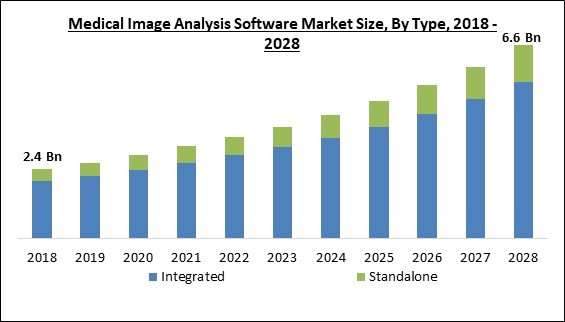

The Global Medical Image Analysis Software Market size is expected to reach $6.6 billion by 2028, rising at a market growth of 11.4% CAGR during the forecast period.

Medical personnel can track, archive, organize, and manipulate patient images using medical image analysis software. In addition, diagnostic equipment must have medical image analysis software since it enhances the qualities of an image, improving the effectiveness or efficiency of medical therapy. The purpose of this software is to save, view, train, and share medical data.

Growingdemand for diagnostic imaging software in disciplines, including dental, orthopedics, neurology,urology, and oncology, is projected to expand the market. Furthermore, the need is anticipated to increase as ultrasonic imaging devices are used more frequently for quicker diagnosis, particularly chronic disorders. Additionally, it is projected that ongoing advancements in imaging technologies, like computer-aided diagnosis (CAD), would increase demand for these systems.

Furthermore, medical image analysis software market dynamics have evolved in recent years as a result of the advent of artificial intelligence (AI), and this is expected to continue in the near future. Applications for AI-based solutions in medical imaging include image analysis,clinical decision support,diagnosis, and detection. Although the use of AI in MRI and CT technologies is still in its infancy, it is projected that demand for efficiency,accuracyand patient safety will grow throughout the forecast period.

Growing consumer demand is fueled by the adoption of technologically advanced goods such as multimodality imaging platforms and 3D imaging, as well as the advantages of using these systems, like high-resolution imaging, easy use, and flexibility. In the upcoming years, the market expansion is anticipated to be fueled by the release of technologically sophisticated products and the development of effective information management systems.

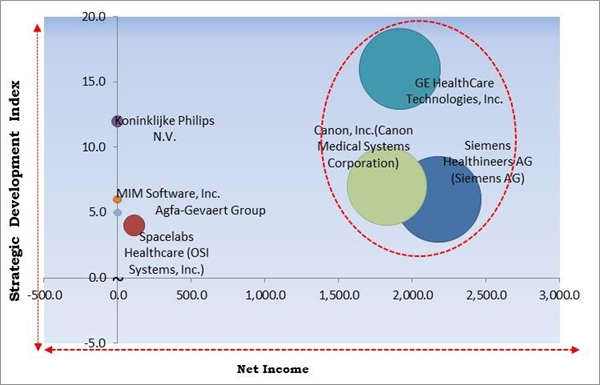

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; GE HealthCare Technologies, Inc., Siemens Healthineers AG (Siemens AG), Canon, Inc.(Canon Medical Systems Corporation) are the forerunners in the Medical Image Analysis Software Market. Companies such as Koninklijke Philips N.V., MIM Software, Inc. and Spacelabs Healthcare (OSI Systems, Inc.) are some of the key innovators in Medical Image Analysis Software Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Canon, Inc. (Canon Medical Systems Corporation), Koninklijke Philips N.V., GE HealthCare Technologies, Inc., Siemens Healthineers AG (Siemens AG), Spacelabs Healthcare (OSI Systems, Inc.), Agfa-Gevaert Group, MIM Software, Inc., Esaote SpA, Aquilab SAS (Coexya), and Merative L.P. (Francisco Partner)

Medical personnel can track, archive, organize, and manipulate patient images using medical image analysis software. In addition, diagnostic equipment must have medical image analysis software since it enhances the qualities of an image, improving the effectiveness or efficiency of medical therapy. The purpose of this software is to save, view, train, and share medical data.

Growingdemand for diagnostic imaging software in disciplines, including dental, orthopedics, neurology,urology, and oncology, is projected to expand the market. Furthermore, the need is anticipated to increase as ultrasonic imaging devices are used more frequently for quicker diagnosis, particularly chronic disorders. Additionally, it is projected that ongoing advancements in imaging technologies, like computer-aided diagnosis (CAD), would increase demand for these systems.

Furthermore, medical image analysis software market dynamics have evolved in recent years as a result of the advent of artificial intelligence (AI), and this is expected to continue in the near future. Applications for AI-based solutions in medical imaging include image analysis,clinical decision support,diagnosis, and detection. Although the use of AI in MRI and CT technologies is still in its infancy, it is projected that demand for efficiency,accuracyand patient safety will grow throughout the forecast period.

Growing consumer demand is fueled by the adoption of technologically advanced goods such as multimodality imaging platforms and 3D imaging, as well as the advantages of using these systems, like high-resolution imaging, easy use, and flexibility. In the upcoming years, the market expansion is anticipated to be fueled by the release of technologically sophisticated products and the development of effective information management systems.

COVID-19 Impact Analysis

The market was positively impacted by the rise in demand for medical image analysis software used in clinical or medical applications to analyze chest scan pictures and diagnose COVID-19-infected patients. Also, there was a huge surge in the usage of telehealth globally. Patients might communicate with medical professionals remotely and share their medical records, including X-ray, magnetic resonance imaging (MRI),ultrasound, and other imaging modalities' images. These elements supported the expansion of the market for medical image analysis software.Market Growth Factors

Incorporation of AI in medical image analysis software

Medical imaging has proven to be an indispensable diagnostic and monitoring tool for serious diseases and disorders. Artificial intelligence (AI) improves picture processing and analysis in medical imaging. AI-enabled medical image analysis software utilizes enormous quantities of medical data to train its algorithms to recognize certain anatomical markers in medical pictures acquired from X-rays, magnetic resonance imaging (MRI), ultrasound imaging, and other modalities. Using image algorithms and a rigorous study of medical picture patterns, AI-enabled software for medical image analysis derives metrics and outputs.Technological enhances in medical imaging systems

ML will enable radiologists to discover and interpret results, control quality, and potentially automate findings, interpretations, and dosage estimation in radiological imaging by automating the correlation and integration of pictures with other data. Using data-driven decisions, point-of-care medical imaging also supports radiologists, emergency personnel, doctors, and patients in hastening diagnosis and treatment. These innovative technological advancements are anticipated to support the growth of the medical image analysis software market in the upcoming years.Market Restraining Factors

Rising concern regarding the software’s compliance & security

In the medical image analysis software market, hacking is a significant issue because hackers can readily manipulate system equipment, leading to data breaches or affecting patient outcomes. In addition, the growing reliance on software exacerbates problems such as bugs, malfunctions, and cyber vulnerability. Due to the detrimental effects of inadvertent malfunction and hacking, healthcare practitioners are cautious about using IT solutions, like image analysis software, in medical procedures. Loss of effectiveness & adverse consequences on patients may come from tampering with medical equipment. This may be an obstacle to the expansion of the market in the years to come.Type Outlook

Based on type, the medical image analysis software market is segmented into integrated and standalone. In 2021, the integrated segment held the highest revenue share in the medical image analysis software market. This large proportion is attributed to the advantages of using these solutions. A variety of radiology applications can benefit from the integrated toolkit's improved workflow. Increased acceptance of integrated systems because of their advantages - affordability, centralized data storage, and access to real-time data for various users to process - is projected to further expand the segment's revenue share.Modality Outlook

On the basis of modality, the medical image analysis software market is fragmented into computed tomography, magnetic resonance imaging, ultrasound, combined modalities and others. In 2021, the ultrasound segment recorded a remarkable revenue share in the medical image analysis software market. Ultrasound is among the primary techniques used for imaging organs and soft tissues. Ultrasonic imaging is a non-invasive, radiation-free imaging technology. Moreover, it offers imaging in real-time. Ultrasound is a low-cost procedure when compared to other medical imaging methods. The domains of medical image analysis and computer-assisted interventions are concerned with reducing digital picture volume.Application Outlook

By application, the medical image analysis software market is divided into orthopedic, dental, neurology, cardiology, oncology and others. In 2021, the neurology segment projected a prominent revenue share in the medical imaging market. This is due to the rising prevalence of brain cancer, tumors, and other brain-related disorders, leading to the increased usage of CT and MRI, pushing the market for software over the forecast period. In addition, the increased emphasis on the most recent technological breakthroughs in the medical industry has a substantial impact on the expansion of the market.End-user Outlook

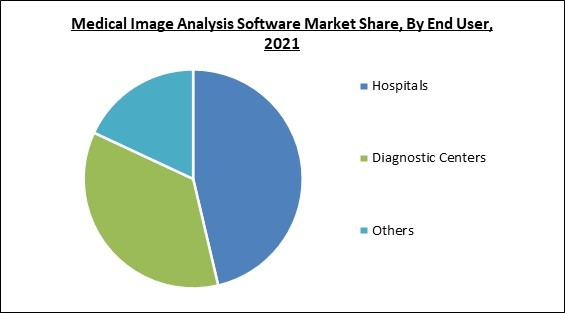

Based on end user, the medical image analysis software market is bifurcated into hospitals, diagnostic centers and others. In 2021, the hospital segment registered the maximum revenue share in the medical image analysis software market. Supportive infrastructure, which is essential for performing surgical procedures with medical imaging software, is one of the most important aspects contributing to the segment's growth. The installed base of diagnostic imaging equipment and solutions is greater in hospitals compared to research and diagnostic facilities. In addition, the influx of patients is significantly greater. Hence, the end-use market continues to maintain its advantage.Regional Outlook

Region wise, the medical image analysis software market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the medical image analysis software market by generating the highest revenue share. Its rise is attributable to the availability of well-established medical facilities with sophisticated diagnostic equipment and favorable government measures that encourage the deployment of healthcare information technology in this region. In addition, increasing R&D expenditures and the presence of important market participants also contribute to expanding the regional market.The Cardinal Matrix - Medical Image Analysis Software Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; GE HealthCare Technologies, Inc., Siemens Healthineers AG (Siemens AG), Canon, Inc.(Canon Medical Systems Corporation) are the forerunners in the Medical Image Analysis Software Market. Companies such as Koninklijke Philips N.V., MIM Software, Inc. and Spacelabs Healthcare (OSI Systems, Inc.) are some of the key innovators in Medical Image Analysis Software Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Canon, Inc. (Canon Medical Systems Corporation), Koninklijke Philips N.V., GE HealthCare Technologies, Inc., Siemens Healthineers AG (Siemens AG), Spacelabs Healthcare (OSI Systems, Inc.), Agfa-Gevaert Group, MIM Software, Inc., Esaote SpA, Aquilab SAS (Coexya), and Merative L.P. (Francisco Partner)

Strategies Deployed in Medical Image Analysis Software Market

Partnerships, Collaborations and Agreements:

- Feb-2023: Agfa joined hands with Lunit, a company engaged in the development of medical AI software. This collaboration would aim to provide clinicians with the latest critical findings notification workflow by combining the Lunit INSIGHT CXR software in the MUSICA Workstation. Additionally, Agfa would aim to deliver on its vision to transform digital radiography.

- Nov-2022: GE Healthcare teamed up with MediView XR, an augmented reality med-tech company. Under this collaboration, Companies would develop the OmnifyXR Interventional Suite System for the combination of medical imaging into mixed-reality solutions. Additionally, the collaboration intends to develop precision care utilizing remote collaboration, intuitive visualization, and evidence-based insight.

- Jul-2022: Siemens Healthineers partnered with Subtle Medical, a provider of artificial intelligence solutions for medical imaging. Following the partnership, Siemens Healthineers Open Recon, the company's reconstruction pipeline subtle Medical's SubtleMR™ image-enhancement software. Moreover, this partnership would deliver better time savings to existing Siemens customers.

- Apr-2022: Philips entered into a partnership with Prisma, the industry's most complete Cloud Native Application Protection Platform. This partnership aimed to improve healthcare across the enterprise and unleash the power of patient data. Through the Philips HealthSuite safeguard cloud platform at its foundation, Philips would strengthen enterprise interoperability, standardize patient monitoring, and boost innovation in enterprise imaging solutions to improve patient care and enhance clinical performance.

- Feb-2022: MIM Software, Inc. partnered with AMG Medtech Ltd., a provider of artificial intelligence, software solutions, and process improvement medical technologies throughout a variety of diagnostic and therapy care paths. This partnership would focus on advancing MIM software's prospective and existing customer base in the United Kingdom and Ireland.

- Dec-2021: Canon Medical teamed up with Spectronic Medical, a research, and development company. This collaboration aimed to provide integrated AI solutions for precise radiotherapy planning in MRI.

- Jul-2021: Canon came into a partnership with Cleerly, a digital healthcare company. Under this partnership, the companies would facilitate simple and streamlined adoption of cardiac CT and introduce new standards of heart disease care.

- Apr-2021: Siemens Healthineers came into a partnership with Radlink, a leading medical device manufacturer. This partnership aimed to introduce Radlink HIP and Radlink TRAUMA Software Apps, which would offer a fully integrated, app-based solution for orthopedic surgeons to simplify intraoperative imaging guidance, verify component positioning and enhance efficiency during surgery.

- Mar-2021: Siemens Healthineers announced a partnership with Epsilon Imaging, a provider of visualization and analysis software. Through this partnership, Siemens Healthineers would broaden precision medicine into routine care by combining a vendor-neutral tool for training imaging into cardiovascular clinical practice.

- Mar-2021: Royal Philips partnered with DiA Imaging Analysis, a leader in providing AI-powered applications for ultrasound. Following this partnership, the companies would offer automated solutions to clinicians at the point of care. Additionally, Philips's high image quality in combination with the AI library of automated solutions of DiA Imaging Analysis would help increase operational efficiency, diagnostic confidence, and access to care for Point-of-Care customers everywhere.

Product Launches and Product Expansions:

- Nov-2022: Philips announced the launch of The Advanced Visualization Workspace, the new version of Philips’ diagnostic imaging platform. The platform is created to connect a hospital’s neurology, radiology, cardiology, and oncology departments in one virtual space, enabling them to ease the process of sharing patient data and communicating with each other regarding the result and diagnosis.

- Apr-2021: Royal Philips expanded its product line by introducing improved digital diagnostic and interventional neurovascular imaging solutions in the new Central Acute Services Building at Westmead Hospital in Sydney, Australia. This latest technology would offer up-to-date MR information at any time while surgical procedures that would assist clinicians to develop real-time adjustments to treatment in such procedures.

Acquisitions and Mergers:

- Feb-2023: GE Healthcare signed an agreement to acquire Caption Health, an AI healthcare company. With this acquisition, Caption Health's AI application would help allow consistent, reliable ultrasound examinations to provide more precise diagnoses, improved treatment decision-making, and further better patient outcomes.

- Feb-2023: Spacelabs Healthcare completed the acquisition of PeraHealth, a predictive analytics company. Through this acquisition, PeraHealth’s powerful analytics would be combined with Spacelabs’ digital health offering. Also, the acquisition would further help healthcare businesses provide better outcomes and decrease costs with a better picture of their patient's health.

- Jan-2023: GE HealthCare took over IMACTIS, a France-based company that created CT-Navigation. CT-Navigation is a unique interventional radiological innovation for the advantage of patients and caregivers. Following this acquisition, companies would offer substantial expansion opportunities for the IMACTIS CT-Navigation system with the help of GE Healthcare's global presence and infrastructure.

Approvals and Trials:

- Sep-2022: GE Healthcare got FDA approval for AIR Recon DL software, a MRI software. The product produces better image quality and offers patients a quick trip inside the scanner.

- Apr-2021: Philips received FDA approval for SmartCT 3D imaging software, an image acquisition, visualization, and measurement software. The Product would be able to improve streamline workflows, and clinical confidence, and accelerate productivity by bringing the intuitive touchscreen controls of advanced 3D image acquisition, visualization, quantitative measurements, and vessel/organ segmentation inside the uncontaminated zone of the intervention lab and the table-side.

Scope of the Study

By Type

- Integrated

- Standalone

By Modality

- Computed Tomography

- Ultrasound

- Magnetic Resonance Imaging

- Combined Modalities

- Others

By End-user

- Hospitals

- Diagnostic Centers

- Others

By Application

- Cardiology

- Orthopedic

- Neurology

- Dental

- Oncology

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Canon, Inc. (Canon Medical Systems Corporation)

- Koninklijke Philips N.V.

- GE HealthCare Technologies, Inc.

- Siemens Healthineers AG (Siemens AG)

- Spacelabs Healthcare (OSI Systems, Inc.)

- Agfa-Gevaert Group

- MIM Software, Inc.

- Esaote SpA

- Aquilab SAS (Coexya)

- Merative L.P. (Francisco Partner)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Medical Image Analysis Software Market by Type

Chapter 5. Global Medical Image Analysis Software Market by Modality

Chapter 6. Global Medical Image Analysis Software Market by End-user

Chapter 7. Global Medical Image Analysis Software Market by Application

Chapter 8. Global Medical Image Analysis Software Market by Region

Chapter 9. Company Profiles

Companies Mentioned

- Canon, Inc. (Canon Medical Systems Corporation)

- Koninklijke Philips N.V.

- GE HealthCare Technologies, Inc.

- Siemens Healthineers AG (Siemens AG)

- Spacelabs Healthcare (OSI Systems, Inc.)

- Agfa-Gevaert Group

- MIM Software, Inc.

- Esaote SpA

- Aquilab SAS (Coexya)

- Merative L.P. (Francisco Partner)