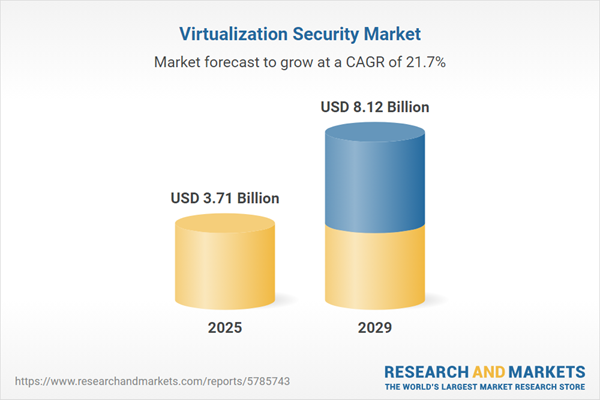

The virtualization security market size is expected to see exponential growth in the next few years. It will grow to $8.12 billion in 2029 at a compound annual growth rate (CAGR) of 21.7%. The growth in the forecast period can be attributed to integration of containerization, focus on zero trust security models, continuous evolution of cyber threats, quantum computing threat landscape, global connectivity and interconnected systems, enhanced integration with security orchestration, enhanced user authentication and access controls. Major trends in the forecast period include cloud-based virtualization, micro-segmentation for network security, endpoint security integration, multi-tenancy security, integration with security information and event management, automation and orchestration.

The increasing frequency of cyberattacks is propelling the virtualization security market. A cyberattack refers to an attempt to gain unauthorized access to a computer system or network with the intent to cause harm. Attackers consistently target virtualization systems for malicious purposes, heightening the need for robust security measures. Virtualization security services can address this demand. For example, in July 2022, the Department for Digital, Culture, Media and Sport, a UK government organization, reported that 39% of UK businesses experienced a cyberattack in the past year. Among those businesses, the most prevalent threat was phishing attempts, accounting for 83% of attacks. Additionally, around one in five (21%) of the affected businesses reported more sophisticated attack types, such as denial of service, malware, or ransomware attacks. Consequently, the rising number of cyberattacks is advancing the virtualization security market.

The rising adoption of cloud computing is anticipated to drive the growth of the virtualization security market in the coming years. As organizations transition to the cloud, virtualization technologies become essential for optimizing resource utilization and scalability. This shift necessitates enhanced virtualization security due to the shared resources and multi-tenancy inherent in cloud environments. Additionally, the dynamic nature of cloud resources, along with network virtualization and the emergence of hybrid and multi-cloud deployments, further highlights the need for strong security measures. For example, a December 2023 article from Eurostat, the Luxembourg-based statistics agency for the European Union, reported that 42.5% of EU enterprises purchased cloud computing services in 2023, primarily for email, file storage, and office software. This represents a 4.2 percentage point increase from 2021. Thus, the growing adoption of cloud computing is fueling the expansion of the virtualization security market.

Product innovations are emerging as key trends gaining traction in the virtualization security market. Leading companies in the sector are introducing new technologies, such as virtualization extensions, as part of their virtualization security advancements. For example, in January 2023, Panasonic Automotive Systems Co., Ltd., a prominent solutions provider for vehicle manufacturers across the transportation industry in Japan, launched VERZEUSE for Virtualization Extensions. This innovation aims to address cyber-attacks targeting next-generation vehicle cockpit systems. It allows for monitoring the communication data of networks and storage systems managed by the virtualization platform, thereby offering security measures against unauthorized access and attacks that exploit other functions.

Major companies within the virtualization security market are actively innovating new protection and control solutions as part of their strategy to secure a competitive advantage. An example is ABB Ltd.'s recent introduction in January 2023 of the Smart Substation Control and Protection SSC600 SW. This virtualized solution enables customers to utilize their preferred hardware while accessing established protection and control functionalities. The SSC600 SW, a virtualized iteration of the SSC600 device, consolidates protection and control functionalities within substations, streamlining network complexity. It supports Linux KVM and VMware Edge Compute Stack platform environments, providing enhanced flexibility and scalability. Additionally, ABB unveiled the FP 4 feature pack, augmenting the SSC600 with an improved user interface, disturbance recorder function, fuse failure supervision, and compliance support for simulation as per the IEC 61850 standard. These advancements facilitate streamlined testing throughout the protection system's lifecycle, underscoring ABB's commitment to enhancing virtualization security offerings.

In a significant move in May 2022, Broadcom, a US-based semiconductor device manufacturing company, completed the acquisition of VMware for $61 billion. This strategic acquisition aims to unite the strengths of both entities, presenting customers with an expanded platform offering a diverse range of critical infrastructure solutions. By amalgamating Broadcom's complementary Software portfolio with VMware's leading cloud-computing and virtualization technology, the combined entity aims to accelerate innovation and address intricate information technology infrastructure needs. VMware, renowned for its cloud-computing and virtualization technology solutions, further bolsters Broadcom's position in providing comprehensive and robust virtualization security and infrastructure offerings to a global clientele.

Major companies operating in the virtualization security market are GE Healthcare, Infosys Limited, McKesson Corporation, Koninklijke Philips N.V., Change Healthcare Inc., VMware AppDefense, Kaspersky Hybrid Cloud Security, Trellix MOVE AntiVirus, Trend Micro Cloud One Workload Security, Morphisec Inc., VMware NSX, The Aqua Platform, International Business Machines Corporation (IBM), Cybereason Ltd., Juniper Networks Inc., Akamai Technologies Inc., SentinelOne Inc., Arctic Wolf Networks Inc., Snyk Ltd., Lacework Inc., Cynet Systems Ltd., Palo Alto Networks Inc., CrowdStrike Holdings Inc., Deepwatch Inc., Ping Identity Corporation.

North America was the largest region in the virtualization security market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the virtualization security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the virtualization security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Virtualization security involves the implementation of collective measures, procedures, and actions to safeguard the virtualization infrastructure. This is achieved by shifting security functions from specialized hardware appliances to software that can be easily transferred across common hardware or utilized in the cloud. Virtualization, in this context, refers to the operation of multiple virtual instances of a device on a single physical hardware resource. The aim is to address the security challenges faced by various components within a virtualization system.

The primary types of virtualization security are solutions and services, which are deployed on-premise and in the cloud by both small and medium enterprises as well as large enterprises. Solutions encompass software or computer programs designed to perform time-consuming and regular tasks, thereby simplifying work processes. Virtualization security solutions include various software components such as virtual appliances, anti-malware tools, and more. The application of virtualization security spans across industries including BFSI, government and defense, IT and telecommunications, healthcare and life sciences, retail, manufacturing, education, and other sectors.

The virtualization security market research report is one of a series of new reports that provides virtualization security market statistics, including virtualization security industry global market size, regional shares, competitors with a virtualization security market share, detailed virtualization security market segments, market trends and opportunities, and any further data you may need to thrive in the virtualization security industry. This virtualization security market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The virtualization security market includes revenues earned by virtualization security solutions such as host-based, anti-malware, virtual appliance, virtual zone, virtual infrastructure protection, virtual lifecycle protection, log, and patch management, configuration management, virtualization security API, anti-malware/anti-virus, application security tools, data centers/servers security tools, professional services, and managed services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Virtualization Security Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on virtualization security market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for virtualization security ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The virtualization security market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Solution; Service2) by Deployment Model: on-Premise ; Cloud

3) by Organizational Size: Small and Medium Enterprises; Large Enterprises

4) by Industry: BFSI; Government and Defense; IT and Telecommunication; Healthcare and Life Sciences; Retail; Manufacturing; Education; Other Industries

Subsegments:

1) by Solution: Endpoint Security Solutions; Network Security Solutions; Data Security Solutions; Identity and Access Management (IAM) Solutions; Security Information and Event Management (SIEM) Solutions; Intrusion Detection and Prevention Systems (IDPS)2) by Service: Consulting Services; Implementation Services; Managed Security Services; Security Auditing and Compliance Services; Incident Response Services

Key Companies Mentioned: GE Healthcare; Infosys Limited; McKesson Corporation; Koninklijke Philips N.V.; Change Healthcare Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Virtualization Security market report include:- GE Healthcare

- Infosys Limited

- McKesson Corporation

- Koninklijke Philips N.V.

- Change Healthcare Inc.

- VMware AppDefense

- Kaspersky Hybrid Cloud Security

- Trellix MOVE AntiVirus

- Trend Micro Cloud One Workload Security

- Morphisec Inc.

- VMware NSX

- The Aqua Platform

- International Business Machines Corporation (IBM)

- Cybereason Ltd.

- Juniper Networks Inc.

- Akamai Technologies Inc.

- SentinelOne Inc.

- Arctic Wolf Networks Inc.

- Snyk Ltd.

- Lacework Inc.

- Cynet Systems Ltd.

- Palo Alto Networks Inc.

- CrowdStrike Holdings Inc.

- Deepwatch Inc.

- Ping Identity Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.71 Billion |

| Forecasted Market Value ( USD | $ 8.12 Billion |

| Compound Annual Growth Rate | 21.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |