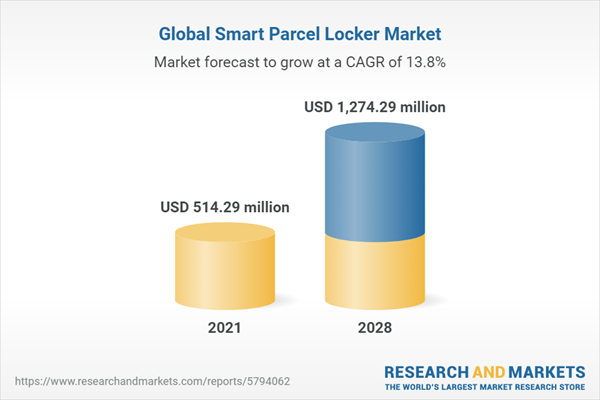

The smart parcel locker market is projected to grow at a CAGR of 13.84%, reaching US$1,274.291 million in 2028 from US$514.286 million in 2021.

Smart parcel locker is the integration of automated technological services to ensure the safety and delivery of the contents of a parcel. Applying smart parcel lockers to parcel shipments helps establish higher security and safety levels for the parcels. The increasing adoption of smart parcel lockers by leading shipping and courier companies across the planet indicates the growth opportunity of the smart parcel locker market. Smart parcel lockers are automated security systems that notify customers about the movement and delivery of their parcels through notifications and confirm the delivery through safe codes passed as QR codes or other SMS codes. It enables the customers to manage their parcels and can be used for outdoor or indoor purposes. Smart parcel lockers have a software system and physical locker systems installed to contain the parcels.

Market Drivers:

Growing incidences of parcel thefts

The increasing rate of parcel thefts and the lower probability of recovery of stolen parcels are fueling the demand for smart parcel lockers. For instance, a survey by the UK Ecommerce Association revealed that parcel theft crimes increased by 7% in 2021, and approximately 1 billion parcels were reported stolen in 2020 and 2021. In addition, a parcel worth INR 96 lakhs was reported stolen from the DTDC courier warehouse in Delhi, India. Hence, the higher degree of security offered by smart parcel lockers ensures the guaranteed safety of the parcel's contents. Furthermore, adopting smart parcel lockers effectively eliminates the risk of theft and wrong delivery in the parcel shipment and delivery system. For instance, Tata 1MG, a pharmaceutical delivery company in India, requires delivery personnel to enter a one-time password sent to the customer's phone to ensure the shipment was delivered safely to the correct address. In addition to one-time passwords, companies might use barcodes, QR codes, or other SMS codes as a safety measure practice to ensure the proper delivery of their parcels. In addition to this, the customers receive automated notifications to help them keep track of their parcels.

The growing demand for contactless delivery and flexible service hours

The post-pandemic priority for cleanliness and hygiene standards has resulted in a preference for contactless delivery. Whereas the varying work shifts and customers' hectic schedules are resulting in a demand for flexible parcel delivery timings. A survey conducted by Medallia Zingle Company revealed that approximately 54% of consumers in the US had changed their shopping preferences to virtual stores and contactless delivery systems since the COVID lockdown. This further results in high demand for smart parcel lockers since the security provided by these lockers enables customers to have access to contactless delivery and flexible parcel pickup timings at any time throughout the day. In addition, the availability of terminals, smart locker stations for parcels, such as the Parcel Hive, and automatic parcel terminals ensure that the parcels can be collected or left at the customers' convenience and the safety of their contents. This enhances the reliability and security of smart parcel lockers and ensures contactless delivery of parcels. Therefore, considering the key factors driving the demand for smart parcel lockers, it can be expected that the market will witness an expansion over the forecast period.

The inability of smart parcel lockers to be employed by wholesale businesses is a restraining factor affecting the expansion of the international smart parcel locker market.

Smart parcel lockers are effective as storage and security systems for meeting the requirements of small and medium-sized parcels used by domestic customers. However, the availability of different types and systems of smart parcel lockers at varying temperature modes in the market cannot provide security to the huge parcel shipments sent and received by companies engaged in the wholesale business. In addition, the effectiveness of a smart locker system depends on compatibility with the nature of the business of a company. Hence, professional advice must be sought before adopting or installing a smart locker system in a company.

Market Developments:

In February 2022, WIB Smart Lockers collaborated with SendeeX Company to debut a new all-time available parcel service, SesamoBox, equipped with two types of smart locker systems that can be activated through mobile applications.

In September 2022, Quadient Company, specializing in the manufacture of smart lockers, entered into an agreement with DHL Parcel UK to ensure safe delivery using smart lockers by installing over 500 locker stations.

In June 2021, Pitney Bowes Inc. launched a new smart parcel locker, Parcelpoint Smart Lockers, as an addition to its existing product line of smart locker systems to assure the safety of the parcels by using SaaS software.

North America is expected to hold a significant share of the global smart parcel locker market.

North America is witnessing an increase in the delivery and receipt of mail, parcels, and couriers due to globalization and digitalization. There has been an increase in the exports and imports of goods, immigration rates, and international shipments. The parcel shipping index report published by Pitney Bowes established that the parcel volume and sales increased by an average of 33% in the leading parcel shipment companies. In addition to this, according to the annual report of FedEx, the USA contributed approximately $64,941 million to the annual shipment revenue. Apart from this, Effigy Consulting Company reported an overall increase in the parcel volume of Mexico by around 26%. The presence of leading parcel companies such as United Parcel Service, FedEx, and Pitney Bowes broadens the growth opportunities for smart parcel lockers in the USA courier and parcel shipment system. Therefore, considering the growth opportunities for smart parcel lockers due to the present parcel market statistics in North American countries and future growth predictions, it can be anticipated that the North American smart parcel locker system will grow significantly over the forecast period.

Market Segmentation:

By Type

- Indoor

- Outdoor

By Component

- Hardware

- Software and Services

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Smartbox Ecommerce Solutions Pvt. Ltd.

- eLocker Ltd.

- Pitney Bowes Inc.

- Parcel Pending LLC. (Quadient SA)

- Ricoh

- Cleveron

- KEBA

- Hollman Inc.

- TZ Limited

- VSGate

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | May 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 514.29 million |

| Forecasted Market Value ( USD | $ 1274.29 million |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |