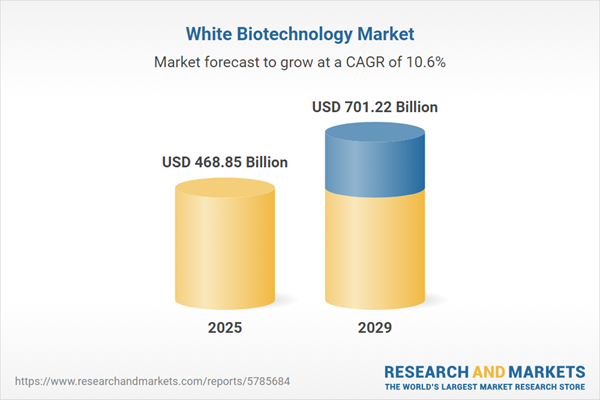

The white biotechnology market size is expected to see rapid growth in the next few years. It will grow to $701.22 billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to consumer preference for sustainable products, global shift towards renewable energy, investment and funding growth, focus on circular economy and waste reduction. Major trends in the forecast period include cost competitiveness, consumer awareness and preference, product innovations, shift towards circular economy, reduction in greenhouse gas emissions.

The escalating global demand for biofuels is anticipated to drive the growth trajectory of the white biotechnology market. Biofuels, derived from organic sources like by-products and corn-based ethanol, are witnessing increased popularity. White biotechnology, utilizing living organisms or enzymes from renewable sources, is crucial for sustainably synthesizing biofuels. As reported by the International Energy Agency (IEA) in December 2022, biodiesel production is projected to reach 47.4 billion liters by 2022, up from 45.7 billion in 2021. Similarly, ethanol production has surged to 114 billion liters in 2022. This surge in biofuel demand is a pivotal factor propelling the white biotechnology market's expansion.

The increasing preference for sustainable products is anticipated to drive the growth of the white biotechnology market in the future. A sustainable product reduces its negative impacts on the environment and society, responsibly and efficiently utilizes resources, and remains profitable throughout its life cycle. White biotechnology is employed to create sustainable products that leverage microorganisms, enzymes, and biocatalysts to produce eco-friendly and resource-efficient goods and processes across various industries. For example, in July 2024, the Energy Information Administration, a US government agency, projected that the production capacity of sustainable aviation fuel (SAF) in the United States will increase from around 2,000 barrels per day (b/d) to nearly 30,000 b/d by 2024. Thus, the growing preference for sustainable solutions is fueling the expansion of the white biotechnology market.

Technological advancements stand out as a prominent trend shaping the white biotechnology sector. Innovative platforms like co-polymer and precise platforms, rooted in biotechnological applications, are witnessing increased adoption. Major industry players are focused on leveraging these advancements to drive groundbreaking discoveries. For instance, in June 2023, International Flavors & Fragrances Inc. unveiled the Designed Enzymatic Biomaterials (DEB) technology. This innovative platform offers sustainable biopolymers, allowing producers to adapt to evolving market demands and regulatory shifts by substituting conventional synthetic polymers from fossil fuels. DEB technology enables the direct incorporation of petroleum-based polymer properties into biopolymer materials, tailoring polysaccharides for enhanced long-term performance in specific applications.

Leading corporations within the white biotechnology sector prioritize the development of pioneering technologies, specifically growth platforms, to deliver steadfast services to their clientele. A growth platform denotes a strategic initiative pursued by business entities to achieve sustained long-term growth. Typically, these platforms involve cross-functional collaboration across multiple business units or departments. As showcased in May 2022, Solvay SA, a Belgian chemical manufacturing company, introduced the Renewable Materials and Biotechnology platform. This initiative aims to facilitate research and development focused on generating novel bio-based products derived from renewable sources like plant-based materials and agricultural waste. These products are engineered to exhibit higher sustainability and reduced environmental impact compared to conventional alternatives. Solvay intends to leverage biotechnology for innovating new processes to manufacture chemicals and materials.

In a move during March 2022, Kerry Group PLC, an Irish publicly-traded food corporation, acquired 92% of c-Lecta GmbH's issued share capital for $134.8 million (€137M). This strategic acquisition is set to expedite Kerry's innovative capacities in enzyme engineering, fermentation, and bioprocess development. Moreover, the acquisition underscores Kerry's commitment to investing in pioneering sustainable technologies that will form the cornerstone of future sustainable food and health systems. c-Lecta GmbH, a German biotechnology company specialized in creating, producing, and distributing enzyme products, aligns well with Kerry's strategic goals, fostering advancements in sustainable solutions.

Major companies operating in the white biotechnology market are Novozyme A/S., Koninklijke DSM N.V., BASF SE., Du Pont Danisco., Amyris Inc., Henkel AG & Co. KGaA., Kaneka Corporation., Biosphere Corporation., Fujifilm Holdings Corporation., General Electric Company., Bayer AG., Evonik Industries AG., Evolva Holding., EUCODIS Bioscience GmbH., Lonza Group Ltd., Laurus Labs., Borregaard ASA., Codexis Inc., Deinove SA., Fermentalg SA., Gevo Inc., Global Bioenergies SA., Metabolic Explorer SA., Oligomerix Inc., immatics biotechnologies GmbH., Neurimmune Therapeutics AG., AkzoNobel N.V.

North America was the largest region in the white biotechnology market in 2024. The regions covered in the white biotechnology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the white biotechnology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

White biotechnology, also known as industrial or environmental biotechnology, is a branch dedicated to industrial production, providing essential components to various industries such as food, pharmaceuticals, and agriculture. It involves the environmentally friendly synthesis of biochemicals, biomaterials, and biofuels from renewable resources using live cells and their enzymes.

The primary product types in white biotechnology include biofuels, biomaterials, biochemicals, and industrial enzymes. Biofuels, such as biodiesel, biogas, and ethanol, represent renewable energy sources produced through living organisms. Biotechnology-enhanced biofuels are designed to function similarly to traditional gasoline, offering improved fuel efficiency and fewer blending issues than ethanol. White biotechnology finds applications in the production of bioenergy, food and feed additives, pharmaceutical ingredients, personal care products, household items, and more.

The white biotechnology market research report is one of a series of new reports that provides white biotechnology market statistics, including white biotechnology industry global market size, regional shares, competitors with a white biotechnology market share, detailed white biotechnology market segments, market trends and opportunities, and any further data you may need to thrive in the white biotechnology industry. This white biotechnology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The white biotechnology market includes revenues earned by entities by providing enzyme engineering, synthetic biology, metabolic engineering, fermentation, separation and purification processes. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

White Biotechnology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on white biotechnology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for white biotechnology ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The white biotechnology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product Type: Biofuels; Biomaterials; Biochemicals; Industrial Enzymes2) by Application Type: Bioenergy; Food and Feed Additives; Pharmaceutical Ingredients; Personal Care and Household Products; Other Applications

Subsegments:

1) by Biofuels: Ethanol; Biodiesel; Biogas2) by Biomaterials: Bioplastics; Bio-Based Composites; Bio-based Chemicals

3) by Biochemicals: Organic Acids; Amino Acids; Solvents

4) by Industrial Enzymes: Proteases; Amylases; Lipases

Key Companies Mentioned: Novozyme a/S.; Koninklijke DSM N.V.; BASF SE.; Du Pont Danisco.; Amyris Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this White Biotechnology market report include:- Novozyme A/S.

- Koninklijke DSM N.V.

- BASF SE.

- Du Pont Danisco.

- Amyris Inc.

- Henkel AG & Co. KGaA.

- Kaneka Corporation.

- Biosphere Corporation.

- Fujifilm Holdings Corporation.

- General Electric Company.

- Bayer AG.

- Evonik Industries AG.

- Evolva Holding.

- EUCODIS Bioscience GmbH.

- Lonza Group Ltd.

- Laurus Labs.

- Borregaard ASA.

- Codexis Inc.

- Deinove SA.

- Fermentalg SA.

- Gevo Inc.

- Global Bioenergies SA.

- Metabolic Explorer SA.

- Oligomerix Inc.

- immatics biotechnologies GmbH.

- Neurimmune Therapeutics AG.

- AkzoNobel N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 468.85 Billion |

| Forecasted Market Value ( USD | $ 701.22 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |