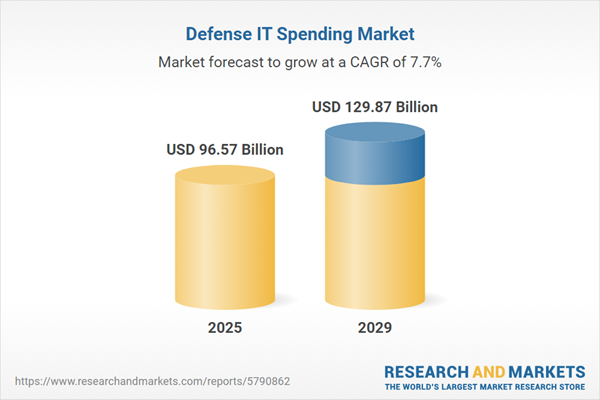

The defense IT spending market size is expected to see strong growth in the next few years. It will grow to $129.87 billion in 2029 at a compound annual growth rate (CAGR) of 7.7%. The growth in the forecast period can be attributed to autonomous systems development, mobile solutions emphasis, focus on interoperability, modernization efforts, IoT expansion, advancements in AI and analytics. Major trends in the forecast period include supply chain security, satellite communication and space-based technologies, AI-enabled autonomous systems, focus on mobility solutions, interoperability and integration, modernization initiatives.

The anticipated growth in the defense IT spending market is attributed to increasing geopolitical tensions. Geopolitical concerns between nations are prompting the adoption of advanced IT systems to address various challenges. For instance, in June 2022, Uppsala University reported a 46% increase in organized violence-related deaths compared to the previous year. This rise in geopolitical tensions is leading to a heightened demand for defense IT spending as countries invest in advanced technologies to bolster their national security.

The defense IT spending market is expected to witness significant growth due to the surge in global military expenditure. Governments allocate substantial financial resources to fund military forces, defense infrastructure, and related activities. In April 2023, the Stockholm International Peace Research Institute reported a record-high world military expenditure of $2.24 trillion in 2022. With the United States, China, and Russia accounting for 56% of the total spending, the increased investment in military capabilities is propelling the growth of the defense IT spending market.

A key trend in the defense IT spending market is the focus on product innovation by major industry players. Companies are actively developing new product solutions to enhance their market position. For instance, BAE Systems launched the LiteWave lightweight head-up display for both commercial and military aircraft in May 2022. This innovative product offers unique features, including easy installation in limited cockpit space, faster maintenance, and state-of-the-art digital technology. The emphasis on product innovation underscores the commitment of industry leaders to stay at the forefront of technological advancements.

In June 2024, Cognizant, a US-based information technology company, acquired Belcan LLC for $1.3 billion. This acquisition will significantly enhance Cognizant's engineering, research, and development (ER&D) capabilities, bolstering its leadership in the Internet of Things (IoT) and Digital Engineering sectors. By merging with Belcan, Cognizant will achieve greater scale and reinforce its position as a leader in the rapidly expanding aerospace and defense (A&D) industry, leveraging a blue-chip client base, extensive domain expertise, and robust technological capabilities supported by over 6,500 engineers and technical consultants. Belcan LLC is a US-based provider of information technology (IT) services to clients in the aerospace, defense, automotive, industrial, and government sectors.

In June 2024, Honeywell International Inc., a US-based multinational conglomerate, acquired CAES Systems Holdings LLC (CAES) for $1.9 billion. This acquisition will enhance Honeywell’s defense technology solutions across land, sea, air, and space, particularly by introducing new electromagnetic defense solutions for comprehensive radio frequency (RF) signal management. The combined entity will improve Honeywell’s existing production and upgrade capabilities on critical platforms such as the F-35, EA-18G, AMRAAM, and GMLRS, while also expanding its offerings to include new platforms like Navy Radar (SPY-6) and UAS and C-UAS technologies. CAES Systems Holdings LLC is a US-based provider of defense IT services.

In February 2021, Veritas Capital, a private-equity firm headquartered in New York, successfully acquired Northrop Grumman for a cash amount totaling $3.4 billion. This acquisition marks the creation of a leading government mission capability integrator and IT provider, with a strategic focus on delivering high-end technology-enabled services and unparalleled support for a diverse range of critical government missions. Northrop Grumman, the acquired company, is a US-based entity operating in defense IT spending. The transaction reflects Veritas Capital's commitment to consolidating its presence in the government services and technology market, leveraging the combined expertise of the newly formed entity to address the evolving needs of government missions.

Major companies operating in the defense IT spending market are Leidos Holdings Inc., Accenture PLC, International Business Machines Corporation, General Dynamics Corporation, BAE Systems PLC, DXC Technology Company, Dell Inc., Northrop Grumman Corporation, Unisys Corporation, Atos SE, Capgemini SE, Fujitsu Limited, Oracle Corporation, SAP SE, Microsoft Corporation, Amazon Inc., AT&T Intellectual Property, CACI International Inc., Atkins, Raytheon Technologies Corp., Lockheed Martin Corporation, Aerojet Rocketdyne Holdings Inc., L3Harris Technologies Inc, Science Applications International Corporation, Kratos Defense & Security Solutions Inc., Mercury Systems Inc., Cubic Corporation, Parsons Corporation, Hewlett Packard Enterprise Development LP, Viasat.

Defense IT spending refers to the financial investment in a collection of computers, software, and networks dedicated to defense systems. It represents the funds allocated by a government to equip its military with various technologies and infrastructure.

The primary categories of defense IT spending include services, hardware, and software. Hardware encompasses the physical components of computers and related devices. The forces involved in defense IT spending include defense forces and civilian forces. Applications of defense IT spending cover a wide range, including IT infrastructure, cybersecurity, defense cloud computing, data analytics, IT applications, logistics and assets management, and other related areas.

The defense IT spending market research report is one of a series of new reports that provides defense IT spending market statistics, including defense IT spending industry global market size, regional shares, competitors with a defense IT spending market share, detailed defense IT spending market segments, market trends and opportunities, and any further data you may need to thrive in the defense IT spending industry. This defense IT spending market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the defense IT spending market in 2024. The regions covered in the defense it spending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the defense it spending market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The defense IT spending market consists of sales of defense material handling, enabling cost-savings and a competitive edge to the army, naval, and space domain. The market value includes the value of related goods sold by the service provider or included within the service offering. The defense IT spending market also includes sales of spending on defense equipment such as weapons, aircraft, and gear or personal equipment. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Defense IT Spending Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on defense it spending market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for defense it spending? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The defense it spending market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Services; Hardware; Software2) by Force: Defense Forces; Civilian Forces

3) by Application: IT Infrastructure; Cybersecurity; Defense Cloud Computing; Data Analytics; IT Application; Logistics and Assets Management; Other Applications

Subsegments:

1) by Services: Consulting Services; System Integration Services; Managed IT Services; Cybersecurity Services2) by Hardware: Servers and Storage Solutions; Networking Equipment; Communication Devices; Specialized Defense Equipment

3) by Software: Defense Management Software; Cybersecurity Software; Simulation and Training Software; Data Analytics Software

Key Companies Mentioned: Leidos Holdings Inc.; Accenture PLC; International Business Machines Corporation; General Dynamics Corporation; BAE Systems PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Defense IT Spending market report include:- Leidos Holdings Inc.

- Accenture PLC

- International Business Machines Corporation

- General Dynamics Corporation

- BAE Systems PLC

- DXC Technology Company

- Dell Inc.

- Northrop Grumman Corporation

- Unisys Corporation

- Atos SE

- Capgemini SE

- Fujitsu Limited

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- Amazon Inc.

- AT&T Intellectual Property

- CACI International Inc.

- Atkins

- Raytheon Technologies Corp.

- Lockheed Martin Corporation

- Aerojet Rocketdyne Holdings Inc.

- L3Harris Technologies Inc

- Science Applications International Corporation

- Kratos Defense & Security Solutions Inc.

- Mercury Systems Inc.

- Cubic Corporation

- Parsons Corporation

- Hewlett Packard Enterprise Development LP

- Viasat

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 96.57 Billion |

| Forecasted Market Value ( USD | $ 129.87 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |