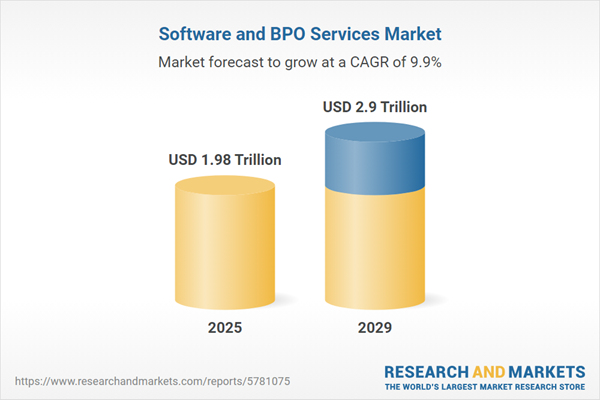

The software and bpo services market size has grown strongly in recent years. It will grow from $1.84 trillion in 2024 to $1.98 trillion in 2025 at a compound annual growth rate (CAGR) of 8%. The growth in the historic period can be attributed to globalization, cost efficiency, focus on core competencies, scalability.

The software and bpo services market size is expected to see strong growth in the next few years. It will grow to $2.9 trillion in 2029 at a compound annual growth rate (CAGR) of 9.9%. The growth in the forecast period can be attributed to digital transformation, data privacy and security, artificial intelligence (AI) and automation, remote work, industry-specific solutions, sustainability and ESG. Major trends in the forecast period include electrification and lightweighting, advanced materials, additive manufacturing, digitalization and connectivity, collaboration and partnerships.

The emergence of startups as significant clients for software and BPO service providers is expected to be a driving force in the market. Startups are increasingly turning to specialized agencies and companies to outsource non-core operations like finance and recruitment, driven by the pursuit of cost-efficiency and the need to focus on their core activities. For example, Leverage Edu, an India-based EdTech startup that connects students with mentors, has saved approximately 40% of its capital by outsourcing finance and tech operations. The growing number of startups, expected to reach 10,500 in India by 2020, offers new opportunities for the software and BPO services market to expand its client base and boost revenue.

The expanding e-commerce industry is expected to drive the growth of the software and BPO services market in the coming years. E-commerce, or electronic commerce, involves buying and selling goods and services, as well as transferring money or data through electronic networks, primarily the internet. Software and BPO services support e-commerce businesses by providing access to skilled agents trained to handle customer inquiries, ensuring high-quality assistance and support for customers. For example, in November 2023, the International Trade Administration, a U.S.-based Department of Commerce, reported that as of January 2021, consumer e-commerce accounted for 36.3% of the total retail market in the UK, with revenue expected to reach $285.6 billion by 2025. Additionally, e-commerce revenues in the UK are projected to grow at an average annual rate of 12.6% by 2025. As a result, the growth of the e-commerce industry is driving the demand for software and BPO services.

Many software services companies are adopting quality standards such as Information Technology Infrastructure Library (ITIL) and International Organization for Standardization (ISO) 9001 to ensure their IT services align with business requirements. ITIL outlines processes, procedures, and tasks that organizations can apply to deliver software products and services that meet predefined quality standards. Similarly, ISO 9001 is a certification for products and services that meet established quality benchmarks and demonstrate reliability. As of now, approximately 1.1 million ISO 9001 certificates have been issued globally, covering industries such as software services, medical devices, oil and gas, automotive, and government organizations.

Major companies operating in the software and BPO services market are intensifying their focus on introducing AI-based real-time contact center solutions to maximize their profits. AI assists contact center agents by analyzing customer needs and emotions, offering real-time coaching to guide them in delivering the best customer service. In October 2022, Qualtrics, a US-based software company, introduced Real-Time Agent Assist and Automated Call Summaries Solutions for call centers. These solutions employ AI and machine learning to provide personalized coaching and suggestions to contact center agents during customer calls. Real-Time Agent Assist helps agents enhance their customer support skills by analyzing real-time conversations and offering improvement prompts. Automated Call Summaries generate summaries of each customer call, including sentiment, discussed topics, and action items, enabling better agent performance and overall contact center tracking.

In January 2022, International Business Machines Corporation (IBM), a U.S.-based technology company, acquired Envizi for an undisclosed amount. This acquisition reinforces IBM's focus on AI-driven solutions, including Maximo, Sterling, and the Environmental Intelligence Suite, which help organizations improve sustainability and operational resilience within their supply chains. It highlights IBM's commitment to developing innovative tools that promote efficient and sustainable business practices. Envizi is an Australia-based provider of data and analytics software.

Software and BPO services involve offering businesses technology solutions and outsourced processes to enhance efficiency. Software services focus on creating and maintaining applications customized to meet specific business requirements. BPO (Business Process Outsourcing) services involve outsourcing non-core functions, such as customer support and IT services, allowing companies to reduce costs and concentrate on their core operations.

The primary categories within the software and BPO services industry encompass software services and BPO services. BPO services refer to the tasks outsourced to third-party service providers to handle essential business processes. These services are utilized by various types of enterprises, including large corporations and small and medium-sized businesses, and are commonly employed in sectors such as financial services, retail and wholesale, information technology, manufacturing, healthcare, and other industries.

The software and BPO services market research report is one of a series of new reports that provides software and BPO services market statistics, including software and BPO services industry global market size, regional shares, competitors with a software and BPO services market share, detailed software and BPO services market segments, market trends and opportunities, and any further data you may need to thrive in the software and BPO services industry. This software and BPO services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the software and BPO services market include Tata Consultancy Services Limited, Nippon Telegraph and Telephone Corporation, Telefonaktiebolaget LM Ericsson, Cognizant Technology Solutions Corporation, Dell Technologies Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Capgemini SE, Cisco Systems Inc., Infosys Limited, Accenture PLC, International Business Machines Corporation, Wipro Limited, HCL Technologies Limited, DXC Technology, Genpact Limited, NTT Data Corporation, Atos SE, CGI Inc., Larsen & Toubro Infotech Limited, Tech Mahindra Limited, WNS Global Services Limited, Syntel Inc., LTIMindtree Limited, Hexaware Technologies Limited, Mphasis Limited, Virtusa Corporation, Zensar Technologies Limited, EPAM Systems Inc, Citibank NA, ExlService Holdings Inc., WNS Limited, Wipro Limited, Hinduja Global Solutions Limited, Sutherland Global Services Inc., Teleperformance SE.

Asia-Pacific was the largest region in software and BPO services market in 2024. North America was the second largest region in software and BPO services market. The regions covered in the software and BPO services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the software and bpo services market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The software and BPO services market includes revenues earned by entities by providing software and BPO services including application software programming services, computer program (software) development, computer software support services and web design services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Software and BPO Services Global Market Report 2025 - by Type (BPO Services, Software Services), by Organization Size (Large Enterprises, Small and Medium Enterprises), by End-Use Industry (Financial Services, Retail & Wholesale, Information Technology, Manufacturing, Healthcare, Other End-User Industries) provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on software and bpo services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for software and bpo services ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The software and bpo services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: BPO Services; Software Services2) By Organization Size: Large Enterprises; Small and Medium Enterprises

3) By End-Use Industry: Financial Services; Retail and Wholesale; Information Technology; Manufacturing; Healthcare; Other End-User Industries

Subsegments:

1) By BPO Services: Customer Support Services; IT Helpdesk and Technical Support; Human Resources Outsourcing (HR Outsourcing); Finance and Accounting Outsourcing; Procurement and Supply Chain Outsourcing; Healthcare BPO Services; Legal Process Outsourcing (LPO); Knowledge Process Outsourcing (KPO)2) By Software Services: Custom Software Development; Software Maintenance and Support; Cloud Computing Services; Software Testing and Quality Assurance; Enterprise Resource Planning (ERP) Services; Application Development and Integration; Data Analytics and Business Intelligence Services; Cybersecurity Services

Key Companies Mentioned: Tata Consultancy Services Limited; Nippon Telegraph and Telephone Corporation; Telefonaktiebolaget LM Ericsson; Cognizant Technology Solutions Corporation; Dell Technologies Inc.

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Software and BPO Services market report include:- Tata Consultancy Services Limited

- Nippon Telegraph and Telephone Corporation

- Telefonaktiebolaget LM Ericsson

- Cognizant Technology Solutions Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- Capgemini SE

- Cisco Systems Inc.

- Infosys Limited

- Accenture plc

- International Business Machines Corporation

- Wipro Limited

- HCL Technologies Limited

- DXC Technology

- Genpact Limited

- NTT Data Corporation

- Atos SE

- CGI Inc.

- Larsen & Toubro Infotech Limited

- Tech Mahindra Limited

- WNS Global Services Limited

- Syntel Inc.

- LTIMindtree Limited

- Hexaware Technologies Limited

- Mphasis Limited

- Virtusa Corporation

- Zensar Technologies Limited

- EPAM Systems Inc

- Citibank NA

- ExlService Holdings Inc.

- WNS Limited

- Wipro Limited

- Hinduja Global Solutions Limited

- Sutherland Global Services Inc.

- Teleperformance SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 300 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.98 Trillion |

| Forecasted Market Value ( USD | $ 2.9 Trillion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |