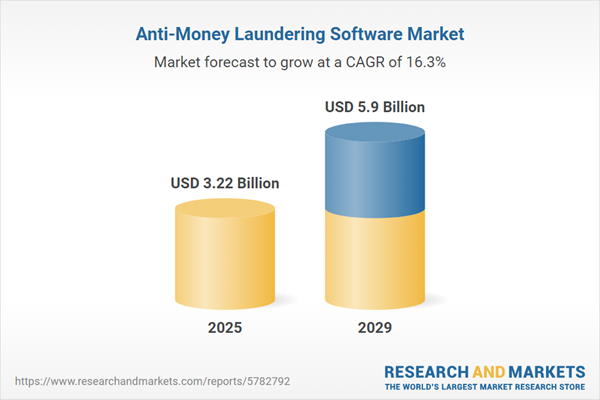

The anti-money laundering software market size is expected to see rapid growth in the next few years. It will grow to $5.9 billion in 2029 at a compound annual growth rate (CAGR) of 16.3%. The growth in the forecast period can be attributed to focusing on customer due diligence, sanctions screening enhancement, growth of cryptocurrencies, mobile payment risks, real-time transaction monitoring. Major trends in the forecast period include increasing regulatory stringency, integration of artificial intelligence and machine learning, focus on transaction monitoring and surveillance, automation of due diligence processes, cloud-based AML solutions, enhanced risk-based approaches.

The rising incidence of money laundering cases is anticipated to drive the growth of the anti-money laundering software market. Money laundering involves transforming illegally obtained funds into legitimate assets. As the number of money laundering incidents increases, there is a growing adoption of anti-money laundering software applications to help organizations comply with legal requirements for detecting and preventing financial crimes. For example, a report from the Enforcement Directorate (ED) in India revealed that the number of money laundering cases registered in the financial year 2022-23 reached 579, representing a significant increase compared to previous years. Additionally, the ED reported a total of 3,497 money laundering cases documented over the past five years, indicating a rising trend in enforcement actions against financial crimes. Therefore, the growing prevalence of fraudulent activities and the increase in money laundering cases are expected to propel the growth of the anti-money laundering software market.

The increase in cyber-security threats is expected to propel the growth of anti-money laundering software market going forward. The growth is driven by factors such as increased financial crimes, risks associated with digital transactions, phishing attacks, and online fraud. AML software plays a crucial role in monitoring and detecting suspicious patterns in digital transactions, addressing the complexities of money laundering through digital channels. Additionally, technological advances in AML solutions, cross-border transaction monitoring, regulatory compliance requirements, and the prevention of data breaches contribute to the market's expansion. For instance, in February 2023, according to the Australian Cyber Security Centre, an Australia-based cyber security agency, the cybercrime reports received in 2022 were 76,000, an increase of nearly 13% from the previous financial year. Therefore, the increase in cyber-security threats is driving the growth of anti-money laundering software market.

Major companies operating in the anti-money laundering software market are developing new Ai-based solutions to sustain their position. For example, in June 2023, Google LLC, a US-based technology company launched Anti Money Laundering AI (AML AI), an artificial intelligence-powered product aimed at helping global financial institutions efficiently detect money laundering. The product employs machine learning to generate a customer risk score based on transactional patterns, network behavior, and Know Your Customer (KYC) data. This approach offers an alternative to rules-based transaction alerting, reducing false positives and improving overall program effectiveness and operational efficiency.

Major corporations within the anti-money laundering (AML) software sector are actively innovating by introducing new transaction monitoring solutions to fortify their market presence. For example, in November 2022, NetGuardians SA, a Switzerland-based software firm, unveiled its upgraded NG|Screener platform with an integrated AML transaction monitoring solution. This technology amalgamates internal and external data sources to detect behavioral anomalies, thereby reducing false alerts and augmenting operational efficiency. NetGuardians aims to enhance collaboration between fraud and AML teams, ensuring a more robust approach to tackling financial crimes while meeting regulatory obligations more effectively and economically.

In July 2023, Nityo Infotech, an IT services company, formed a strategic partnership with Azentio Software, a technology firm backed by funds advised by Apax Partners. This collaboration aims to significantly enhance Nityo Infotech's position in the anti-money laundering (AML) software sector, with a focus on delivering advanced AML technology solutions to the Banking, Financial Services, and Insurance (BFSI) industry. Azentio Software specializes in providing technology solutions that include AML capabilities, designed to meet the evolving challenges faced by the BFSI sector in compliance and risk management. Through this partnership, Nityo Infotech seeks to leverage Azentio's expertise to offer more robust and effective AML solutions, addressing the increasing demand for regulatory compliance and fraud prevention in financial institutions.

Major companies operating in the anti-money laundering software market are Accenture Inc., ACI Worldwide Inc., AML Partners LLC, Ascent Business Technology Inc., BAE Systems Inc., Eastnets Holding Limited, Verafin Inc., Fidelity National Information Services Inc., Fiserv Inc., Oracle Corporation, SAS Institute Inc., Sungard Availability Services, Experian Information Solutions Inc., Fico, NICE Systems Ltd., Accuity Inc., SmartSearch, SynerScope B.V., Truth Technologies Inc., Exiger LLC, Global RADAR, The International Business Machines Corporation, GB Group PLC, MSA Focus Inc., KPMG International Limited, RELX PLC, Temenos AG, Quantexa, London Stock Exchange Group PLC, KYC Global Technologies Limited.

North America was the largest region in the anti-money laundering software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the anti-money laundering software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the anti-money laundering software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Anti-money laundering (AML) software encompasses tools utilized for analyzing customer data and identifying suspicious activities. It employs technology to aid legal and financial institutions in fulfilling regulatory requirements imposed by financial authorities, facilitating the detection and prevention of financial crimes. The software's applications span data management, procedural filtering, predictive analysis, and machine learning.

The primary components of AML software include both software and services. The software serves as a computer program designed for managing anti-money laundering activities, typically sold by companies and installed locally on hosting servers. AML software is deployed both on-premise and in the cloud, playing a crucial role in transaction monitoring, currency transaction reporting, customer identity management, compliance management, and various other applications. End-users of AML software comprise sectors such as BFSI (Banking, Financial Services, and Insurance), defense, healthcare, IT and telecom, retail, and others.

The anti-money laundering software market research report is one of a series of new reports that provides anti-money laundering software market statistics, including anti-money laundering software industry global market size, regional shares, competitors with an anti-money laundering software market share, detailed anti-money laundering software market segments, market trends and opportunities, and any further data you may need to thrive in the anti-money laundering software industry. This anti-money laundering software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The anti-money laundering software market consists of revenues earned by entities by providing kyc (know your customer), fraud detection, watch-list screening, data warehouse management, analytics & visualization, alert management & reporting, and case management solutions. The market value includes the value of related goods sold by the service provider or included within the service offering. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Anti-Money Laundering Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on anti-money laundering software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for anti-money laundering software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The anti-money laundering software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Software; Services2) by Deployment: on-Premise; on-cloud

3) by Application: Transaction Monitoring; Currency Transaction Reporting; Customer Identity Management; Compliance Management; Other Applications

4) by End-Use: BFSI; Defense; Healthcare; IT and Telecom; Retail; Other End-users

Subsegments:

1) by Software: Transaction Monitoring Software; Customer Due Diligence Software; Risk Assessment Software; Reporting and Analytics Software2) by Services: Consulting Services; Implementation Services; Support and Maintenance Services; Training Services

Key Companies Mentioned: Accenture Inc.; ACI Worldwide Inc.; AML Partners LLC; Ascent Business Technology Inc.; BAE Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Anti-Money Laundering Software market report include:- Accenture Inc.

- ACI Worldwide Inc.

- AML Partners LLC

- Ascent Business Technology Inc.

- BAE Systems Inc.

- Eastnets Holding Limited

- Verafin Inc.

- Fidelity National Information Services Inc.

- Fiserv Inc.

- Oracle Corporation

- SAS Institute Inc.

- Sungard Availability Services

- Experian Information Solutions Inc.

- Fico

- NICE Systems Ltd.

- Accuity Inc.

- SmartSearch

- SynerScope B.V.

- Truth Technologies Inc.

- Exiger LLC

- Global RADAR

- The International Business Machines Corporation

- GB Group PLC

- MSA Focus Inc.

- KPMG International Limited

- RELX PLC

- Temenos AG

- Quantexa

- London Stock Exchange Group PLC

- KYC Global Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.22 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |