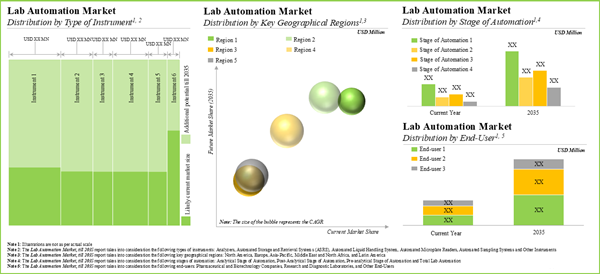

The global lab automation market is estimated to grow from USD 6.5 billion in 2025 to USD 16 billion by 2035, at a CAGR of 9.4% during the forecast period, to 2035.

Lab Automation Market: Growth and Trends

Laboratory automation has been one of the most significant developments in diagnostic laboratory sciences in recent years. The purpose of laboratory automation, which began in the 1950s, is to reduce human error and turnaround time for laboratory testing. It is worth highlighting that human error accounts for approximately 30% to 86% of all pre-analytical mistakes among all laboratory processes. As a result, the implementation of robots in place of humans can effectively and immediately eliminate this significant amount of inaccuracy. Over the years, lab automation has garnered significant interest from researchers as well as from industry players, owing to the potential of machines to replace manual operations in every field of research and technology. This is because automation enhances process quality, eliminates human error and variability, and eventually makes operations more cost-effective, efficient, and quick.

Furthermore, given the rate at which the concept of lab automation has evolved over the last decade, new technologies in this domain have demonstrated enormous potential. In fact, many lab managers are exploring the field of mobile robots as a means to streamline repetitive tasks and enhance efficiency. A robotic lab assistant that can independently transport and handle materials in the lab has been conceptualized by many scientists. Lab automation devices, such as automated liquid handling systems, have several advantages, including the ability to simplify sample preparation while maintaining consistent high accuracy and allowing labs to free up manual labor and run more samples along with maintaining reproducibility. In addition, automated storage and retrieval systems (ASRS) lower down the variable cost of operations by eliminating the need for manual labor for tasks such as picking, storing, assembly and inventory replenishment. Consequently, owing to the growing research efforts, development of advanced instrumentations, and efforts of various stakeholders, this segment of industry is likely to witness noteworthy growth in the foreseen future.

Lab Automation Market: Key Insights

The report delves into the current state of the lab automation market and identifies potential growth opportunities within industry.

Some key findings from the report include:

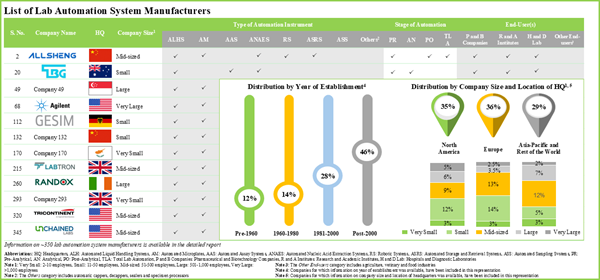

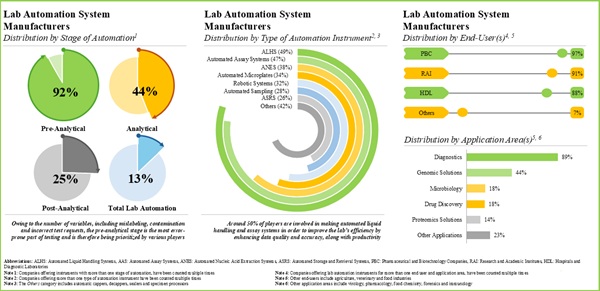

- More than 90% of the lab automation system manufacturers are focusing on pre-analytical stage-based instruments; of these, ALHS and AAS have been more widely adopted by pharma and biotech companies.

- In pursuit of gaining a competitive edge, companies are actively enhancing their existing capabilities to strengthen their respective product portfolios and drive compliance to evolving industry benchmarks.

- The partnership activity has increased at a CAGR of around 25%; in fact, the maximum deals related to lab automation have been inked in the last three years.

- More than 6,200 patents related to lab automation have been filed / granted recently, highlighting the growing interest of stakeholders in scalable and configurable lab automation systems.

- Majority of the lab automation software providers are headquartered in North America; more than 55% of the market is captured by small players.

- The increasing adoption of lab automation in the healthcare industry is anticipated to create profitable business opportunities for lab automation software providers.

- The market is estimated to grow at an annualized rate of 9.4%; the opportunity is likely to be well distributed across various types of instruments, geographical regions, stages of automation and end-users.

The market sizing and opportunity analysis has been segmented across the following parameters:

Stage of Automation

- Pre-Analytical Stage

- Analytical Stage

- Post-Analytical Stage

- Total Lab Automation

Type of Instrument

- Automated Liquid Handling Systems

- Automated Microplate Readers

- Automated Sampling Systems

- Analyzers

- Automated Storage and Retrieval Systems (ASRS)

- Other Instruments

Application

- Diagnostics

- Genomic Solutions

- Microbiology

- Drug Discovery

- Proteomic Solutions

- Other Applications

End-user

- Pharmaceutical and Biotechnology Companies

- Research and Diagnostic Laboratories

- Other End-users

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Lab Automation Market: Key Segments

Pre-analytical Stage Segment holds the Largest Share of the Lab Automation Market

Based on the stage of automation, the market is segmented into pre-analytical stage, analytical stage, post-analytical stage and total lab automation. At present, the pre-analytical stage segment holds the maximum share of the global lab automation market. However, the total lab automation segment is expected to show the highest market growth potential during the forecast period.

By Type of Instrument, Analyzers is the Fastest Growing Segment of the Global Lab Automation Market

Based on the type of instrument, the market is segmented into automated liquid handling systems, automated microplate readers, automated sampling systems, analyzers, automated storage and retrieval systems (ASRS), and other instruments. At present, the automated liquid handling systems segment holds the maximum share of the global lab automation market. Further, the market for analyzers segment is expected to grow at a higher CAGR during the forecast period.

By Application, Diagnostics Segment Accounts for the Largest Share of the Global Lab Automation Market

Based on the application, the market is segmented into diagnostics, genomic solutions, microbiology, drug discovery, proteomic solutions and other applications. Currently, the diagnostics segment captures the highest proportion of the global lab automation market. Further, the drug discovery segment is expected to grow at a higher CAGR during the forecast period.

By End-user, Other End-users is the Fastest Growing Segment of the Global Lab Automation Market

Based on the end-user, the market is segmented into biotechnology and pharmaceutical industries, research and academic institutes and other end users. At present, the biotechnology and pharmaceutical industries segment holds the maximum share of the global lab automation market. However, the market for the other end-user segment is expected to grow at a higher CAGR during the forecast period.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. Currently, North America dominates the global lab automation market and accounts for the largest revenue share. Further, the market Asia-Pacific is likely to grow at a higher CAGR in the coming future.

Example Players in the Lab Automation Market Include

- Abbott

- Anton Paar

- BD

- Beckman Coulter

- ERWEKA

- Leuze

- Ortho Clinical Diagnostics

- Pall Corporation

- PerkinElmer

- Roche Diagnostics

- Siemens Healthineers

- SYSTAG

Lyophilization Services Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global lyophilization services market, focusing on key market segments, including stage of automation, type of instrument, application, end-user and key geographical regions.

- Market Landscape: A comprehensive evaluation of around 350 lab automation system manufacturers, based on several relevant parameters, such as year of establishment, company size, location of headquarters, types of lab automation system(s), stage(s) of automation, application area(s) and end-user(s).

- Company Competitiveness Analysis: A comprehensive competitive analysis of lab automation system manufacturers, examining factors, such as company strength, product diversity and portfolio strength.

- Company Profiles: In-depth profiles of key players that are currently engaged in the development of lab automation systems across North America, Europe and Asia-Pacific and Rest of the World, focusing on overview of the company, financial information (if available), product portfolio and recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as year of partnership, type of partnership, type of partner, type of automation instrument(s), most active players (in terms of number of partnerships) and regional distribution of partnership activity.

- Patent Analysis: An in-depth analysis of patents filed / granted till date related to lab automation, based on various relevant parameters, such as patent publication year, type of patent, patent jurisdiction, CPC symbols, type of applicant, emerging focus areas and leading players (in terms of number of patents filled / granted), leading individual assignees, benchmarking analysis and patent valuation.

- Case Study: A detailed discussion on the lab automation software providers, based on various parameters, such as year of establishment, company size, location of headquarters, type of software, mode(s) of deployment and end-user(s).

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott

- Anton Paar

- BD

- Beckman Coulter

- ERWEKA

- Leuze

- Ortho Clinical Diagnostics

- Pall Corporation

- PerkinElmer

- Roche Diagnostics

- Siemens Healthineers

- SYSTAG

Methodology

LOADING...