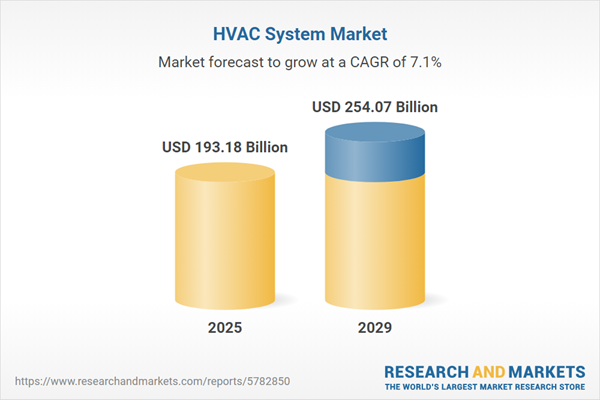

The HVAC system market size has grown strongly in recent years. It will grow from $182.15 billion in 2024 to $193.18 billion in 2025 at a compound annual growth rate (CAGR) of 6.1%. The growth in the historic period can be attributed to urbanization and construction boom, global temperature variations, energy efficiency concerns, government regulations and standards, indoor air quality awareness, health and comfort factors.

The HVAC system market size is expected to see strong growth in the next few years. It will grow to $254.07 billion in 2029 at a compound annual growth rate (CAGR) of 7.1%. The growth in the forecast period can be attributed to globalization of markets, focus on net-zero buildings, advancements in refrigerants, renewable energy integration, resilience to climate change, evolving building codes. Major trends in the forecast period include rise of smart HVAC systems, integration of artificial intelligence (ai), variable refrigerant flow (VRF) systems, hybrid and integrated HVAC solutions, remote monitoring and control, electrification and heat pump adoption.

The increase in construction activities within the commercial and residential sectors is projected to drive the growth of the HVAC system market in the future. The construction sector encompasses both residential and non-residential infrastructure, which includes commercial, industrial, and other types of buildings. HVAC systems are essential mechanical systems that provide thermal comfort and maintain indoor air quality, commonly used in a variety of settings, including industrial, commercial, residential, and institutional buildings. For instance, in March 2024, Atradius, a Netherlands-based insurance company specializing in trade credit insurance, reported that global construction output is expected to rise by 2% in 2024, following a 3.7% increase in 2023. Advanced economies are projected to grow by 1.8%, while emerging markets are anticipated to see a 2.2% rise in building activity. Furthermore, non-residential output and civil engineering are expected to grow by 2.8% and 4.4%, respectively, this year. In 2025, global construction is forecasted to grow by 1.8%, with residential construction output rebounding by 2.4% due to improving economic conditions and the impact of more lenient monetary policies. Consequently, the surge in construction activities in both commercial and residential sectors is driving the expansion of the HVAC system market.

The HVAC system market is experiencing growth attributed to the rising manufacturing industry. HVAC systems are crucial in maintaining optimal indoor conditions, including temperature and air quality, in manufacturing facilities. This regulation enhances productivity and overall efficiency in industrial processes. Eurostat reported a 0.2% increase in industrial output in the European area in July 2023, signaling the importance of HVAC systems in supporting manufacturing growth. As the manufacturing industry continues to expand, the demand for HVAC systems is expected to rise, contributing to the market's overall growth.

Green and smart technology is emerging as a significant trend in the HVAC system market. Key players in this sector are concentrating on delivering innovative solutions that leverage the Internet of Things (IoT) and machine learning to enhance their market presence. These green and smart technologies contribute to improved living conditions and promote eco-friendly practices for the construction, renovation, and operation of homes and buildings. For example, in February 2024, Voltas Limited, an India-based multinational company specializing in home appliances such as air conditioners, air coolers, refrigerators, and washing machines, unveiled its new commercial AC product line at ACREX India 2024 in Noida. This line features inverter scroll chillers with cooling capacities ranging from 12 to 72 TR. These environmentally friendly units utilize advanced refrigerants and are equipped with IoT capabilities, BMS compatibility, and mobile app control, ensuring quiet and convenient operation. This product line aims to foster energy-efficient solutions in commercial spaces, reinforcing the company's commitment to incorporating cutting-edge technology into its operations.

Major companies in the HVAC system market are intensifying their focus on advanced heating and cooling solutions to stay competitive. The introduction of the dual fuel system is one such innovation that optimizes energy use by utilizing two different fuel sources, such as natural gas and electricity. Johnson Controls-Hitachi Air Conditioning launched the Hitachi Air365 Hybrid dual fuel system in September 2023. This system integrates electric and gas technologies for efficient climate control in residential and commercial settings. The emphasis on advanced solutions demonstrates the commitment of HVAC industry leaders to meet evolving market demands and enhance overall system performance.

In May 2023, Daikin Applied, a prominent US-based HVAC solutions company, successfully acquired Carroll Air Systems for an undisclosed sum. This strategic acquisition is anticipated to facilitate the expansion of Daikin Applied's HVAC product offerings. Aldridge Carroll Air Systems, the acquired company, is based in the US and specializes in providing heating, ventilation, and air-conditioning (HVAC) systems and services tailored for commercial, industrial, and institutional facilities.

Major companies operating in the HVAC system market are Daikin Industries Ltd., Johnson Controls International, Carrier Global Corporation, Trane Technologies PLC, LG Electronics, AAON Heating and Cooling Products, Addison HVAC, Allied Commercial, Danfoss AS, Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Nortek Air Management, Samsung Group, Midea Group, Electrolux AB, Toshiba Corporation, York International Corporation, Nortek Global HVAC, Rheem Manufacturing Company, Goodman Manufacturing Company, Lennox International Inc., SPX Corporation, Standex International Corporation, CSW Industrials Inc., EMCOR Group Inc., Ingersoll-Rand plc (Ireland), Watts Water Technologies Inc.

Asia-Pacific was the largest region in the HVAC system market in 2024. The regions covered in the hvac system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hvac system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A Heating, Ventilation, and Air Conditioning (HVAC) system is a mechanical system within a building designed to provide thermal comfort for occupants while ensuring indoor air quality.

The primary components of HVAC systems are heating, ventilation, and cooling. Heating utilizes various technologies to regulate air temperature, humidity, and purity within the HVAC system. These systems can be implemented in different contexts, including new construction and retrofit projects, and are applicable in commercial, residential, and industrial settings.

The HVAC system market research report is one of a series of new reports that provides HVAC system market statistics, including HVAC system industry global market size, regional shares, competitors with an HVAC system market share, detailed HVAC system market segments, market trends and opportunities, and any further data you may need to thrive in the HVAC system industry. This HVAC system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The HVAC system market consists of sales of heat pumps, furnaces, unitary heaters, boilers, single splits, variable refrigerant flow (VRF) systems, chillers, room air conditioners, and other types. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

The HVAC system market size is expected to see strong growth in the next few years. It will grow to $254.07 billion in 2029 at a compound annual growth rate (CAGR) of 7.1%. The growth in the forecast period can be attributed to globalization of markets, focus on net-zero buildings, advancements in refrigerants, renewable energy integration, resilience to climate change, evolving building codes. Major trends in the forecast period include rise of smart HVAC systems, integration of artificial intelligence (ai), variable refrigerant flow (VRF) systems, hybrid and integrated HVAC solutions, remote monitoring and control, electrification and heat pump adoption.

The increase in construction activities within the commercial and residential sectors is projected to drive the growth of the HVAC system market in the future. The construction sector encompasses both residential and non-residential infrastructure, which includes commercial, industrial, and other types of buildings. HVAC systems are essential mechanical systems that provide thermal comfort and maintain indoor air quality, commonly used in a variety of settings, including industrial, commercial, residential, and institutional buildings. For instance, in March 2024, Atradius, a Netherlands-based insurance company specializing in trade credit insurance, reported that global construction output is expected to rise by 2% in 2024, following a 3.7% increase in 2023. Advanced economies are projected to grow by 1.8%, while emerging markets are anticipated to see a 2.2% rise in building activity. Furthermore, non-residential output and civil engineering are expected to grow by 2.8% and 4.4%, respectively, this year. In 2025, global construction is forecasted to grow by 1.8%, with residential construction output rebounding by 2.4% due to improving economic conditions and the impact of more lenient monetary policies. Consequently, the surge in construction activities in both commercial and residential sectors is driving the expansion of the HVAC system market.

The HVAC system market is experiencing growth attributed to the rising manufacturing industry. HVAC systems are crucial in maintaining optimal indoor conditions, including temperature and air quality, in manufacturing facilities. This regulation enhances productivity and overall efficiency in industrial processes. Eurostat reported a 0.2% increase in industrial output in the European area in July 2023, signaling the importance of HVAC systems in supporting manufacturing growth. As the manufacturing industry continues to expand, the demand for HVAC systems is expected to rise, contributing to the market's overall growth.

Green and smart technology is emerging as a significant trend in the HVAC system market. Key players in this sector are concentrating on delivering innovative solutions that leverage the Internet of Things (IoT) and machine learning to enhance their market presence. These green and smart technologies contribute to improved living conditions and promote eco-friendly practices for the construction, renovation, and operation of homes and buildings. For example, in February 2024, Voltas Limited, an India-based multinational company specializing in home appliances such as air conditioners, air coolers, refrigerators, and washing machines, unveiled its new commercial AC product line at ACREX India 2024 in Noida. This line features inverter scroll chillers with cooling capacities ranging from 12 to 72 TR. These environmentally friendly units utilize advanced refrigerants and are equipped with IoT capabilities, BMS compatibility, and mobile app control, ensuring quiet and convenient operation. This product line aims to foster energy-efficient solutions in commercial spaces, reinforcing the company's commitment to incorporating cutting-edge technology into its operations.

Major companies in the HVAC system market are intensifying their focus on advanced heating and cooling solutions to stay competitive. The introduction of the dual fuel system is one such innovation that optimizes energy use by utilizing two different fuel sources, such as natural gas and electricity. Johnson Controls-Hitachi Air Conditioning launched the Hitachi Air365 Hybrid dual fuel system in September 2023. This system integrates electric and gas technologies for efficient climate control in residential and commercial settings. The emphasis on advanced solutions demonstrates the commitment of HVAC industry leaders to meet evolving market demands and enhance overall system performance.

In May 2023, Daikin Applied, a prominent US-based HVAC solutions company, successfully acquired Carroll Air Systems for an undisclosed sum. This strategic acquisition is anticipated to facilitate the expansion of Daikin Applied's HVAC product offerings. Aldridge Carroll Air Systems, the acquired company, is based in the US and specializes in providing heating, ventilation, and air-conditioning (HVAC) systems and services tailored for commercial, industrial, and institutional facilities.

Major companies operating in the HVAC system market are Daikin Industries Ltd., Johnson Controls International, Carrier Global Corporation, Trane Technologies PLC, LG Electronics, AAON Heating and Cooling Products, Addison HVAC, Allied Commercial, Danfoss AS, Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Nortek Air Management, Samsung Group, Midea Group, Electrolux AB, Toshiba Corporation, York International Corporation, Nortek Global HVAC, Rheem Manufacturing Company, Goodman Manufacturing Company, Lennox International Inc., SPX Corporation, Standex International Corporation, CSW Industrials Inc., EMCOR Group Inc., Ingersoll-Rand plc (Ireland), Watts Water Technologies Inc.

Asia-Pacific was the largest region in the HVAC system market in 2024. The regions covered in the hvac system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hvac system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A Heating, Ventilation, and Air Conditioning (HVAC) system is a mechanical system within a building designed to provide thermal comfort for occupants while ensuring indoor air quality.

The primary components of HVAC systems are heating, ventilation, and cooling. Heating utilizes various technologies to regulate air temperature, humidity, and purity within the HVAC system. These systems can be implemented in different contexts, including new construction and retrofit projects, and are applicable in commercial, residential, and industrial settings.

The HVAC system market research report is one of a series of new reports that provides HVAC system market statistics, including HVAC system industry global market size, regional shares, competitors with an HVAC system market share, detailed HVAC system market segments, market trends and opportunities, and any further data you may need to thrive in the HVAC system industry. This HVAC system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The HVAC system market consists of sales of heat pumps, furnaces, unitary heaters, boilers, single splits, variable refrigerant flow (VRF) systems, chillers, room air conditioners, and other types. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

1. Executive Summary2. HVAC System Market Characteristics3. HVAC System Market Trends and Strategies4. HVAC System Market - Macro Economic Scenario Including the Impact of Interest Rates, Inflation, Geopolitics, and the Recovery from COVID-19 on the Market32. Global HVAC System Market Competitive Benchmarking and Dashboard33. Key Mergers and Acquisitions in the HVAC System Market34. Recent Developments in the HVAC System Market

5. Global HVAC System Growth Analysis and Strategic Analysis Framework

6. HVAC System Market Segmentation

7. HVAC System Market Regional and Country Analysis

8. Asia-Pacific HVAC System Market

9. China HVAC System Market

10. India HVAC System Market

11. Japan HVAC System Market

12. Australia HVAC System Market

13. Indonesia HVAC System Market

14. South Korea HVAC System Market

15. Western Europe HVAC System Market

16. UK HVAC System Market

17. Germany HVAC System Market

18. France HVAC System Market

19. Italy HVAC System Market

20. Spain HVAC System Market

21. Eastern Europe HVAC System Market

22. Russia HVAC System Market

23. North America HVAC System Market

24. USA HVAC System Market

25. Canada HVAC System Market

26. South America HVAC System Market

27. Brazil HVAC System Market

28. Middle East HVAC System Market

29. Africa HVAC System Market

30. HVAC System Market Competitive Landscape and Company Profiles

31. HVAC System Market Other Major and Innovative Companies

35. HVAC System Market High Potential Countries, Segments and Strategies

36. Appendix

Executive Summary

HVAC System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hvac system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hvac system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hvac system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Heating; Ventilation; Cooling2) by Implementation Type: New Construction; Retrofit

3) by Application: Commercial; Residential; Industrial

Subsegments:

1) by Heating: Furnaces; Heat Pumps; Boilers; Radiant Heating Systems; Electric Heaters2) by Ventilation: Exhaust Fans; Air Handling Units (AHUs); Energy Recovery Ventilators (ERVs); Demand-Controlled Ventilation Systems; Ductless Ventilation Systems

3) by Cooling: Air Conditioners; Chillers; Cooling Towers; Evaporative Coolers; Portable Air Conditioners

Key Companies Mentioned: Daikin Industries Ltd.; Johnson Controls International; Carrier Global Corporation; Trane Technologies PLC; LG Electronics

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this HVAC System market report include:- Daikin Industries Ltd.

- Johnson Controls International

- Carrier Global Corporation

- Trane Technologies PLC

- LG Electronics

- AAON Heating and Cooling Products

- Addison HVAC

- Allied Commercial

- Danfoss AS

- Emerson Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Nortek Air Management

- Samsung Group

- Midea Group

- Electrolux AB

- Toshiba Corporation

- York International Corporation

- Nortek Global HVAC

- Rheem Manufacturing Company

- Goodman Manufacturing Company

- Lennox International Inc.

- SPX Corporation

- Standex International Corporation

- CSW Industrials Inc.

- EMCOR Group Inc.

- Ingersoll-Rand plc (Ireland)

- Watts Water Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 193.18 Billion |

| Forecasted Market Value ( USD | $ 254.07 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |