Strategic Development Initiatives by Manufacturers fuel the North America RTD Cocktails Market

RTD cocktail manufacturers are investing significantly in strategic development initiatives such as product innovation, merger & acquisition, and expansion of their businesses to attract many consumers and enhance their market position. Moreover, the demand for RTD products is increasing among consumers owing to the convenience offered by such products. Thus, manufacturers such as Beam Suntory Inc, Diageo plc, and Constellation Brands Inc are launching various RTD cocktails in different flavors and varieties to cater to the increasing demand. For instance, in March 2021, Diageo plc launched “Crown Royal ready-to-drink cocktails” for whiskey-based cocktail enthusiasts. They are available in classic, signature Crown Royal flavors such as apple, cranberry, cola, and peach tea. Additionally, in August 2020, Diageo plc launched a range of flavored, low-calorie, RTD cocktails under its Ketel One brand in the US. The product is formulated with vodka blended with botanicals, natural fruits, and sparkling water. It comprises three strong flavors: peach & orange blossom, cucumber & mint, and grapefruit & rose. Such product innovations help companies extend their reach in domestic markets and gain a competitive edge in international markets. Major manufacturers are employing strategies such as acquisition, expansion, and production capacity scaleup to serve their customers better and satisfy their growing demands. In March 2021, Diageo invested US$ 80 million into expanding its RTD operations at its new Plainfield, Illinois, site. The project includes installing two high-speed can lines that produce over 25 million RTD cases per year. Such initiatives by manufacturers are driving the North America RTD cocktails market.North America RTD Cocktails Market Overview

The North America RTD cocktails market is segmented into the US, Canada, and Mexico. North America is one of the prominent regions for the market growth owing to the rapidly increasing consumption of RTD alcoholic beverages across the region. As busy lifestyles increasingly shift toward indulgent experiences at home, RTD cocktails provide consumers with a convenient way to enjoy their choice of alcoholic beverages without visiting a restaurant or bar. Consumers in the region are increasingly prioritizing convenience, taste, variety, and quality in their choice of beverages. Spirit-based RTD cocktails fit squarely into this trend, thus, the demand for such cocktails is increasing across the region. The alcoholic beverage industry has witnessed the growth of the ready-to-drink cocktails market in recent years due to increasing disposable income, changing consumer lifestyles, and growing demand for low-alcoholic drinks from the younger population. The biggest names in RTD cocktails on Canadian liquor store shelves were Smirnoff Ice, Palm Bay, and Mike’s Hard Lemonade. They were most popular among teenagers and novice drinkers. However, government authorities have set some regulations on selling of alcoholic beverages and their alcohol content which restricts the growth of the market to some extent. For instance, As of May 2019, Canada set in place restrictions on ABV in canned cocktails. Previously a 568 mL beverage could contain up to 11.9% ABV. Now, a 473 mL canned cocktail may contain 5.4% ABV, while a 568 mL can is limited to just 4.5% ABV. Such unforeseen situations created by the government creates a hurdle in the smooth functioning of the manufacturers.North America RTD Cocktails Market Revenue and Forecast to 2030 (US$ Million)

North America RTD Cocktails Market Segmentation

The North America RTD cocktails market is segmented based on base type, packaging type, distribution channel, and country. Based on base type, the North America RTD cocktails market is segmented into malt based, tequila based, vodka based, whiskey based, and others. The malt based segment held the largest market share in 2022.Based on packaging type, the North America RTD cocktails market is segmented into bottles, cans, and others. The cans segment held the largest market share in 2022.

Based on distribution channel, the North America RTD cocktails market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held the largest market share in 2022.

Based on country, the North America RTD cocktails market is segmented into the US, Canada, and Mexico. The US dominated the North America RTD cocktails market share in 2022.

Bacardi Limited, Beam Suntory Inc, Boulevard Brewing Co, Bully Boy Distillers LLC, Constellation Brands Inc, Cutwater Spirits LLC, Five Drinks Co, New Holland Brewing Co LLC, Post Meridiem Spirit Co, and The Crown Royal Co are some of the leading players operating in the North America RTD cocktails market.

Table of Contents

Executive Summary

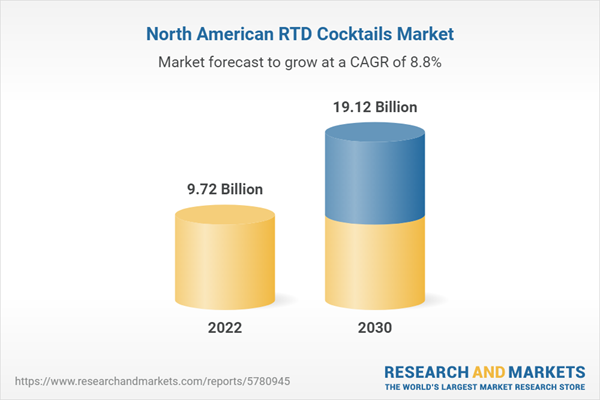

At 8.8% CAGR, the North America RTD Cocktails Market is Speculated to be worth US$ 19,123.71 million by 2030.According to this research,, the North America RTD cocktails market was valued at US$ 9,724.73 million in 2022 and is expected to reach US$ 19,123.71 million by 2030, registering a CAGR of 8.8% from 2022 to 2030. Strong preference for RTD alcoholic beverages among consumers and strategic development initiatives by manufacturers are the critical factors attributed to the North America RTD cocktails market expansion.

The consumption of high-quality RTD cocktails is increasing worldwide, which is currently one of the biggest trends in the alcoholic beverage industry. The convenience offered by RTD alcoholic beverages, such as RTD cocktails, allows consumers to save time and effort associated with ingredient shopping, mixing, and preparing drinks. Due to hectic work schedules, consumers prefer to be efficient with their time rather than spending it on tedious tasks. Thus, they are more likely to spend their money on convenience, which dives into the popularity of RTD beverages such as cocktails and hard seltzers. According to the report of The Distilled Spirits Council (DISCUS) on the growth of the RTD cocktails category, premixed, spirit-based RTD suppliers increased their revenue by 42% in 2020-2021. This period, which coincides with the height of the COVID-19-induced lockdowns, saw rapid growth in the demand for RTD alcoholic beverages. Moreover, the consumers worldwide gravitated toward RTDs as a convenient way to enjoy their favorite cocktail at home during the pandemic. Based on a recent consumer survey conducted by Public Opinion Strategies (POS) and economic data from DISCUS, premixed cocktails - including spirit-based RTDs - were the significantly growing spirits category in 2021. Nearly two-thirds of survey respondents considered themselves regular or occasional consumers of RTD beverages. Adult consumers strongly want greater access to spirit-based RTDs in the marketplace, including at restaurants and bars, grocery and convenience stores, and entertainment venues such as concerts and sporting events. Thus, a surging preference for RTD alcoholic beverages among consumers is driving the RTD cocktail market across the North America. RTD cocktails featuring whiskey, vodka, gin, rum, and tequila have gained popularity in recent years. These beverages used as a base beverage in RTD cocktails, are catered to consumer’s requirement who appreciate rich, complex flavors of these spirits and enjoy classic cocktails like ‘Old Fashioned’. Consumers who enjoy the distinct taste and agave notes of tequila increasingly prefer tequila based RTD cocktails. Rum-based RTD cocktails, such as margaritas or pina coladas, have a tropical appeal and are often associated with summer and beach settings. Vodka-based RTD cocktails are quite popular due to vodka’s versatility and neutral flavor profile. Gin-based RTD cocktails, particularly those with classic flavors like gin martinis, are favored by consumers who enjoy the distinct botanical notes and refreshing qualities of gin. Hence, the availability of a wide variety of base ingredients in the global marketplace and diverse consumer preferences for RTD cocktails are fueling the RTD cocktails market growth across the North America.

On the contrary, complex and diverse regulations hurdles the growth of North America RTD cocktails market.

Based on base type, the North America RTD cocktails market is categorized into malt based, tequila based, vodka based, whiskey based, and others. The malt based segment held 78.5% market share in 2022, amassing US$ 7,629.77 million. It is projected to garner US$ 14,964.70 million by 2030 to expand at 8.8% CAGR during 2022-2030.

Based on packaging type, the North America RTD cocktails market is categorized into bottles, cans, and others. The cans segment held 76.6% share of North America RTD cocktails market in 2022, amassing US$ 7,444.62 million. It is projected to garner US$ 14,784.67 million by 2030 to expand at 9.0% CAGR during 2022-2030.

Based on distribution channel, the North America RTD cocktails market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held 43.8% share of North America RTD cocktails market in 2022, amassing US$ 4,257.58 million. It is projected to garner US$ 8,200.90 million by 2030 to expand at 8.5% CAGR during 2022-2030.

Based on country, the North America RTD cocktails market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US captured 74.5% share of North America RTD cocktails market in 2022. It was assessed at US$ 7,241.04 million in 2022 and is likely to hit US$ 14,192.28 million by 2030, exhibiting a CAGR of 8.8% during 2022-2030.

Key players operating in the North America RTD cocktails market are Bacardi Limited, Beam Suntory Inc, Boulevard Brewing Co, Bully Boy Distillers LLC, Constellation Brands Inc, Cutwater Spirits LLC, Five Drinks Co, New Holland Brewing Co LLC, Post Meridiem Spirit Co, and The Crown Royal Co among others.

In Jun 2021, Bully Boy Craft Distillery Offers Canned, Bottled Cocktails. In Mar 2022, Constellation Brands Inc Enters into the Ready-to-Drink Boxed Wine Cocktail Category.

Companies Mentioned

- Bacardi Limited

- Beam Suntory Inc,

- Boulevard Brewing Co

- Bully Boy Distillers LLC

- Constellation Brands Inc

- Cutwater Spirits LLC

- Five Drinks Co

- New Holland Brewing Co LLC

- Post Meridiem Spirit Co

- The Crown Royal Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | December 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 9.72 Billion |

| Forecasted Market Value by 2030 | 19.12 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |