Gene Therapy Introduction

Gene therapy is a rapidly evolving field in medical science, offering innovative solutions for the treatment and management of various genetic disorders. It is a ground-breaking approach that involves the direct manipulation of an individual's genes to correct or replace faulty genetic information, ultimately mitigating or curing the associated medical condition. With the advent of advanced molecular biology and genetic engineering techniques, gene therapy has emerged as a promising alternative to traditional treatment methods, aiming to address the root causes of genetic diseases rather than just managing their symptoms.The purpose of this report is to provide an overview of gene therapy, its underlying principles, and its potential applications. We will examine the different types of gene therapy, the methods employed to deliver therapeutic genetic material into target cells, and the safety and ethical concerns associated with this cutting-edge technology. Furthermore, we will explore the latest research and clinical trials that demonstrate the potential of gene therapy in treating a wide range of genetic disorders, including monogenic diseases, metabolic disorders, and certain types of cancer.

By presenting an in-depth analysis of gene therapy, this report aims to offer a comprehensive understanding of its current state and future prospects. With continued research and clinical trials, gene therapy holds immense potential to revolutionize the field of medicine and pave the way for personalized, precision-based treatments that address the unique genetic makeup of each individual patient.

Gene Therapy Market Scenario

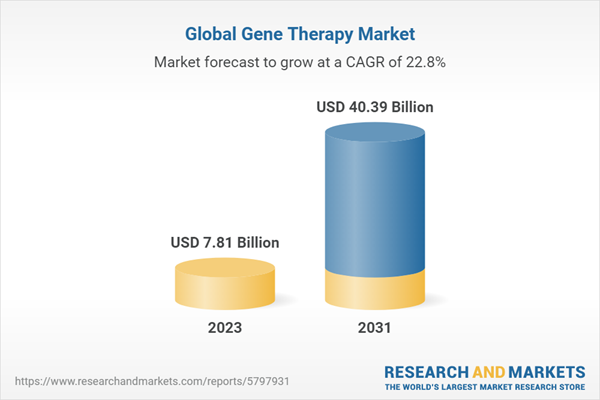

The global gene therapy market has experienced substantial growth in recent years, driven by factors such as the increasing prevalence of genetic disorders, advancements in genetic engineering techniques, and a growing number of regulatory approvals for gene therapy products. As of September 2021, the market was projected to continue expanding at a rapid pace, with a compound annual growth rate (CAGR) ranging from 20% to 30% over the next several years.Factors driving the growth of the gene therapy market included the rising prevalence of genetic disorders, advancements in genetic engineering techniques, and growing investments in research and development.

The gene therapy market faced challenges such as safety concerns, ethical issues, and high costs associated with gene therapy treatments.

Gene Therapy Market segmentations

Market Breakup by Therapy Type

- In-Vivo Therapy

- Ex-Vivo Therapy

Market Breakup by Indications

- Acute Lymphoblastic Leukemia (ALL)

- Inherited Retinal Disease

- Large B-Cell Lymphoma

- ADA-SCID

- Melanoma

- Beta-Thalassemia Major/SCD

- Head & Neck Squamous Cell Carcinoma

- Peripheral Arterial Disease

- Spinal Muscular Atrophy (SMA)

- Others

Market Breakup by Vector Type

Viral Vector

- Lentiviral Vectors

- Adeno-Associated Viral (Aav) Vectors

- Retrovirus Vectors

- Modified Herpes Simplex Virus

- Adenovirus Vectors

- Others

- Non-Viral Vector

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Gene Therapy Market

Some key trends of the market are as follows:- Regulatory Approvals: The increasing number of regulatory approvals for gene therapy products has been a significant trend, as it indicates the growing recognition and acceptance of these treatments by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA)

- Strategic Collaborations and Partnerships: Companies and research institutions have been forming collaborations and partnerships to share resources, knowledge, and expertise. These collaborations aim to accelerate the development of gene therapy products, expand their pipelines, and enhance their market presence

- Personalized Medicine: The gene therapy market has been increasingly focusing on personalized medicine, as it offers the potential to provide targeted and precise treatments based on an individual's unique genetic makeup. This approach is expected to improve treatment outcomes and reduce the risk of side effects

- Advancements in Delivery Systems: Continued research and development have led to the emergence of new and more efficient gene delivery systems, such as viral and non-viral vectors, which play a crucial role in the success of gene therapy treatments

- Focus on Rare Diseases: Many gene therapy companies have been concentrating on developing treatments for rare genetic diseases, often with limited treatment options. This focus has been driven by the high unmet medical needs, the potential for orphan drug designation, and the possibility of premium pricing for successful therapies

- Expansion of Indications: Gene therapy was initially focused on monogenic diseases; however, its potential applications have expanded to include a wider range of conditions, such as various forms of cancer, neurological disorders, and metabolic diseases

- Government and Private Funding: The gene therapy market has witnessed increased financial support from both government and private organizations. This funding has accelerated research and development, clinical trials, and commercialization of gene therapy products

- Ethical and Regulatory Discussions: As gene therapy continues to advance, ethical and regulatory discussions surrounding its use have become more prominent. This includes topics such as germline editing, access to treatments, and the long-term safety of gene therapies

Gene Therapy Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- AstraZeneca

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline plc

- Novartis AG

- CHIESI Farmaceutici SpA

- Sunovion Pharmaceuticals Inc

- Teva Pharmaceutical Industries Ltd

- Mylan N.V., Orion Corporation

- Merck & Co., Inc

- Grifols, S.A

- Abbott

- F. Hoffmann-La Roche Ltd

- Vectura Group plc

- Pfizer Inc, Alkermes

- Mylan N.V, Almirall, S.A, Genentech, Inc

- Biogen

- Astellas Pharma Inc

Table of Contents

Companies Mentioned

- Astrazeneca

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline plc

- Novartis AG

- Chiesi Farmaceutici Spa

- Sunovion Pharmaceuticals Inc

- Teva Pharmaceutical Industries Ltd

- Mylan N.V. Orion Corporation

- Merck & Co. Inc.

- Grifols, S.A.

- Abbott

- F. Hoffmann-La Roche Ltd

- Vectura Group plc

- Pfizer Inc, Alkermes

- Mylan N.V, Almirall, S.A, Genentech, Inc

- Biogen

- Astellas Pharma Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 7.81 Billion |

| Forecasted Market Value ( USD | $ 40.39 Billion |

| Compound Annual Growth Rate | 22.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |