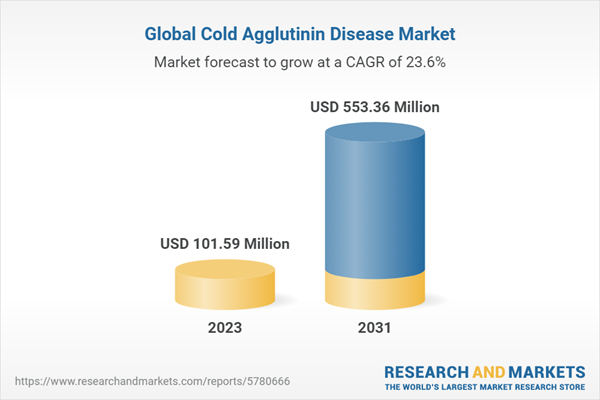

The global cold agglutinin disease (CAD) treatment market size attained a value of USD 82.194 million in 2022, driven by the increasing prevalence of CAD, the development of novel therapies, and the rise in healthcare expenditure. The market is projected to grow at a CAGR of 23.60% during the forecast period of 2023-2031.

The report provides a comprehensive analysis of the cold agglutinin disease treatment market, including market size, growth, and trends. The report covers the market for CAD treatment, including drugs and therapies used for the treatment of CAD.

The treatment of CAD typically involves the use of corticosteroids and immunosuppressive agents, although there are currently no FDA-approved therapies for the condition. Other treatment options for CAD include blood transfusions, plasmapheresis, and rituximab therapy.

As the global population continues to age and the prevalence of autoimmune disorders rises, the demand for CAD treatment is expected to grow in the coming years. This is expected to drive the growth of the CAD treatment market, as healthcare providers seek new and innovative therapies to manage this rare and debilitating disease.

North America dominates the CAD treatment market, followed by Europe and the Asia Pacific. The high prevalence of CAD in North America, coupled with the favorable reimbursement policies, is driving the growth of the market in the region. Europe is also a significant market for CAD treatment, with the presence of key players and increasing investment in research and development activities. The Asia Pacific region is expected to grow at the highest CAGR during the forecast period, owing to the increasing awareness about the disease and the rising healthcare expenditure in the region.

The market for CAD treatment can be categorized into various segments, including treatment type, distribution channel, and end-user. The most used treatment types for CAD include corticosteroids, immunosuppressive agents, and others. In terms of distribution channel, the market can be segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

Cold Agglutinin Disease Market: Introduction

Cold agglutinin disease is a rare autoimmune disorder that occurs when the body's immune system produces cold-reactive antibodies that bind to and destroy red blood cells. The disease can cause anaemia, fatigue, and other symptoms, and can be life-threatening in severe cases. The treatment of CAD typically involves the use of corticosteroids and immunosuppressive agents, although there are currently no FDA-approved therapies for the condition.The report provides a comprehensive analysis of the cold agglutinin disease treatment market, including market size, growth, and trends. The report covers the market for CAD treatment, including drugs and therapies used for the treatment of CAD.

Cold Agglutinin Disease Epidemiology

Cold agglutinin disease is a rare autoimmune disorder that affects approximately 15 per million people worldwide. The disease is more common in women than men and is typically diagnosed in patients aged 50 or older. CAD can occur in isolation or as a complication of other conditions, such as lymphoproliferative disorders, infections, and connective tissue diseases. The disease is typically diagnosed through a combination of clinical and laboratory tests, including the cold agglutinin titer, the direct antiglobulin test, and the Coombs test.The treatment of CAD typically involves the use of corticosteroids and immunosuppressive agents, although there are currently no FDA-approved therapies for the condition. Other treatment options for CAD include blood transfusions, plasmapheresis, and rituximab therapy.

As the global population continues to age and the prevalence of autoimmune disorders rises, the demand for CAD treatment is expected to grow in the coming years. This is expected to drive the growth of the CAD treatment market, as healthcare providers seek new and innovative therapies to manage this rare and debilitating disease.

Cold Agglutinin Disease Market Segmentations

The market can be categorised into type, treatment type, drug class, therapy type, distribution channel, end user, and major region.Market Breakup by Diagnosis Method

- Complete Blood Count (CBC) Test

- Reticulocyte Count

- Serum Level Test

- Direct Coombs Test (DAT)

- Cold Agglutinin Titer Test

- Others

Market Breakup by Drug Class

- Corticosteroids

- Alkylating Agents

- Purine Nucleoside Analogs

- Biologics

- Others

Market Breakup by Route of Administration

Oral

- Tablets

Parenteral

- Injections

- Others

Market Breakup by End Users

- Hospitals

- Speciality Clinics

- Homecare

- Others

Cold Agglutinin Disease Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Cold Agglutinin Disease Market Scenario

The market is expected to experience moderate growth during the forecast period of 2023-2031. The key drivers of the market include the increasing prevalence of CAD, the development of novel therapies, and the rise in healthcare expenditure. However, the limited awareness of the disease and the lack of approved therapies are likely to hinder the growth of the market.North America dominates the CAD treatment market, followed by Europe and the Asia Pacific. The high prevalence of CAD in North America, coupled with the favorable reimbursement policies, is driving the growth of the market in the region. Europe is also a significant market for CAD treatment, with the presence of key players and increasing investment in research and development activities. The Asia Pacific region is expected to grow at the highest CAGR during the forecast period, owing to the increasing awareness about the disease and the rising healthcare expenditure in the region.

The market for CAD treatment can be categorized into various segments, including treatment type, distribution channel, and end-user. The most used treatment types for CAD include corticosteroids, immunosuppressive agents, and others. In terms of distribution channel, the market can be segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

Key Players in the Global Cold Agglutinin Disease Market

The report gives an in-depth analysis of the key players involved in the Cold Agglutinin Disease market, sponsors manufacturing the drugs, and putting them through trials to get FDA approvals. The companies included in the market are as follows:- Roche Holding AG

- Viatris Inc

- Teva Pharmaceutical Industries Ltd

- Sanofi S.A

- Pfizer Inc

- GSK plc

- Novartis AG

- Zydus Lifesciences Limited

- AstraZeneca plc

- Johnson & Johnson

- Bayer AG

- Apellis Pharmaceuticals, Inc

- Incyte Corporation

Table of Contents

1 Preface

4 Cold Agglutinin Disease Overview

5 Patient Profile

6 Challenges and Unmet Needs

7 Global Cold Agglutinin Disease Treatment Market Dynamics

8 Global Cold Agglutinin Disease Treatment Market

9 North America Cold Agglutinin Disease Treatment Market

10 Europe Cold Agglutinin Disease Treatment Market

11 Asia Pacific Cold Agglutinin Disease Treatment Market

12 Latin America Cold Agglutinin Disease Treatment Market

13 Middle East and Africa Cold Agglutinin Disease Treatment Market

14 Current Scenario Evaluation and Regulatory Framework

15 Supplier Landscape

16 Global Cold Agglutinin Disease Treatment Market- Drug Distribution Model (Additional Insight)

17 Payment Methods (Additional Insight)

Companies Mentioned

- Roche Holding AG

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Pfizer Inc.

- GSK plc

- Novartis AG

- Zydus Lifesciences Limited

- AstraZeneca plc

- Johnson & Johnson

- Bayer AG

- Apellis Pharmaceuticals, Inc.

- Incyte Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 101.59 Million |

| Forecasted Market Value ( USD | $ 553.36 Million |

| Compound Annual Growth Rate | 23.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |