Asthma Spacers Market: Introduction

Asthma spacers, also known as aerosol-holding chambers or valved holding chambers, are medical devices used in combination with metered-dose inhalers (MDIs) to improve the delivery of inhaled medications for asthma and other respiratory conditions. Spacers are typically made of plastic and consist of a tube or chamber with a mouthpiece or mask on one end and an opening to attach the MDI on the other end.Uses and benefits of asthma spacers:

1. Improved medication delivery: When using an MDI alone, a significant portion of the medication can end up in the mouth, throat, or stomach, rather than the lungs where it is needed. Spacers help ensure that more medication reaches the lungs by creating a temporary space for the aerosolized drug to slow down and mix with the air, making it easier to inhale the medication effectively.

2. Better coordination: Some people, especially children and the elderly, may have difficulty coordinating their breath with the actuation of the MDI. Spacers provide a buffer, allowing the user to inhale the medication at their own pace, reducing the risk of poor inhaler technique and ensuring optimal medication delivery.

3. Reduced side effects: By ensuring that more medication reaches the lungs and less remains in the mouth and throat, spacers can help reduce the risk of side effects associated with inhaled corticosteroids, such as oral thrush or hoarseness.

4. Enhanced treatment efficacy: As spacers improve the delivery of inhaled medications, they can enhance the efficacy of asthma treatment, leading to better symptom control, reduced risk of asthma exacerbations, and improved quality of life for patients.

In summary, asthma spacers are valuable tools that can improve the delivery of inhaled medications, enhance treatment efficacy, and reduce side effects. They are particularly useful for children, the elderly, and individuals who have difficulty coordinating their breath with the use of an MDI alone. Healthcare providers often recommend the use of spacers for patients with asthma and other respiratory conditions to ensure optimal treatment outcomes.

Asthma Spacers Market Segmentations

The market can be categorised into type, distribution channel, and region.Market Breakup by Type

- Volumatic

- Aerochamber

- InspirEase

- Optichamber

- Others

Market Breakup by Distribution Channel

- Hospitals Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Asthma Spacers Market Scenario

The global asthma spacers market is driven by the increasing prevalence of asthma and other respiratory conditions that require the use of inhaled medications. Asthma spacers, also known as aerosol-holding chambers or valved holding chambers, are essential devices that improve medication delivery, coordination, and reduce side effects for patients using metered-dose inhalers (MDIs). The market encompasses various aspects, including the production and distribution of asthma spacers, as well as research and development of new and improved spacer designs.Market Drivers

Key factors propelling the asthma spacers market include the growing global prevalence of asthma, which affects approximately 339 million people worldwide according to the World Health Organization (WHO), and the increasing awareness of the benefits of using spacers with MDIs. Additionally, the market is driven by the aging population, which may face challenges in coordinating their breath with MDIs, and the focus on improving asthma management and treatment outcomes. Furthermore, advancements in technology and materials used for spacer production contribute to the market's growth.Market Challenges

Despite the growing demand for asthma spacers, the market faces some challenges. Affordability and accessibility of spacers may be limited, particularly in low- and middle-income countries where healthcare resources are constrained. Furthermore, a lack of awareness about the benefits of using spacers with MDIs may result in underutilization and suboptimal treatment outcomes for patients with asthma and other respiratory conditions.Regional Analysis

Geographically, the global asthma spacers market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market due to its advanced healthcare infrastructure, increased awareness about asthma management, and the presence of key market players. Europe follows closely, while Asia Pacific is anticipated to be the fastest-growing region due to the increasing prevalence of asthma, improving healthcare infrastructure, and rising healthcare expenditures in the region.Future Outlook

The asthma spacers market is expected to continue growing in the coming years, primarily driven by the increasing prevalence of asthma and other respiratory conditions, advancements in spacer technology, and improved access to healthcare services. As new technologies emerge and healthcare systems continue to evolve, the market may experience increased access to asthma spacers, resulting in better asthma management and improved patient outcomes worldwide.Key Players in the Global Asthma Spacers Market

The report gives an in-depth analysis of the key players involved in the asthma spacers market, sponsors manufacturing the drugs, and putting them through trials to get FDA approvals. The companies included in the market are as follows:- Trudell Medical International

- PARI Respiratory Equipment, Inc

- Koninklijke Philips N.V

- GlaxoSmithKline plc

- Intervet Inc

- Lupin

- Cipla Inc

- Medical Developments International

- HAAG-STREIT Group

- Visiomed Group Ltd.

Table of Contents

Companies Mentioned

- Trudell Medical International

- Pari Respiratory Equipment, Inc.

- Koninklijke Philips N.V

- GlaxoSmithKline plc.

- Intervet Inc.

- Lupin

- Cipla Inc.

- Medical Developments International

- Haag-Streit Group

- Visiomed Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | April 2023 |

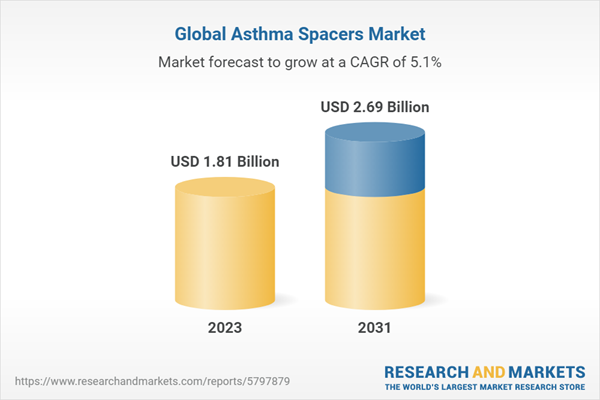

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 1.81 Billion |

| Forecasted Market Value ( USD | $ 2.69 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |