Connected Drug Delivery Devices Market: Introduction

Connected drug delivery devices are medical devices that incorporate digital technology to help patients manage their medications more effectively. These devices are designed to monitor the delivery of medications, track adherence to treatment plans, and provide real-time feedback to healthcare providers and patients. Connected drug delivery devices can take many forms, including inhalers, injection devices, and smart pills.Connected drug delivery devices are used in a variety of medical conditions, including asthma, diabetes, multiple sclerosis, and cancer. They can be used to deliver a wide range of medications, including insulin, chemotherapy drugs, and biologics.

Benefits of connected drug delivery devices include:

- Improved medication adherence: Connected drug delivery devices can help patients adhere to their medication schedules more effectively by providing reminders, tracking adherence, and providing real-time feedback

- Improved disease management: Connected drug delivery devices can help patients manage their diseases more effectively by monitoring symptoms, tracking medication use, and providing feedback to healthcare providers

- Better patient outcomes: Connected drug delivery devices have been shown to improve patient outcomes by increasing medication adherence and reducing hospitalization rates

- Real-time data: Connected drug delivery devices provide real-time data on medication use, which can be used by healthcare providers to adjust treatment plans and improve patient outcomes

Connected Drug Delivery Devices Market Segmentations

The market can be categorised into product type, technology, end user, and region.Market Breakup by Product Type

- Connected Sensors

- Connected Inhaler Sensors

- Connected Injection Sensors

- Integrated Connected Devices

- Integrated Inhalation Devices

- Integrated Injection Devices

- Others

Market Breakup by Technology

- Near Field Communication (NFC)

- Bluetooth

- Other

Market Breakup by End User

- Healthcare Providers

- Homecare

- Hospitals

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

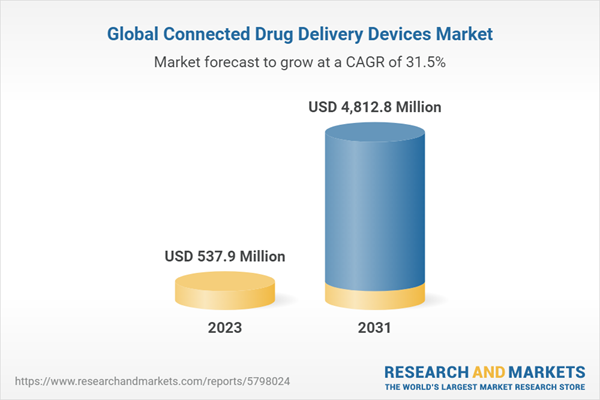

Connected Drug Delivery Devices Market Scenario

The global market for connected drug delivery devices is a rapidly growing segment of the healthcare industry, driven by factors such as the increasing prevalence of chronic diseases, rising demand for innovative drug delivery devices, and advancements in digital technology. Connected drug delivery devices incorporate digital technology to help patients manage their medications more effectively. They are designed to monitor the delivery of medications, track adherence to treatment plans, and provide real-time feedback to healthcare providers and patients.The market for connected drug delivery devices is expected to continue to grow at a rapid pace, driven by several factors, including increasing awareness about the benefits of digital health technology, the development of new and innovative devices, and the increasing adoption of these devices in emerging markets.

North America is the largest market for connected drug delivery devices, owing to the well-established healthcare infrastructure and high prevalence of chronic diseases in the region. However, the Asia Pacific region is expected to witness significant growth in the coming years, driven by the increasing focus on healthcare development and rising demand for cost-effective medical devices. Countries like China and India are expected to be major contributors to this growth due to their large populations and increasing healthcare spending.

The market for connected drug delivery devices is highly competitive, with many players offering a wide range of products to cater to the diverse needs of healthcare providers and patients. Some of the key players in the market include Medtronic plc, Roche Holding AG, Insulet Corporation, Ypsomed AG, and West Pharmaceutical Services, Inc.

Overall, the connected drug delivery devices market is expected to continue to grow at a rapid pace, driven by the increasing demand for safe and effective healthcare delivery. With increasing awareness about the benefits of digital health technology and the development of new and innovative devices, the adoption of connected drug delivery devices is likely to increase in the coming years, further fuelling the growth of the market.

Key Players in the Global Connected Drug Delivery Devices Market

The report gives an in-depth analysis of the key players involved in the connected drug delivery devices market, sponsors manufacturing the drugs, and putting them through trials to get FDA approvals. The companies included in the market are as follows:- BD

- F. Hoffmann-La Roche Ltd

- Propeller Health

- BioCorp

- Antares Pharma

- Novartis AG

- 3M

- Sulzer Ltd

- Gerresheimer AG

- Sanofi

- Johnson & Johnson Services, Inc

- Bayer AG

- GlaxoSmithKline plc

- Novosanis

- MEDMIX SYSTEMS AG

- Merck & Co., Inc

- Pfizer Inc.

Table of Contents

Companies Mentioned

- Bd

- F. Hoffmann-La Roche Ltd.

- Propeller Health

- Biocorp

- Antares Pharma

- Novartis AG

- 3M

- Sulzer Ltd.

- Gerresheimer AG

- Sanofi

- Johnson & Johnson Services, Inc.

- Bayer AG

- GlaxoSmithKline plc.

- Novosanis

- Medmix Systems AG

- Merck & Co. Inc.

- Pfizer Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 537.9 Million |

| Forecasted Market Value ( USD | $ 4812.8 Million |

| Compound Annual Growth Rate | 31.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |