Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This trend is further reinforced by heightened awareness of pet hygiene and health, leading consumers to seek premium grooming products formulated for specific coat types and skin conditions. Moreover, the increasing shift toward eco-conscious and natural product choices is influencing purchase decisions, with environmentally aware consumers opting for formulations that are chemical-free and sustainably packaged. Higher disposable incomes have also encouraged the purchase of premium grooming solutions, while the growth of grooming salons and mobile grooming services has enhanced market accessibility across regions.

Key Market Drivers

Growing Adoption of Pets Across the Region

The rising number of pet adoptions in New Zealand is a major factor driving growth in the grooming products market. As of 2025, about 63% of households in the country own pets, with cats found in 40% of these homes, accounting for approximately 1.26 million cats. Dogs follow closely, with an estimated population of 830,000. This surge in pet ownership has led to greater demand for grooming products like shampoos, conditioners, clippers, and brushes. The increasing humanization of pets - where pets are treated as family members - has amplified attention on their hygiene and well-being. As a result, pet owners are investing more in grooming products to ensure their pets remain healthy and comfortable. The expanding reach of grooming salons and mobile grooming services has also made it easier for consumers to access high-quality grooming options, further fueling market demand.Key Market Challenges

Rise in Counterfeit Products

The increasing prevalence of counterfeit pet grooming products poses a significant challenge to the New Zealand market. As demand rises, low-quality replicas that imitate reputable brands are entering the marketplace, especially through online platforms. These fake products often fail to meet safety and quality standards, potentially leading to adverse effects like skin irritations or allergic reactions in pets. This not only endangers animal health but also diminishes consumer trust in established brands. The difficulty in distinguishing genuine from counterfeit products complicates purchasing decisions and undermines legitimate businesses by creating unfair market conditions. Addressing this issue requires robust regulatory enforcement, consumer education, and improved monitoring mechanisms to safeguard product integrity and market credibility.Key Market Trends

Rising Demand for Eco-Friendly and Natural Products

A notable trend in the New Zealand pet grooming products market is the increasing consumer preference for eco-friendly and natural formulations. Environmentally conscious pet owners are choosing products that avoid harsh chemicals such as parabens and sulfates, instead favoring those enriched with plant-based ingredients that are both skin-friendly and sustainable. Brands like Ashley & Co. are responding to this shift with offerings like the Awash Woof pet shampoo, which uses 100% natural ingredients and recyclable packaging. This trend reflects a broader movement toward sustainable consumer behavior, aligning product purchases with values of health, wellness, and environmental responsibility. As awareness of ingredient safety and sustainability grows, the demand for natural grooming products is expected to increase steadily.Key Players Profiled in this New Zealand Pet Grooming Products Market Report

- Kin

- Mipuchi

- Mollies Pet Salon

- Zenobia Aromatics

- Pure Source LLC

- Health Focus Manufacturers

- SIA “PURUS.PET”

- Glowel Cosmetics

- Orchid Lifesciences

- Zoic Cosmetics

Report Scope:

In this report, the New Zealand Pet Grooming Products Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:New Zealand Pet Grooming Products Market, by Pet Type:

- Dog

- Cat

- Horse

- Others

New Zealand Pet Grooming Products Market, by Product Type:

- Shampoo & Conditioner

- Comb & Brushes

- Shear & Trimming Tools

New Zealand Pet Grooming Products Market, by End User:

- Pet Owner

- Pet Care Facilities

- Grooming Salons

New Zealand Pet Grooming Products Market, by Distribution Channel:

- Online

- Offline

New Zealand Pet Grooming Products Market, by Region:

- North Island

- South Island

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the New Zealand Pet Grooming Products Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this New Zealand Pet Grooming Products market report include:- Kin

- Mipuchi

- Mollies Pet Salon

- Zenobia Aromatics

- Pure Source LLC

- Health Focus Manufacturers

- SIA “PURUS.PET

- Glowel Cosmetics

- Orchid Lifesciences

- Zoic Cosmetics

Table Information

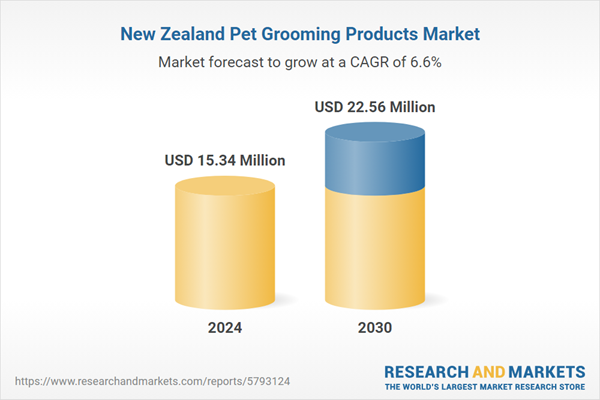

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.34 Million |

| Forecasted Market Value ( USD | $ 22.56 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | New Zealand |

| No. of Companies Mentioned | 11 |