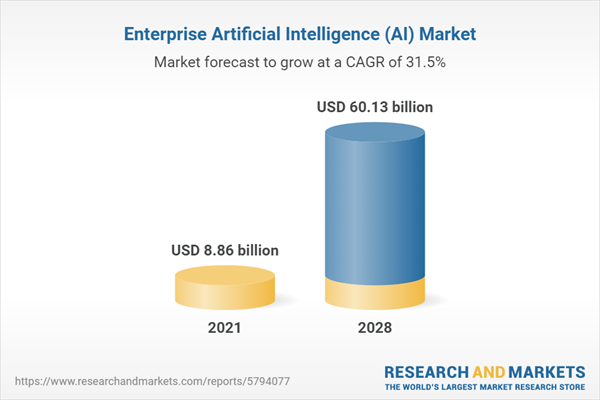

Enterprise AI market is expected to grow at a CAGR of 31.47% from a market size of US$8.86 billion in 2021 to reach US$60.13 billion in 2028.

Enterprise AI is a sub-division of business software that employs AI software and methods to promote digital transformation. A new type of technological stack is needed for the large-scale development and deployment of enterprise AI. Enterprise AI is the process through which a company integrates artificial intelligence into its infrastructure at a level of sophistication that is equal to human capabilities. In many industries, artificial intelligence is assisting businesses in gaining a competitive edge. An enterprise AI platform can automate and optimize various stages of business operations and eliminate certain steps or expenses through efficiency. Enterprise AI solutions advance the potential of maximum utilization of the resources of an enterprise further by processing enormous amounts of data and displaying it in straightforward interfaces for practical use by the individuals and groups in charge of large-scale enterprises. Enterprise AI offers a variety of answers to typical operational problems, while increasing staff productivity, cutting costs, and optimizing business operations. Considering the penetration of AI and other technological solutions across enterprises in different industries, it can be anticipated that the enterprise AI market will expand significantly over the forecast period.Market Drivers

The increase in data generated by companies

The massive advancement in the data generated by companies and their customers is resulting in the need for big data analytics solutions using AI technology in enterprises. According to research, it was revealed that more than 97% of business enterprises are actively investing in AI solutions and big data management software. In addition, it was demonstrated that only a medium portion of around 40% of the data generated by an enterprise is being effectively utilized. The ideal utilization of data by an enterprise could assist in increasing profit margins by understanding the customers’ preferences and problems, the inefficiencies in any working departments, and the reduction in excess resources being unused in the business operations. In addition to this, the recent shift to data-driven decision-making processes is creating a higher level of demand for AI-based software applications to process the vast amount of data.Growing demand for automating business processes

The automation of company processes is encouraged by the increase in operational productivity of business tasks and the improvement in accuracy levels owing to the decrease in human errors. According to IBM's Global AI Adoption Index research from 2022, more than 37% of AI software is used to automate IT operations, while 27% of AI software applications are used by large enterprises to automate business workflow procedures and customer care services. Therefore, the increase in the volume of data generated and processed by companies and the growing demand for automating business processes are driving the demand for enterprise AI products.The threat of cybersecurity vulnerabilities and data integration could slow down the expansion of the enterprise AI market.

The data issues and the threat of violation of cybersecurity are restraining the extensive adoption of enterprise AI by all companies. In addition, the integration of various departments and systems under a unified system increases the risk of hacking and other unethical activities. Virtual assistants that enable client self-service are one example of an AI system that needs data from several systems that may never have been merged previously. Consumer information, financial information, and virtual assistant training and configuration data may all be stored in different systems. AI makes data integration necessary, which a corporation may have avoided up until now. This can be particularly difficult in a business that has developed through acquisition and retains numerous, unconnected systems from various periods.Market Developments:

In March 2023, Alpha Metaverse Technologies Inc. announced that it has entered into a contract with The Brand Label, a prominent fashion enterprise operating in multiple nations to create a metaverse platform to enhance the customer experience and virtual display setting of the enterprise.In January 2023, C3 AI, a company specializing in the manufacture of enterprise AI solutions introduced its new product line C3 Generative AI by launching a new search product that enables enterprises to search for specific data across all the information systems of the enterprise.

In March 2023, Tata Consultancy Services introduced its Cognitive Plant Operations Adviser product, an AI solution that utilizes 5G internet on a Microsoft Azure platform to assist pharmaceutical, FMCG, and other manufacturing industries to help to make automated decisions in plant production processes.

North America has a significant share of the enterprise AI market and is expected to grow in the forecast period.

North America contributes a prominent share of the international enterprise AI market. The automation of business operations and other associated tasks is encouraged by the gradual transition of top firms and brands in North America towards digitalization. As a result, there is a huge demand for products providing access to software applications and services utilizing artificial intelligence at the enterprise level. The presence of international technology conglomerates such as Google and Amazon and the emergence of new AI application development startups over the last few years such as RisingMax, Suffescom Solutions Inc., Western Stack, and AlphaSense are further widening the expansion of the enterprise AI market in North America. In addition, the favorable free trade agreements of the North American countries are expanding the customer base of business enterprises to an international level resulting in an expansion in their business operations. Consequentially, enterprise AI solutions are required to ensure the effective management of an enterprise’s business. Hence, the market size of North American enterprise AI is anticipated to expand over the forecast period.Market Segmentation:

By Technology

- Machine Learning

- Speech Recognition

- Natural Language Processing

- Image Processing

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- SMEs

By End-User

- Automotives

- BFSI

- Telecommunication

- Manufacturing

- Retail

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Intel Corporation

- Amazon Web Services Inc.

- Google LLC

- Amelia US LLC

- NVIDIA Corporation

- SAP SE

- Wipro Limited

- Verint Systems

- IBM Corporation

- Oracle Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | May 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 8.86 billion |

| Forecasted Market Value ( USD | $ 60.13 billion |

| Compound Annual Growth Rate | 31.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |