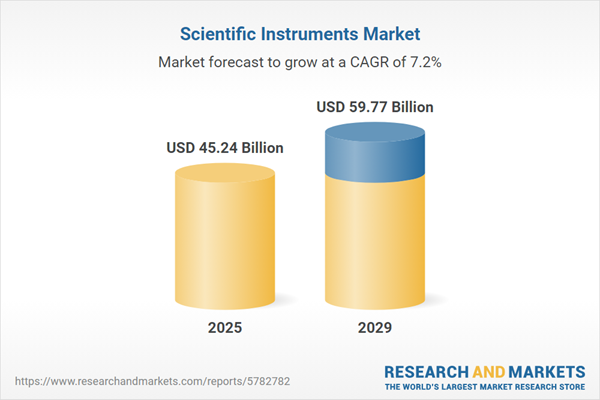

The scientific instruments market size is expected to see strong growth in the next few years. It will grow to $59.77 billion in 2029 at a compound annual growth rate (CAGR) of 7.2%. The growth in the forecast period can be attributed to precision medicine and personalized healthcare, emergence of point-of-care testing, rise of regenerative medicine, customization and modular instrument design, regulatory compliance and quality assurance. Major trends in the forecast period include demand for biotechnology, increasing sustainable and green technologies, multi-modal imaging systems, applications in material science, enhanced connectivity and data sharing, global expansion of research and development (R&D) activities.

The growing number of testing and research facilities is fueling the expansion of the scientific instruments market. This surge in facilities is largely attributed to the global spread of viruses and the intensified efforts to address their aftermath. Such testing and research centers require scientific instruments to facilitate effective testing and develop solutions. For example, in April 2024, The Office for National Statistics, a UK-based executive office, reported that total net expenditure on research and development (R&D), which includes contributions to the EU R&D budget and knowledge transfer activities, reached £16.4 billion ($21.46 billion) in 2022. This marks an 8.9% increase from £15 billion ($19.62 billion) in 2021. Consequently, the rise in testing and research facilities is driving growth in the scientific instruments market.

The emergence of nanotechnology is another factor propelling the growth of the scientific instruments market. Nanotechnology, which involves manipulating matter at the nanoscale, relies on precise scientific instruments for accurate analysis and manipulation. Instruments like scanning tunneling microscopes (STMs) and atomic force microscopes (AFMs) play a crucial role in visualizing and manipulating individual atoms and molecules, contributing to the development of nanomaterials and nanostructures. According to a November 2021 article, the medical nanotechnology market is projected to reach $461.25 billion by 2026, with an estimated compound annual growth rate (CAGR) of around 11.9% from 2021 to 2026. The growth of nanotechnology is a driving force for the scientific instruments market.

Artificial intelligence (AI) is a key trend gaining prominence in the scientific instruments market. The integration of AI in research practices is expected to bring significant advancements. In February 2022, Agilent Technologies Inc., a U.S.-based analytical instrumentation development and manufacturing company, acquired AI technology developed by Virtual Control. This AI technology is intended for use with mass spectrometry equipment, enhancing capabilities in liquid and gas chromatography. The incorporation of AI streamlines labor-intensive processes such as sampling and report production, showcasing the adoption of cutting-edge technologies in the scientific instruments market.

Major players in the scientific instruments market are actively engaging in collaborations and strategic partnerships to fortify their positions. These business partnerships, characterized by structured affiliations between commercial enterprises, are established through business agreements or contracts. An illustration of this strategic approach is evident in the partnership between Quantum Detectors, a UK-based provider of reliable direct electron detection and readout solutions, and Amsterdam Scientific Instruments (ASI), a Netherlands-based provider of scientific instruments. In September 2023, Quantum Detectors and ASI formed a collaborative venture aimed at advancing scientific research. The partnership not only seeks to enhance the distribution process but also provides researchers with consolidated access to Medipix and Timepix based technology through a single provider.

In February 2024, Shimadzu Scientific Instruments, Inc., a US-based manufacturer of scientific instruments, entered into a partnership with Telescope Innovations Corp. for an undisclosed amount. This collaboration aims to enhance Shimadzu's portfolio by leveraging Telescope's expertise in providing scientific instruments. Telescope Innovations Corp. is a Canada-based company specializing in scientific instrument offerings.

Major companies operating in the scientific instruments market are Thermo Fisher Scientific Inc., Agilent Technologies Inc., Bruker Corporation, Danaher Corporation, Waters Corporation, The Merck Group, Horiba Limited, PerkinElmer Inc., F. Hoffmann-La Roche AG, Carl Zeiss AG, Shimadzu Corporation, Mettler-Toledo International Inc., Oxford Instruments PLC, Eppendorf AG, JEOL Ltd., Hitachi High-Technologies Corporation, Malvern Panalytical GmbH, Bio-Rad Laboratories Inc., Becton Dickinson and Company, Illumina Inc., Bio-Techne Corporation, Sartorius AG, Hamilton Company, Siemens Healthineers AG, Koninklijke Philips N.V. Healthcare.

North America was the largest region in the scientific instruments market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the scientific instruments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the scientific instruments market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Scientific instruments are specialized tools designed to facilitate scientific endeavors, aiding in the research and development of novel products. These instruments play a pivotal role in both the creation of new products and the enhancement of existing ones. They are considered more advanced and specialized compared to standard measuring instruments and are essential for indicating, measuring, and recording various physical quantities within research laboratories and R&D facilities.

Within the scientific instruments market, prominent categories include clinical analyzers, analytical instruments, and other specialized variants. Clinical analyzers are devices employed for examining urine, plasma, and blood serum samples. They serve various laboratories, ranging from small point-of-care clinics to high-throughput clinical labs, enabling the testing of analytes such as proteins, enzymes, and electrolytes. Scientific instruments find extensive usage across research, clinical diagnostics, and various applications in hospitals, diagnostic laboratories, pharmaceutical and biotechnology companies, and other sectors involved in scientific pursuits.

The scientific instruments market research report is one of a series of new reports that provides scientific instruments market statistics, including scientific instruments industry global market size, regional shares, competitors with a scientific instruments market share, detailed scientific instruments market segments, market trends and opportunities, and any further data you may need to thrive in the scientific instruments industry. This scientific instrument market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The scientific instruments market consists of sales of scientific instruments that are used for natural phenomena and theoretical research. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Scientific Instruments Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on scientific instruments market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for scientific instruments ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The scientific instruments market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Clinical Analyzers; Analytical Instruments; Other Types2) by Application: Research; Clinical and Diagnostics; Other Applications

3) by End User: Hospitals and Diagnostic Laboratories; Pharmaceutical and Biotechnology Companies; Other End-Users

Subsegments:

1) by Clinical Analyzers: Hematology Analyzers; Biochemistry Analyzers; Immunoassay Analyzers2) by Analytical Instruments: Chromatography Instruments; Spectroscopy Instruments; Mass Spectrometry Instruments

3) by Other Types: Microscopes; Laboratory Balances; Environmental Testing Instruments

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; Bruker Corporation; Danaher Corporation; Waters Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Scientific Instruments market report include:- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bruker Corporation

- Danaher Corporation

- Waters Corporation

- The Merck Group

- Horiba Limited

- PerkinElmer Inc.

- F. Hoffmann-La Roche AG

- Carl Zeiss AG

- Shimadzu Corporation

- Mettler-Toledo International Inc.

- Oxford Instruments PLC

- Eppendorf AG

- JEOL Ltd.

- Hitachi High-Technologies Corporation

- Malvern Panalytical GmbH

- Bio-Rad Laboratories Inc.

- Becton Dickinson and Company

- Illumina Inc.

- Bio-Techne Corporation

- Sartorius AG

- Hamilton Company

- Siemens Healthineers AG

- Koninklijke Philips N.V. Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 45.24 Billion |

| Forecasted Market Value ( USD | $ 59.77 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |