ltd., Meadow Foods Limited, Royal FrieslandCampina N.V., Lactalis Group, and United Global Agencies Group.

Triacylglycerols, or glycerol readily converted to three fatty acids, are a range of compounds that make up anhydrous milk fat, each with a distinct physical property. Anhydrous milk fat, for instance, melts at a range of temperatures and has a high melting point. Anhydrous milk fat has a normal melting point higher than 40 °C. The anhydrous milk now changes into a transparent liquid with a little yellow color due to the presence of carotene.

When chilled, anhydrous milk fat crystallizes and transforms into a soft, somewhat gritty, and pale white-yellow solid. Due to its longer shelf life and low moisture content, anhydrous milk fat is frequently stored for several months at room temperature and then easily shipped throughout the globe. Also, it has a varied range of applications in the fast food sector, which is predicted to expand significantly over the coming few years. Anhydrous milk fat will become highly in demand worldwide as a result.

The way that consumers select healthier products is changing. Rather than concentrating only on functional ingredients, they are emphasizing more natural products and avoiding those that contain many additives, preservatives, and stabilizers. Anhydrous milk fats have become increasingly common because they have constant flavor, texture, mouthfeel, structure, and anti-bloom qualities. Also, customers are prioritizing their health and refusing to compromise on taste, driving up demand for goods with buttery flavors.

Demand in the market has been significantly influenced by how easily anhydrous milk can be preserved. As a result, the use of preservatives in producing several dairy and pastry goods, including packaged yogurt, cakes, and chocolates, has increased. In addition, the rise of the world market for anhydrous milk fat has also been boosted by the popularity of milk-flavored drinks and confections.

COVID-19 Impact Analysis

The supply of dairy products was stopped as a result of these disruptions to global trade, which also caused the projects that were already under development to be delayed and incurred higher capital expenditures (CAPEX). Because of the upheaval in supply and demand, businesses that produce diaries have had issues, making it challenging to develop a long-term strategy. As a result, raw material costs rose dramatically, sending manufacturers of dairy products into a panic. Considering all of these aspects, the market for anhydrous milk fat has suffered due to COVID-19's widespread distribution.Market Growth Factors

Rise in customer awareness about nutritional food

Due to increased consumer concern about their health and the idea that diet has a direct impact on health, the growth of nutrient-rich foods has recently played a significant part in the development of good behaviors. The need for nutrient-dense food is growing rapidly with expanding global welfare and population. The high-nutrition trend is picking up steam and will keep generating interest in the future. Consumers are now more aware of the advantages of protein and other nutrients in promoting an active lifestyle. This results in a strong demand for these goods and, as a result, the expansion of the anhydrous milk fat market.Growing demand for organic & functional dairy products

Functional dairy products are nutritious dairy items that contain probiotics, vitamins, and minerals, as well as substances that improve energy. Food with functional features, including sour milk, are in high demand due to consumer trends toward healthier lifestyles, which positively impacts the market throughout the projection period. To satisfy the growing demand for goods with a balanced nutritional profile, functional & organic dairy products have been introduced. This supports the growth of the regional market.Market Restraining Factor

Growing preference to plant based dairy alternatives

Vegan diets are becoming increasingly popular globally, which is also boosting sales of plant-based dairy replacements. The increasing frequency of lifestyle-related chronic diseases or hypersensitivity to animal protein is one of the primary causes driving demand. In addition, as lactose intolerance instances increase globally, there is a shift in people's tastes toward plant-based foods. Consumer preferences for plant-based foods have grown as consumer awareness of animal cruelty has improved. These elements are assisting the market's expansion in the region.Nature Outlook

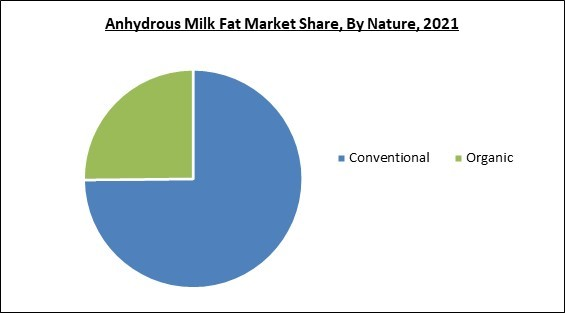

Based on nature, the anhydrous milk fat market is segmented into organic, and conventional. In 2021, the organic segment covered a considerable revenue share in the anhydrous milk fat market. An unwanted by-product of the processing of organic milk is organic anhydrous milk fat. Since it contains no water, it is suitable for a variety of food applications in place of regular anhydrous butter or margarine. Due to the product's high level of purity, that makes it acceptable for use in many foods and beverages that need little water or are dry, it is becoming increasingly well-known across the world.Application Outlook

On the basis of application, the anhydrous milk fat market is categorized into dairy, bakery, confectionary and others. In 2021, the dairy segment witnessed the largest revenue share in the anhydrous milk fat market. AMF can also be utilized to produce low-fat dairy and blended spreads; the most obvious application for AMF's low-melting fractions is to make butter. Dairy fat spreads more spreadable at low temperatures. Including high-melting fractions might be considered to make the butter more stable at high temperatures, which may be desirable in tropical regions.Distribution Channel Outlook

By distribution channel, the anhydrous milk fat market is bifurcated into online and offline. In 2021, the offline segment registered the maximum revenue share in the anhydrous milk fat market. Consumers benefit from one-stop shopping at these stores, providing a considerably greater variety of household goods and dairy products. This type's rapid expansion is mostly related to the expansion of omnichannel retailers and rising levels of digitalization.Regional Outlook

Region wise, the anhydrous milk fat market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region led the anhydrous milk fat market with the maximum revenue share. There are numerous potential opportunities in the region for producers of anhydrous milk fat. The market is shifting due to the increased export of anhydrous milk fat products from New Zealand to China and Australia. Ghee, an anhydrous milk fat, is extensively used in India. In addition to being utilized in cooking, it is also used in the nation's various religious traditions.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Royal VIVBuisman (The Van Ballegooijen), Interfood Holding BV, Eurial Services (Agrial Group), Polmlek Group, Asha Ram & Sons Pvt. Ltd., Meadow Foods Limited, Royal FrieslandCampina N.V., Lactalis Group, and United Global Agencies Group.

Scope of the Study

By Distribution Channel

- Offline

- Online

By Nature

- Conventional

- Organic

By Application

- Dairy

- Bakery

- Confectionary

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand (ANZ)

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Royal VIVBuisman (The Van Ballegooijen)

- Interfood Holding BV

- Eurial Services (Agrial Group)

- Polmlek Group

- Asha Ram & Sons Pvt. Ltd.

- Meadow Foods Limited

- Royal FrieslandCampina N.V.

- Lactalis Group

- United Global Agencies Group

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Global Anhydrous Milk Fat Market by Distribution Channel

Chapter 4. Global Anhydrous Milk Fat Market by Nature

Chapter 5. Global Anhydrous Milk Fat Market by Application

Chapter 6. Global Anhydrous Milk Fat Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- Royal VIVBuisman (The Van Ballegooijen)

- Interfood Holding BV

- Eurial Services (Agrial Group)

- Polmlek Group

- Asha Ram & Sons Pvt. Ltd.

- Meadow Foods Limited

- Royal FrieslandCampina N.V.

- Lactalis Group

- United Global Agencies Group