Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Saudi Arabia Catalysts Market plays a critical role in the Kingdom’s industrial landscape, supporting key sectors such as petroleum refining, petrochemical production, environmental protection, and chemical synthesis. Catalysts, including heterogeneous and homogeneous types, facilitate essential chemical reactions, enhancing efficiency and product quality in processes like cracking, hydroprocessing, and polymerization. The market is propelled by Saudi Arabia’s Vision 2030, which emphasizes economic diversification and industrial growth, fostering demand for catalysts in downstream industries. The Kingdom’s position as a global leader in oil and gas, backed by Saudi Aramco’s extensive refining infrastructure, drives significant catalyst consumption for producing high-value fuels and petrochemicals compliant with international standards, such as Euro V and IMO low-sulfur regulations.

Government initiatives, including the In-Kingdom Total Value Add (IKTVA) program, encourage local catalyst production, reducing reliance on imports and bolstering supply chain resilience. The Saudi Environmental Protection Authority (SEPA) enforces stringent regulations, increasing the use of catalysts in emission control and wastewater treatment to align with the Saudi Green Initiative’s net-zero emissions target by 2060. The petrochemical sector, led by companies like SABIC, relies on catalysts for producing plastics, fertilizers, and specialty chemicals, supporting both domestic needs and exports to Asia-Pacific and Europe. The National Industrial Development and Logistics Program (NIDLP) further promotes investments in refining and chemical manufacturing, creating opportunities for catalyst applications.

Emerging applications, such as carbon capture and storage (CCS) and hydrogen production, are gaining traction, driven by sustainability goals. However, challenges like raw material price volatility and the need for skilled expertise persist. The market benefits from technological advancements, including nanotechnology and regenerative catalysts, enhancing performance and sustainability. Strategic partnerships with global firms and local R&D efforts, supported by institutions like King Abdulaziz City for Science and Technology (KACST), position Saudi Arabia as a hub for catalyst innovation. The market’s growth trajectory through 2030F reflects its alignment with industrial and environmental priorities, making it a compelling opportunity for investors.

Key Market Drivers

Expansion of Petroleum Refining and Petrochemical Industries

The expansion of Saudi Arabia’s petroleum refining and petrochemical industries is a primary driver for the catalysts market, underpinned by the Kingdom’s strategic focus on downstream growth. Vision 2030’s Downstream Development Strategy aims to enhance refining capacity, with projects like the Jazan Refinery Complex utilizing catalysts for processes such as hydrocracking and desulfurization to meet global fuel standards. According to the Ministry of Energy, Saudi Arabia’s refining capacity reached 3.3 million barrels per day in 2023, necessitating catalysts for efficient crude processing.The IKTVA program incentivizes local production, with companies like Axens establishing catalyst manufacturing facilities. Supporting data from the General Authority for Statistics (GASTAT) indicates that petrochemical exports grew significantly in 2023, driven by catalysts enabling high-yield production of ethylene and propylene. SEPA’s environmental mandates require catalysts for sulfur removal, aligning with the Circular Carbon Economy framework. This driver is strengthened by global demand for high-purity petrochemicals, positioning Saudi Arabia as a key supplier.

Key Market Challenges

Volatility in Raw Material Costs

Volatility in raw material costs poses a significant challenge to the Saudi Arabia Catalysts Market, impacting production economics. Key materials like zeolites, precious metals, and chemical compounds are subject to global price fluctuations, influenced by geopolitical tensions and supply chain disruptions. Reports from the Saudi Industrial Development Fund highlight how import dependency for specialized catalyst components increases costs, particularly with Red Sea shipping delays. Local manufacturers face margin pressures, potentially affecting competitiveness. Diversifying supply sources and investing in local raw material processing are critical to mitigate this challenge, but require substantial capital.Key Market Trends

Adoption of Regenerative and Sustainable Catalysts

The adoption of regenerative and sustainable catalysts is a key trend, driven by environmental and cost-efficiency goals. These catalysts, designed for multiple regeneration cycles, reduce waste and operational costs in refining and petrochemical processes. The Saudi Green Initiative supports this trend, with companies like SABIC exploring bio-based catalysts derived from renewable feedstocks. Collaborations with KACST focus on sustainable catalyst formulations, enhancing compliance with SEPA regulations. This trend strengthens the Kingdom’s position in global markets by offering eco-friendly solutions.Key Market Players

- BASF Saudi Arabia Co. Ltd.

- Honeywell UOP

- Axens Catalyst Arabia Ltd (ACAL)

- Sinopec Catalyst Co. Ltd.

- Shell plc (Shell Catalysts & Technologies)

- SABIC Industrial Catalyst Company

- Arkema Chemicals Saudi Arabia

- Haldor Topsoe Middle East

- Clariant Ali Al Abdullah Al Tamimi Company Ltd

- AFI Group

Report Scope:

In this report, Saudi Arabia Catalyst Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Catalyst Market, By Type:

- Homogeneous Catalysts

- Heterogeneous Catalyst

Saudi Arabia Catalyst Market, By Material:

- Zeolites

- Metals

- Additives

- Chemical Compounds

Saudi Arabia Catalyst Market, By Region:

- Eastern

- Northern & Central

- Western

- Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Saudi Arabia Catalyst Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF Saudi Arabia Co. Ltd.

- Honeywell UOP

- Axens Catalyst Arabia Ltd (ACAL)

- Sinopec Catalyst Co. Ltd.

- Shell plc (Shell Catalysts & Technologies)

- SABIC Industrial Catalyst Company

- Arkema Chemicals Saudi Arabia

- Haldor Topsoe Middle East

- Clariant Ali Al Abdullah Al Tamimi Company Ltd

- AFI Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

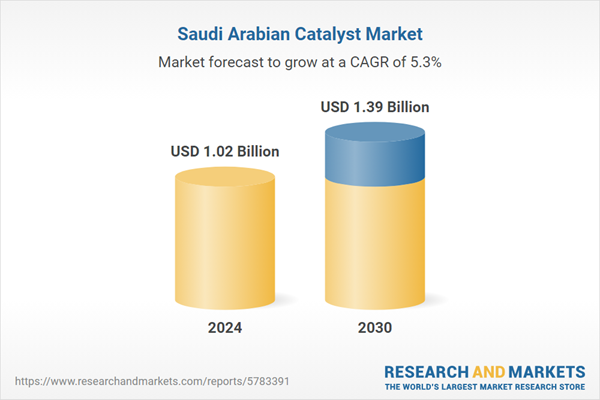

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.02 Billion |

| Forecasted Market Value ( USD | $ 1.39 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |